Apple Inc (AAPL) Earnings Interpretation 2023

Summarize Apple's fiscal 2023 quarterly results for your reference。

Apple recently released its latest earnings numbers, which are important for investors and analysts alike。In the disclosed results, we can see Apple's performance in each quarter in the business area and the company's overall financial position.。Here's a brief analysis of Apple's latest earnings。

Apple's Fourth Quarter Results Report 2023

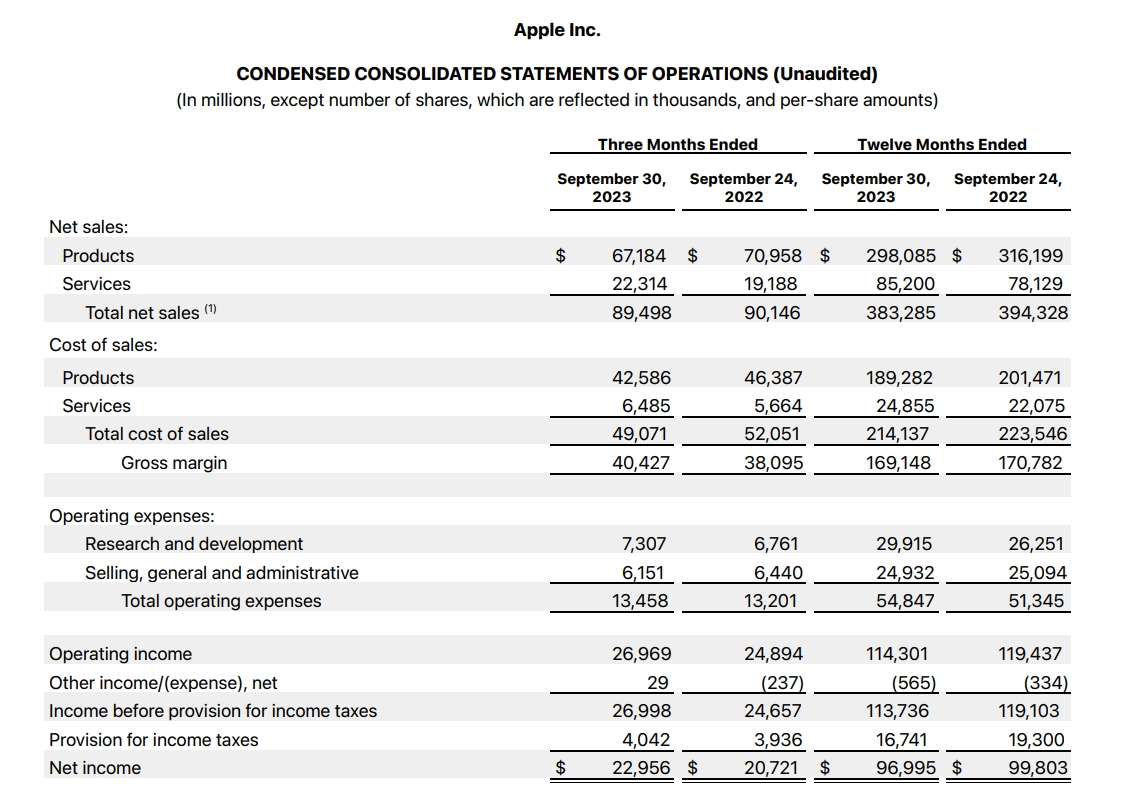

After the U.S. stock market on November 2, local time, Apple announced its fourth-quarter results for fiscal 2023 (i.e., third-quarter results for natural year 2023), and the earnings season for large technology stocks for the quarter came to an end。Data show that during the reporting period, Apple's total revenue reached $89.5 billion, higher than market expectations of $89.3 billion, down 4% year-on-year; net profit of $23 billion, higher than market expectations of $21.8 billion, up 11.1%; quarterly diluted EPS of 1.$46, compared to 1.29美元。

Overall, Apple's growth in its fiscal fourth quarter already appears to be in a bottleneck。Although both revenue and net profit were above market expectations, Apple's revenue again recorded a year-over-year decline during the reporting period, the first time since the 2007 iPhone launch that Apple has recorded four consecutive fiscal quarters of year-over-year revenue declines, and then going back to that record to catch up to 2001。

In addition, according to the company's performance guidance, iPad and wearable devices in the next quarter (December quarter) performance will usher in a "significant decline," but total revenue is expected to be comparable to the same period last year。Wall Street believes that at the end of the year, which includes many consumer festivals, if only to hand over the return to the same period last year, which represents Apple's bearish outlook for the fourth quarter。As a result, although U.S. stocks rose more than 2% after the session, they fell more than 4% after the earnings call began.。

Please refer to the full financial report analysis: Apple's fiscal 2023 Q4 results announced: revenue fell again year-on-year market does not buy it.?

Apple's Third Quarter Results Report 2023

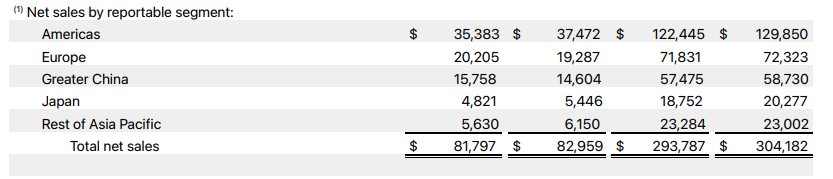

After the U.S. stock market on August 3, technology giant Apple released its third fiscal quarter 2023 (second quarter 2023) results report。Report data shows that Apple's third-quarter revenue reached 817.$9.7 billion, down 1.4%, Apple's third consecutive quarterly revenue decline since 2016; net profit of 198.$8.1 billion, up 2.3%; adjusted EPS is EPS 1.$26, up 5% YoY, the market had expected 1.21美元。

By business。Sales of Apple's core product iPhone in the third quarter were 396.$6.9 billion, below market expectations of $40.2 billion, down 2.4%; Mac business revenue of 68.$4 billion, down 7.34%; wearable (AirPods, Apple Watch), home and accessories business revenue of 82.$8.4 billion, up 2.47%; iPad revenue was 57.$9.1 billion, down 19.84%; services (App Store, Apple Music, Apple TV +, etc.) revenue of 212.$1.3 billion, up 8.21%。

by region.。Apple's Americas segment revenue was 353 in the third quarter..$8.3 billion, compared with 374.$7.2 billion; European segment revenue of 202.$05 billion, up from 192 in the same period last year.$8.7 billion; Greater China revenue 157.$5.8 billion, compared with 146 in the same period last year..$04 billion compared to an increase of 7.9%, and revenue as a percentage of Apple's total revenue was 19.26%; Japan segment revenue 48.$2.1 billion, compared to 54.$4.6 billion; Rest of Asia Pacific revenue 56.$3 billion, compared to 61.$5 billion。

Commenting on the quarter's performance, Apple CEO Tim Cook (Tim Cook) said, "Our services revenue is at an all-time high, boosted by more than 1 billion paid subscribers, while iPhone sales in emerging markets continue to be strong, further fueling iPhone expansion.。"

Cook also said that iPhone sales in China achieved double-digit percentage growth, and sales of other products were also high.。Cook said: "We also set quarterly records for wearables, home and accessories and services in China.。"

Apple CFO Luca Maestri said fiscal third-quarter results improved year-over-year from the previous quarter, with an all-time high base of active device installations in all geographic segments。Operating cash flow for the quarter was as high as $26 billion, with more than $24 billion returned to shareholders.。

In addition, Masteri warned that fiscal fourth-quarter year-over-year results would be similar to fiscal third, suggesting that revenue may continue to fall year-over-year, unlike Wall Street's expected return to growth.。He expects iPhone and services revenue to grow from the third quarter, but the iPad and Mac are likely to see double-digit percentage declines.。

Full earnings analysis please refer to: Q2 barely pass Q3 in advance "splash cold water" Apple how?

Apple's Second Quarter Results Report 2023

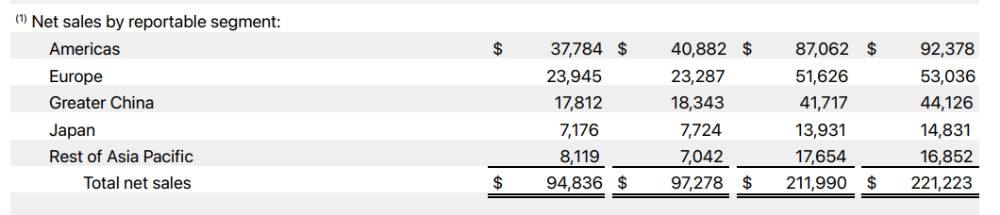

On May 4, technology giant Apple announced its results for the second quarter ended April 1, 2023.。Apple's total second-quarter revenue during the reporting period was 948, according to earnings data.$3.6 billion, compared with 972 in the same period last year.$7.8 billion, down 2.5%; net profit of 241.$6 billion, compared to 250.$1 billion, down 3% YoY; diluted earnings per share of 1.$52, unchanged from the same period last year。

Continuous decline: Apple's second consecutive quarter of year-over-year decline in revenue, Apple CEO Tim Cook also had to admit in the earnings call。Cook said product price factors dragged down earnings figures and plans to revive sales through trade-ins and installment payments。

Product sales warning: Ahead of earnings, Apple warned that sales of iPads and Macs could plummet。More aggressively, analysts believe iPad and Mac sales could fall 12% and 25% year-over-year..4%, while iPhone revenue may decline 3.8% to 486.600 million dollars。

iPhone business highlights: earnings show that despite the overall decline in revenue, but the iPhone mobile phone business revenue still recorded 513.$300 million, up 2% year-over-year, a record high for the same period, making it the highlight of the quarter。

Market share competition: the overall decline in the global smartphone market, Apple is gradually catching up with Samsung in market share。Solid demand for iPhone 14 Pro series drives closing of market share gap between Apple and Samsung。

Factory resumption and supply chain: Analysts believe that the global factory resumption will help alleviate component shortages and supply chain disruptions for iPhone products, leaving iPhone sales unaffected by the supply side。

Sales growth in the Asia-Pacific region: Despite declining sales in the Americas, Greater China and Japan, strong sales in the rest of the Asia-Pacific region led to Apple's overall revenue growth, particularly in India, which rose 15% from the same period last year..3%。

Full earnings analysis please refer to: "hit the face" analysts?Apple's second-quarter revenue exceeded expectations, and iPhone revenue hit a new high in the same quarter!

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.