Hidden Risks in US Stock Market? Goldman Sachs and Morgan Stanley Issue Warnings

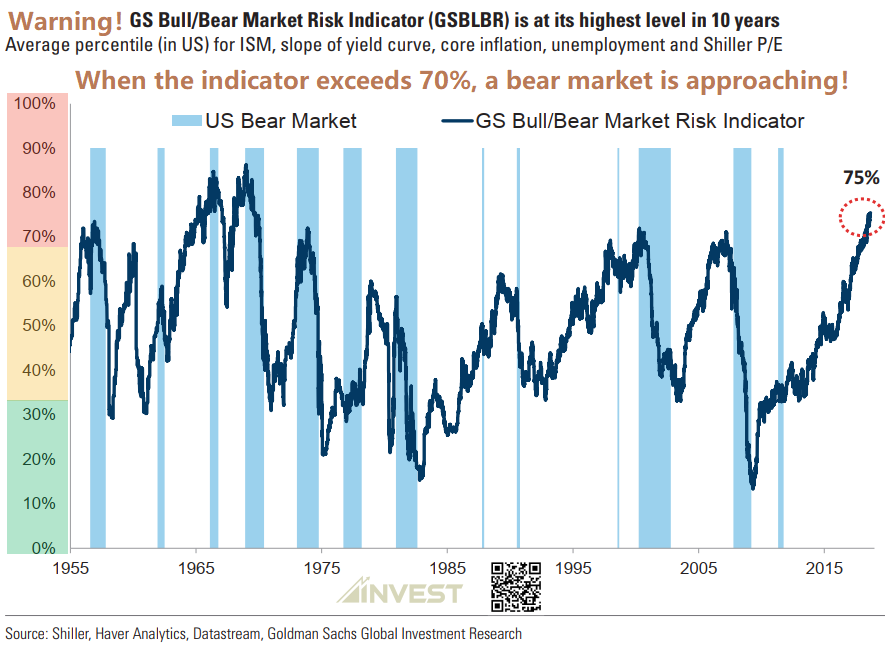

US stock market has shown strong performance recently, but the hidden risks cannot be ignored. Goldman Sachs' US stock market bull bear index has exceeded the warning threshold of 70%.

US stock market has shown strong performance recently, but the hidden risks cannot be ignored. Goldman Sachs' US stock market bull bear index has exceeded the warning threshold of 70%.

The Goldman Sachs Bull Bear Index is based on stock valuation indicators, growth momentum, unemployment rate, inflation rate, and yield curve. When the index exceeds 70%, a significant stock market recession usually follows.

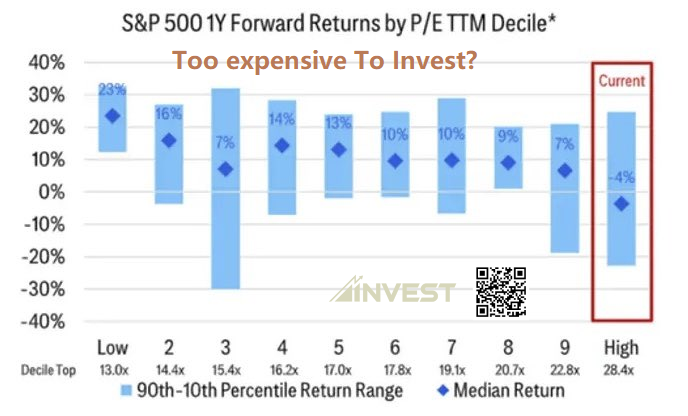

From a valuation perspective, the risk return ratio of the US stock market is no longer attractive.

The forward P/E ratio of the S&P 500 index has reached 28.4 times. Historical data shows that when the valuation is so high, the median expected return of the index for the next year is -4%.

In addition to the charts, Goldman Sachs analysts and another large investment bank, Morgan Stanley, have also issued warnings about the bullish trend in the US stock market.

Scott Rubner, Managing Director and Tactical Expert of Goldman Sachs Global Markets, said that after significant fluctuations in the first half of this year, buyers have fully invested and their cash flow has run out; The threshold for corporate profitability is already high and reflected in stock prices, which means that the second quarter financial report season is no longer a driving factor for the stock market.

Mike Wilson, Chairman of Morgan Stanley's Global Investment Committee, stated that investors should be prepared for a significant correction in the stock market due to increasing uncertainty in the US presidential election, corporate earnings reports, and Federal Reserve policies. He believes that there is a high possibility of a 10% correction in the stock market from now until the election period, and the third quarter will be a period of volatility.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.