Tesla shareholders approve Musk's high salary plan, but victory is still one step away

On Wednesday (June 12th), Musk announced on social media platform X that Tesla's two shareholder resolutions are being passed by a significant margin, including its $56 billion compensation plan.

On Wednesday (June 12th), Musk announced on social media platform X that both Tesla shareholder resolutions are currently passing by wide margins.

The two shareholder resolutions mentioned by Musk were regarding his $56 billion compensation plan and the relocation of the company's legal headquarters to Texas.

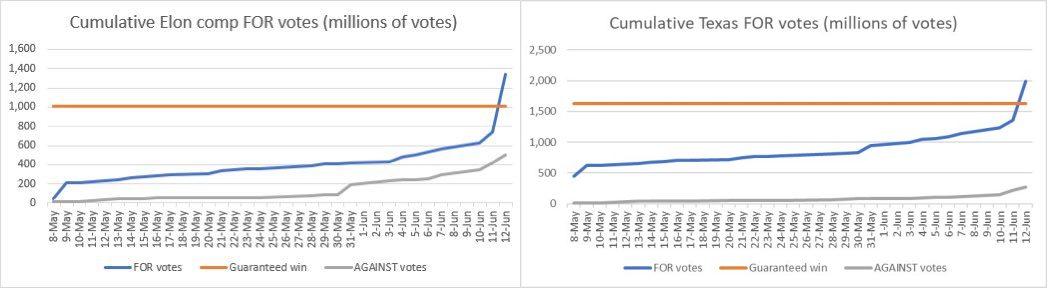

According to the attached image in Musk's related post, it can be seen that since June, the approval votes of shareholders for Musk's $56 billion salary plan have been slowly increasing, and there has been a significant increase from June 10th to 12th. The resolution to relocate the legal headquarters of the company to Texas also has a similar trend.

"Thank you all for your support!" Musk wrote in X's post.

The preliminary results are good news for both Musk and Tesla.In recent weeks, Tesla has been striving to gain support for these two resolutions among large institutional investors and corporate retail shareholders. The voting deadline for these two resolutions is 10:59 PM Central Time on June 12th, the day before Tesla's annual shareholders meeting. Tesla's annual shareholder meeting will be held on June 13th at Tesla's headquarters in Austin.

The most eye-catching of the two resolutions mentioned above is Tesla CEO Musk's $56 billion compensation plan.

In 2018, Tesla's board of directors submitted a compensation plan for CEO Musk. The plan mentions that Musk will be granted 12 batches of stock options within ten years, provided that Musk leads Tesla to achieve certain performance goals. At that time, Tesla's shareholders overwhelmingly approved the compensation plan with a percentage of about 73%.

But the plan was rejected by a Delaware judge in January this year, citing that investors did not have all the necessary information when approving the plan. Meanwhile, the judge pointed out that Tesla's board of directors failed to prove the fairness of the compensation plan and stated that Musk had a close relationship with the company's executives, resulting in bias in the development of the plan.

It is worth noting that Musk has led Tesla to achieve the performance prerequisites mentioned in the compensation plan. The re approval of this compensation plan indicates that the majority of Tesla's shareholders still support Musk's leadership over Tesla.However, even if Tesla's shareholders once again vote to approve the 2018 sky high salary plan, Tesla still needs to "persuade" Delaware judges.

Adam Badawi, a law professor at the University of California, Berkeley, said, "Even if the shareholders do approve the old package, it is not clear that the Delaware court will allow that vote to be effective."

Ann Lipton, a corporate law professor at Tulane University, said, "How the shareholders vote now doesn't really answer the question whether the board violated its duties in 2018, and that's the issue on appeal"

Piper Sandler analyst Alexander Potter also has a similar view. He believes that this has not completely solved the problem, and the compensation plan may still be considered illegal.

However, Porter believes that the salary plan was once again approved as expected. He wrote in a report to clients late Wednesday, "A Delaware judge previously struck down the package citing limited shareholder disclosure, and given enhanced disclosures preceding this vote, it’s unclear why anyone would take issue with this newly-ratified deal."

Porter also stated that Tesla stocks are expected to respond positively to this news. On Wednesday, Tesla's stock price closed up 3.9%.

It is understood that supporters of the above-mentioned compensation plan include Baillie Gifford&Co., a Scottish asset manager, Ark Investment Management LLC under Cathie Wood, and Ron Baron, who runs Baron Funds.

Barron is a long-term investor of Tesla, and in an open letter supporting Musk's compensation plan, he stated that the wishes of shareholders who voted in 2018 should be respected. He bluntly stated that without Musk, there would be no Tesla, and stated that this vote may determine whether Musk will continue to stay in the company.

Opponents include Norway's sovereign wealth fund, Norges Bank, and California Public Employees' Retirement System.

It is reported that before the voting deadline, Tesla Chairman Robyn Denholm had been in contact with large institutional investors, and Tesla had also posted multiple posts on X calling for shareholders to vote in favor. In addition, in the days leading up to the voting deadline, several Tesla engineers, current and former executives also posted on X expressing their support for Musk and acknowledging his leadership.

After Musk announced the proposal to relocate Tesla's legal headquarters to Texas, Texas Governor Greg Abbott immediately congratulated him. Abbott said on X, "Welcome to a state that has neither personal income tax nor corporate income tax."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.