Trump-Harris Debate Ends, How Will U.S. Stocks React?

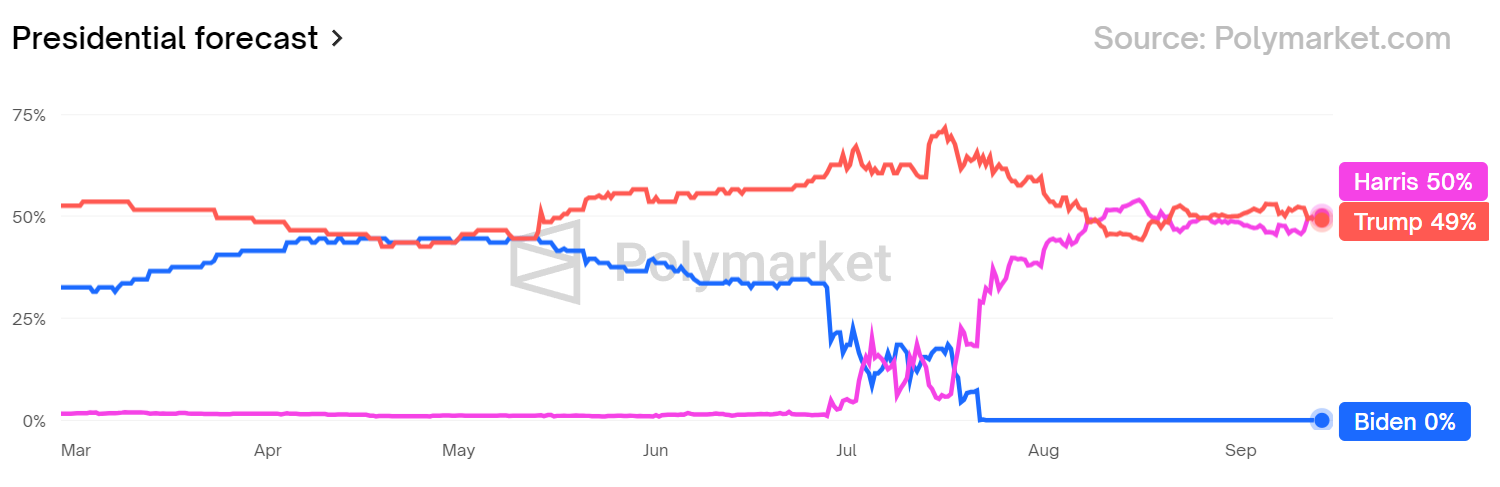

Prediction sites generally show that expectations for a Harris win have risen after this debate.

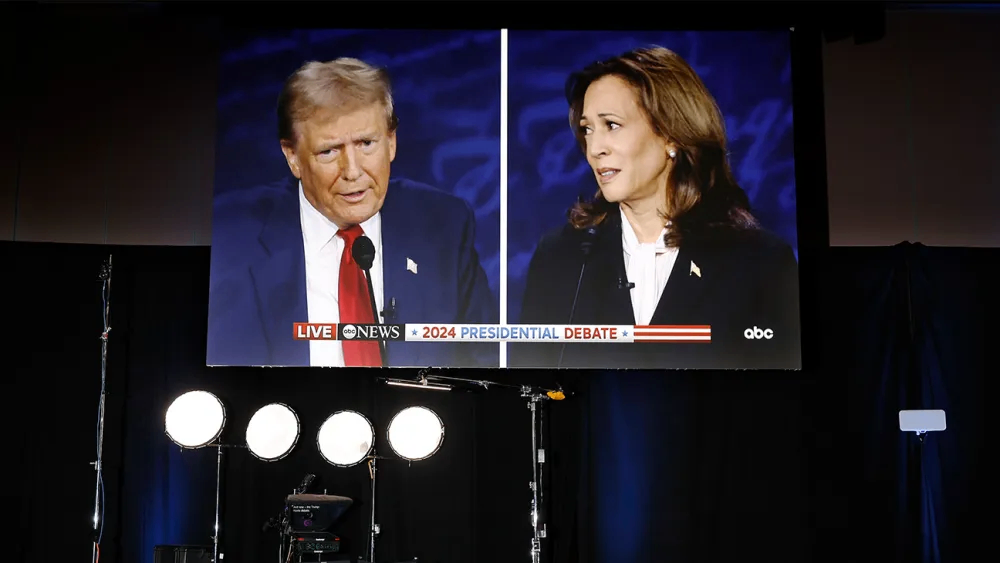

On Sept. 10, Democratic candidate Harris and Republican candidate Donald Trump engaged in the first presidential debate between the two. The debate, which was televised live, lasted 90 minutes, with the two sides trading barbs on a number of topics, including the economy, immigration, abortion, and inflation.

Prediction sites generally showed that expectations for a Harris win rose after this debate. According to the latest data from prediction site Polymarket, Trump has a 49 percent chance of winning the 2024 presidential election, trailing Harris by one percentage point.

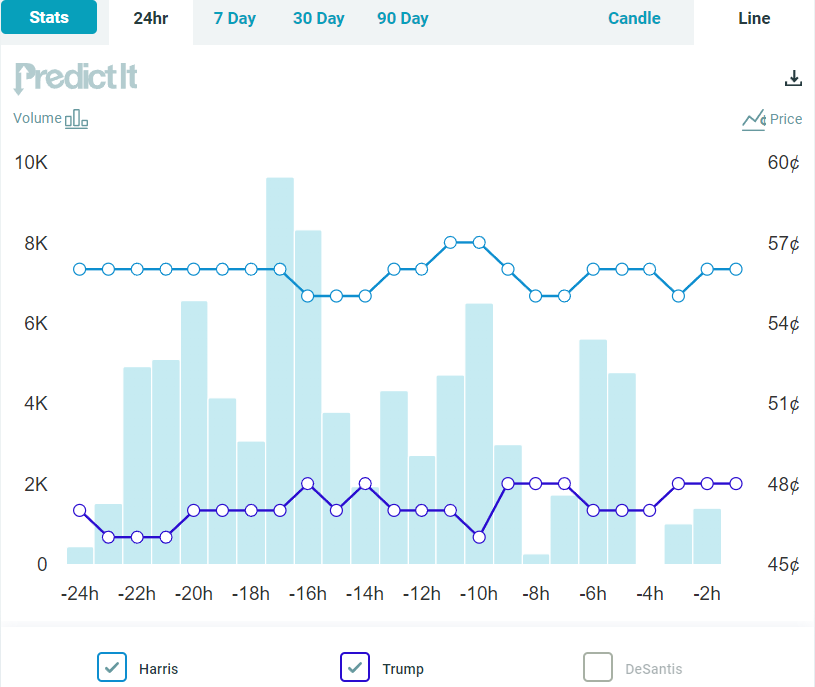

Real-time data from online betting site PredictIt also shows Harris with a higher margin of victory than Trump.

In the wake of the debate, Trump-concept stocks generally fell.

The first to bear the brunt were Trump-owned media stocks.Trump Media & Technology Group, the parent company of Truth Social, plummeted 10% on Wednesday, at one point dropping more than 17% during the course of the day to a new all-time low. However, it is important to note that the stock has very few shares outstanding, making it extremely volatile. The stock has underperformed in recent months, with its market capitalization shrinking by about half since Biden announced in July that he was dropping out of the presidential race.

Also taking a second hit were cryptocurrency stocks, as Trump has repeatedly articulated his supportive stance on cryptocurrencies. On Tuesday, the price of bitcoin fell from about $57,650 at the start of the debate to about $56,880 by the end of it.

In contrast, Harris' performance boosted clean energy stocks, and the clean energy sector was one of the best performers in the S&P 500 on Wednesday.

In solar stocks, shares of First Solar jumped more than 15 percent Wednesday, while SolarEdge Technologies shares rose more than 8 percent and Enphase Energy shares gained nearly 6 percent.

While Harris did not specifically address solar energy in the debate, she has been a supporter of the Biden administration's Inflation Reduction Act, which includes tax credits for rooftop solar and other clean energy programs.

In addition, other green energy stocks rose as investors weighed the possibility of Harris continuing the Biden administration's climate policies.

Lithium giant Albemarle was up 11% on Wednesday, green energy utility AES was up 7%, and the Invesco Solar ETF, a photovoltaic ETF managed by asset manager Invesco, was up 5%.

Outside of these sectors, the overall market performance was relatively quiet. According to analysts, both sides in the debate on the subject of more general, and no side showed overwhelming advantage, so the market wait-and-see mood is strong.

Convera Asia-Pacific chief foreign exchange and macro strategist Shier Lee Lim said, “Overall, there is not much substance to the market. I'm not surprised that the market didn't react too much.”

ING Economics said, “Betting odds show Trump's chances of winning the election falling back below 50 percent, but with both campaigns signaling openness to another debate, the market may want to wait for new polls in the coming days to take a more decisive stance on the election.”

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.