In the third quarter, SK Hynix's revenue and profits exceeded historical records. Company executives said that the market was "too early" to worry about the surplus of chips.

On October 24, SK Hynix released its third-quarter financial report for the fiscal year 2024 ending September 30.

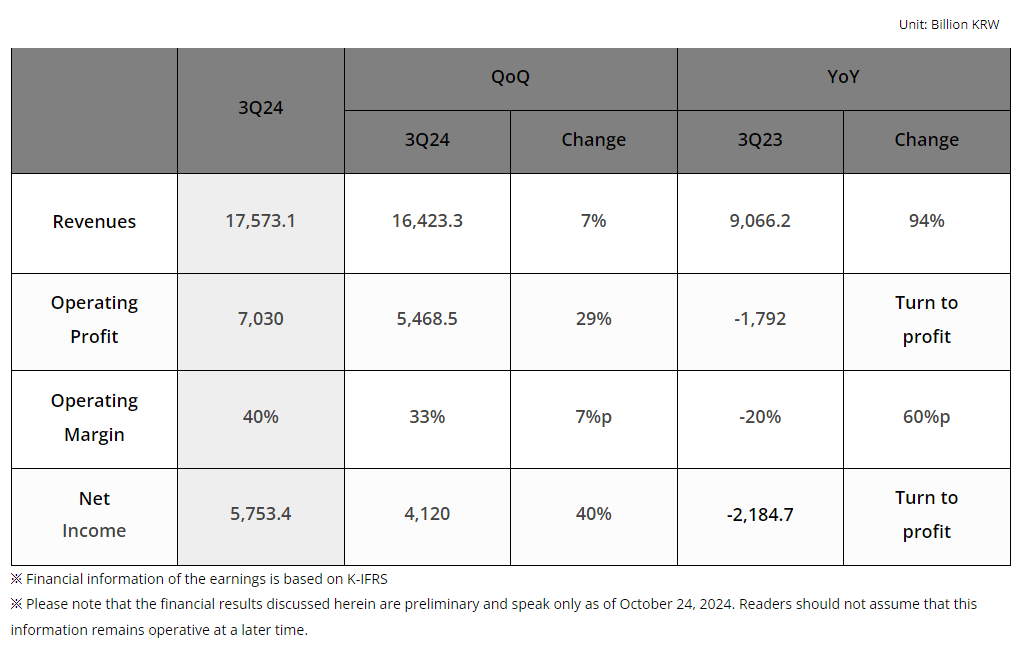

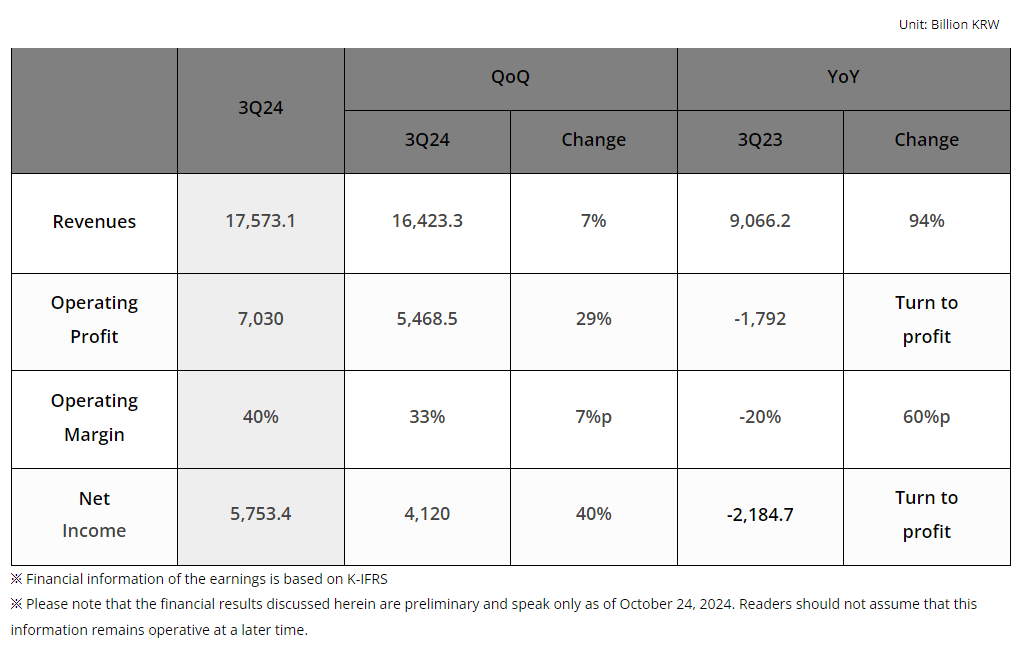

Data showed that SK Hynix's performance in the quarter hit a record high: revenue increased by 94% year-on-year to 17.57 trillion won; operating profit and net profit were 7.03 trillion won and 5.75 trillion won respectively, both of which turned around; operating profit margin was 40%, and net profit margin was 33%.

In terms of products, DRAM revenue accounted for 69%, up 3% month-on-month; NAND revenue fell 3 percentage points to 28% from 31% in the previous quarter.Among them, HBM's sales during the quarter increased by 70% month-on-month and surged by 330% year-on-year; eSSD sales increased by 20% month-on-month and 430% year-on-year.

SK Hynix said that the third-quarter results were mainly due to sales expansion of high-value added products such as HBM and eSSD. The profitability of DRAM and NAND improved month-on-month-the average selling price of DRAM during the period increased by about 15% compared with the second quarter; The average selling price of NAND increased by about 10% month-on-month.The company expects DRAM's second-quarter revenue share to increase from 30% in the third quarter to 40%.

During the telephone conference, the company's executives pointed out: "The company's quarterly results broke the record in history and consolidated its position as the world's largest AI memory company.We will continue to adopt flexible product and supply strategies based on market demand to maximize profitability while ensuring stable revenue.”

Since the beginning of this year, SK Hynix's share price has risen by more than 35%, outperforming Samsung Electronics and Micron Technology, and expanding its lead over competitors in the design and supply of cutting-edge HBM, which powers Nvidia's AI accelerators.

In the fourth quarter, SK Hynix will also supply Nvidia with its top 12-layer HBM3E chips. By the first half of next year, HBM3E 12H may reach half of total HBM3E shipments.

Industry insiders said that under the influence of soaring demand from Nvidia and other AI chip manufacturers, the HBM market will continue to grow strongly next year, and SK Hynix has therefore downplayed the market's concerns about chip oversupply.Market research firm TrendForce released a research report that driven by NVIDIA's Blackwell GPUs, HBM3E's share is expected to increase from 46% this year to 85% in 2025. By then, NVIDIA will continue to dominate the AI market, while Samsung Electronics, SK Hynix and Micron Technology Competition between major memory chip manufacturers will intensify.

Kim Kyu-hyun, head of marketing for SK Hynix DRAM, said in a telephone conference: "AI memory demand centered on data center customers is still strong. Given current trends, we think it is too early to talk about slowing demand for AI chips and HBM.”

In terms of capital expenditure, SK Hynix Vice President and Chief Financial Officer Kim Yu-hyun mentioned that the company's capital expenditure this year may exceed previous plans or increase to more than 10 trillion won.

This year, SK Hynix announced a series of investment plans, including spending US$3.87 billion to build an advanced packaging factory and AI product research center in Indiana, USA. It is also spending US$14.6 billion to build a new memory chip complex and promote other domestic investments, such as the government-backed Yongren Semiconductor Cluster Project.

In sharp contrast to SK Hynix, its rival Samsung issued a warning earlier this month that third-quarter profits would fall short of market expectations and apologized for the disappointing performance, admitting it had difficulty making progress in high-end chip supplies.

Currently, Samsung provides HBM38H chips to customers such as NVIDIA, Google, AMD and Amazon's AWS, and provides HBM2E chips to China companies, and is still working to obtain approval from NVIDIA for its HBM3E chips.

As Samsung competes fiercely with competitors in the HBM field, Quan Yongxian, head of the DS department responsible for Samsung's semiconductor business and Samsung's vice chairman, threatened to significantly cut chip executive positions and restructure semiconductor-related businesses.Samsung has also established a special HBM chip development team and reached a cooperation with TSMC on HBM4 chips.