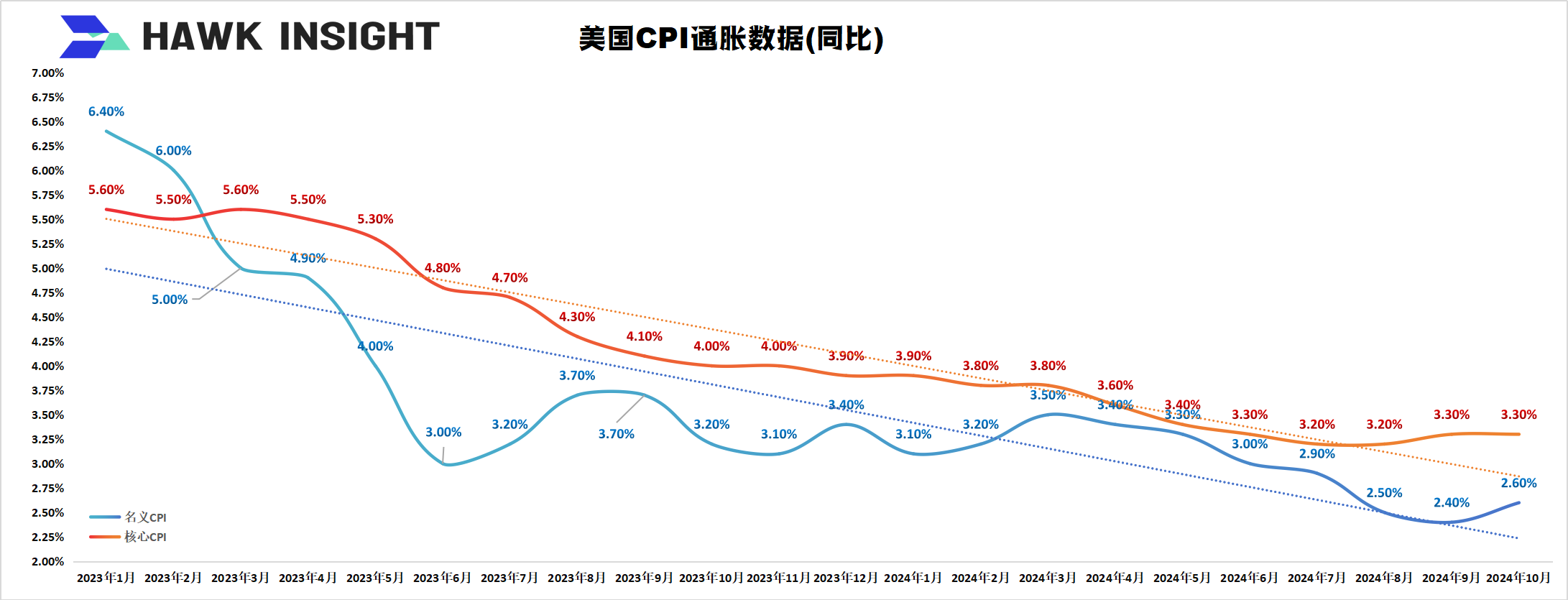

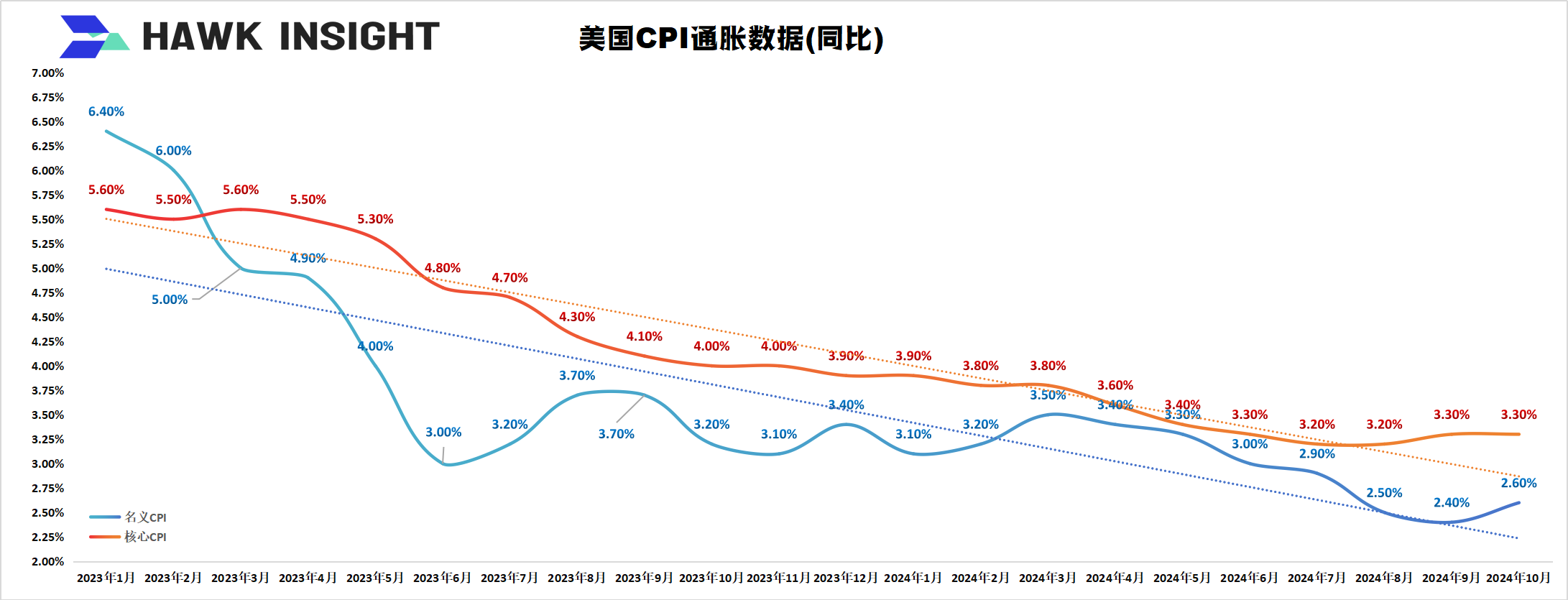

On November 13, U.S. Eastern Time, the first inflation data after the U.S. election was released.Data showed that the U.S. CPI data in October rose 2.6% year-on-year, in line with market expectations, but rebounded from the previous month's 2.4%.What scares the market even more is that the CPI has ended its six-consecutive decline trend, and slowing inflation is the prerequisite for the Federal Reserve to cut interest rates by 75 basis points in September and November.

The core CPI (excluding seasonal fluctuations such as food and energy) remained unchanged at 3.3% as in September.

The core CPI remains unchanged, the overall CPI is rising, and food and energy costs are definitely "playing tricks".Sure enough, energy prices, a "top performer" that had been declining in the past few months, remained flat in October.Energy commodity prices continued to narrow month-on-month, but energy service prices increased month-on-month, pushing overall energy sub-prices upward.

Food costs rose by 2.1%.Among them, the increase in household food was not large (except for eggs, although egg prices fell by 6.4% month-on-month, they were still significantly higher than the same period last year by 30.4%), up 1.1% year-on-year (previous value of 1.3%), but non-household foods increased year-on-year. 3.8%.

Non-household food refers to the food and services consumed by consumers outside the home. This includes food and beverages purchased in restaurants, fast food restaurants, cafes, bars and other places. This sub-item is closely related to the U.S. food service industry.

In terms of food and energy, non-core inflation related to basic consumption (energy prices and household food) increased little, but inflation related to advanced consumption (energy services and non-household foods) recorded increases, indicating that the U.S. service industry is recovering.

Among the core CPI, the biggest contributor to the upward trend of inflation this time is housing prices, which rose by 4.9% year-on-year.Although the figure is less than the 8.2% year-on-year increase in transportation services, this sub-item contributed the most to the increase in CPI data in October since housing prices account for one-third of the overall CPI.

Looking further down, in the past year, Americans 'rents have recorded an increase of about 5%.Owner's equivalent rent (which can be understood as the landlord's expected rent) increased by 5.2% year-on-year, flattening from the previous value; main residence rent (which can be understood as the tenant's core rent) increased by 4.6% year-on-year, down from the previous value of 4.8%.The decline in the price of out-of-home accommodation has also narrowed significantly.In particular, hotels and other outings rebounded to 0.5% month-on-month quarterly, while the previous value was only-2.3%.

Core service sub-items surged year-on-year across the board, with residences rising by 4.9%, transportation services rising by 8.2%, and medical care services rising by 3.8%.

From a numerical point of view, this is a data in line with expectations, but from a detailed point of view, the U.S. service industry did not decline in prosperity in October, and the Federal Reserve is facing the risk of a substantial rebound in inflation.According to another report from the U.S. Bureau of Labor Statistics, the average hourly wage of workers in the United States for the month can still increase by 1.4% year-on-year and 0.1% month-on-month.

Originally, the market was worried that rising inflation would limit the Federal Reserve's path to cut interest rates. Coupled with the potential tariff impact and strong stimulus measures after Trump took office, the market's expectation that the benchmark interest rate would remain stuck at a high level has increased.The market generally believes that this year, the Federal Reserve will still cut interest rates by 25 basis points in December, but next year may not cut interest rates as many as expected.If the economy continues to overheat, the Federal Reserve may press the "pause button" to cut interest rates as early as January.

In the relevant contract market, traders also cut the Federal Reserve's expectations for interest rate cuts in 2025.The market expects that the Federal Reserve may only cut interest rates by 75 basis points in 2025, about 50 basis points less than expected before the election.

Expectations for high interest rates brought about by the strong U.S. services industry in October stimulated the sell-off of U.S. bonds.After the data was released, the U.S. 10-year Treasury yield rose to 4.483%, the highest level since July 1.The US dollar index also rose to its highest point since November 2023, reaching 106.54.

Corresponding to this is the sell-off of gold.Since gold is not an interest-bearing asset, higher US bond yields will severely hit gold prices.Yesterday, spot gold continued to be weak. The price of gold fell in early trading. After the European market opened, the price of gold once rebounded to around US$2,610. However, before and after the release of inflation data, the price of gold fell again, closing at US$2,597.27/ounce, down 0.88% throughout the day.

Regarding the future trend of gold, Bank of China analyzed that technically, gold has fallen to a two-month low, the largest decline since the rally started in March, and has formed a trend of upward correction.After the daily level closed a series of negative lines, the order of various indicators was in a short position. In the short term, pay attention to the support node near the lower track of the Bollinger Band 2,558. On the 4-hour chart, the downward energy released by the MACD indicator has decreased, and the KDJ indicator has shown signs of gluing in the overbought area below, with unknown direction.