U.S. Stock Futures and Dollar Gain in Wednesday Pre-Market Amid Election Uncertainty

Market sentiment fluctuated on Wednesday as preliminary results of the U.S. presidential election showed a tight race. Investors sought safety, driving U.S. stock index futures and the U.S. dollar higher during Asian trading hours.

Market sentiment fluctuated on Wednesday as preliminary results of the U.S. presidential election showed a tight race.Investors sought safety, driving U.S. stock index futures and the U.S. dollar higher during Asian trading hours.

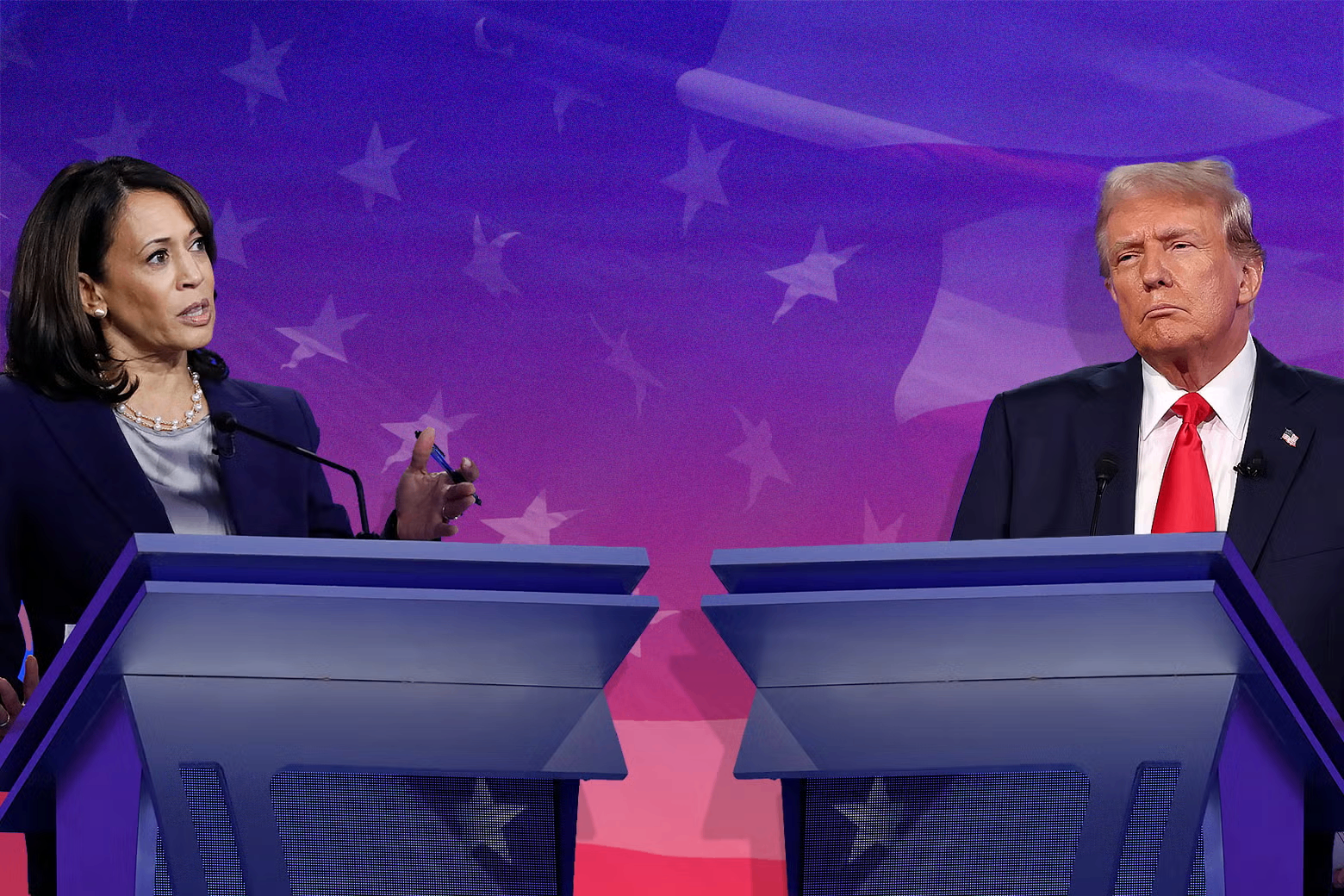

According to Edison Research, Republican candidate Donald Trump won in eight states, while Democratic candidate Kamala Harris won in three states, including Washington, D.C.However, results for most key swing states have not yet been released and may take hours or even days to be announced.

Standard & Poor's 500 Index futures rose 0.6% in volatile trading, while Nasdaq futures rose 0.3%.In Europe, Eurozone blue-chip index EUROSTOXX 50 futures rose 0.2%, German DAX futures rose 0.4%, and UK FTSE 100 futures rose 0.3%.

Asia-Pacific stock markets performed relatively smoothly, with the MSCI Asia-Pacific (excluding Japan) stock index showing little change.On the Japanese stock market, the Nikkei 225 index rose 1.2% as the yen fell, which was in line with the overnight rally in U.S. stocks.

In the foreign exchange market, the US dollar index rose 0.8% to 104.19.Against the dollar, the euro fell 0.8% to 1.0834, falling back to a one-week high of 1.0937.

Against the yen, the dollar rose 0.8% to 152.86, further away from its low of 151.34.In addition, the US dollar rose 0.5% against the offshore yuan to 7.1375 yuan.China is regarded as the forefront of global trade frictions due to tariff risks, and the implied volatility of the RMB against the US dollar is at a historically high, indicating market tensions about the Sino-US trade situation.

Gold prices remained largely stable as the dollar strengthened and bond yields rose.Spot gold was quoted at $2,744 an ounce, down from a previous high of $2,790.15.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.