High interest rates under the oil market: Saudi Arabia began to play "Huairou" Asian refiners want to take refuge in the Atlantic.?

As for the reason why oil prices have not risen as expected, Sen believes that an underappreciated culprit is rising interest rates, which have pushed up the cost of capital at a time when fears of a global recession have led companies to reduce inventories.。

July 5 Asian session, WTI crude oil traded at 71.05 near $/ barrel, down 0 on the day.38%, relatively weak today after recording a big rally yesterday。

El Niño reappears after seven years Saudi crude oil exports cut prices in August

Yesterday, as the market is still affected by Saudi Arabia and Russia's additional production cuts brought about by the positive effect of international oil prices recorded first shock after the strong run。In addition, the RBA's decision to slow the pace of rate hikes again in July after a surprise rate hike in June will also help boost oil prices and ease downward pressure on the economy.。It is worth noting that while the RBA has held its policy rate on hold in this decision, its policy rate remains at 4.The high of 1% does not rule out the possibility of further monetary tightening in the future.。

On the positive side, on Tuesday, the World Meteorological Organization issued an announcement confirming that El Niño is back on Earth after seven years and is expected to push up extreme heat records.。Some analysts pointed out that the high temperature phenomenon or boost oil to electricity demand, the demand or alleviate the current oil market supply side tightening state, for the oil price bottom。

In addition, geopolitically, although the conflict between Russia and Ukraine has been cooling in the near future, Russian President Vladimir Putin (Vladimir Putin) is still expressing concern in the near future.。According to media reports, at the Council of Heads of State of the Shanghai Cooperation Organization on July 4, Putin said that someone was waging a hybrid war against Russia and imposing illegal sanctions on an unprecedented scale.。Putin also said that Russia will continue to firmly oppose external pressure and sanctions.。

On the negative side, crude oil exports from some oil-producing countries will increase in August, according to the crude oil shipment plan compiled by the media.。In Nigeria, for example, data show that Nigeria's August exports of 19 major crude oil grades will reach at least 46.4 million barrels or 1.5 million barrels per day, the highest level since February.。

Among them, the Escravos field will export four ships of crude oil, 950,000 barrels per ship, equivalent to 12.30,000 bpd, unchanged from July; Egina field will load three ships of crude oil at 950,000 bpd for a total of 9.20,000 bpd, up from 6 in July.50,000 bpd; Brass field to export four ships of crude, total 7.70,000 bpd, up from 3 in July.10,000 barrels per day。Nigeria will also export 950,000 barrels of Pennington and Yoho crude oil.。

In addition, according to a recent media survey, Saudi Arabia, which has just pledged to cut production further in July, is expected to reduce the price of its crude oil supplies to Asia in August.。Earlier, Saudi Arabia had unexpectedly raised the price of crude oil exports to the region once in June, to the displeasure of refiners in the region.。There is already news that if Saudi Arabia does "repeat its mistakes" again in August, these Asian refiners are likely to turn to the United States, West Africa and the North Sea for crude supplies.。

Public data show that Asia is the fastest growing demand market for Middle East refiners, on the one hand, if Asian refiners will direct demand to the Atlantic, or will encourage direct competitors of Middle East oil-producing countries;。Under such circumstances, Saudi Arabia can only pursue the region's soft play of "cutting production while lowering prices," giving them a lollipop in August after brutally hurting them in June.。

Currently, according to six sources, Saudi Aramco, the Saudi state-owned oil company, will likely reduce the official selling price (OSP) of Arab light crude oil in August by about 0 percent from the previous month..$50 / barrel。In response, one respondent said Saudi Arabia needs to cut prices to reflect market movements.。They've been a little too far from reality in the last few months。

The main culprit driving oil prices down - high interest rates

Some analysts have pointed out that the biggest driver of oil prices is the increase in oil storage costs due to rising interest rates.。

Amrita Sen, head of research and co-founder of Energy Aspects, said the fall in oil prices is often blamed on weak demand, yet there is evidence that weak oil demand this year is simply nonsense.。

So far this year, according to OilX's official data, global oil demand is up 2.5 million bpd year-on-year, 1.3 million bpd higher than its forecast.。Consumer demand remains strong despite a decline in market demand for certain industrial petroleum products。

As for the reason why oil prices have not risen as expected, Sen believes that an underappreciated culprit is rising interest rates, which have pushed up the cost of capital at a time when fears of a global recession have led companies to reduce inventories: for refiners and trading companies, the cost of storing oil has become much more expensive, and the increase in financing costs means that inventory costs will be higher than before.。

It is for this reason that he pointed out that Asian refiners have begun to seek oil replenishment due to concerns that the "road to inventory" has gone too far, which is an important reason why they were previously willing to buy Saudi Arabia's "price-increasing crude oil."。by the end of this year, global commercial oil stocks will drop to the lowest level in the past decade, sen noted。Meanwhile, the U.S. government will start buying back 1.800 million barrels of crude oil to replenish its strategic oil reserves that were depleted last year, and all of this will make the oil market more vulnerable to news shocks by the end of the year.。

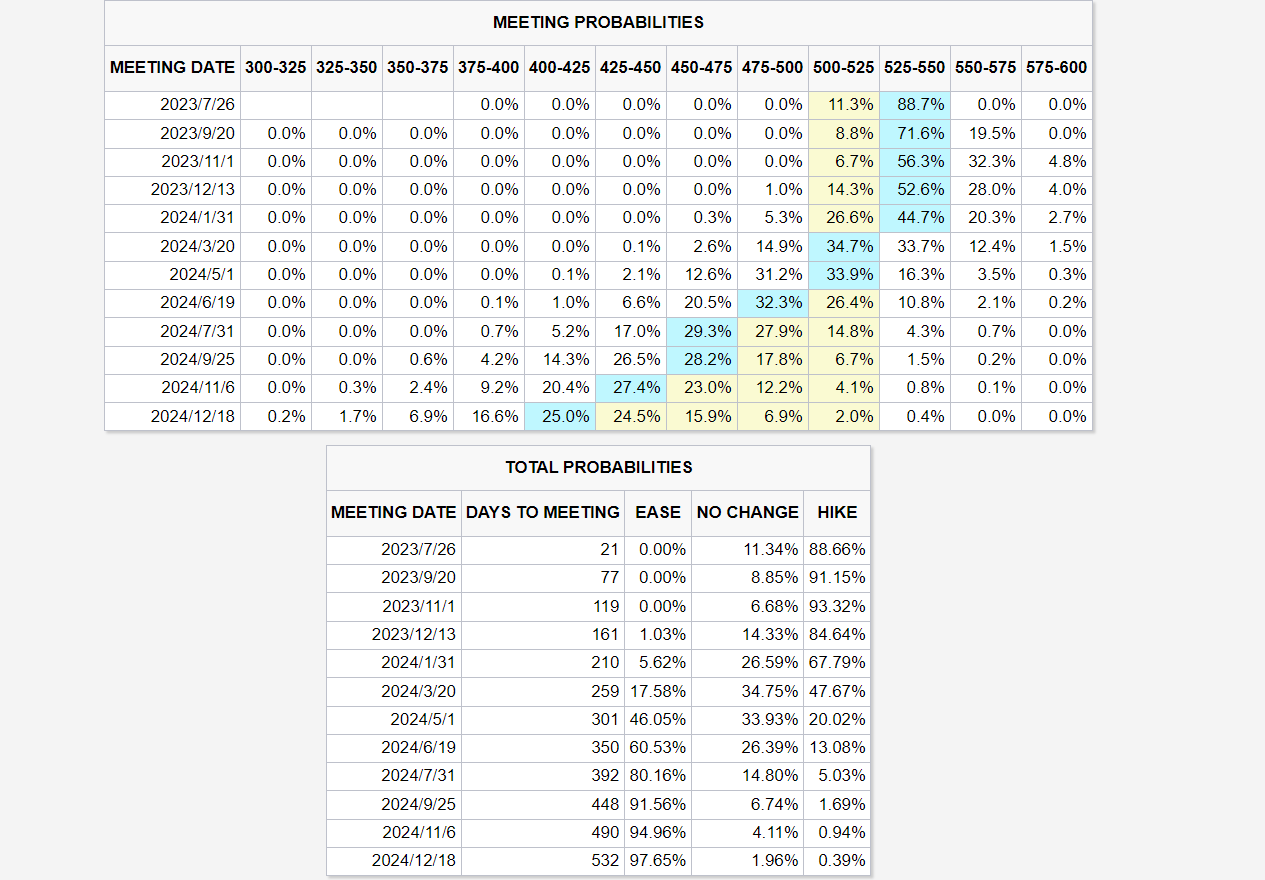

As of press time, according to CME Fed Watch, the current market-priced interest rate policy path is: the Fed raises interest rates by 25 basis points in July and then maintains the policy rate at 5.5% cap to the end of this year, the current market pricing the bank in July to restart the rate hike window probability as high as 88.7%, raising interest rates only once during the year and opening the rate cut channel in 2024。

However, according to Fed Chairman Jerome Powell (Jerome Powell), inflation is not expected to return to the Fed's 2% target until 2025, which means the Fed will not cut interest rates for some time after that.。Last week, two Kansas City Fed economists also said in their latest paper that to bring inflation down to 2 percent, the Fed would have to keep interest rates higher (above 5 percent) and longer than market expectations, perhaps until 2026.。

Policy rates remain high, and today Morgan Stanley also lowered its price forecast for cloth oil.。According to Damo forecasts, Brent crude oil prices will reach $70 a barrel in 2023。Morgan Stanley still expects crude inventories to fall in the third quarter, driven mainly by OPEC production cuts and positive seasonal factors, which will keep Brent crude at around $70 a barrel.。

The bank also said that in 2024, non-OPEC supply growth is likely to outpace global demand growth, a trend that is likely to continue.。Unexpected increase in discounted crude supplies from Russia, Venezuela and Iran。However, as the market focus shifts from inventory reductions in the second half of 2023 to inventory increases in the first half of 2024, Brent crude is expected to slow to $70 / bbl.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.