Human clinical trial approved by the U.S. FDA Neuralink valuation bucked the trend and tripled!

Recently, there have been media reports that Elon Musk's brain implant startup Neuralink is estimated to be valued at about $5 billion based on privately conducted stock trading data.。The company was valued at only about $2 billion in a private placement two years ago, more than tripling in two years.。

Recently, media reports have estimated that Elon Musk's brain-computer interface startup Neuralink is valued at about $5 billion, based on privately conducted stock trading data.。The company was valued at only about $2 billion in a private placement two years ago, more than tripling in two years.。

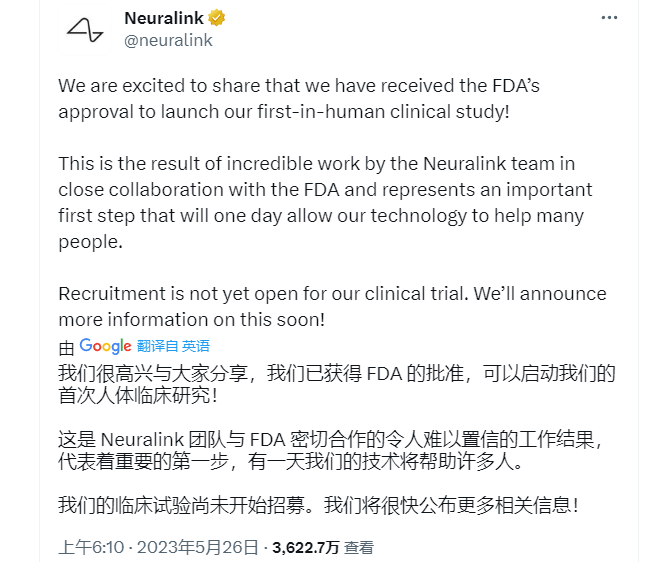

Musk brain-computer interface company Neuralink human clinical trial approved by FDA

On May 25, Neuralink announced on its Twitter account that it had received the first human clinical trial approval from the US Food and Drug Administration (FDA).。This is not the first time the company has applied to the FDA for a human clinical trial.。As early as last year, the FDA rejected Neuralink's human trial request on safety grounds.。The FDA also confirmed the news.。

It is reported that in the months before U.S. regulators approved Neuralink's brain-computer interface chip for human trials, some bullish investors made private deals, which also pushed up the company's valuation。After receiving FDA approval, there was a private sale of Neuralink stock to investors at $55 per share (about $7 billion valuation), but it is not yet certain whether any buyers will accept the price.。

Most of the recent stock sales have been for small and medium-sized investors.。It is understood that the highest offer for Neuralink shares sold at $55 per share was only $500,000.。Usually such investors prefer the name "Musk" and mostly just want to follow Musk and buy shares of the company they own, without scrutinizing its valuation.。

Sim Desai, chief executive of trading platform Hiive, said demand for Neuralink shares had been "huge."。He believes the valuation, based on the value buyers are willing to pay, is about $4.5 billion.。

Of course, these aforementioned stock transactions were conducted privately by shareholders such as company employees and early supporters, not by Neuralink selling new shares to investors.。In the past two years, with the rapid development of the brain-computer interface industry, Neuralink employees have also benefited from it.。According to secondary market trading, the value of company shares held by some Neuralink employees has risen by about 150% in just two years。However, such transactions are small in volume and lack broader market consensus such as public financing or initial public offerings (IPOs), so they do not represent or measure a company's value well。

It's worth noting that Neuralink's soaring valuation in secondary market trading stands in stark contrast to other startups.。According to data provider Caplight, about 85% of companies are currently valued at an average 47% discount from their previous round of funding before an IPO。And according to Pitchbook, the last known financing at Neuralink was in 2021, when the company raised 2.$05 billion, and now, the estimated valuation is about $5 billion。

But there are also biomedical experts who are skeptical about the valuation of Neuralink, which is bucking the trend.。Arun Sridhar, a scientist and entrepreneur specializing in neuromodulation, called Neuralink's valuation "crazy" because he believes brain implants are still early in clinical development.。"A study evaluating safety and tolerability cannot justify a $5 billion valuation in any form," Sridar said.。"

Sridar helped found Galvani Bioelectronics, an implant company supported by GSK and Alphabet's Verily Life Sciences.。But Galvani and Neuralink are not competitors because the implants they are developing are not implanted in the brain, but in the arteries of the spleen to help treat rheumatoid arthritis.。

In addition to the valuation is still controversial, there is also a lot of discussion about the commercialization of Neuralink.。

Although Neuralink has been approved for human clinical trials, some experts believe it is still far from commercial landing。Experts say it could take years for Neuralink to be licensed for commercial use.。Kip Ludwig, a former director of neuroengineering programs at the National Institutes of Health (NIH), said he is "optimistic" that it will take at least another 10 years for Neuralink to commercialize its brain implants.。

Neuralink under investigation after being accused of hasty surgery leading to unnecessary deaths of animals

Despite the promising valuation of Neuralink, the company's path to listing has been rocky。The company was previously facing a federal investigation into its handling of animal research.。

Neuralink was founded in 2016 by Musk and a group of engineers.。The company claims to be making a brain-computer interface chip that can be implanted in the human skull and is expected to help patients with disabilities regain vision, mobility and communication.。

It is reported that Neuralink launched a brain-computer interface chip, similar in size to a coin, using battery power.。The chip can process and transmit nerve signals, which are then transmitted to devices such as computers or mobile phones。With the chip, people can control a mouse, keyboard or other computer function with their minds。In addition, Neuralink said its device will eventually be able to restore nerve activity in the body, allowing people with spinal cord injuries to reactivate their limbs.。Musk said in April 2021 that the first Neuralink product will enable paralyzed people to use their smartphones with their minds, even faster than people who use their thumbs.。

Neuralink's brain-computer interface chip was first tested in animals。In 2021, the company showed a video of animal testing results.。Video shows a macaque monkey being able to play a simple electronic ping-pong game after being implanted with a brain chip。

But last year, Neuralink was embroiled in controversy over animal testing.。According to the company's internal staff, because the company in the animal test operation is too hasty, causing unnecessary suffering and death of many animals。The operation was rushed because Musk urged them to speed up their research to get FDA approval early.。In total, the company killed about 1,500 animals from 2018 to the end of 2022, including more than 280 sheep, pigs and monkeys.。USDA enforcement has stepped in to investigate possible animal welfare violations by Neuralink。

In addition, the U.S. Department of Transportation is separately investigating whether Neuralink illegally transported dangerous pathogens taken from monkey brains without proper safeguards.。It is reported that these pathogens attached to the chip, may have spread with the transportation。Dangerous pathogens involved include antibiotic-resistant staphylococci and herpes B viruses。Once infected, humans can develop serious health problems, such as blood infections, pneumonia, and severe brain damage.。

At present, the relevant departments are still under investigation。However, Neuralink's listing plans will continue to run aground until the results of the relevant investigation are released.。

Despite the turmoil of animal testing, the Neuralink study has not stopped and is still making great strides, and this FDA approval for human clinical trials is the most important step before its commercialization.。Musk is confident that Neuralink will be plugged into devices to treat obesity, autism, depression and schizophrenia, and even that the chip can be used for web surfing and telepathy.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.