Goldman Sachs cuts Tesla's earnings forecast for this year and next.

On Monday (September 18) local time, Tesla shares fell more than 3% to close at 265.28 U.S. dollars, nearly 29 billion U.S. dollars (about 211.7 billion yuan) evaporated from market value

As soon as the week started, Tesla's stock began to fall。

On Monday (September 18) local time, Tesla shares fell more than 3% to close at 265.28 U.S. dollars, nearly 29 billion U.S. dollars (about 211.7 billion yuan) evaporated from market value。

On the news, Goldman Sachs analysts lowered Tesla's profit forecast in a report released on Monday, citing narrower profit margins and lower selling prices.。

In the report, Goldman Sachs analyst Mark Delaney said the recent price cuts could put pressure on Tesla's already declining gross margins and lead to lower overall profits this year and next.。

In the first half of this year, Tesla made a series of price cuts in China, and then its auto profit margins have been squeezed。In the first half of the year, Tesla's gross margin of 17.9%, down from 22% in the same period last year..4%, also below peer BYD's 20.67%。

Into the second half of the year, Tesla has not stopped the pace of price cuts。In mid-August, Tesla lowered its Model Y pricing in China, and on September 1, Tesla slashed its Model S / X pricing by 15% -19%.。

Delaney mentioned in the report that Tesla may cut prices further in 2024 to support higher sales, which will weaken the earnings per share growth brought about by cost reduction.。

However, Tesla recently launched a new version of the Model 3 (Highland), which is more expensive than the old version, and the new model is currently on sale in Europe and China.。

Delaney believes that Tesla sales are expected to rebound in the fourth quarter, up to 49, boosted by the launch of the new version of the Model 3 Huan and the increase in sales of the Model S / X after the sharp price cuts..40,000 vehicles。And Tesla is expected to deliver 184 for the full year..20,000 vehicles。Earlier, Tesla reported second-quarter sales of 466,140 vehicles, a record high.。

Affected by the expected decline in average selling price (ASP) and the impact of lower prices on automotive gross margins, Delaney reduced Tesla's 2023 / 2024 earnings per share forecast from the previous 3.00 USD / 4.$25 each down to 2.$90 / 4.15美元。He wrote in the report: "We have lowered Tesla's 2023 and 2024 earnings per share forecasts, mainly based on lower ASP, which in turn reduces the automotive gross margin forecast.。According to FactSet, several analysts believe Tesla's 2023 profit will fall 17 percent to 3 percent per share..36美元。

Despite downgrading its earnings forecast, Goldman Sachs maintains a neutral rating on Tesla and a $275 price target.。Delaney said the headwinds in near-to-medium-term margins were offset by Goldman's positive view of Tesla's industry leadership and long-term growth potential.。

However, the pressure on Tesla's profit margins is not uncommon among electric car companies.。

Electric vehicles this track has poured into too many companies, in order to compete for market share, price reduction has become the most direct and effective means, but also "have to go the way."。What's more, as a pioneer in the electric vehicle industry, Tesla has seized the opportunity to start first.。

Tesla CEO Musk told investors in July: "It makes sense to sacrifice margins in favor of producing more cars, as we believe their valuations will rise significantly in the not-too-distant future."。He said that in the second half of the year, Tesla will continue to focus on winning market share rather than expanding profit margins.。

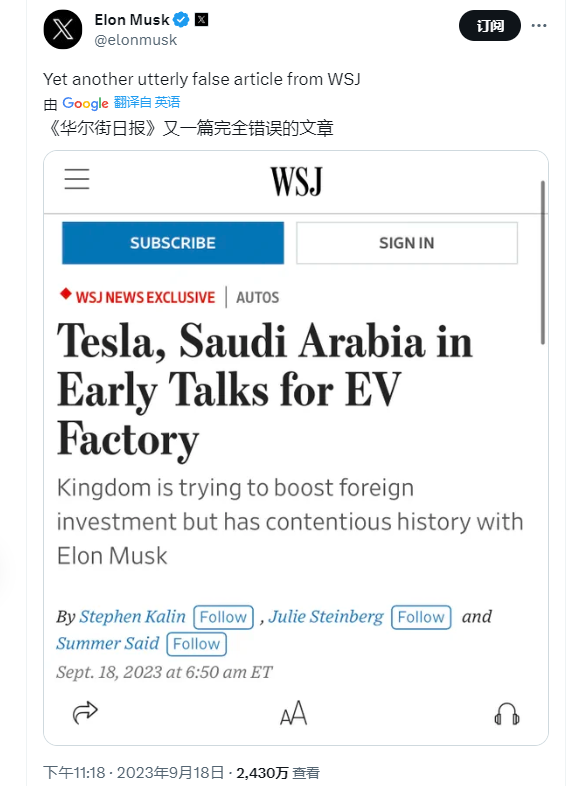

What Musk is talking about is winning market share, not just in mature markets。Tesla is currently looking for locations around the world to prepare for its seventh factory.。In order to get to Tesla, the electric car giant, officials in many countries have begun to contact Tesla。The report comes on the same day that a media report said Tesla was in "early talks" with Saudi Arabia about building the plant.。But then the news was personally refuted by Musk.。

Before Saudi Arabia, India, France, Spain and others were also revealed to have thrown an olive branch to Tesla.。At present, Tesla has not announced the address of the new plant.。

It is worth noting that, unlike Goldman Sachs's caution, another major Wall Street bank, Morgan Stanley, has recently "sung more" to Tesla.。Damore analyst Adam Jonas puts perspective on Tesla's Dojo supercomputer。He predicts that the Dojo supercomputer will add up to $500 billion to Tesla's market value.。To that end, he raised Tesla's price target significantly by $400, or about 60 percent, from $250 previously.。You know, Wall Street's average price target for Tesla is now around $270.。After the release of this report, Tesla's share price rose by more than 10% on that day.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.