Monetary tightening is linked to the intensity of monetary policy - a shift in policy perspective from Powell's latest speech

On Friday, May 19, Federal Reserve Chairman Jerome Powell and former Chairman Ben Bernanke attended a monetary policy seminar, the "Thomas Laubach Research Conference."。At the meeting, Powell revisited the current banking crisis and monetary policy, while Bernanke, who left office in 2014, also shared his views on the current economic situation。

On Friday, May 19, Federal Reserve Chairman Jerome Powell and former Chairman Ben Bernanke attended a monetary policy seminar, the "Thomas Laubach Research Conference."。At the meeting, Powell revisited the current banking crisis and monetary policy, while Bernanke, who left office in 2014, also shared his views on the current economic situation。

It is worth noting that, and his colleagues in the recent views are not very similar, Powell's "final appearance" to convey the message, quite a bit dovish feeling.。

At this seminar, Powell wants to set the tone for the U.S. banking situation first。He said that the U.S. banking system as a whole is still strong and resilient, with the ability to deal with the problems that may arise now and in the future, while Bernanke stressed that the current banking crisis still follows the classic steps of "deposit decline, run, contagion" evolution, which ultimately affected the credit environment, of course, from the scale, scope, this time the crisis is very different from 2008.。

Powell then reviewed the Fed's financial stabilization measures in the wake of the banking crisis and linked the fact of the credit crunch brought about by the crisis to monetary policy。Powell said that after problems in the U.S. banking sector in early March, the Federal Reserve urgently introduced liquidity support tools to avoid affecting the goal of monetary policy tools to intervene in price stability。He also said that the financial stability tool not only stabilized the banking sector, the subsequent tightening of credit conditions, but also reduced the pressure on the Fed to raise policy rates.。

According to CEIC data, since the banking crisis, the size of industrial and commercial loans to small U.S. banks in the week ending May 3 has contracted by 3 percent compared to March 8..1%, while the big banks contracted by a cumulative 0.5%。In addition, commercial real estate lending by small U.S. banks contracted in the week of March 22 by 1.25%, the largest tightening since January 2015。As of May 3, the size of commercial lending by large banks had recovered above the size of the week of March 8, while the gap for small banks remained unfilled.。

In fact, since the crisis, the contraction in credit conditions in the banking sector has indeed met, to some extent, the Fed's tightening targets that it had intended to reach with policy instruments such as interest rate hikes.。At present, the indirect tightening of monetary policy brought about by negative economic events is slowly providing the Fed with a new policy perspective, that is, through the actual monetary tightening situation in the market, to assist the Fed's monetary policy intensity, the two work together to achieve the desired effect of monetary policy.。

However, this approach clearly places higher demands on the Fed。Because of the inclusion of new variables, officials need longer time to constantly assess and quantify the extent to which the market reacts to the new variables, and to discuss whether the decisions at the monetary policy meeting will have an "appropriate" effect on the market.。If so, the Fed's decisions are likely to become increasingly cautious in the future。

In addition, the liquidity tightening effect of the banking crisis is quite direct, as banks and other financial institutions are already part of the liquidity supply chain.。However, there may be more risk events in the future that are difficult to quantify with liquidity, at which point the central bank will need to unravel the context of the risk event, prudently judge the effect of the event on liquidity, and dynamically adjust its outstanding monetary policy。

Powell said that after such a long period of interest rate hikes, monetary policy has now entered a restrictive zone, and the uncertainty is the delay in the effectiveness of monetary policy and the credit crunch caused by the recent banking crisis.。As a result, there are also restrictions on the Fed's current assessment of whether it needs to continue raising interest rates in the future。As he said at an earlier press conference, relevant assessments can only be made on an ongoing basis at each meeting.。

Finally, Powell noted that there is very great uncertainty about the level of interest rates needed to eventually control inflation。Prior to the near term, the need for continued interest rate hikes has been。But as policy rates became more restrictive of the economy, the risks of "raising rates too much" and "not enough" began to become balanced, so Fed policy changed.。While no decision has yet been made on what to do next, given how many rate hikes have already been made, the Fed now has the leeway to look at the data and the changing outlook for a careful assessment.。

This view, on the other hand, was interpreted by the market as a signal that Powell hinted that the Fed would pause rate hikes in June。

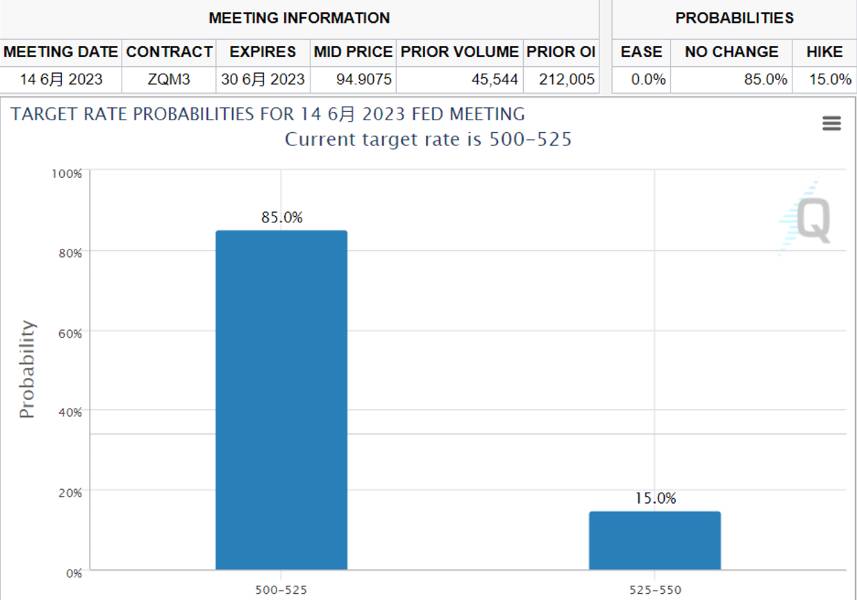

According to the CME "Fed Watch" tool, after Powell's speech, the probability of the Federal Open Market Committee keeping current interest rates unchanged in June soared from 64% to 82%.。As of press time, that number had risen to 85..0%。

For now, disagreement within the Fed over the magnitude of the June rate hike is growing。Among them, a few officials support continued rate hikes, but other senior officials such as Powell have hinted that the Fed may skip rate hikes to better study the potential lag effects of rapid rate hikes。

On Thursday, the U.S. Department of Commerce will release U.S. GDP data for the first quarter; on Friday, the U.S. April PCE index will also make its final debut.。May is coming to an end, and the release of two important data will undoubtedly deepen Fed officials' understanding of the state of the U.S. economy in the first half of the year and have a significant impact on the Fed's monetary policy in June.。

On the one hand, if GDP and its related data fall short of expectations, the Fed may really loosen the reins of interest rate hikes in its hands, giving the market some breathing room.。On the other hand, if the PCE data is slow to get signs of suppression, do not rule out the Fed will first ensure that inflation will be pulled back to a reasonable range of policy expectations, the sword of the Damocles of interest rate hikes, once again suspended above the market。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.