eToro Commentary: eToro Pros and Cons Analysis

eToro is a popular broker offering a wide range of trading assets and innovative trading features。Whether a beginner or an experienced trader, eToro offers a friendly trading platform and the opportunity to interact with other traders through its social trading features。

eToro is a reputable UK forex broker founded in 2007 by David Ring and the Assia brothers (Ronen Assia and Yoni Assia).。Over the years, the broker has become famous for its more than 17 million users worldwide, with operations in more than 100 countries (data as of 2018).。

eToro has the best, user-friendly trading platform in the industry, especially for beginners, especially those traders interested in social and copy trading。It is a multi-asset platform offering over 2,000 tradable assets including stocks, commodities, CFDs, forex, cryptocurrencies and indices.。

The most prominent feature of eToro is the copy trading feature, which allows new investors to copy the strategies and portfolios of professional investors。In return, professional investors will receive certain rewards from the company。The platform also offers a wide range of educational tools and resources to meet the needs of beginners。

In addition, the broker is also a leading broker in the cryptocurrency space。eToro provides access to 18 of the world's most popular cryptocurrencies, including mainstream cryptocurrencies like Bitcoin, Ethereum, and smaller cryptocurrencies like Tron Coin and Stellar Lumens。

eToroWhether safe and reliable?

eToro has no problem with security。The broker has top-of-the-line security measures and regulations and offers strict fund protection features to ensure the safety of funds。Founded in 2007, eToro has established physical offices in various countries around the world, including London, Limassol, New Jersey, Shanghai and Sydney.。The broker is also licensed by several top regulators, including the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).。The regulation of these institutions means that the broker is unlikely to manipulate market prices and comply with the regulator's policies.。

In addition to the legal license obtained,eToro is also ESMA compliant and regulated in almost all European countries.。As a result, eToro can provide services to virtually any country worldwide, including the United States.。However, for U.S. traders, there are some trading restrictions。Therefore, if you are from the United States, be sure to check the terms and conditions before registering。

in terms of financial protection,eToro always makes sure to put it first。The broker offers two security measures to help you keep your money as safe as possible。

First, traders' funds are held in separate accounts at top banks like Barclays and Goldman Sachs。This is very important to ensure that your funds are safely deposited in a separate account and will not be used by the broker for personal gain。This can also protect your funds if the broker suddenly goes bankrupt or encounters financial difficulties。

The second measure is liability protection。With this feature, your account balance will not become negative or below0 USD。Therefore, if you lose money on your trade and the broker's forced closing fails to work, liability protection will automatically set your balance to $0, even if you may have a loss exceeding that amount。

Advantages: Why ChooseeToro?

What are the special features of eToro compared to its competitors?Here is a detailed explanation of why eToro should be chosen:

Excellent trading platform

eToro is known for its user-friendly trading platform for mobile and desktop users。Unlike other brokers, eToro offers only one type of platform, their own trading platform, and has built a strong reputation among traders over the years.。The best thing about the platform is that it is very easy to use and navigate, even for people who are just starting out trading。

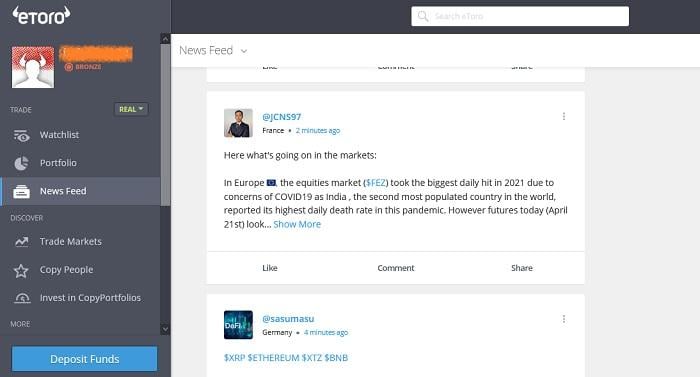

Since social transactions areAn important part of eToro, the platform provides many features that can help traders build a strong community。For example, the Dynamic section allows you to share any information, policies, news, and pictures for everyone to see。You can also follow other traders and participate in various discussions。

No Commission Trading

One of the best features of eToro is that you can trade without commission on stocks and ETFs。This is very convenient for many traders and can reduce transaction costs。However, please note that the broker may still retain a percentage of the dividend depending on your country。

Unlimited Demo Account

For beginners, it is a good idea to start with a demo account。在在eToro, the demo account is completely unlimited and can be opened by providing the most basic personal information。You only need to provide an email address, username and phone number。

通过eToro's demo account, you can get a practice account with a virtual fund of $100,000, which functions exactly like real funds。Most importantly, it is risk-free and ideal for trying different strategies or trading tools。

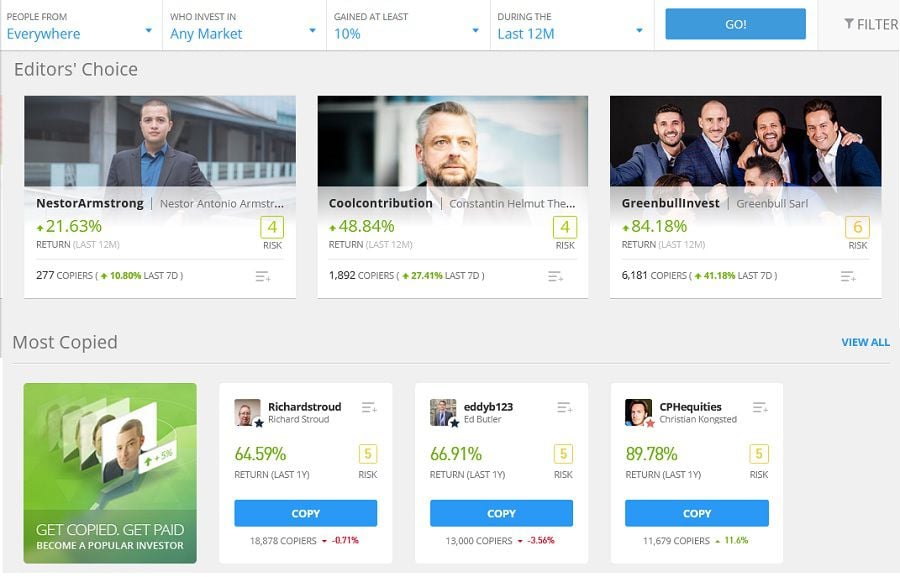

Copy Trading and Popular Investor Program

If we talk about social and copy deals, there's no questioneToro is the best platform。With this feature, traders can copy other traders' portfolios and strategies。This is a huge advantage for beginners with limited knowledge and experience。You can make a profit while learning to build effective trading strategies。Ultimately, you will be able to find the best strategy for you and trade independently。

on the other hand,eToro also offers a program for professional traders, the Popular Investor Program。By joining the program, you actually let other people copy your deals, and in return, you will get paid from eToro。Before joining the program, you will need to contact eToro so they can confirm your order and decide if your profile qualifies as a popular investor。The number of rewards given will be based on the level you are in (higher levels get more rewards)。Therefore, these programs offer a win-win solution for beginners and professionals。

Disadvantages: Factors to consider

AlthougheToro offers various advantages for both novice and experienced traders, but it also has some disadvantages。Are they still acceptable or completely unacceptable?After reading the full explanation below, you can conclude:

Relatively high spreads and non-transaction costs

Although there is no commission, each trade needs to execute a specific spread based on different assets becauseeToro only offers floating spreads。Although still considered competitive, it is relatively higher than other brokers。In cryptocurrency trading, the spread of popular cryptocurrencies like Bitcoin starts at about 0.75%, but depending on volatility, it could rise to 5% or more。In addition, the minimum purchase amount for any cryptocurrency is $25, which makes it difficult for small traders to spread their balances across multiple currencies.。

Another disadvantage relates to non-transaction costs。You may encounter several fees, including withdrawal fees, inactivity fees, and overnight fees。Typically, these fees are used to compensate for the commission-free trading model they offer。

Trading Account

eToro offers several trading accounts, including:

Demo Account: As mentioned earlier, a demo account isOne of the top features offered by eToro。It is a great way to practice trading because it provides completely free and unlimited virtual balances that function exactly the same as real funds。Just provide a username, email address and phone number to open it。

Standard Account: This is a typical account for any trader。To start trading, you need to provide several documents for a quick verification process。Required documents include ID card/ Passport and proof of residence (utility bill or bank statement)。Once these requirements are submitted, eToro will check the documents and verify the account。In addition, a minimum deposit of $200 is required to open this type of account。

Islamic Account: If you are a Muslim trader, you can apply specifically for an Islamic account。According to Islamic law, there is no interest charge on the account。To open this account, you need to deposit at leastUS $1,000。

Deposits and withdrawals

Deposits and withdrawals are very important for traders。As mentioned earlier, you areeToro's first deposit must be at least $200。After that, a deposit of at least $50 is required。Payment methods offered will vary depending on your country, but typically offer wire transfers, primary credit / debit cards, cryptocurrency payments, and e-wallets。Commonly accepted currencies include the Euro, US Dollar, British Pound Sterling, Australian Dollar and Russian Ruble, depending on your region。

As for fees, if you deposit in US dollars, the fees are usually lower。If you deposit in another currency, you will need to pay an exchange fee。In addition, the cost also depends on the payment method you choose。

The payment method of withdrawal is basically the same as that of deposit.。In fact, due to anti-money laundering regulations, your withdrawal method should be the same as your deposit method。The broker will ask you to pay$5 fixed withdrawal fee or equivalent。In addition, the minimum withdrawal amount is $30。

Education and support

As a broker for beginners,eToro offers a variety of educational materials and resources。The platform itself is available in 19 different languages, including English, Italian, Spanish, French

Language, Russian, Arabic and Chinese。in terms of research,eToro also offers sophisticated market research and daily updates。There are many webinars and trading videos available for beginners, as well as access to detailed fintech guides。In addition, you can find more information on eToro's blog, which is updated daily and provides a useful economic calendar to track current events。

As for customer support,eToro provides satisfactory service on three different platforms: email, phone, and web-based online chat。The first two languages are available in almost all of the 19 languages on offer, while online chat offers support in the main languages。Another great feature is that once you open an account, you will be assisted by an account manager and can contact and ask for help when needed。

It's safe to say,eToro is an excellent broker and trading platform especially for those interested in social and copy trading。The main advantage of eToro is a simple and complex platform that is equally beneficial for beginners and professional traders。Beginners can easily sign up for a demo account and get access to a variety of educational materials。While professional traders can earn extra income by becoming popular investors。Most importantly, eToro does not charge any additional commissions for these features beyond the standard spread and the cost of buying and selling assets。

Founded in 2007, eToro is committed to making transactions reliable for anyone, anywhere, and reducing reliance on traditional financial institutions.。The company has headquarters in the UK, Cyprus, USA and Australia。

eToro (Europe) Limited is a financial services company authorized and regulated under license number # 109 / 10 of the Cyprus Securities and Exchange Commission (CySEC).。Meanwhile, eToro (UK) Limited is authorised and regulated under the licence number FRN 583263 of the Financial Conduct Authority (FCA).。

As foreToro AUS Capital Pty Ltd, under the supervision of the Australian Securities and Investments Commission (ASIC), was granted recognition to provide financial services under licence number 491139。

As a belonging4-digit type of broker, eToro offers short- and long-term options for day traders and investors, such as their innovative CopyPortfolio ™, a fully managed thematic portfolio。

自Since 2007, eToro has been at the forefront of the fintech revolution.。The most recent was the machine learning AI-based CopyPortfolio launched in 2017.。In addition to developing CopyPortfolio, the company is also integrating Microsoft's machine learning technology into Momentum DD.。

NewThe CopyPortfolio investment strategy uses AI to find the most stable traders who are most likely to generate double-digit returns and bundles traders into a fully managed portfolio.。eToro has hundreds of different classes of financial assets available for trading, including stocks, commodities, cryptocurrencies, currencies, indices and exchange-traded funds.。Each asset class has specific characteristics and can be traded using a variety of investment strategies。

SomeeToro's position involves ownership of underlying assets, such as non-leveraged positions in stocks and cryptocurrencies。Using CFDs, you can make a variety of options, such as leveraged trading, short (sell) positions, fractional ownership, etc.。For example, even if the price of an ounce of gold is $1,000, a trader can invest in gold with $100。Some of eToro's popular CFDs commodities include gold, crude oil, natural gas, silver and platinum。

Currencies are traded only as CFDs。In addition, CFDs allow short selling (short) positions and leveraged trading in some assets that are not offered in traditional trading.。Some popular currency pairs includeEUR / USD, GBP / USD, AUD / USD, USD / JPY, and USD / CAD。

In addition,Exchange Traded Funds (ETF) is a financial instrument consisting of several assets, as a tradable fund。in openingAfter an eToro account, traders can invest at least $250 in an ETF worth $500。Some popular ETFs on eToro include SPY, VXXB, TLT and HMMJ。

However,eToro also offers the opportunity to use CFDs for other functions。In the UK, all leveraged ETF positions are regulated by the FCA。Meanwhile, all CFD positions executed by eToro Australia are regulated by ASIC.。

The company has other advantages.。Of all tradable financial assets, with the exception of spreads,eToro does not charge any deposit or transaction fees。

eToro's copy trading function is very useful for traders。Compared to other brokers,eToro's social trading network is much larger, allowing traders to share and learn from other traders。In addition, the copy trading feature allows traders to automatically copy their trades to someone else's account, thereby gaining。

Anyway,eToro is a popular broker offering a wide range of trading assets and innovative trading features。Whether a beginner or an experienced trader, eToro offers a friendly trading platform and the opportunity to interact with other traders through its social trading features。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.