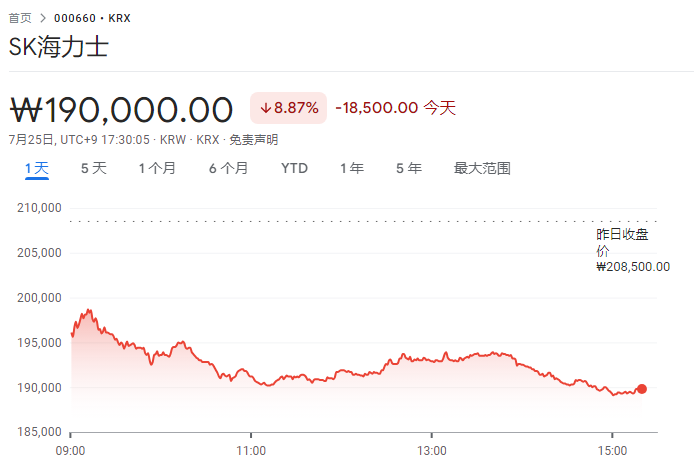

SK Hynix Breaks Record with Q2 Results but Stock Prices Plunge

Despite the promising earnings figures, SK Hynix shares still obtain the biggest drop in 20 months.

On July 24, SK Hynix, the world's second-largest memory chip manufacturer, released its financial report for the second quarter of fiscal year 2024, ending June 30, 2024.

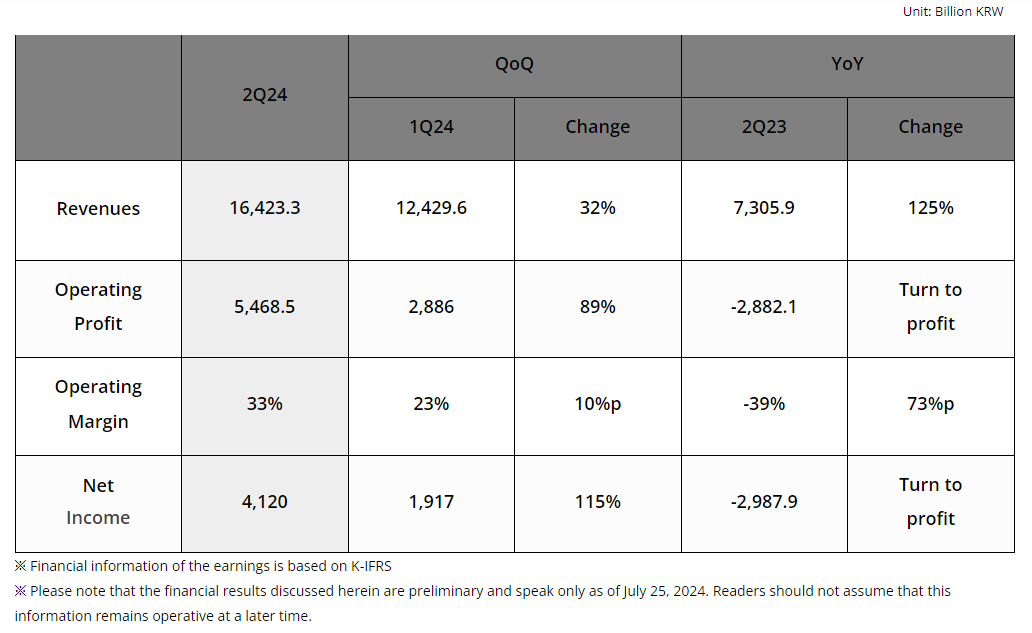

Data showed that SK Hynix achieved profitability for the third consecutive quarter, with revenue for the period reaching a record high of KRW 16.42 trillion, up 125% year-on-year, and operating profit of KRW 5.47 trillion, breaking a six-year record, a sharp turnaround from the KRW 2.88 trillion loss in the same period last year, and in line with LSEG SmartEstimate's expectations; Operating profit margin was 33%, up 10% YoY.

However, U.S. tech stocks have been caught in a recent sell-off wave as investors worry about the outlook for AI. Despite this stellar performance, SK Hynix tumbled at the opening bell, with the company's Korean shares plummeting 8.87 per cent by the end of the day, its biggest drop in 20 months.

AI Boom Beneficiary

It is understood that as Nvidia's main AI chip supplier and the only manufacturer of large-scale production of HBM3E chips, SK Hynix has undoubtedly become the biggest beneficiary of the AI boom.。

For its part, SK Hynix said the company's strong results for the quarter were driven by rapid growth in the AI industry, resulting in a surge in demand for high-end memory chips, especially HBM chips, eSSDs and other memory suitable for AI, as well as overall price increases in DRAM and NAND flash memory chip products, driving a 32% increase in revenue from the quarter.。

At the same time, sales growth, mainly high-end products, coupled with a boost in the exchange rate, boosted operating margins to 33%, resulting in good results in line with market expectations.。"

In terms of DRAM, in March this year, HBM3E chip has started mass production, and the first shipment to Nvidia。According to statistics, HBM sales increased by more than 80% month-on-month and 250% year-on-year in the quarter.。

As for NAND, its sales growth was mainly driven by high-end eSSD products, with sales increasing by about 50% month-on-month during the period.。"Since the fourth quarter of last year, the average selling price of NAND flash products has steadily increased, achieving profitability for two consecutive quarters.。

Q3's Outlook

Following the earnings release, SK Hynix expects memory demand for AI to continue to grow in the second half of the year, with PC and mobile demand improving with new product releases.

As a result, SK Hynix will begin mass production of 12-layer HBM3E chips in the third quarter and begin supplying large quantities to NVIDIA in the fourth quarter. In April this year, SK Hynix also entered into a partnership with TSMC to co-develop the next-generation AI chip, HBM4, which is scheduled to be launched in the second half of 2025.

In May, SK Hynix CEO Kwak Noh-Jung had revealed that HBM capacity is nearly sold out and is not expected to be surplus until 2025.

In addition, SK Hynix plans to launch 32Gb DDR5 DRAM for servers and MCR DIMM1 for high-performance computing in the second half of the year in order to maintain its competitive edge in the DDR5 segment, and for NAND, the company plans to expand sales of high-capacity eSSDs, with sales expected to more than quadruple from last year.

In addition, the Cheongju M15X advanced DRAM chip plant, which is under construction, will go into operation in the second half of next year, while construction of the Longin Semiconductor Cluster will begin in March next year and is scheduled to be completed by May 2027.

In response to speculation that annual capex may exceed expectations, SK Hynix CFO Kim Woo-hyun said, "We have reduced the company's debt size by KRW 4.3 trillion while making the necessary investments, and we will consolidate our position as a leader in AI chips based on a stable financial structure."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.