What are the benefits of a Singapore bank account??How to handle not in Singapore?

The biggest headache for investing in U.S. stocks is the high cost of wire transfers and the long time it takes to make them, which can be solved by opening a Singapore bank account! This article disassembles the complete process of applying for a Singapore CIMB bank account online, which can be done easily at home!

In recent years, more and more U.S. stock brokerage firms have set up bases in Singapore, opening up direct investment accounts for users from Singapore banks.。The deposit and withdrawal are zero fees, and the remittance deposit is instant to the account, the fastest withdrawal only needs 1 working day, greatly solving the traditional international wire transfer (Telegraphic Transfer, TT) in and out of the high cost and exchange rate, time-consuming problem.

For example, TD Ameritrade, Interactive Brokers, moomoo Futu Securities, Tiger Brokers Tiger Securities all accept Singapore bank deposits, making it easier to trade U.S. stocks.。Investors can save a lot of exchange rate losses and transfer fees as long as they have a Singapore bank account.

Why Open a Singapore Bank Account??

If your job often involves trading in Singapore dollars, having a Singapore bank account makes the money transfer process faster and easier; many overseas U.S. stock brokers accept Singapore dollars (SGD) as one of the remittance currencies compared to the ringgit (MYR).。Having a Singapore bank account allows investors to deposit gold in Singapore dollars into an overseas investment account, or from an overseas investment account to a Singapore account.。The deposit is instant, anytime, anywhere remittance deposit, not afraid of investment account no money, miss any investment opportunities。

Of course, investors can also deposit money into overseas investment accounts through local bank wire transfers (Telegraphic Transfer, TT), but they have to pay a bank and transit bank wire transfer fee and take 1 to 3 working days to arrive.。With a Singapore bank account, you can speed up your deposit time and save on international transfer fees and exchange rate losses.。

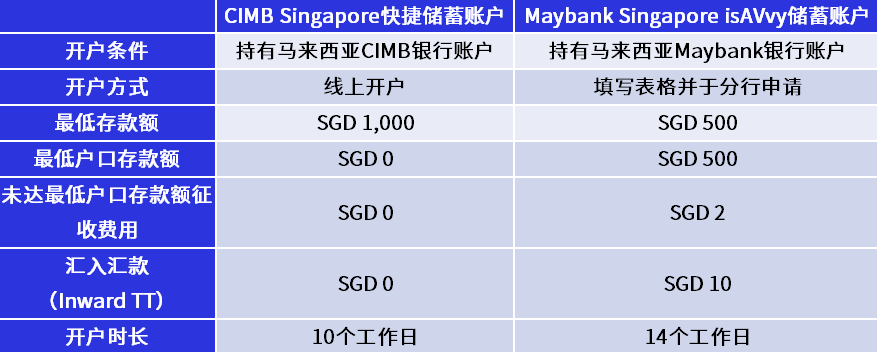

CIMB SG vs Maybank SG

There are many banks in Singapore, but there are two conditions to be met - you don't need to hold a Singapore work permit, you don't need to go to Singapore, you can open an account in Malaysia, only CIMB Singapore and Maybank Singapore meet the requirements。

Maybank Singapore bank accounts need to be handled in person at the Maybank branch in Malaysia, and Singapore accounts are required to retain SGD500, if the minimum account balance is not reached, SGD 2 fees will be levied every month;

In contrast, CIMB Singapore can open an account online, and there is no minimum account deposit requirements, which is simpler and more convenient, as long as you have a CIMB bank account in Malaysia.。

What to prepare before opening a CIMB SG account?

- Malaysian Identity Card

- CIMB Malaysia bank account (remember to activate CIMB Clicks Malaysia)

- SGD 1,000 Equivalent Funds

- Proof of current residential address (driver's license, bank statement, credit card statement, letter from insurance company, utility bill, telephone bill, house lease or title deed, local government letter)

- Tax Number

- Company Name and Address

Step 1: Opening a Malaysian CIMB Account

At present, the easiest way to apply for a CIMB account in Malaysia is to open an OctoSavers Account.。Remember to prepare your ID card and other online banking accounts in advance, and transfer RM20 by FPX online banking when opening an account.。

- Download the CIMB Apply app in the Google Play Store or Apple App Store

- Enter CIMB Apply to open an account

- Click Open OctoSavers Account > Apply Now > Begin Application。

Follow the system instructions to complete the following five steps

- Fill in personal contact information (mobile phone number, email address)

- Verification of identity (taking identity documents and a selfie)

- Fill out the application form

- Transfer RM20 by FPX Internet Banking

- Set up CIMB Clicks Online Banking

Step 2: Apply for a Singapore CIMB Account

After the Malaysian CIMB account is completed, we will then apply for the Singapore CIMB account.。

1.Go to Singapore CIMB official website to apply for FastSaver Account

Enter the official website, click "Apply Now" to enter the account opening process, it is recommended to take some time to understand the details of FastSaver Account before opening an account。

2.Confirm customer identity

Select "I am a new customer" and click "Apply Now" to proceed to the next step。

3.Confirmation of application method

Select the application method - Singpass or manually fill in the online form, here I choose to fill in the form "Proceed to complete form"。

4.Fill in personal data

Fill in your personal information, read the "Customer Statement and Confirmation" and the "Terms and Conditions of the Personal Data Protection Act 2012" and tick。

Click Start Application to proceed to the next step。

5.Follow the system instructions to complete the following five steps

- Select account details (personal or joint account, reasons for opening an account, source of funds for opening a deposit)

- Fill in personal information (personal identification information, contact address, work status)

- Tax Statement (Provide TIN Tax Number)

- Identity verification (remember to prepare photos and electronic signature files before and after the ID card)

- Send the application after confirming all application information and documents

6.Email received from CIMB Singapore

Upon completion, CIMB Singapore will send you an email instructing you to proceed to the next step, which contains an encrypted PDF file containing your bank account information.。At the same time, Singapore CIMB will send an SMS, the content is encrypted PDF file unlock password。Open the PDF file, the upper right corner is your Singapore CIMB bank account number。

Step 3: Link Malaysia and Singapore CIMB accounts

1.Login to CIMB Clicks Malaysia

Next, link CIMB Clicks in Malaysia and CIMB FastSaver accounts in Singapore。Log in to CIMB Clicks Malaysia and click Services > Account Linking > Singapore Account。

2.Enter ID or Passport Number

3.Waiting for Account Link Approval

After submitting the account link application, the bank will spend 1 to 2 working days for certification。You can log in to CIMB Clicks Malaysia at any time to check the progress of the link.

Step 4: Transfer to Singapore CIMB account to complete the certification process

After the account link is successful, proceed to the next step, deposit the first SGD1,000 to the Singapore CIMB account to activate the Singapore bank account。You can choose to transfer FAST through your own Malaysian CIMB account or another Singapore bank account.。

Note: Must be a bank account with a personal name, a third-party payment platform such as Wise.Com, Western Union transfers not accepted。If bank account activation fails, this SGD1,000 will be refunded。

1.Log in to your CIMB Clicks account in Malaysia

Log in to CIMB Clicks Malaysia and click "Pay & Tranfer > Transfer Money > Select Your Singapore Account"。

To: Select Singapore Bank Account From: Select Malaysia Bank Account

2.Enter Transfer Amount

Here you need to transfer SGD1,000, click "Transfer Money," enter TAC Number and send it out。The transfer is completed.。

3.Received Singapore Account Activation code

After a few business days, you will receive an email notification of account activation and an SMS about logging into the Activation code of CIMB Clicks SG。

Step 5: Register for CIMB Clicks Online Banking in Singapore

1.Go to Singapore official website CIMB Clicks SG

Log in to CIMB Clicks SG in Singapore and click "First Time Login" in the upper right corner.。

2.Input data and Activation code

Enter ID card, Activation code received from SMS, username and password, click "Submit"。After entering the received SMS OTP, you have successfully registered for CIMB Clicks Online Banking in Singapore。

3.Download CIMB Clicks SG App, set up Digital Token

Go to the App Store to download the CIMB Clicks SG App, log in and set the Digital Token Pin, so that you can transfer money online in the future.。

Once completed, the entire account opening process is over and you can start trading through your Singapore CIMB bank account, deposit investment account, or any financial-related transaction.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.