Apple-Circle Partnership May Open Trillions-Dollar Market for Ethereum

Jeremy Allaire, CEO of Circle, recently hinted that the pay-as-you-go feature of Circle's USDC stablecoin will soon be available on Apple devices.

Jeremy Allaire, CEO of Circle, recently hinted at a revolution in digital payments. Following Apple's decision to open up the iPhone's NFC payments to third-party developers, Allaire revealed that the “pay-as-you-go” feature of Circle's USDC stablecoin will soon be available on Apple devices.

This development could have a significant impact on the price of Ethereum, as USDC is built on the Ethereum blockchain.

On August 14, Allaire posted a message on the X platform urging wallet developers to “get ready,” suggesting that USDC payments will soon be available on Apple devices.

Allaire said that while Circle does not have a direct partnership with Apple, the NFC upgrade will allow Web3 and cryptocurrency wallets to use the technology for transactions. This means that USDC-enabled iPhone wallets may be able to complete payments through a simple “pay-as-you-go” operation, while the iPhone's FaceID system confirms the payment and initiates a blockchain transaction to complete the USDC payment.

Allaire emphasized that this innovation is expected to open up powerful channels for merchants to receive USDC payments directly, as well as for other uses such as NFT tickets and certificates.

Integrating USDC into Apple's vast ecosystem is especially attractive to ethereum investors and the cryptocurrency industry in general.

USDC may open up a $7.4 trillion market for ethereum

NFC, or Near Field Communication, is a revolutionary payment technology.NFC payments allow consumers to easily complete payments by bringing an NFC-enabled card, smartphone, or wearable device close to a contactless payment device.

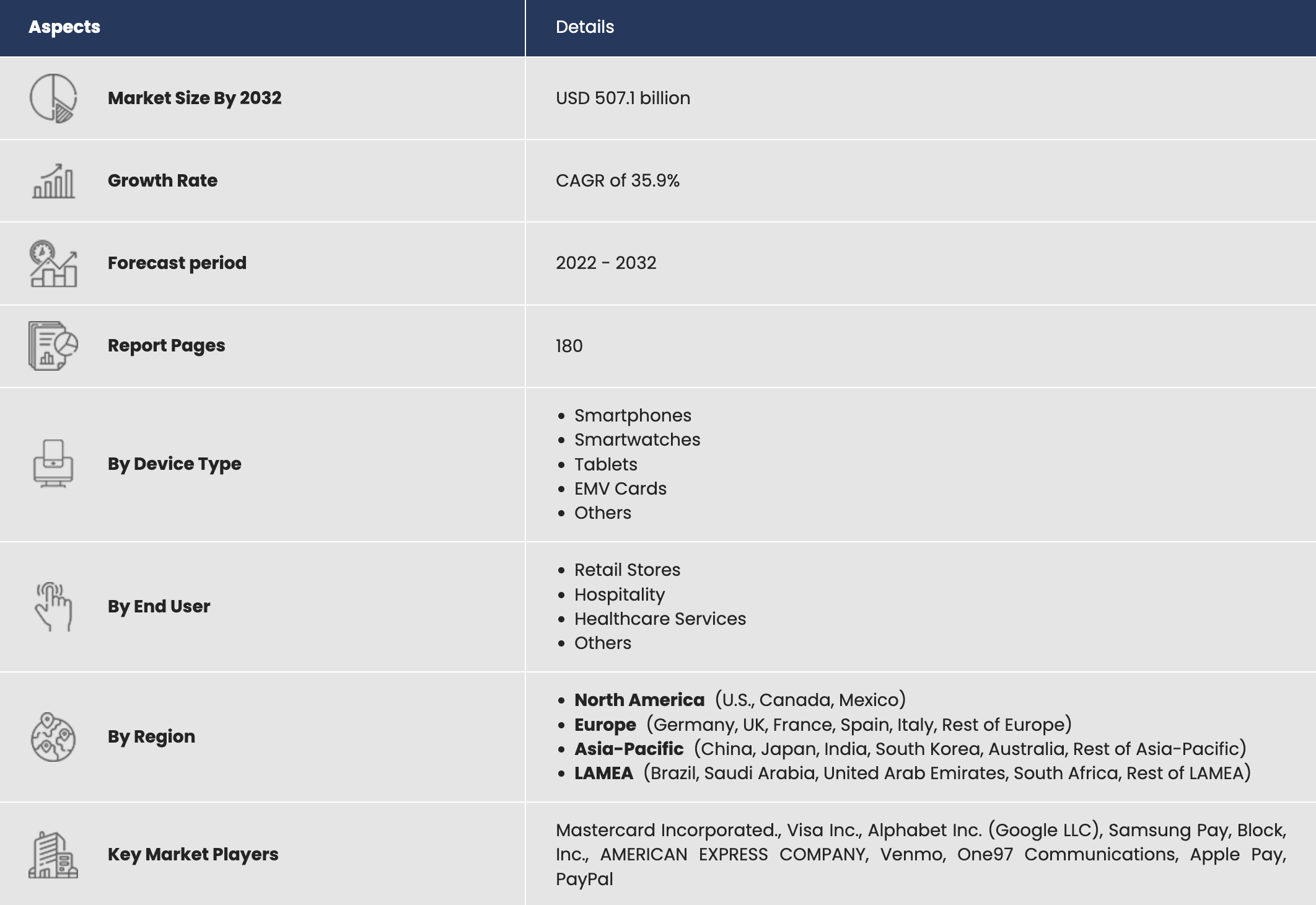

The global NFC payment market size reached $25.8 billion in 2022 and is expected to increase to $507.1 billion by 2032, at a CAGR of 35.9%.

This innovative payment method not only simplifies the payment process for retailers, but also promotes financial inclusion. Combining USDC with NFC payments on Apple devices could mark a paradigm shift, especially on the Ether network where USDC is primarily used.

As one of the leading stablecoins, USDC is expected to capitalize on the growing NFC market, which is projected to be valued at $507 billion by 2033, higher than the current combined market capitalization of Ether and USDC, which currently stand at $314 billion and $34 billion, respectively.

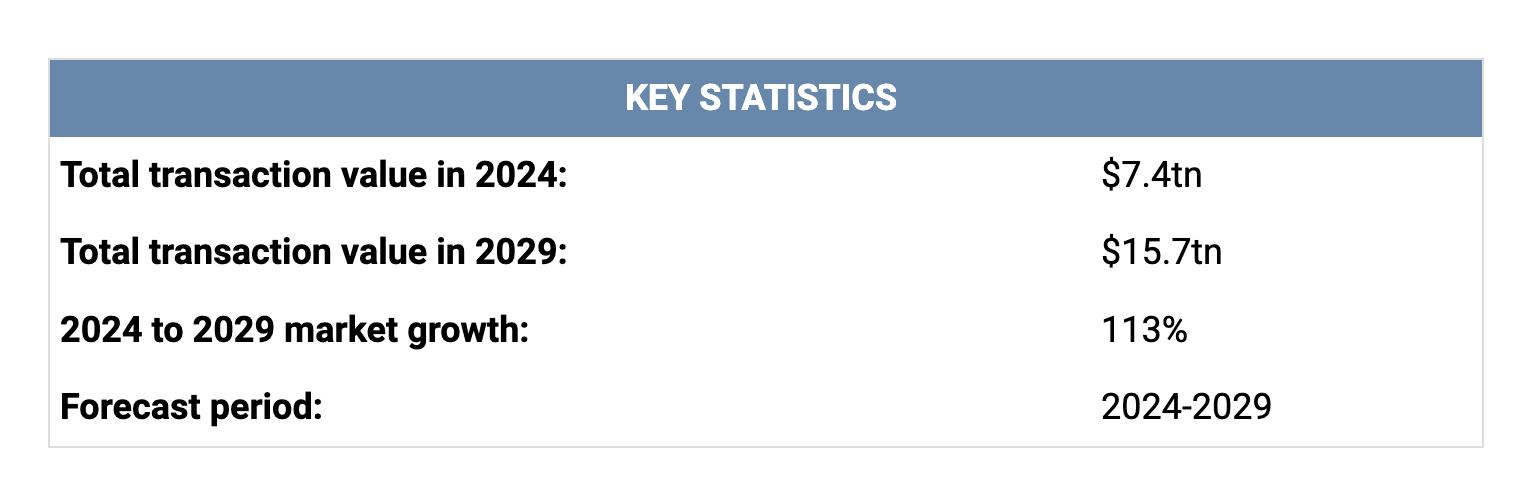

According to Juniper Research, the total global transaction value of contactless payments is expected to grow from $7.4 trillion in 2024 to $15.7 trillion in 2029, a growth rate of 113%.

This significant growth highlights the enormous potential of NFC technology, and integrating USDC into this ecosystem could benefit Ether. As contactless payments become more prevalent, if USDC were to capture 2% of this market, it would bring approximately $314 billion in transaction volume to the Ethernet ecosystem annually, which would significantly increase Ethernet's network activity and value.

Three Major Impacts USDC's Partnership with Apple Could Have on Ether Prices

- Increased Demand and Usage of USDC. usdc is an ethereum-based stablecoin, and demand for usdc is likely to increase dramatically with the introduction of the iPhone NFC payment feature. The ability to conduct everyday transactions via Apple devices could drive widespread adoption of USDC by consumers and merchants.This increased usage could lead to higher transaction volumes on the Ether network.

- Widespread adoption of Ether.The seamless integration of USDC with the iPhone NFC payment feature may encourage wider adoption of Ether apps. As USDC transactions become more popular, users may begin to explore other Ether-based services, further driving activity and value in the Ether ecosystem.

- Network effects and developer activity. This development may inspire developers to create more applications and services that leverage the power of Ether, especially in the areas of decentralized finance (DeFi) and payments.

Summary

Apple's possible partnership with Circle to integrate USDC into its NFC payment system could have a profound impact on Ether. As users adopt USDC via Apple devices, demand for transactions on the Ether network could surge, which in turn could have a positive impact on ETH prices.

This development comes after years of regulatory pressure on Apple to make changes, marking a major shift in its strategy that could usher in a new era for mobile payments and digital currencies.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.