The UK financial services industry received 1.87m complaints in 2023H2

The Financial Conduct Authority (FCA) has published complaint data for the period from 1 July to 31 December 2023.

The UK Financial Conduct Authority (FCA) has published complaints data for the period ending December 31, 2023.

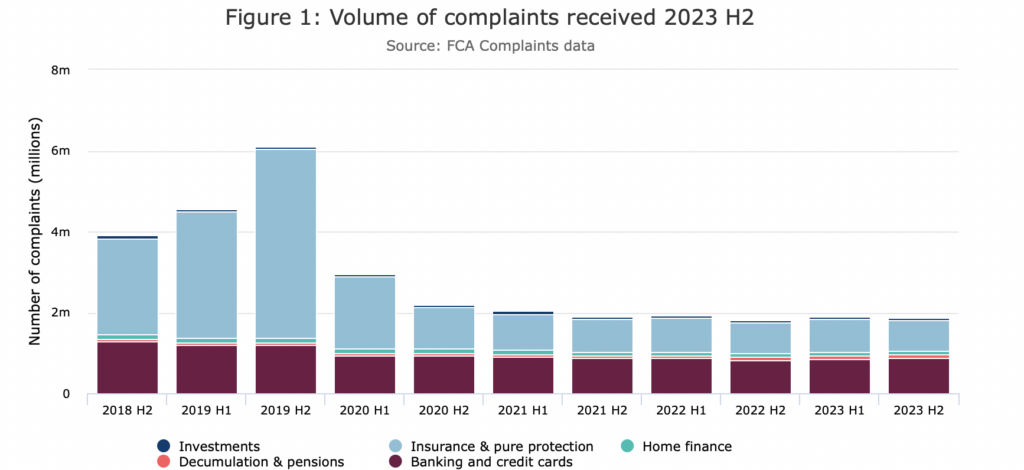

In the second half of 2023, UK financial services firms received 1.87 million complaints, a decrease of 1% from the first half of 2023's 1.89 million. Since the peak of Payment Protection Insurance (PPI) in 2020, the number of complaints has remained relatively stable between 1.8 million and 2 million.

The product groups that experienced an increase in complaint numbers were:

- Banking and credit cards: increased from 847,497 (first half of 2023) to 874,568 (second half of 2023), up by 3.2%.

- Home finance: increased from 91,470 (first half of 2023) to 94,822 (second half of 2023), up by 3.7%.

- Investments: increased from 59,417 (first half of 2023) to 61,446 (second half of 2023), up by 3.4%.

Complaint numbers decreased in the following product groups:

- Pension and retirement income: decreased from 88,058 in the first half of 2023 to 85,547 in the second half of 2023, a decrease of 2.8%.

- Insurance and pure protection: decreased from 800,253 in the first half of 2023 to 753,192 in the second half of 2023, a decrease of 5.8%.

The three products with the highest number of complaints experienced an increase:

- Current accounts increased from 509,923 in the first half of 2023 to 515,336 in the second half of 2023, up by 1%.

- Motor vehicles and transportation insurance increased from 278,148 in the first half of 2023 to 281,082 in the second half of 2023, up by 1%.

- Credit cards increased from 201,925 in the first half of 2023 to 217,032 in the second half of 2023, an increase of 7.5%, consistent with recent fluctuation trends.

Complaint numbers decreased for most other products.

The proportion of complaints upheld decreased from 61% in the first half of 2023 to 58% in the second half of 2023.

Compensation totalled £259 million in the second half of 2023, a 10% increase from £236 million in the first half of 2023.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.