First inflation data after UK rate cut: prices rise moderately

Although the data is expected by the central bank, it will still have some impact on market expectations and the direction of monetary policy.

On August 14, following the first interest rate cut in over four years, the UK released its first inflation data.

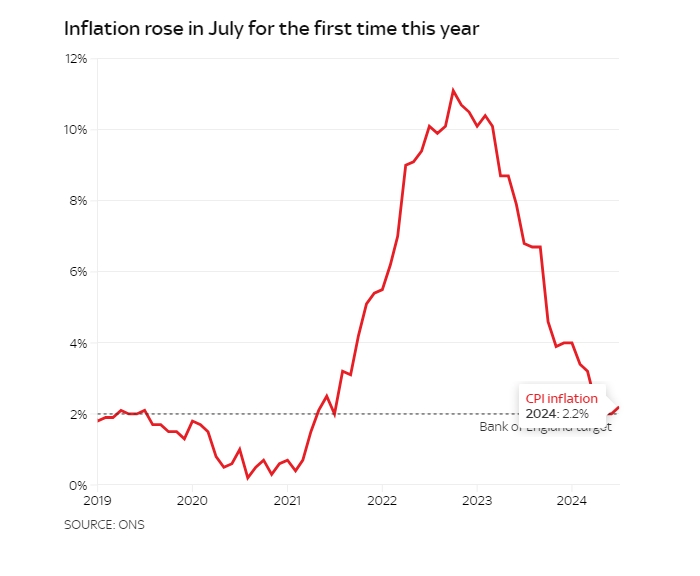

Data from the Office for National Statistics (ONS) shows that the UK's Consumer Price Index (CPI) rose to 2.2% year-on-year in July, slightly above the Bank of England's 2% target inflation rate but below the 2.3% predicted by economists and the 2.4% forecast by the Bank of England.

Core CPI, excluding food and fuel, grew by 3.3% year-on-year, lower than the expected 3.4% and the previous 3.5%.

Specifically, the price of food and non-alcoholic beverages rose by 1.5% year-on-year, matching the increase in June and marking the lowest level since October 2021. It is also the first time since March 2023 that food and beverage prices have not declined; the service industry's prices cooled down from 5.7% to 5.2%, below the Bank of England's expected 5.6%, reaching a new low in over two years.

Although this data was anticipated by the central bank, it will still have a certain impact on market expectations and the direction of monetary policy.

The Bank of England's decision in early August to cut interest rates, reducing the benchmark rate by 25 basis points to 5%, was based on a prudent assessment of the inflation outlook. There is disagreement among members of the Bank's Monetary Policy Committee, but there is a general consensus that monetary policy needs to remain restrictive for a sufficient period until inflation can return sustainably to the target level.

The Bank of England expects the UK CPI to rise to around 2.75% in the second half of the year. Although the data for July has risen, the decline in core inflation and service inflation provides the bank with some policy space.

One of the members of the Bank's Monetary Policy Committee, Darren Jones, said that the new government is clearly aware of the challenges faced, with many families still struggling to cope with the rise in living costs. The government is making tough decisions to repair the economic foundation in order to reshape the UK's economic landscape, making every part of the country more prosperous.

Currently, the market is particularly concerned about the pace of the Bank of England's future rate cuts. After the release of the inflation data, the pound fell sharply in the short term, and as of the time of writing, it has fallen to 1.2829 against the US dollar.

Regarding this data, the Chief Economist of the Office for National Statistics, Grant Fitzner, said, "Inflation rose slightly in July, although domestic energy costs fell, the decline was less than a year ago. This was partly offset by the fall in hotel costs in July, which fell back after a strong increase in June."

The Chief Economist of the Confederation of British Industry (CBI), Martin Sartorius, said, "The moderate rise in inflation will be seen as a positive signal for the normalization of price pressures for households and businesses. Today's data will give the Bank's Monetary Policy Committee some confidence that domestic price pressures are unlikely to disrupt the sustainable return to the 2% target."

The head of economic research at Deloitte, Debapratim De, believes that the latest official data is unlikely to substantially change the Bank of England's view on interest rates. "We expect the rate to remain unchanged in September, but there may be two more rate cuts this year."

After the CPI, the market will closely monitor the Gross Domestic Product (GDP) data to be released on Thursday. Analysts expect the GDP data to show that economic growth in the second quarter continues to be healthy, continuing the recovery momentum after last year's economic downturn. However, the central bank also warned that a strong economy has intensified inflation risks.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.