Cost reduction strategy shows results Amazon Q2 results exceeded expectations! Artificial intelligence will be the core of follow-up work

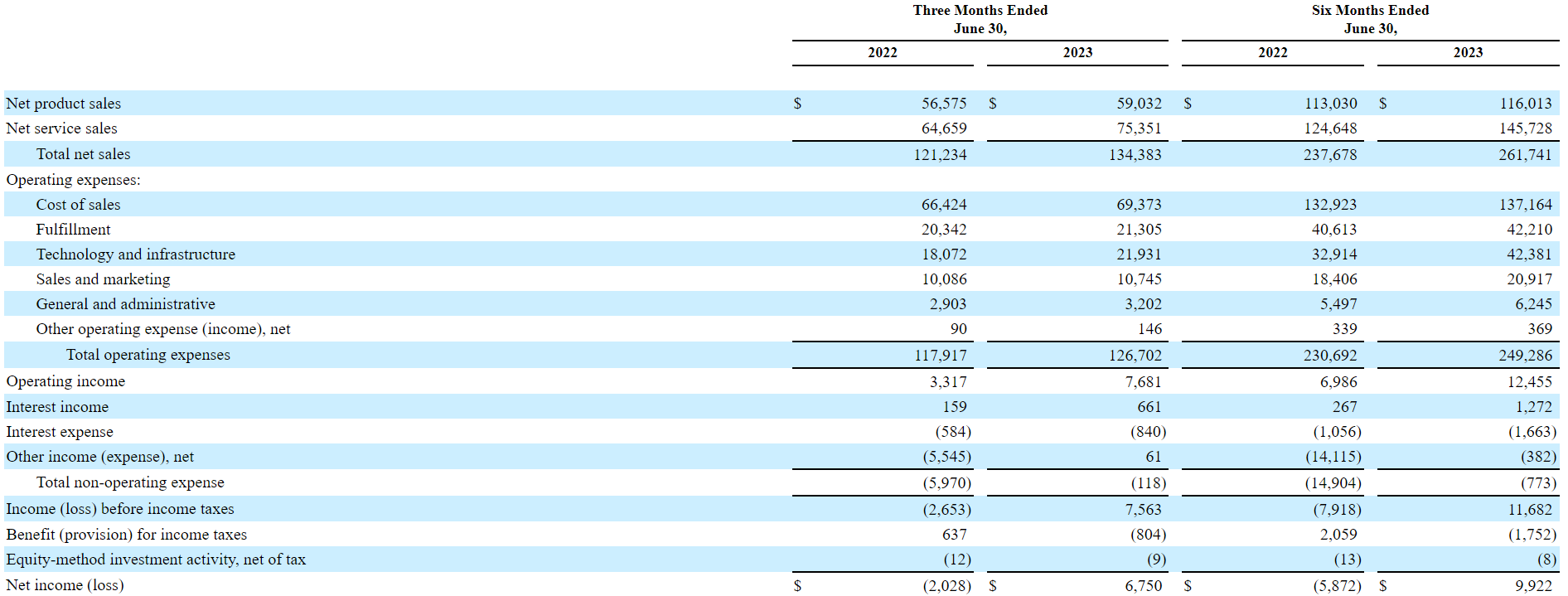

On August 3, Amazon announced its financial results for the second quarter ended June 30, 2023.。Second-quarter net sales rose 11 percent to $134.4 billion, beating analysts' expectations of $131.5 billion.。Second-quarter net income of $6.7 billion, diluted earnings per share of 0.$65, more than three times Q2 2022 EPS。

After U.S. Stock Market on August 3, Amazon Announces Second Quarter Financial Results Ended June 30, 2023。

Second-quarter net sales rose 11 percent to $134.4 billion, beating analysts' expectations of $131.5 billion.。Among them, North American segment sales increased 11% year-on-year to $82.5 billion (market expectation: $81.3 billion)。International segment sales of $29.7 billion (market expectation: $28.6 billion), up 10% YoY。Amazon Web Services (AWS) segment sales of $22.1 billion (market forecast: $21.5 billion), up 12% year-over-year。

Operating income rose to $7.7 billion, compared to $3.3 billion in the same period last year.。Second-quarter net income of $6.7 billion, diluted earnings per share of 0.$65, exceeding market expectations of 0 per share.$35, more than three times Q2 2022 EPS。The second-quarter net profit figure includes a $200 million pre-tax valuation gain from Amazon's stake in electric car maker Rivian.。This compares to a pre-tax valuation loss of $3.9 billion in the 2022 quarter.。

Significant improvement in cash flow。Free cash flow inflows for the past 12 months were $7.9 billion, compared with an outflow of $23.5 billion for the 12 months ended June 30, 2022.。

The company raised its revenue guidance for the next quarter on the back of strong Q2 results。The company expects net sales in the next quarter to be between $138 billion and $143 billion, compared with analysts' estimates of 1,382..500 million dollars。

Boosted by strong results and significantly better-than-expected third-quarter guidance, Amazon U.S. stocks rose more than 10% after the session on August 3, and U.S. stocks rose more than 8% again before the session today.。It's worth noting that Amazon shares have risen more than 53% this year.。

A number of businesses exceeded expectations of growth

In terms of online stores, revenue for the quarter reached $53 billion, up 4% year-over-year, higher than analyst estimates of 2.73%。

Under the influence of the external environment, consumers at this stage are mostly cautious about their consumption, no longer buying as they please, but turning to buying value goods.。According to Amazon CFO Brian Olsavsky, household budgets remain tight, but the headwinds from inflation are easing.。

In order to stimulate the vitality of the online store, Amazon held a Prime Day big membership day event on July 11-12.。This is the largest ever Member Day event for Amazon independent sellers, most of whom are small and medium-sized businesses, and the first time that Prime members in the U.S. can use Buy with Prime to purchase offers directly from the merchant's website。

Amazon revealed its highest ever single-day sales on the first day of the July event, with Prime members worldwide buying more than 3.7.5 billion items, saving more than $2.5 billion。These sales are expected to be fully reflected in the third quarter。

Andrew Lipsman, analyst at Insider Intelligence, said after the results: "The turnaround in Amazon's e-commerce business is an encouraging sign for the second half of the year, which should boost revenue growth.。"

In the long run, Amazon aims to turn its annual B2B e-commerce sales of $35 billion into $100 billion, Jassie told analysts on a conference call.。

In addition, Amazon's revenue from the business of providing services and advertising to independent merchants also hit a new high.。Amazon's third-party seller services revenue rose 18% to $32.3 billion in the quarter。Advertising sales up 22% to $10.7 billion。Both businesses outperformed market expectations.。

In addition, the company has made considerable achievements in reducing costs.。The company's operating expenses rose just 7 percent in the quarter..5%, the lowest increase since at least 2012。

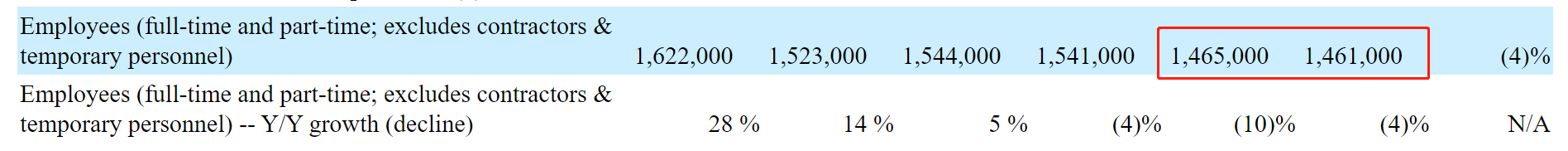

The reduction of operating expenses is not unrelated to the company's cost reduction strategy.。One of the strategies to reduce costs is massive layoffs.。According to Amazon's earnings report, the company lost 4,000 employees in the second quarter compared to the previous quarter, and lost a total of 80,000 employees in the first half of this year.。

AWS Beats Expectations, CEO: AI Will Be Central to Our Work

In this earnings report, the cloud division AWS performed better than expected, and the business's second-quarter sales rose 12% to $22.1 billion。Despite a sixth straight quarter of slower growth, the business's earnings were above Wall Street expectations of 217..100 million dollars。

In contrast, Amazon's competitors are growing faster, but both cloud businesses are smaller than Amazon's。

Google Cloud made its first profit in the first quarter of this year and continued its earnings trend in the second quarter, reaching 3.$9.5 billion, almost 1 in the first quarter.Twice the $9.1 billion。And last year the business was still in the red, with a loss of 5.900 million dollars。Microsoft's fourth-quarter intelligent cloud division revenue was 239.$9.3 billion, compared with 208.$0.4 billion, up 15% year-over-year, of which Azure and other cloud services revenue grew 26% year-over-year after deducting exchange rate changes。

Operating margin for AWS business in the quarter was 24.2%, stable in recent quarters。Subsequently, as the commercialization of artificial intelligence increases, it may be able to return to the high margin range, provided that Amazon can occupy a favorable position in the AI market.。

Amazon is not far behind as major technology companies launch AI-related products。AWS launched its AI service, Bedrock, in April, offering customized large-scale models for companies that don't want to spend time and money building their own models.。Amazon also provides the chips needed to train and run AI models。

For the race for artificial intelligence, Amazon is not impatient。CEO Jassie has said that artificial intelligence is still in the early stages of development, and the race in this field is actually a marathon。During the quarterly call, Jassie again emphasized this point: "I think AI will be transformative, and I think it will change almost every customer experience we know.。But I think it's really early。I think most companies are still thinking about how to achieve this... but it's still early days。I expect this to be very important, but in the future。"

If this AI race is a marathon, Amazon's potential is still very large.。

Amazon has a wide range of businesses, including retail supermarkets, e-commerce, streaming entertainment business, online advertising business and more, which means that artificial intelligence has a lot of room to play in the company。AI can empower multiple businesses within it to save costs or deliver new customer experiences。

Jassie also said on the conference call that every business within Amazon, every one of which is currently running multiple generative artificial intelligence programs。Jassie said: "This will be at the heart of our work.。This is a major investment and focus for us.。"

Jassie said Amazon expects to invest more than $50 billion in capital for the full year 2023, with AWS accounting for a large portion of the spending.。

Arun Sundaram, an equity analyst at CFRA Research, said Amazon has the edge in the field of generative artificial intelligence, where it can create new text, images and other content based on past data.。He added that the potential of AI "should benefit all the big tech companies."。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.