Malaysia overtakes Thailand as ASEAN's second largest auto market

Malaysia has overtaken Thailand to become ASEAN's second-largest auto market after Indonesia, signalling the region's emergence as a key competitive market for Asian automakers.

It is reported that Malaysia has surpassed Thailand to become the second-largest automotive market in Southeast Asia, trailing only Indonesia. This marks a significant shift in the ASEAN region, indicating that the Southeast Asia has become a key competitive market for Asian automakers.

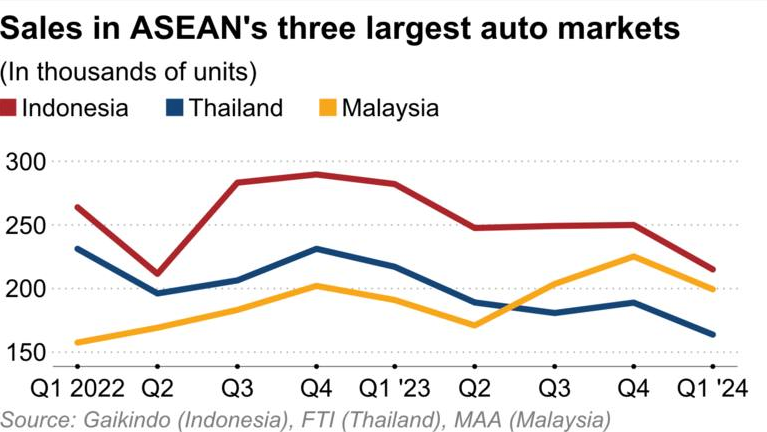

Data shows that as of the first quarter of 2024, Malaysia's automotive sales have surpassed Thailand's for three consecutive quarters. Indonesia leads in automotive sales, followed closely by Malaysia, with Thailand, the Philippines, and Vietnam following in the top five.

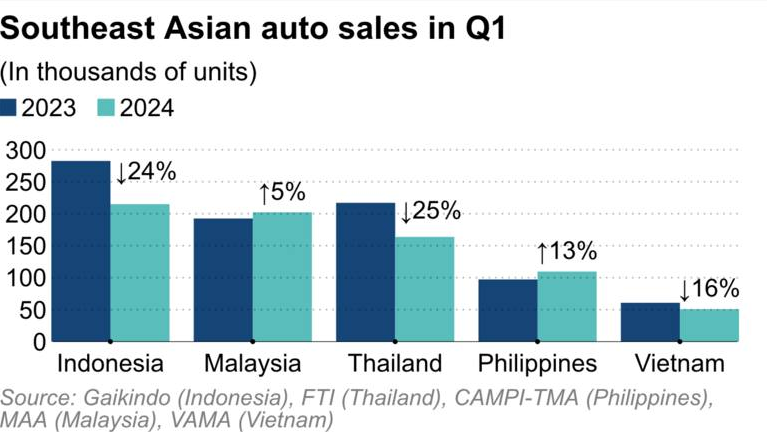

However, among the top five countries, only Malaysia (with a 5% year-on-year increase) and the Philippines (with a 13% year-on-year increase) saw growth in automotive sales in the first quarter compared to the same period last year. Indonesia, Thailand, and Vietnam experienced decreases of 24%, 25%, and 16%, respectively, year-on-year.

According to the sales and production data released by the Malaysian Automotive Association (MAA), in the first quarter of 2024, a total of 202,245 vehicles were sold in the country, representing a 5% year-on-year increase. This marks a further growth for Malaysia following its record sales of 799,731 vehicles in 2023, representing an 11% year-on-year increase.

Despite the impressive sales performance, MAA anticipates a 7.5% decline in total vehicle sales for the year. However, sales of hybrid and electric vehicles are expected to continue growing. The association stated, "Due to rationalization of targeted subsidies, cost of living, and the impact of higher goods and services tax rates, consumer spending this year may slow down."

It is noted that during the COVID-19 in 2020, the Malaysian government introduced a sales tax exemption as one of the measures to stimulate the economy. This policy also provided support for the domestic brands Perodua and Proton, which together hold around 60% of the market share. Although the policy was terminated in 2022, it continued to have a driving effect on the sales data of 2023. The introduction of new models such as highly competitive electric vehicles also contributed to the momentum.

Ivan Khoo, a Toyota sales agent in Kuala Lumpur, Malaysia, revealed that sales in the first two months of this year exceeded expectations, with the Vios model being the best seller due to its price below 100,000 Malaysian Ringgit. He also expects that both ICE (internal combustion engine) and hybrid models from Toyota will continue to perform well in the coming months.

By contrast, the automotive market in Thailand has been persistently sluggish. Long known as the "Detroit of Asia" due to its highly concentrated automotive industry, Thailand had maintained its position as the second-largest automotive market in ASEAN until sales dropped by 25 percentage points in the first quarter of last year.

Since last June, automotive sales in Thailand have been declining year-on-year due to increased bad car loans and subdued consumer demand. According to data from the Federation of Thai Capital Market Organizations (FETCO), the non-performing loan amounts of the top three banks in Thailand rank highest among Southeast Asian countries, with Kasikornbank, the third-largest bank, recording negative growth in annual profits in the first half of 2023 due to excessive exposure to risks from small enterprises.

In Indonesia, due to the rise in policy interest rates and weak consumer purchasing intentions, automotive sales in the first quarter of 2024 declined by 24% year-on-year, indicating a significant lack of growth momentum. In 2023, automotive sales were just over 1 million units, a 4% decrease from 2022, and 30,000 units fewer than the pre-pandemic level in 2019, failing to meet the Indonesian Automotive Industry Association's (Gaikindo) expectation of 1.05 million units.

As for Vietnam, since last year, the domestic economy has been on the brink of stagnation due to factors such as sluggish exports. In the first quarter of this year, automotive sales decreased by 16%. Although there was a peak in demand in December before the expiration of the registration fee exemption for domestically produced cars, sales data for January and February plummeted uncontrollably.

Meanwhile, sales data in the Philippines saw the fastest growth among five countries, benefiting from the country's inflation dropping to around 4% in the latter half of 2023 and sustained strong consumer spending. In the first quarter, the country achieved a 13% year-on-year increase in car sales.

With increasing competition from car manufacturers in China, Japan, South Korea, and other countries in Southeast Asia, subsidies and macroeconomic conditions are expected to become key factors in car sales in the region. For instance, BYD and NETA have recently debuted at the Jakarta Electric Vehicle Expo, unveiling the BYD DOLPHIN model (425 million Indonesian Rupiah) and the NETA V-II model (2-3 billion Indonesia Rupiah) respectively.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.