U.S. PPI data for March increased by 2.1%, is a rate cut in June out of the question?

As a series of hot data is released, the entire Wall Street is reassessing the Federal Reserve's policy path, with the conclusion being generally pessimistic.

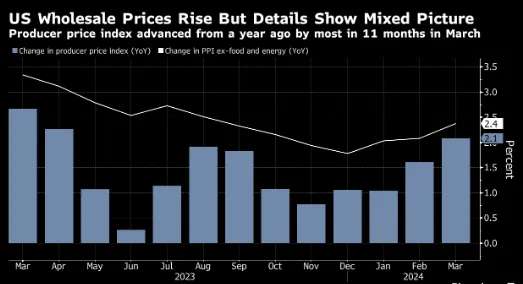

On April 11th, the U.S. PPI index for March rose by 2.1% year-on-year, reaching the highest level in 11 months, which once again dealt a blow to expectations for a rate cut. The good news is that U.S. commodity prices continued to decline in March, and the rate of service price increases has also slowed down.

Specifically, the U.S. PPI for March rose by 2.1% year-on-year, estimated to increase by 2.2%, with the previous value rising by 1.6%; the PPI for March increased by 0.2% month-on-month, estimated to rise by 0.3%, with the previous value rising by 0.6%.

Excluding the more volatile food and energy sectors, the U.S. core PPI for March increased by 2.4% year-on-year, slightly higher than the expected 2.3%; the core PPI month-on-month slowed down from 0.3% in February to 0.2%, in line with expectations.

In the categories most closely watched by the Federal Reserve, such as PCE, the price of portfolio management rose by 0.5%, while the cost of outpatient care at hospitals remained unchanged. More broadly, service costs increased by 0.3%, partly due to the rise in airfare prices. Overall, commodity prices continue to trend downward.

The PPI data also show that service costs have risen for the third consecutive month, proving to be the main reason for persistent inflation. Because of this, traders have begun to postpone their expectations for a Federal Reserve rate cut once again.

In addition to this PPI data, on Wednesday this week, the U.S. also released a stronger-than-expected inflation report: the CPI for March rose by 0.4% month-on-month and by 3.5% year-on-year. Excluding the more volatile food and energy prices, the core CPI rose by 0.4% month-on-month and by 3.8% year-on-year, with all four figures being 0.1 percentage points higher than market expectations.

After the data release, the swap market fully digested the Federal Reserve's first rate cut time being postponed from September to November, with bets on a June rate cut almost disappearing, and traders also firmly believe in the expectation of only two rate cuts this year. Nick Timiraos, known as the "Fed's mouthpiece," wrote that hot inflation has weakened the rationale for a rate cut by the Federal Reserve in June.

In the recently published FOMC meeting minutes from March 19th to 20th, policymakers also expressed concern about the slow decline in inflation, stating: "It may be necessary to maintain contractionary policies for a longer period of time." In contrast, U.S. President Biden insists on his expectations for a Federal Reserve rate cut, saying that the Federal Reserve will cut rates by the end of the year.

According to the Federal Reserve's dot plot released in March, the bank expects to cut rates three times this year. However, with a series of hot data being released, the entire Wall Street is reassessing the Federal Reserve's policy path, with the conclusion being generally pessimistic.

Public data shows that Goldman Sachs has adjusted its forecast for the Federal Reserve's rate cuts from once to five times, and then to two times. Barclays Bank has now returned to the position that the Federal Reserve will only cut rates once this year. Bank of America has postponed the Federal Reserve's first rate cut from June to December. Deutsche Bank's economists have also made a significant shift, predicting that the Federal Reserve will only cut rates once this year in December. The bank had earlier predicted four rate cuts for the Federal Reserve this year.

Yesterday, John Williams, the third-ranking official of the Federal Reserve, Vice Chairman of the FOMC, and President of the New York Fed, also spoke, stating that "there is no need to adjust monetary policy in the short term." Thomas Barkin, President of the Richmond Fed, said that the inflation data intensified doubts about a change in the inflation trend and was somewhat reluctant to declare victory over inflation for the Federal Reserve.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.