What is a balance sheet??How it reveals the company's finances?

Balance Sheet (Balance Sheet) and Income Statement (Income Statement) and Cash Flow Statement (Cash Flow Statement) are the three major statements that make up a company's financial statements, showing a company's assets, liabilities, and overall financial position.。

What is a balance sheet??

Balance Sheet (Balance Sheet) is one of the financial statements of a company, recording a company's financial position as of a certain point in time, including: asset position, debt position, inventory position, solvency, etc.。

Unlike the income statement and cash flow statement, the balance sheet shows the company's financial position as of the date of the financial report, so the financial report will generally be written as "As at date," or directly on the date;

The basic structure and format of the balance sheet.

The balance sheet is made up of three main parts: assets (Asset), liabilities (Liability), and shareholders' equity (Shareholders' Equity).。

- Assets (Assets) are resources that the company fully owns and can generate benefits in the future, such as cash, production equipment, inventory, real estate, etc.。Assets are also resources that can be converted into cash.。

- Liabilities (liability)is what the company needs to repay, including bank loans, accounts payable, etc.。

- Shareholders "EquityIs the capital injected into the company by the shareholders。After deducting liabilities from the company's assets, the remaining value is attributable to shareholders.。

So, you can also know from "assets" where the company is using its funds, as well as from "liabilities" and "shareholders' equity" where the funds are coming from.。It is worth noting that the addition of "liabilities" and "shareholders' equity" must equal "assets."。

When presenting a balance sheet, an accountant will generally present assets, liabilities and shareholders' equity separately in order。It is important to note that within these three categories, liquidity will also be presented in order of high to low liquidity; higher liquidity means faster conversion to cash; lower liquidity means slower conversion to cash。

- Assets: first current assets (Current Assets), then fixed assets (Fixed Assets)

- Liabilities:First current liability (Current Liability), then long term liability (Long Term Liability)

- Shareholders' equity:In order, capital stock (Capital Stock), capital surplus (Capital Surplus), retained earnings (Retained Earnings), treasury stock (Treasury Stock) and others.。

Individual items of the balance sheet

Current Assets

Current assets are assets that can be quickly liquidated within one year, such as cash (Cash), inventories (Inventories), receivables (Receivables), and short-term investments (Short Term Investments).。

Fixed Assets

Fixed assets are assets that are difficult to realize within one year, such as industry, plant and equipment (Property, Plant and Equipment), intangible assets (Infinite Assets), goodwill (Goodwill), and long-term investment projects (Long Term Investments).。

Current Liabilities

Current liabilities are debts that can be paid off within one year, including Payables, Short Term Loans and Borrowings, and Current Tax Liabilities.。

Non-current liability

Non-current liabilities are debt with a maturity of more than one year, such as long-term loans (Long Term Loans and Borrowings) and deferred tax liabilities (Deferred Tax Liabilities).。

Shareholders "Equity

Shareholders' equity refers to the value of shareholders' ownership of a company's assets, such as capital stock (Capital Stock), capital surplus (Capital Surplus), retained earnings (Retained Earnings), and treasury stock (Treasury Stock).。

Balance Sheet Focus

After understanding the significance of each item in the balance sheet, we can think about how the company has changed by observing changes in data over time。When reading the financial report, it is best to pay attention to several aspects:

Growth in the size of the company's assets

If a company's assets continue to grow steadily, it means that the company's financial strength and production capacity are improving.。

At the same time, asset growth also represents higher debt, and companies with higher debt are usually in a phase of rapid growth。

The turnover capacity of the company

The company is growing rapidly, assets and liabilities are both good and bad, we need to pay attention to whether the company will have excessive debt problems;。

If the company's growth is not as smooth as expected, the debt maturity can not pay off the debt or interest charges, the fear will further drag down the development of operations, or even face bankruptcy.。

At the same time, if the vast majority of the value of an asset is fixed assets, i.e., assets that are difficult to liquidate within a year, the company may also experience short-term poor turnover。

Then again, a company in business, it is inevitable to provide some credit to customers, so we also pay attention to the company's accounts receivable, there is no risk of bad debts can not collect money。

Past cases tell us that many dishonest company management rely on accounts receivable to make false accounts, so if you see a company whose accounts receivable are increasing indefinitely from year to year, be careful to prevent this risk。

Inventory value

The increase in the value of inventory does not depend only on the company's constant purchases, but may also be due to the increase in the price of raw commodities.。However, if the inventory value is still rising without fluctuations in commodity prices, there is a risk that the company's products may not be sold.。At the same time, falling commodity prices, as well as hoarding warehouses for too long, could lead to impairment losses.

How to use the indicators in the balance sheet to judge the performance of the company.?

Current Ratio

The current ratio can help you measure a company's short-term solvency.。The higher the current ratio, the stronger the company's short-term solvency.。

However, current assets include accounts receivable and inventory, so if the value of both is too high, it could lead to a high current ratio result, so the current ratio is not as high as possible。

Generally, the current ratio is between 1.5 times to 2 times, are considered healthy enterprises。

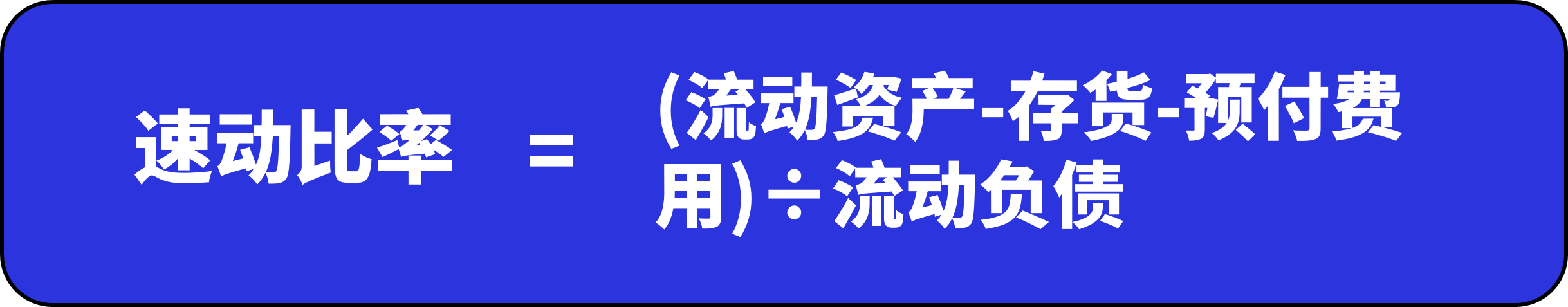

Quick Ratio

The quick ratio is another indicator that helps you measure a company's short-term solvency.。

Unlike the current ratio, the quick ratio deducts inventory and advance payments and is calculated only in cash, short-term investments and accounts receivable, so it is more reliable than the current ratio, after all, inventory is sometimes difficult to realize, and prepayments cannot be realized.。

In general, the ideal quick ratio requires more than 1 times so that the turnover pressure on all short-term liabilities can be met.。

Cash Ratio

The cash ratio measures the liquidity of a company's assets and is generally considered to be at 0.2 times better.。

However, it is not good to be too high (again, there is no standard, mainly depending on whether the nature of the business requires a large amount of capital), because it means that the cash flow of the enterprise is not reasonably invested in business development.。

Asset-liability ratio (Debt Ratio)

The gearing ratio can help you see a company's total liabilities as a percentage of total assets.。In general, investors want debt ratios to remain between 30 and 60 percent, depending on the nature of the industry.。

In addition, if the gearing ratio reaches 100% or exceeds 100%, it means that the company has no net assets or is insolvent。

Inventory Turnover

Inventory turnover can help you see how fast a company's inventory turns.。The inventory turnover rate is good, representing the company's efficient use of funds and strong short-term solvency.。

There is no absolute standard value for inventory turnover for reference, after all, inventory turnover in various industries can vary widely.。

For example, inventory turnover in the retail industry is usually higher than in the automotive industry because retail products are usually easier to sell。

Therefore, we should compare the turnover rate of our peers to see if this company's turnover rate is performing well。

Total Assets Turnover Ratio

The total asset turnover ratio needs to be matched with sales revenue in the income statement to see that the company's assets are not efficient when used to make money。Overall, a higher total asset turnover means that the faster the asset can be turned around and make money, the better for the business。

Similarly, there is no absolute standard value for this indicator, after all, business models vary from industry to industry, so comparisons with peers are needed to make sense.。

In general, industries with low prices like retail products will have higher turnover rates, while industries that burn money, such as technology, automobiles, and aircraft, will have lower turnover rates.。

Return on Equity (ROE)

You can calculate the return on investment received by the investor through the net interest rate of equity, the higher the value, the better.。Usually more than 15% is a better stock selection condition; the lower limit of the net interest rate on equity cannot be lower than the current interest rate on bank time deposits.。

Return on Assets (ROA)

The return on assets is also the higher the better, representing the ability and efficiency of all assets to make money.。Overall, a return on assets of 6-7% is the norm, but still depends on industry standards.。

If a company's return on assets exceeds its peers, it means that the company has a better competitive advantage than other companies in its peers.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.