Amazon's acquisition of iRobot has been frustrated, and EU regulators have issued a statement of opposition.

On Monday, EU regulators issued a statement of disapproval, saying Amazon's proposed acquisition of iRobot would harm the robotic vacuum cleaner (RVC) market and allow Amazon to strengthen its position in online marketplaces and other data-related services.。

Amazon's deal to buy robot vacuum cleaner maker iRobot is facing block from EU regulators。

The acquisition of iRobot suffered a setback

On Monday, EU regulators issued a statement of objection, saying Amazon's proposed acquisition of iRobot would harm the robot vacuum cleaner (RVC) market and allow Amazon to strengthen its position in the online marketplace and other data-related services.。

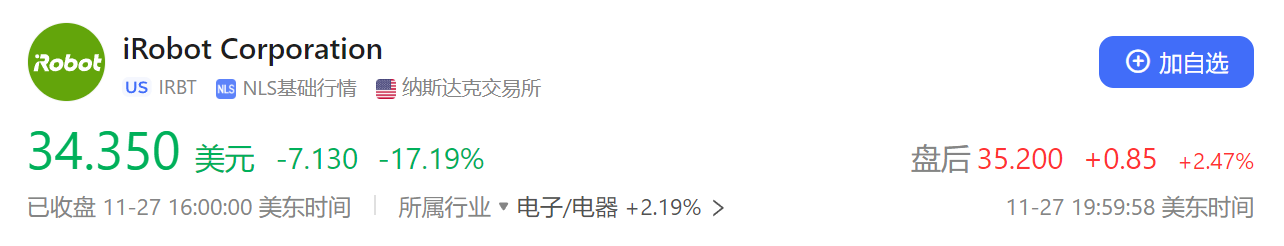

Affected by the news, iRobot's shares fell 17% to 34 on Monday..$35, the biggest drop in nearly three years。

Amazon announced the deal last August.。Since then, regulators in many parts of the world, including the European Union, have been intensifying their regulatory scrutiny of deals such as large technology companies buying smaller competitors.。Regulators believe that large tech companies accumulate large amounts of data in their acquisitions of small-scale peers, which could consolidate their market dominance or even create monopolies, while also helping them expand into other markets。

EU regulators said in a statement that Amazon may promote iRobot's products under labels such as "Amazon's Choice" or "Work with Alexa" and reduce the heat on other robot vacuum cleaner brands.。Amazon is an important online sales channel for robot vacuum cleaners in countries such as France, Germany, Italy and Spain.。

According to the statement, Amazon may have the ability and incentive to exclude iRobot's competitors, as Amazon's online marketplace is a particularly important channel for selling RVCs in France, Germany, Italy and Spain.。RVC customers in these countries are particularly reliant on Amazon for product discovery and final purchase decisions。

Colin Angle, chairman and chief executive of iRobot, said: "Given the fierce competition iRobot faces, we are disappointed that the European Commission has issued a statement of opposition on the grounds that the proposed acquisition will limit competition.。Angle said the company will continue to communicate with the European Commission and other regulators.。

A spokesman for Amazon said the company was working to address concerns from EU regulators.。

Amazon said: "We will continue to work with the European Commission to complete the entire process and focus on addressing issues and any identified concerns at this stage."。iRobot faces stiff competition from other vacuum cleaner suppliers to offer practical and creative products。We believe Amazon can provide companies like iRobot with the resources to accelerate innovation and invest in key features, while lowering prices for consumers.。"

It is worth noting that the above statement of objection only indicates that the monopoly regulator is concerned about the deal and does not indicate that the EU will seek to block the deal.。As a result, this could prompt Amazon to offer remedies to EU authorities to resolve the investigation and avoid the risk of the takeover being blocked.。Amazon has the option to respond to the committee's dissenting statement, access the committee's case file and request an oral hearing.。

EU's next step is reconciliation or blocking?

The acquisition of iRobot is seen as a step for Amazon to expand its presence in the emerging smart home market.。

During the epidemic, iRobot sales surged as consumers looking to "free up their hands" in cleaning their homes increased due to the increase in home office work.。

The EU has been involved in the deal since July this year and has launched an in-depth investigation.。The regulator said the investigation was because the deal could hinder the development of other robotic vacuum cleaners and make it "harder for rival marketplace providers to rival Amazon's online marketplace service."。

Monday's opposition statement once again shows the EU's attitude。However, the UK Competition and Markets Authority is not quite the same as the EU, which has approved the deal after concluding that iRobot has moderate market influence。

The FTC has said it has been concerned about the deal since September 2022 due to concerns about market competition and privacy data.。The committee said the deal would give Amazon too much control over the smart home device market and the privacy data of U.S. households.。

The EU reached a settlement with Amazon late last year over two previous competition investigations, including one over antitrust concerns about Amazon's use of merchant data to support its retail business; the second over how the company operates "BuyBox" and its Prime loyalty program.。

In these cases, Amazon agreed to a series of promises to end the investigation, including saying it would stop using non-public data on sellers in its marketplace and increase transparency for merchants; and promising to treat all sellers equally, regardless of whether they pay for their logistics services.。

At the time, the EU's then competition chief, Margrethe Vestager, touted two settlements with Amazon.。Vestager believes the settlement means the e-commerce giant is "no longer abusing its dual role" as a marketplace operator and private label retailer.。The settlement will ensure that "competing independent retailers and operators, as well as consumers, will benefit from these changes, which open up new opportunities and options."。"

Failure to allay European Commission concerns could mean Amazon's deal to buy iRobot faces a deal with Booking Holdings Inc..The same fate as the €1.6bn takeover of Sweden's Etraveli Group, which was blocked by the EU in September。

The deadline for the committee to make a final decision is February 14.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.