He made a sudden will and donated another 800 million "Thanksgiving gifts."?Buffett says he's playing "overtime."

On November 21, according to a Berkshire Hathaway announcement, Buffett has donated to four family charities worth about 8.$6.6 billion in Berkshire Hathaway shares。

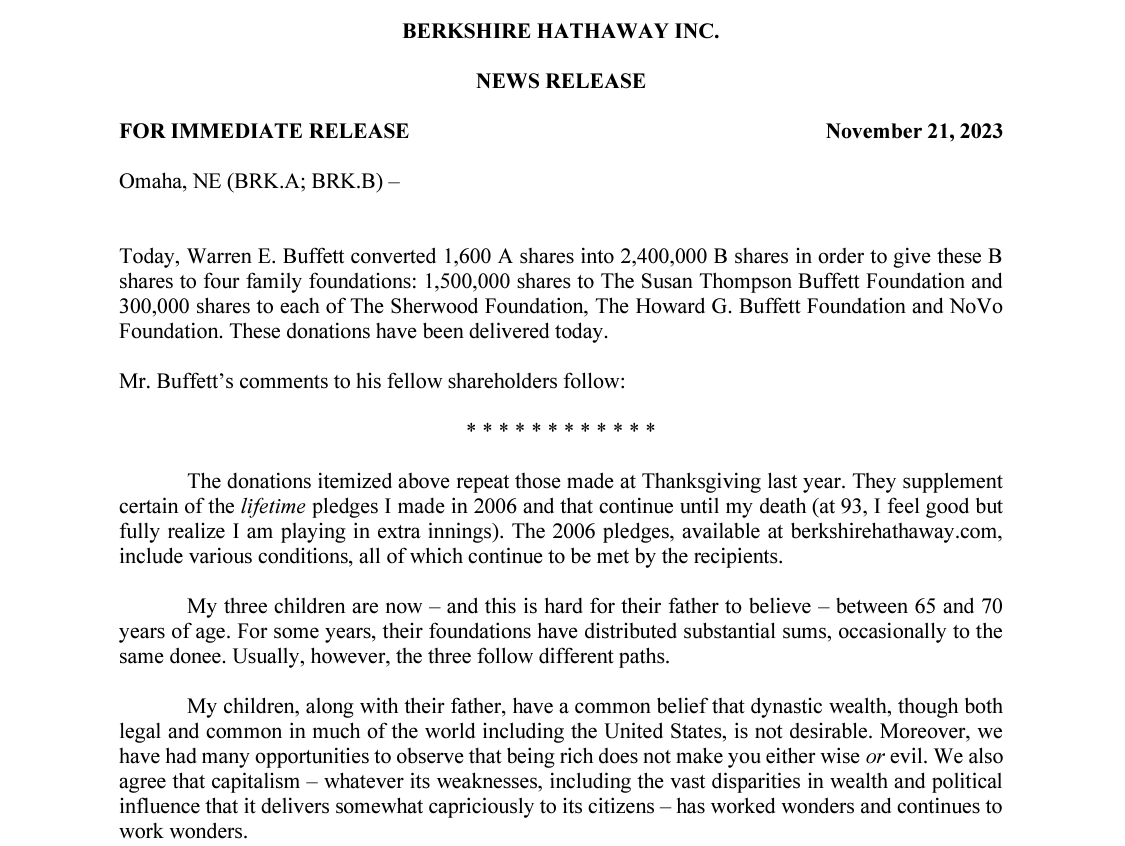

Local time on Tuesday (November 21), according to Berkshire Hathaway (hereinafter referred to as "Berkshire") announced that Buffett has donated to four family charities worth about 8.$6.6 billion in Berkshire Hathaway shares。

According to the official website, Buffett donated 1.5 million Berkshire Class B shares to the Susan Thompson Buffett Foundation.。The foundation, named after his late first wife, is dedicated to the field of reproductive health.。

In addition, Buffett donated an additional 900,000 shares of Berkshire Class B stock, which was equally distributed to charities managed by his children Howard, Susan and Peter.。The three charities are the Howard G. Buffett Foundation..Buffett Foundation, Sherwood Foundation and NoVo Foundation。

The Howard G. Buffett Foundation has been focused on reducing hunger, reducing conflict, fighting human trafficking and improving public safety.。The Sherwood Foundation is a Nebraska-based non-profit organization that focuses on women and people who are oppressed because of their race, sexual orientation, and religion.。The Novo Foundation, on the other hand, aims to support initiatives that focus on girls and women.。

Buffett also sent a rare letter to shareholders.。

In the letter, Buffett said the donation was in addition to last year's Thanksgiving donation。On Thanksgiving Eve last year, Buffett also donated a large amount of Berkshire stock, worth 7.$5.9 billion。

In the letter, Buffett again pledged that more than 99% of his wealth would be donated to charity.。"My three children are the executors of my current will and the appointed trustees of a charitable trust that will receive more than 99% of my wealth under the terms of the will."。In 2006, they were not fully prepared to take on this daunting responsibility, but now they are。"

He wrote: "I'm 93 and I feel good, but I'm fully aware I'm playing extra time.。"

As for Berkshire's successor, Buffett said there will be the right CEO to replace him, and there will be the right board of directors at that time.。He noted that Berkshire, as one of the largest and most diverse companies in the world, inevitably encounters human errors in judgment and behavior.。This happens in all large organizations, whether public or private.。But these mistakes are unlikely to be serious at Berkshire and will be acknowledged and corrected.。

It is reported that Greg Abel, 61, Berkshire's vice chairman, will succeed Buffett as CEO of Berkshire, while Buffett's son, Howard Buffett, will become non-executive chairman.。

In his letter, Buffett assured Berkshire shareholders that even without his oversight, the empire he has cultivated over the past six decades will stand the test of time.。

"In the near term, Berkshire's unique characteristics and behavior will be supported by my substantial stake in Berkshire."。However, before long, Berkshire will earn the reputation it deserves.。Buffett said, "All types of large institutions can decline, whether it's government agencies, charities, or for-profit agencies."。But it's not inevitable。Berkshire's strength is its longevity.。"

According to Forbes, Buffett is the fifth richest person in the world with a fortune of $120.5 billion.。

Buffett has run Berkshire since 1965.。To date, Berkshire has dozens of businesses, including BNSF Railways, Geico car insurance, Dairy Queen and Fruit of the Loom。

Every year since 2006, Buffett has donated to the four charities mentioned above.。It has donated more than half of Berkshire's stock to four family charities and the Bill & Melinda Gates Foundation.。Donations totaled nearly $52 billion, of which the Gates Foundation received more than $39 billion.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.