The beginning of a rapprochement between Powell and Trump?

On December 5, Federal Reserve Chairman Jerome Powell downplayed the prospect of strained relations with the incoming Trump administration and said he expected officials to be cautious as they continued to cut interest rates.

Powell said of neutral interest rates (interest rates that neither stimulate nor inhibit the economy):"We can be more cautious as we try to find neutral points.”

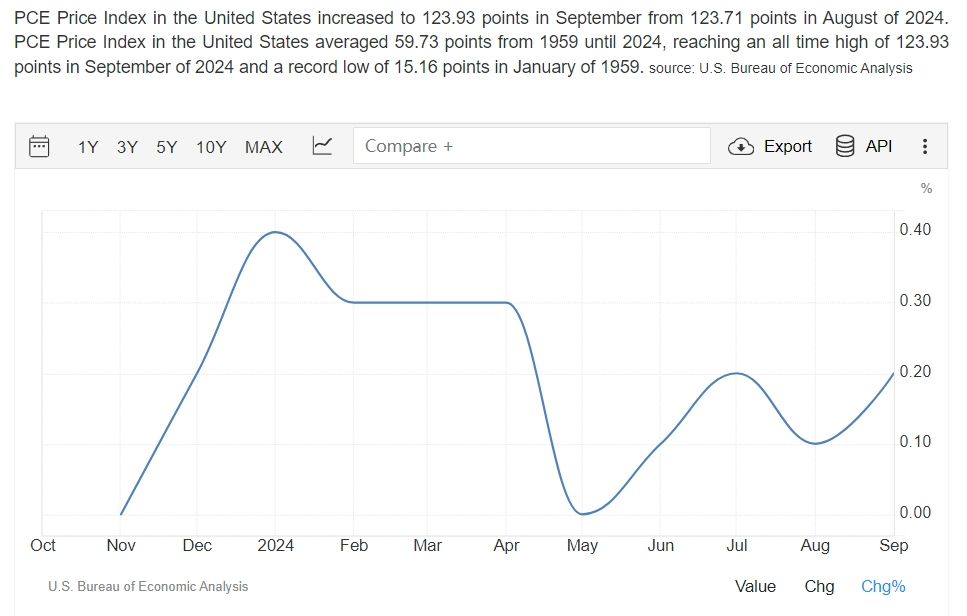

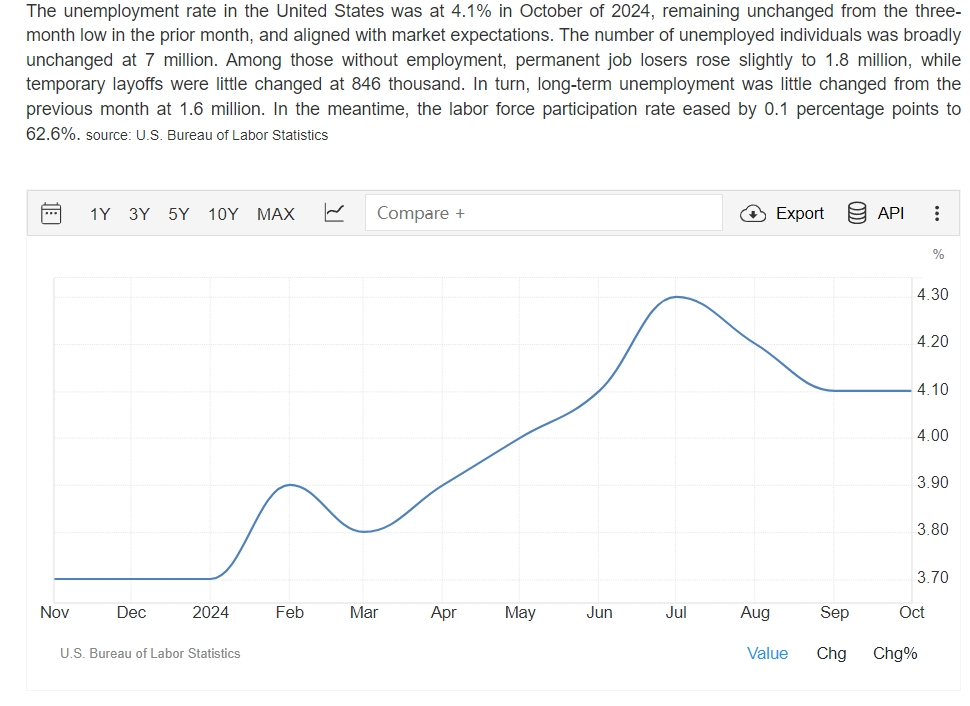

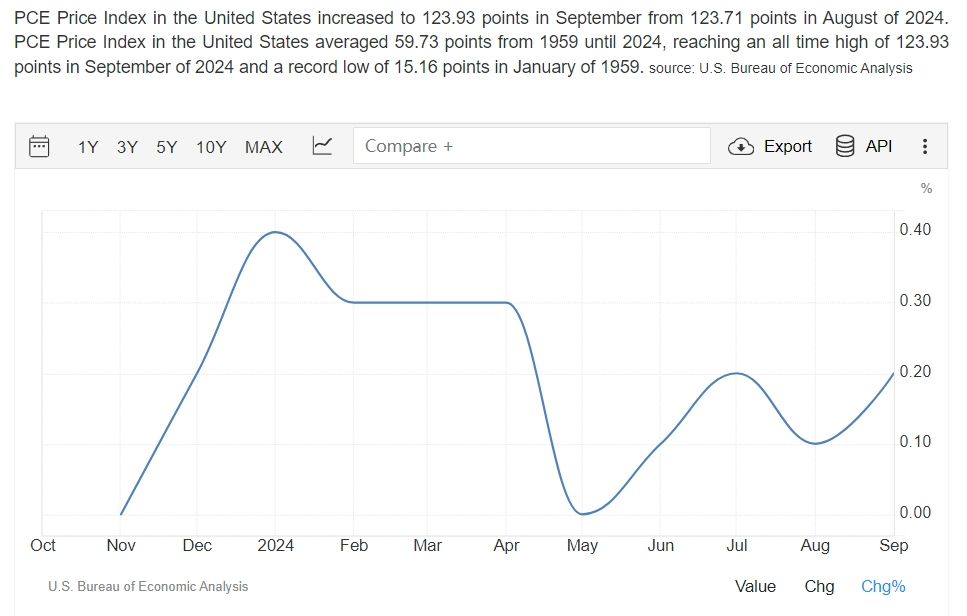

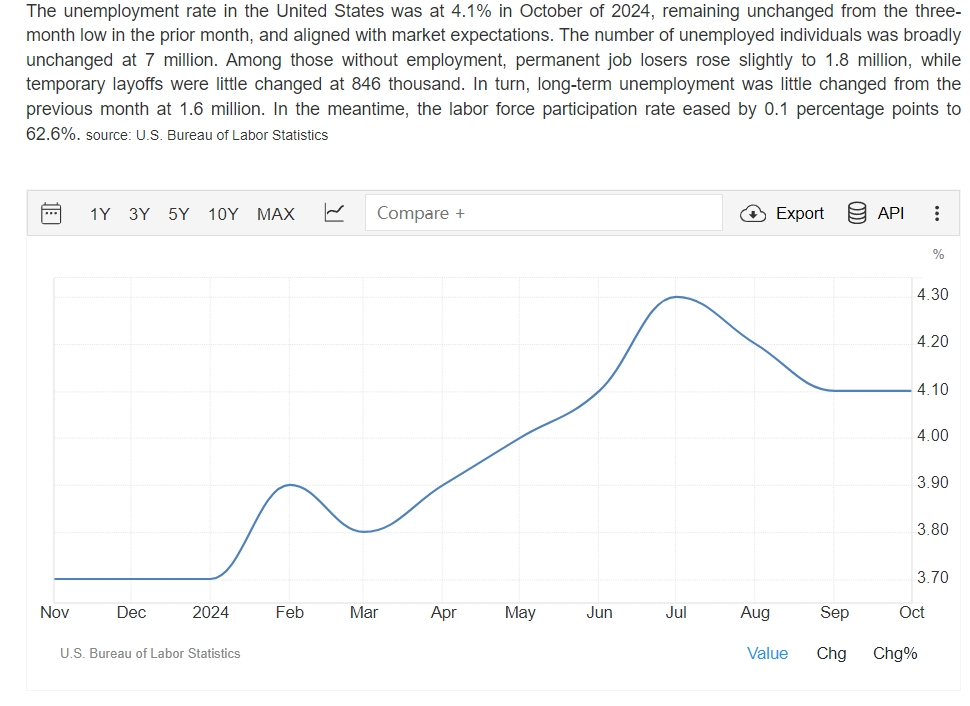

In October, the Federal Reserve's preferred underlying inflation indicator accelerated year-on-year, providing support for cautious interest rate cuts.At the same time, Powell pointed out that downside risks to the job market appear to have receded.

The next meeting of the FOMC committee will be held in Washington on December 17 - 18.The Fed chairman did not say whether he favored lowering interest rates at this meeting.After the speeches, however, multiple analysts said they expected the Fed to cut interest rates by a quarter of a percentage point this month, before suspending interest rates at its January meeting.

"I fully expect that we will maintain the same general and institutional relationships, such as with the Council of Economic Advisers, but most importantly with the Treasury," Powell said at the DealBook Summit in the New York Times on Wednesday.”

Regarding Trump's nomination for a new Treasury secretary, former Soros Fund CEO Besant, Powell said he "believes that once he is confirmed, I will maintain the same relationship with him as other Treasury secretaries."

It is understood that Besent had previously proposed the idea of appointing a "shadow Federal Reserve Chairman" before Powell's term ends in 2026, which would effectively weaken the influence of Federal Reserve leaders on financial markets.

But Powell said he did not believe the incoming administration would bring up the idea: "I don't think it was on the table at all."

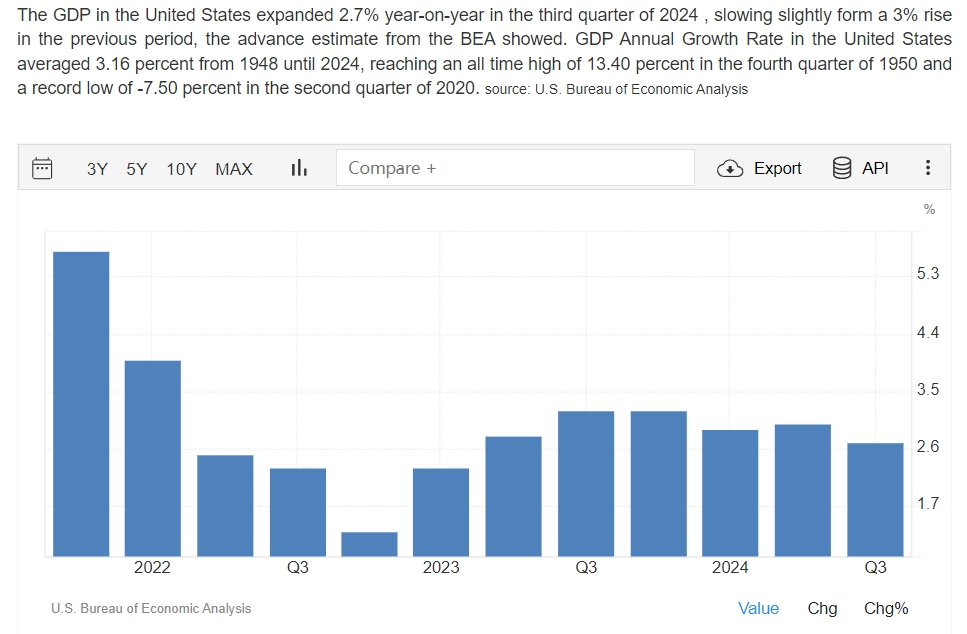

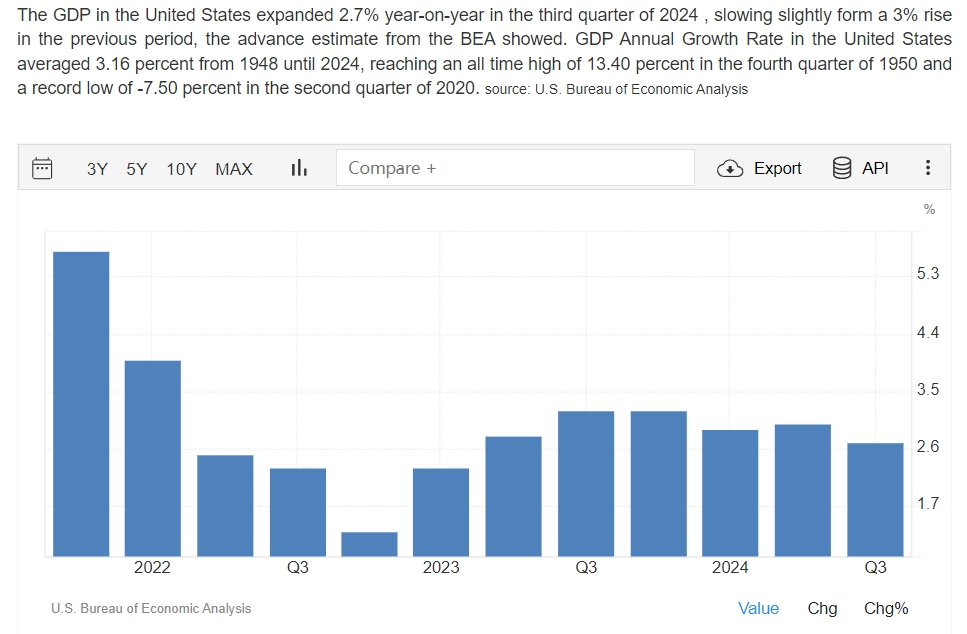

Regarding the future economic outlook of the United States, Powell said the economy was "in very good shape" and added that economic growth was stronger than previously believed.He said: "I feel very good about the state of the economy and monetary policy.”

Powell added that inflation has not yet fully returned to the central bank's 2% target, but he sees no reason why solid economic conditions should not continue.

On the market front, Derek Tang, an economist at LH Meyer/Monetary Policy Analytics, wrote in a note to clients that interest rates are still possible in December."After that, we expect the fund rate to be lowered at a rate of 25 basis points per quarter until it reaches a neutral level," he said.”

Priya Misra, portfolio manager at JPMorgan Asset Management, also said officials still have to weigh new inflation and employment data to be released between now and the December meeting, but Powell "has not ruled out interest rate cuts as an option."

Misra said Powell was trying to leave room for the Fed in December's monetary policy and was creating the conditions for slowing interest rate cuts next year.

Several policymakers said the Fed should continue to cut interest rates at current levels, arguing that interest rates would have a dampening effect on the economy given cooling inflation.However, officials said the pace and timing of the rate cut will depend on changes in economic conditions and data, with several advocating a gradual approach.

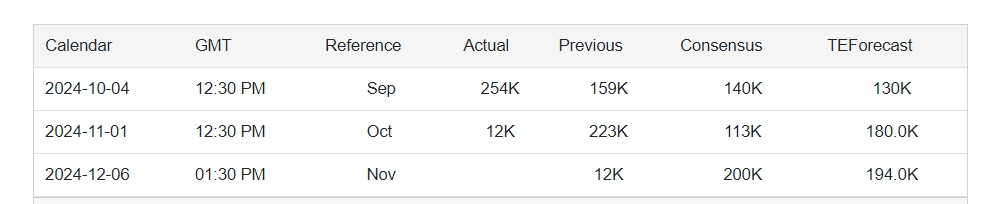

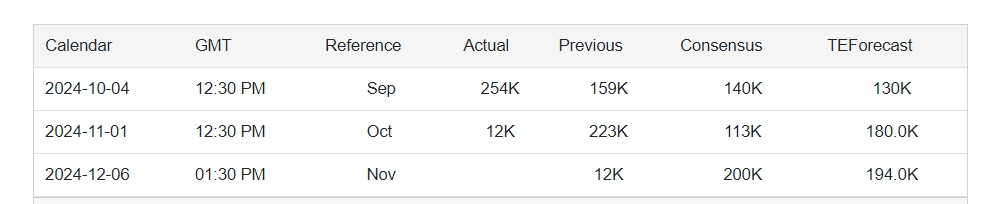

According to the economic survey, non-agricultural data released on Friday will show hiring picked up in November and the U.S. unemployment rate remained stable for the month.