Apple's FY2023 Q4 Results Announced: Revenue Declines Again Year-Over-Year Market Doesn't Buy It?

According to market research firm Counterpoint Research, the new Apple iPhone, while weak in China, has performed quite strongly in the U.S., especially the top-end model Pro Max.

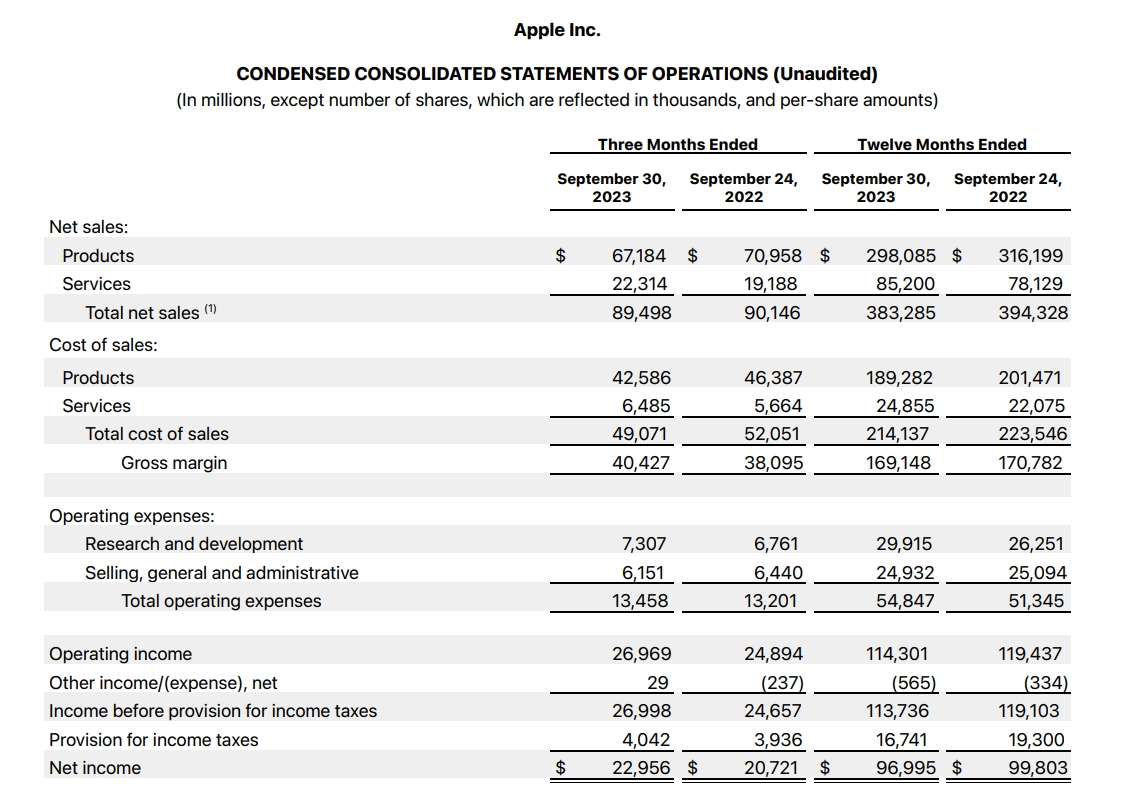

After the U.S. stock market on November 2, local time, Apple announced its fourth-quarter results for fiscal 2023 (i.e., third-quarter results for natural year 2023), and the earnings season for large technology stocks for the quarter came to an end.Data show that during the reporting period, Apple's total revenue reached $89.5 billion, higher than market expectations of $89.3 billion, down 4% year-on-year; net profit of $23 billion, higher than market expectations of $21.8 billion, up 11.1%; quarterly diluted EPS of $1.46, compared to $1.29。

Overall, Apple's growth in its fiscal fourth quarter already appears to be in a bottleneck。Although both revenue and net profit were above market expectations, Apple's revenue again recorded a year-over-year decline during the reporting period, the first time since the 2007 iPhone launch that Apple has recorded four consecutive fiscal quarters of year-over-year revenue declines, and then going back to that record to catch up to 2001.

In addition, according to the company's performance guidance, iPad and wearable devices in the next quarter (December quarter) performance will usher in a "significant decline," but total revenue is expected to be comparable to the same period last year.Wall Street believes that at the end of the year, which includes many consumer festivals, if only to hand over the return to the same period last year, which represents Apple's bearish outlook for the fourth quarter.As a result, although U.S. stocks rose more than 2% after the session, they fell more than 4% after the earnings call began.

In addition, we find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so.

"fist products" iPhone hold up half of the country Mac, iPad performance downturn

In addition, we find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so.

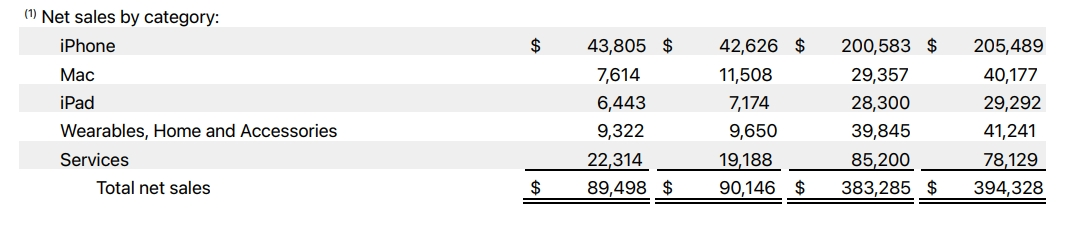

By business, iPhone products remain half of Apple's revenue。During the reporting period, Apple's iPhone sales were $43.8 billion, up 3% from the same period last year, making it the only hardware segment to grow during the quarter.

According to market research firm Counterpoint Research, the new Apple iPhone, while weak in China, has performed quite strongly in the U.S., especially the top-end model Pro Max.。Data show that the first nine days of iPhone 15 sales in the United States compared to the iPhone 14 when the year-on-year growth of double-digit, all models of demand growth is quite solid。Separately in India, Apple's July-September 2023 shipments hit a quarterly high, topping 2.5 million units.

In this regard, Apple CEO Tim Cook (Tim Cook) also confirmed in an interview that in the quarter ended September 30, iPhone 15 series sales are indeed better than the same period last year iPhone 14 series performance.

Compared to the iPhone's outstanding performance, Apple's other hardware devices are slightly inferior, and revenue has declined to varying degrees this quarter.Among them, Apple's Mac product revenue plummeted nearly $4 billion year-over-year, recording $76.14 billion, up from 115 in the same period last year $115.08 million.However, at the just-held Apple Scary fast product launch, both Macbook and iMac welcomed new products with M3 chips.Considering that the previous generation of iMac products are still equipped with the ancient M1 chip, it is expected that the release of new Mac products will release a large number of rigid demand, and the Mac business may show significant growth in the next fiscal quarter.

On the iPad side, Apple's line of business was also ill-fated, recording only 64 revenue during the reporting period $4.3 billion, compared to $71.74 billion。Since Apple usually launches new iPad products in October in previous years, the market originally expected that at the just-concluded Scary fast product launch, Apple may launch a new iPad product line covering the iPad mini, iPad Pro, and iPad Air, and the iPad Pro will also be equipped with an M3 chip with a 3nm process, the most updated in recent years.

However, the market's hopes were ultimately dashed, and Cook did not mention the iPad product too much on Scary fast, much to the disappointment of many and other parties.Now, according to Apple's earnings guidance, the iPad is also expected to perform less well in the December quarter, which is almost certain that the launch of the new iPad will be delayed until at least April next year.

For wearables, household products and accessories, Apple's revenue during the reporting period was $93.22 billion, compared to $96.50 billion, failing to meet analyst expectations。According to data provided by LSEG, analysts had expected Apple's fourth-quarter revenue from wearables, home products and accessories to reach $94.3 million dollars。

It is worth mentioning that Apple's revenue from services in the current quarter.Data for the same period last year was $191.88 billion, compared with 223 for the same period this year.$1.4 billion, compared with a sharp increase of about $3 billion, an increase of 16.3%, a new historical record.

Apple's services include the App Store, Apple Pay and Apple Card, as well as various subscription services (such as Apple Music, Apple TV +, iCloud, etc.) and advertising revenue.In August of this year, Apple announced that the number of paid subscribers exceeded the 1 billion mark, and recently increased the price of several service products.

For example, in September, Apple raised the price of Apple TV + to $9.99, the second price increase since rising twice last year, and the platform was priced at just $4 per month when it launched in 2019.Twice since $99.In addition, Apple raised the price of Apple Arcade, Apple News + and Apple One bundles, all of which contributed to a significant increase in revenue from Apple's services business during the quarter.

In addition, we find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so.

Cook: iPhone sales hit quarterly high in mainland China

In addition, we find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so. We find ourselves in a position to do so.

After the earnings announcement, Apple CEO Tim Cook and CFO Luca Maestri attended the earnings call to respond to Wall Street's concerns.

Regarding Apple's underperforming Mac business in the current quarter, Cook said: "The launch of Apple's new products and the fact that new products in the fiscal first quarter do not involve comparison issues, so we believe that the Mac business will see accelerated growth in the fiscal first quarter.With regard to the fourth quarter, we experienced several weeks of factory shutdowns in the fourth quarter of the previous fiscal year (beginning in June 2022), so the accumulated demand was gradually absorbed in the September 2022 quarter, resulting in record sales in that quarter, so we will not make year-on-year calculations in 2023, and a 34% decline does not represent our true performance."

Regarding the decline in Apple's performance in Greater China in the fiscal fourth quarter, Cook said, "Apple's revenue in Greater China fell 2% year-over-year in the fiscal fourth quarter, which takes into account a change in the exchange rate of nearly 6%, which would have actually increased our revenue at a constant exchange rate.。By product category, sales of iPhone products in mainland China hit a record high in the fourth quarter of the previous year, while the main drag on growth was sluggish sales of Macs and iPads, and Apple's services business also achieved positive growth in the fourth quarter, with the performance of the Macs and iPads business mainly due to the high base in the fourth quarter of the previous fiscal year."

Maestri, on the other hand, focused on Apple's gross margin for the quarter.He said that based on the company's fourth-quarter results, as well as the outlook for the first quarter, we have very good gross margin growth, 45.The 2% level is also a record high for the fourth quarter of the calendar year, and we expect gross margin levels to remain at 45% -46% in the first quarter as well。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.