Hawkinsight Hong Kong Market Closing Roundup (1.23) | Hang Seng Index surges, science net stocks active all day, auto stocks strengthen

On January 23, the three major indexes of Hong Kong stocks soared after opening higher in early trading, and then moved upward.。Hang Seng Index closes up 2 at close.63%, at 15,353.98 points。

On January 23, the three major indexes of Hong Kong stocks soared after opening higher in early trading, and then moved upward.。Hang Seng Index closes up 2 at close.63%, at 15,353.98; Hang Seng SOE Index closes up 2.78% at 5140.93 points; Hang Seng Tech Index closes up 3.7%, at 3147.81 points。

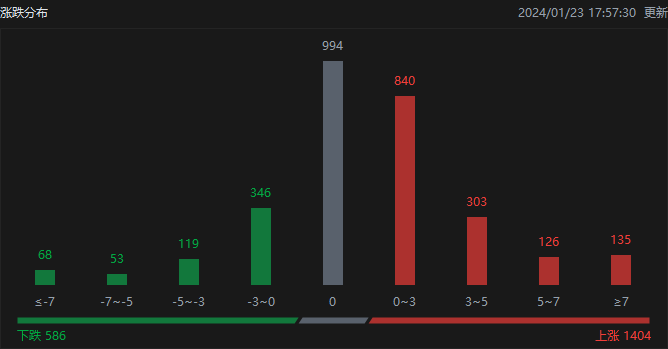

In terms of the distribution of ups and downs, as of the close of the day, Hong Kong stocks rose 1404, fell 586, and closed flat 994.。

Hong Kong stock market on the same day, North Water turnover net sell 53.HK $200 million, of which the Hong Kong Stock Connect (Shanghai) sold a net 24.HK $7.7 billion, Hong Kong Stock Connect (Shenzhen) net sales of 28.HK $4.2 billion。

Sectors and Fundamentals

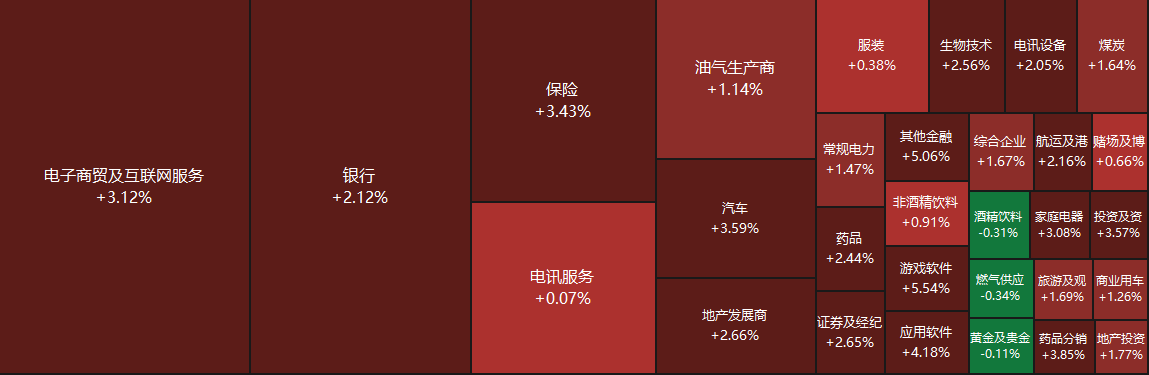

From the disk point of view, the network stocks throughout the day active, beep beep up more than 7%, NetEase rose more than 6%, Jingdong rose nearly 5%, Tencent rose nearly 4%, Ali, fast hand rose more than 3%;。On the other hand, beer stocks, gas stocks, gold stocks, etc. fell more.。

Fundamentally, the National Press and Publication Administration issued the Measures for the Administration of Online Games (Draft for Comment) on December 22, 2023, and feedback will be due on January 22, 2024.。According to several media reports, at present, the link to the opinion draft has shown "404"。In addition, Yuan Da, Deputy Secretary-General of the National Development and Reform Commission, said at a press conference of the State Information Office on the 18th that a comprehensive and prudent assessment of policy effects。Strictly and carefully control the impact of various policies on the total economic volume and structure, supply and demand, industries and regions, employment and expectations, more policies conducive to stable expectations, stable growth, stable employment, prudent introduction of contractionary, repressive measures。

Recently, the regulatory authorities have made it clear that the urban expansion, which includes the transformation of urban villages and the construction of affordable housing, will be expanded from cities with a resident population of more than 3 million to provincial capitals or cities with a resident population of more than 2 million, and provincial capitals or cities with a resident population of more than 1 million.。According to the relevant indicators, the number of cities included in the transformation of urban villages and the construction of affordable housing will be expanded from 35 to 52 and 106 respectively.。In addition, the projects declared by these cities are subject to conditions such as a balance of funds or a balance between project revenues and financing.。The construction of the "three major projects," including affordable housing and the transformation of urban villages, is the focus of policy, and the regulatory authorities have launched a number of support measures, including investment in the central budget, special bonds, mortgage supplementary loan PSL, etc.。Eligible projects in the newly included cities can also enjoy policy support to stabilize or even boost real estate investment.。

Increase or decrease in institutional holdings

According to the HKEx, on January 16, FIDELITY FUNDS increased its holdings of Meidong Motor 66.60,000 shares, price per share 4.HK $1811, total increase of approximately 278.HK $460,000。The latest number of shares held after the increase is 8088..20,000 shares, with the shareholding ratio changed to 6.01%。

On January 17, FMR LLC increased its holdings of Follett Glass 124.10,000 shares, price per share 14.HK $2,482, total increase of approximately 1,768.HK $20,000。The latest number of shares held after the increase is about 2801..180,000 shares, with the shareholding ratio changed to 6.22%。

On January 17, Wellington Management Group LLP reduced its holdings of CITIC Securities 108.90.35 million shares, price per share 6.HK $0480, total reduction of approximately 658.HK $650,000。The latest number of shares held after the reduction is about 7531..750,000 shares, with the shareholding ratio changed to 50,000.97%。

On January 18, Jilin Aodong Pharmaceutical Group Co., Ltd. increased its holdings of GF Securities 93.020,000 shares, price per share 7.HK $818, with a total increase of approximately 727.HK $230,000。The latest number of holdings after the increase is about 2..7.2 billion shares, shareholding changed to 16.01%。

New Stock News

According to the Hong Kong Stock Exchange on January 22, Hangzhou Jiuyuan Genetic Engineering Co., Ltd. (hereinafter referred to as "Jiuyuan Gene") presented the main board of the Hong Kong Stock Exchange, with Huatai International as its sole sponsor.。

According to the prospectus, Jiuyuan Gene is a pioneer in the application of genetic engineering to the pharmaceutical industry in China, with more than 30 years of experience in the development, production and commercialization of biopharmaceuticals and medical devices.。

Nine Genes focuses on four fast-growing therapeutic areas: orthopedics, metabolic diseases, cancer and blood.。According to CIC, the four therapeutic areas together accounted for 52% of total drug sales in China in 2022..0%, far better than the overall performance of China's pharmaceutical industry between 2018 and 2022, and the trend is expected to continue in the near future.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.