Nvidia's financial report sets record: full-year revenue of 950 billion yuan, a year-on-year surge of 114%, Blackwell significantly increased production

In the short term, Blackwell chips are in short supply (US$11 billion delivered in the fourth quarter) and new product expectations at the GTC conference may support the stock price.

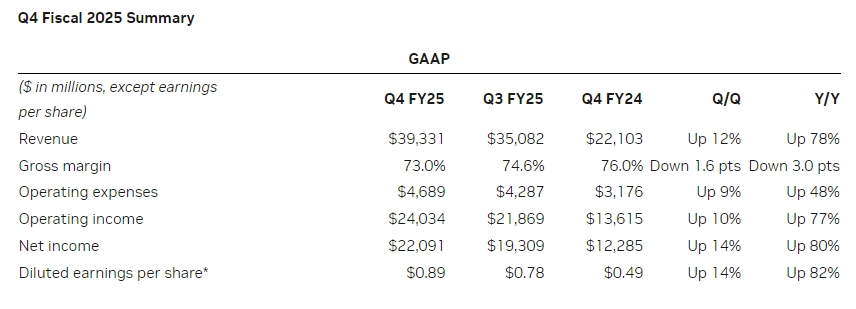

After hours on February 26, Eastern Time, Nvidia handed over a seemingly eye-catching report card but hidden divisions.For the fourth quarter of fiscal year 2025 ended January 26, 2025, the company's revenue was US$39.3 billion, a year-on-year increase of 78%, exceeding analysts 'expectations of US$38.25 billion; adjusted earnings per share (EPS) was US$0.89, a year-on-year increase of 71%, also higher than market expectations of US$0.84.The annual revenue was US$130.5 billion, a year-on-year increase of 114%, and the net profit was US$72.88 billion, a year-on-year surge of 145%.

Structural differentiation of growth momentum

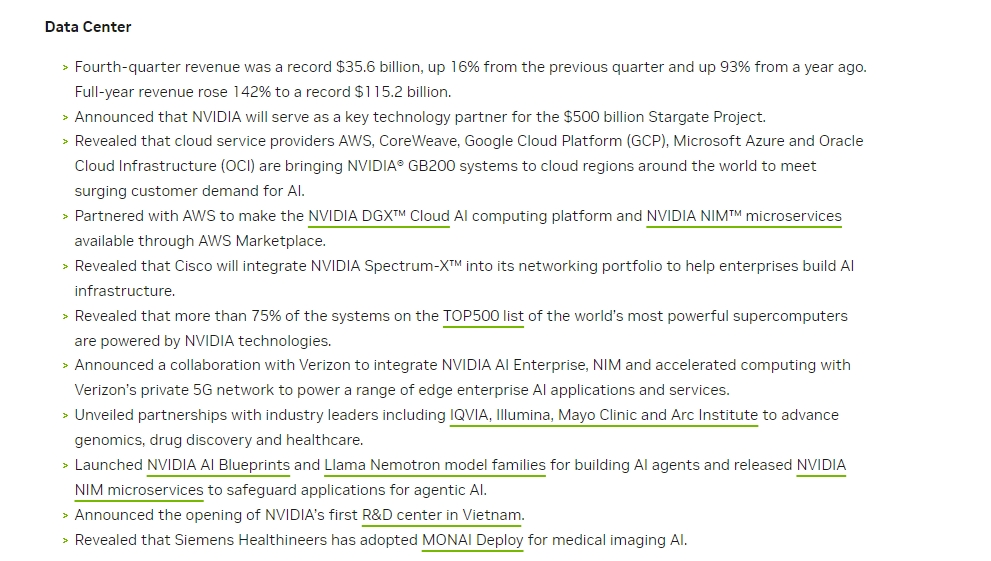

The data center business remains Nvidia's undisputed "cash cow".In the fourth quarter, the division's revenue was US$35.6 billion, a year-on-year increase of 93%, contributing 90.5% of total revenue.The annual data center revenue was US$115.2 billion, a year-on-year increase of 142%, confirming the enthusiasm for global AI infrastructure investment.Huang Renxun emphasized at the performance meeting that Blackwell architecture chips achieved "billions of dollars in sales" in the first full quarter, and the demand for inference computing power is forming a new growth pole-training computing power makes models smarter, and inference computing power makes answers more accurate.At the same time, revenue from the automotive and robotics division was US$570 million, a year-on-year increase of 103%, making it the fastest-growing segment, reflecting Nvidia's initial results in the fields of autonomous driving and industrial automation.InvalidParameterValue

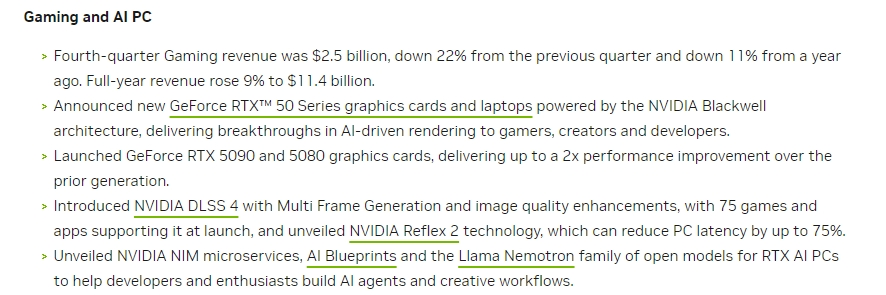

However, revenue from the games and AI PC business was US$2.5 billion, down 11% year-on-year and 22% month-on-month, becoming an obvious shortcoming in the financial report.Although Huang Renxun attributed the weakness in the game business to "users waiting for the next-generation AI PC product cycle," the cyclical fluctuations in the consumer electronics market are in sharp contrast to the strong growth of the data center business, exposing the risk of Nvidia's business structure relying too much on the enterprise-level market.InvalidParameterValue

Game between Cost Pressure and Profit Margin

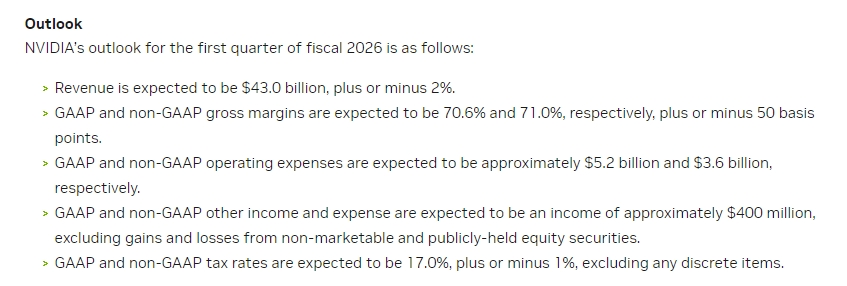

Although revenue continues to expand, Nvidia's profitability is facing structural challenges.The adjusted gross profit margin for the fourth quarter was 73.5%, a year-on-year decrease of 3.2 percentage points and a month-on-month decrease of 1.5 percentage points, mainly due to the complex production process of Blackwell architecture chips driving up costs.Chief Financial Officer Colette Kreis pointed out that the transformation of data center products from a single GPU to a system-level solution integrating CPU and network equipment has increased the added value of the product, but it has also led to an increase in production costs and an exponential increase in supply chain management complexity.Looking forward to the first quarter of fiscal 2026, the company expects gross profit margin to fall further to 71%, lower than the market expectation of 72.2%. This may be related to the fact that the scale effect in the early stage of Blackwell's production capacity climb has not yet been fully realized.InvalidParameterValue

It is worth noting that Nvidia's operating expense control shows pressure.In the fourth quarter, operating expenses under GAAP were US$4.689 billion, a year-on-year increase of 48%. They were mainly invested in next-generation chip research and development and global data center cooperation ecosystem construction.Against the backdrop of the AI arms race, such "strategic losses" may be inevitable, but if gross margins continue to be under pressure, the patience of the capital market may face a test.InvalidParameterValue

A tug-of-war between demand resilience and market doubts

Nvidia provided guidance on revenue for the first quarter of fiscal 2026 of US$43 billion (±2%), far exceeding analysts 'expectations of US$41.78 billion. This is mainly based on the judgment of cloud service providers accelerating the deployment of GB200 systems.Currently, giants such as Amazon AWS, Google Cloud, and Microsoft Azure are introducing the Blackwell architecture GB200 NVL72 system globally, and Nvidia's participation in the US$500 billion "Stargate" project is regarded as a benchmark for the next generation of AI infrastructure.Huang Renxun asserted: "The combination of proxy AI and physical AI will completely reshape the global pillar industry," trying to shift market focus from short-term growth slowdown to long-term technological revolution narrative.InvalidParameterValue

However, market doubts about the demand for AI computing power have not dissipated.In January, the DeepSeek open source model achieved high-performance training at extremely low cost (only 2048 H800 chips were needed), which triggered a sell-off that wiped Nvidia's market value by US$600 billion in a single day.Although Huang Renxun argued that "DeepSeek will stimulate rather than curb demand for computing power" and that China customers have increased their purchases of H20 chips due to the rise of the model, investors are still concerned that improved model efficiency may reduce reliance on high-end chips.Morningstar analysts pointed out that Nvidia's record of exceeding expectations 16 times in the past 18 quarters has raised the market threshold, and its year-on-year revenue growth of 78%(the lowest in seven quarters) has been difficult to ignite investor enthusiasm.InvalidParameterValue

Valuation reconstruction and ecological moat

The current supporting logic for NVIDIA's US$3.2 trillion market value has shifted from pure chip sales to AI ecosystem dominance.The company is extending its business to the software layer through the DGX Cloud platform, NIM microservices, etc., trying to build a complete closed loop from hardware to model.Although this transformation can increase customer stickiness, it also faces the impact of ultra-large-scale customers 'self-developed chips-customized solutions such as Microsoft Maia, Google TPU, and Amazon Trainium are eroding the market share of traditional GPUs.However, Nvidia's CUDA ecological barriers and rapid iteration capabilities (Huang Renxun said that "the complexity of the GPU software stack is 10 times that of two years ago") are still its core advantages.InvalidParameterValue

In the short term, Blackwell chips are in short supply (US$11 billion delivered in the fourth quarter) and new product expectations at the GTC conference may support the stock price; in the long run, it is necessary to verify whether the demand for AI computing power has "power-level" growth potential.As the capital market shifts from marvel at triple-digit growth to examining quality, Nvidia needs to prove that it is not only a "shovel seller" in the AI gold rush, but also a rule maker defining the next generation of computing paradigms.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.