Buffett's investment principles & portfolio

How to check Buffett's latest position (as of February 2024)?

Warren Edward Buffett (Warren Edward Buffett) as a legend in the investment world, has been the object of countless investors competing to imitate。In this rapidly changing environment, investors tend to chase short-term gains。However, Buffett is more in favor of considering value investing, long-term holdings and risk control。

In this article, we'll take an in-depth look at Buffett's investment philosophy and strategies and reveal how he himself uses them to achieve high returns in long-term investments.。We will also analyze Buffett's latest holdings report to explore his current top 10 positions。Through these analyses, we will be able to better understand the core principles and workings of Buffett investing, and draw inspiration and inspiration from them to help us become better investors.。

Buffett in Focus: The Life and Success Story of Investing

Warren Edward Buffett (Warren Edward Buffett) was born on August 30, 1930, is a well-known American investor, philanthropist and businessman, known as the "Oracle of Omaha" and "the king of value investing."。

● Buffett's Investment Enlightenment

Buffett was born in Omaha, Nebraska, USA。He has shown great business talent since he was a child and used to peddle chewing gum at a grocery store run by his grandfather.。When he was a little older, he and his friends went to the course to pick up the golf balls they had played and resell them back to the course or to the guests.。In high school, in addition to spending his spare time as a newsboy, he partnered with his partners to rent out pinball games to barbershop owners to earn extra money.。

Buffett has enjoyed reading books about investing and stocks since he was a child, and he's also good at arithmetic and math。Buffett, 11, started working at his father's stockbroker, and in that year, Buffett bought his first stock。He bought three shares of Cities Services preferred stock at $38 per share and sold them at $40 per share.。After he sold the stock, the stock rose to $200.。On reflection, Buffett believes the experience taught him the importance of long-term holdings。

In the early 1950s, Buffett studied for a master's degree in business at Columbia University, where he was educated by Benjamin Graham.。He was influenced by Graham's approach to value investing and began to explore his own investment philosophy。After graduation, he returned to his hometown of Omaha and joined the management team of a textile factory.。

● From textile mills to investment giants: Buffett's road to success

During his five years in a management position, Buffett gradually found that textile mills could no longer compete with other companies and eventually decided to sell the company.。He got the money to sell the company, founded Berkshire Hathaway, and began his investment career.。

Berkshire Hathaway (Berkshire Hathaway) is an investment company with multiple subsidiaries in the insurance, rail, power, chemicals and jewelry sectors.。Buffett's investment performance is excellent, he is known as one of the greatest investors of the 20th century。His company, Berkshire Hathaway, became one of the largest insurance companies in the world and one of the most valuable in the world.。

Buffett is known for his outstanding value investing strategies, choosing to buy companies with solid long-term performance, potential, and undervaluation.。He believes that finding quality companies that are undervalued by the market is the most effective investment strategy.。He focuses on analyzing the fundamentals of a company and decides whether to invest by carefully assessing the company's competitive advantage, financial position, management team, and other factors.。

Buffett's Amazing Investment Performance: 57-Year Total Return Over 3,600,000%

Few investors have had a more impressive investment performance than Buffett。During his 57 years at the helm of Berkshire Hathaway since 1965, as of December 31, 2022, Buffett led the company's Class A shares (BRK).A) an average annual rate of return of 20.1%, equivalent to a total return of more than 3,600,000%。

According to Buffett's 2022 open letter to shareholders, Berkshire Hathaway owns 400 million shares of Coca-Cola (Coca-Cola) as of 2022, at a total cost of $1.3 billion.。In 1994, Berkshire Hathaway received a cash dividend of $75 million from Coca-Cola.。By 2022, this dividend has been increased to 7.$04 billion。

In addition, American Express's dividend is growing.。Berkshire Hathaway spent $1.3 billion on American Express stock in 1995。From this investment, Berkshire Hathaway's annual dividend has grown from $41 million to 3.$02 billion。

At the end of 2022, Berkshire Hathaway was the largest owner of eight major companies, including American Express, Bank of America, Chevron, Coca-Cola and HP Inc..), Moody's (Moody's), Occidental Petroleum (Occidental Petroleum) and Paramount Global (Paramount Global)。

Looking at the investment history of Buffett and Berkshire Hathaway, Buffett has always adhered to a long-term investment strategy, holding stocks for decades, and he emphasizes picking quality companies rather than looking for short-term speculative opportunities.。His investment success has made Berkshire Hathaway one of the world's largest public companies and continues to create value for shareholders.。

▍ Buffett's 3M Investment Principles

Buffett's 3M investment principles are the foundation of value investing, with 3M representing Business Management (Management), Moat (Moat) and Margin of Safety (Margin of Safety), respectively.

● Enterprise Management Management

In Buffett's investment philosophy, the quality of business management is one of the most important factors affecting company performance.。A competent, experienced and stable management team can lead the company to develop long-term strategic plans, flexibly respond to market changes and challenges, and create sustainable growth and stable profitability for the company.。

A high-quality management team has the ability to coordinate the work between various departments, effectively allocate resources, and continuously optimize business processes。In addition, an excellent management team is able to develop and execute business plans in accordance with a clear corporate vision。

Secondly, a good management team should also have excellent financial management skills and be able to effectively manage the company's assets and liabilities to ensure the company's financial soundness and healthy development.。

Investors should choose an industry they are familiar with, and by having a certain knowledge and understanding of the industry, they can better analyze the development trend of the industry and judge the company's prospects and risks.。

Secondly, investors need to understand the company's business performance, including: the value positioning of the company's products or services, market demand, competitive environment, the company's market share, etc., in order to judge the company's market competitiveness and potential.。

In addition, investors can read the company's financial statements to understand the exact financial situation, such as the company's solvency, economic efficiency and financial risks.。Investors can view the company's balance sheet to understand the company's assets and liabilities, as well as the company's income statement to understand the company's revenue and profitability, etc., and assess the company's earnings stability and potential to determine the company's investment value and risk.。

● Moat

Moat means that a company must have a unique competitive advantage to withstand threats from other competitors in the market, so that the company can continue to earn high profits, thereby maintaining its leading position in the market.。

Buffett believes that finding businesses with an economic moat is an effective investment strategy because these businesses usually have higher investment value and return potential。

The brand of an enterprise is one of the important assets。A strong brand can help companies attract more customers and increase customer loyalty。At the same time, companies with strong brands can also increase the price of their products or services, resulting in higher profit margins。

In addition, the company's know-how effectively develops better and higher quality products or services to meet the changing needs and expectations of the market and customers.。In general, a company's expertise is the need to invest in high R & D costs and expertise, making it difficult for other competitors to replicate or surpass。

By gaining insight into a company's financial metrics, investors can better assess its true value and ensure that there is a sufficient margin of safety when buying stocks。This long-term, value-based investment strategy helps investors maintain solid performance in the face of market volatility and ultimately achieve their investment goals。

● Margin of Safety

The margin of safety refers to the difference between the stock price and its actual value, which is the difference between what investors believe is the true value of the stock and the market price.。

Buffett argues that if investors only consider short-term returns and not the true value of the stock, it will be difficult for them to achieve long-term success。Therefore, after looking for quality stocks, investors need to determine the true value of the stock。Investors need to study and analyze the company's fundamentals and compare the true value with the current stock price to determine if there is a margin of safety。

If the true value is higher than the current share price, then there is a margin of safety and investors can consider buying the stock。If the true value is lower than the current share price, investors should avoid buying the stock。

Before making an investment, investors need to conduct an in-depth study of the financial statements of the company they want to invest in and consider various factors, including: the company's market position, competitive environment, quality of management, etc.。Investors should keep as much of the company as possible, carefully study and value it, and leave a sufficient margin of safety to ensure solid investment performance in times of market volatility。

In a real market, stock prices may be affected by various factors, such as market sentiment, policy changes, etc., causing their prices to fluctuate。Margin of safety is an important means for investors to protect their investment interests, helping investors to leave room when buying stocks, stay calm when stock prices fluctuate, avoid overreaction, and thus achieve more robust investment performance.。

Buffett's Investment Strategy: Value Investing

Buffett is a famous value investor.。The value investing advocated by Buffett is a long-term investment strategy that focuses on the actual value of stocks rather than being affected by short-term market volatility。

● Focus on the financial indicators of the enterprise

As a leading figure in the investment world, Buffett focuses on in-depth research and evaluation of corporate finances。He believes investors should pay careful attention to financial indicators such as revenue, earnings, shareholders' equity, balance sheet and cash flow to determine the true value of the business。

In addition, Buffett focuses on assessing a company's market share in the industry, the stability and growth rate of earnings, and the comparison of metrics such as net income and earnings per share。The balance sheet is one of the most important tools for assessing a company's financial position, and Buffett will assess the company's asset structure, liability structure, the ratio between assets and liabilities, asset turnover and shareholders' equity.。

Not only that, cash flow is also an important indicator of the health and value of an enterprise because it reflects its cash receipts and expenditures。For companies that are financially sound, grow steadily, and have a competitive advantage, Buffett believes they have long-term investment value and therefore chooses to invest。

● Focus on undervalued stocks

Buffett is a famous value investor who often looks for undervalued stocks to invest in。To determine whether a company is undervalued, he will conduct in-depth analysis, including an examination of multiple aspects of the company's financial data, industry outlook, management and investor sentiment。If a company's true value is undervalued, he buys the shares and holds them for a stable long-term return。

Buffett also looks at whether market sentiment and perceptions of businesses are undervalued。He argues that investors in the market sometimes overreact, causing the shares of certain businesses to be overvalued or undervalued。So he looks at market sentiment and perceptions of the business to determine if there are undervalued opportunities。

Taking these factors into account, Buffett will choose high-quality companies with low valuations to invest in.。He believes that these companies have long-term investment value and can deliver stable long-term returns。

● Focus on stocks that can be held for a long time and have the opportunity to increase in value.

Buffett's main investment strategy is to hold for the long term, focusing on a sound business, holding the company's stock for the long term, and achieving stable returns over the next few years or decades.。He believes that short-term fluctuations in the market have a limited impact on the company's true value and is therefore concerned with the company's long-term prospects and profitability.。

Buffett believes that long-term holdings can reduce transaction costs and market volatility risk.。As a result, he warned investors to avoid overtrading, remain patient and focus on the long-term prospects of the business.。In addition, he will select companies with leading positions in the industry, stable returns and strong management teams to invest in。This investment strategy requires investors to have a good understanding of their investment objectives, have enough confidence in the enterprise, and constantly study and analyze the continuous development of the enterprise in the field.。

● Focus on the industrial advantages of enterprises

Buffett believes that successful companies must have undeniable industrial advantages.。He likes to invest in companies that have a wide market share and stable returns because they have the ability to withstand competitive pressures and market volatility.。

In Buffett's philosophy of value investing, focusing on industrial advantages is an important part of the。In general, companies with industrial advantages have a leading position in the industry, with higher market share, better products or services, higher customer loyalty and stronger brand influence。

In addition, enterprises with industrial advantages also have unique technologies or patents, which can create value and competitive advantages in the industry, not only attract more customers and partners, but also build high customer loyalty, thus achieving higher prices and profit margins.。

Buffett believes that companies with extensive experience and expertise can better understand industry trends and customer needs to provide better products and services to sustain sustainable growth and revenue。

Not only that, different industries have different life cycles。Buffett believes that investors should understand the trends of the industry, the life cycle of the industry, and the future direction in order to find the critical time for investment opportunities。Investors should pay attention to the market size, growth rate, competitive situation, technological innovation and policy environment of the industry to determine whether the industry is worth investing in.。

Buffett's 10 investment quotes

The price is what you pay, the value is what you get.

“Price is what you pay, value is what you get.”

This quote is one of Buffett's classic quotes and explains one of the most important concepts in investing - value investing。Stock prices may be affected by market sentiment, volatility, media coverage, etc., but the true value of the company is not changed as a result。Therefore, investors should focus on analyzing the company's fundamentals and future prospects and assessing whether its true value is higher than the current market price.。Buying a good company with an undervalued price, investing for the long term, and getting multiplied value is the most critical value investment。If investors focus only on stock prices and ignore their value, they can easily fall into the trap of price fluctuations and panic and abandon their investments when market prices fall, then they may miss the opportunity to appreciate their investments。

Second, whether we are talking about socks or stocks, I like to buy quality goods when the price is reduced.

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

For equity investments, Buffett prefers to invest in companies with stable financial performance, strong brand values and good management teams。When the market is down, investors should look for stocks of high-quality companies that are undervalued for higher returns。

Third, if you don't want to hold a stock for ten years, then you don't even need to consider holding it for ten minutes.

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

In this sentence, Buffett refers to "ten years" as a symbolic time frame, which means that investors should look for stocks of companies with long-term investment value and be patient and firm in their investments.。If investors are able to hold stocks for ten years or more, then they do not need to pay too much attention to short-term market fluctuations and can enjoy long-term stock gains and dividend returns。

I've never tried to make money in the stock market, and when I invest in buying companies, I assume that the market will close the next day and won't open for five years.

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.”

In this quote, Buffett highlights a key point, which is the long-term investment strategy and investment mindset。Investors should not only focus on short-term market fluctuations, but should focus on the company's long-term value and growth potential, and allocate funds to stocks with long-term stability and growth potential in order to achieve stable returns and equity growth.。

Fifth, you'd better mix with people who are better than you, and partner with good people, and you will unknowingly move in that direction.

“It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.”

When you get along with people who are smarter, more successful, more experienced, and more motivated than you are, you will unconsciously learn how they behave and think, and put it into practice in your life.。Such interactions will motivate you to become a better version of yourself and make your views and thinking more open and diverse.

Risk comes from not knowing what you are doing.

“Risk comes from not knowing what you’re doing.”

Risk management is very important in investing because no one can predict future market trends or company performance。As a result, investors need to understand the companies and industries in which they invest and the risks they face.。Only when investors know exactly what they are investing in can they better manage risk and make informed investment decisions。

Seven, you only know who is swimming naked when the tide is low.

“You only find out who is swimming naked when the tide goes out.”

This statement emphasizes that in a recession or market decline, companies or investors who are unprepared or have inadequate risk controls will expose their problems。Many companies and investors may perform well in times of economic prosperity, but when the economic situation changes, the true merits are revealed。

Eight, buy a good company is not more expensive than buying a poor company

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Buffett stresses the value of quality companies that are worth investing in, even at slightly higher prices。Quality companies have stable profitability, strong brand value and a good management team, and their stocks will deliver higher returns in the long run。

To achieve extraordinary results, you don't need to do extraordinary things.。

“It is not necessary to do extraordinary things to get extraordinary results.”

In the pursuit of success and excellence, you don't necessarily need to do extreme, extraordinary things。On the contrary, as long as you master the basic principles and skills, insist on doing every little thing, and make long-term sustained efforts, you can also achieve excellent results。

This sentence is reflected in Buffett's investment philosophy, he focuses on the fundamental analysis of investment, follows the strategy of long-term holding and value investment, and achieves huge investment returns under relatively sound risk.。

Ten, when the opportunity appears, you have to act。There have been many moments in my life when I have not been creative, and there have been long periods when I have been dull.。If I have a good idea next week, I'll do it.。If not, I do nothing。

“You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.”

Success comes not only from creativity, but also from seizing opportunities and decisive action。This sentence emphasizes the importance of opportunity, but when the opportunity arises, there must be action to seize the opportunity。This sentence also tells us that to succeed, we need to maintain a keen insight and a high degree of action, and in the absence of the right opportunities and ideas, do not act blindly, but wait for the time to come。

Buffett's latest position (as of February 2024)

Warren Buffett has been hailed as a master of value investing, and his investment strategies have been on the radar of investors.。By looking at his positions, you can discover some valuable companies or industries to get investment inspiration and find investment opportunities.。In addition, as an investment guru, Buffett's investment decisions in the stock market usually reflect current market trends。By observing his holdings, you can learn about market hotspots, trends and risks to better grasp the market。

Buffett founded and chaired a well-known U.S. diversified investment firm called Berkshire Hathaway.。Berkshire Hathaway is one of the world's leading value investment firms and one of the world's largest publicly traded companies by market capitalization。

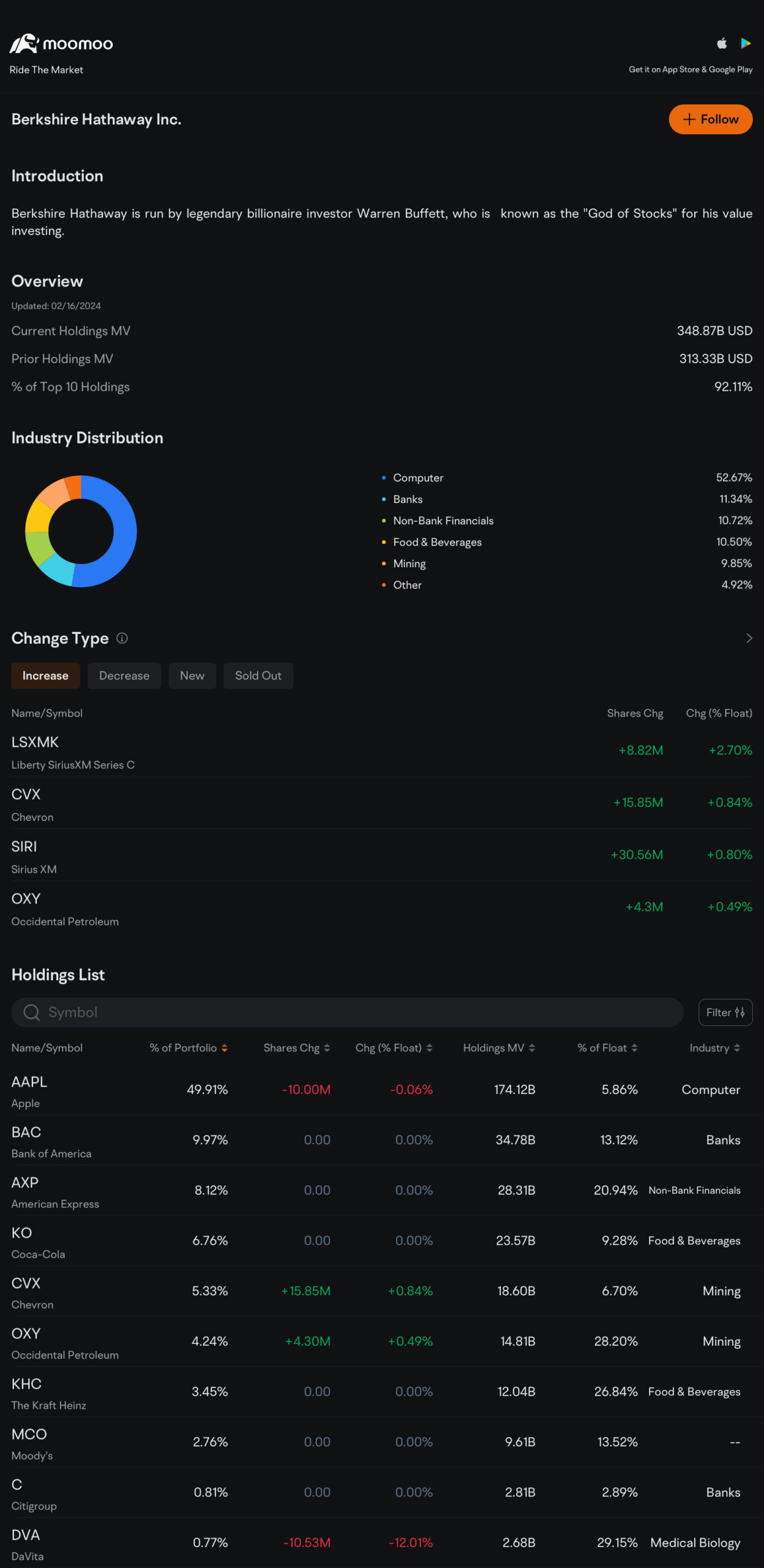

As of February 16, 2024, the total market value of Buffett's current positions was $3,488.700 million。Distribution of shareholding industries includes: computer industry (52.67%), banks (11.34%), non-bank finance (10.72%), food and beverage (10.50%), mining (9.85%), and others (4.92%)。

Second, Buffett's top ten holdings are 92.11%。This shows that Buffett has very strong control over this portfolio and has a high degree of confidence in the companies he invests in, believing that these 10 companies are valuable investments.。

At the same time, it also indicates that Buffett's portfolio is less diversified because these 10 stocks account for the majority of investments, which also increases the risk of the portfolio。In case one of these stocks underperforms, the performance of the entire portfolio may be greatly affected。

Tech Stock Apple Apple (AAPL) -49.91%

Tech giant Apple is Berkshire Hathaway's biggest position to date。Apple offers a range of software, services and accessories, including: iPhone, iPad, Mac, iPod, Apple Watch, Apple TV and more。Apple also provides a range of professional software and applications, such as iPhone OS (iOS), iCloud, Apple Pay and a range of services。

In addition, Apple's market distribution in North America, South America, Europe, Australia, Asia and other regions。Apple also has a very loyal customer base, as Buffett said in an interview: "If you're an Apple user and someone gives you $10,000, but the only condition is that they take your iPhone, you can never buy another one, you won't accept it.。"

In an interview, Buffett was more direct: "Apple is a better business than the other businesses we have.。"

However, in the fourth quarter of 2023, Buffett reduced his stake in Apple by 10 million shares.。However, this is only a negligible portion of Buffett's position。Speculation that this is due to weak demand for Apple's iPhone has led Buffett to seek some evasive action。

Bank of America (BAC) - 9.97%

Bank stocks have been on Buffett's mind for years。Bank of America is one of the largest banks in the world, with an extensive distribution network and strong brand presence in the United States.。

Bank of America as a large enterprise, the source of income is very diverse, such as: commercial loans, home loans, fees, service fees, stock underwriting, bond underwriting and so on.。This gives Bank of America a high level of stability and reliability in the financial services industry, so Buffett sees it as a potential company。

Buffett is more focused on the company's long-term growth potential than short-term profits when investing, which coincides with the bank's stable business model and relatively low volatility.。

Credit service provider American Express (AXP) -8.12%

American Express has always been the representative of high-quality and efficient enterprise management, and its management team has always adhered to the excellent management concept, thus achieving great success.。Buffett has always valued business management and entrepreneurship, so he speaks highly of this excellent business management at American Express。

As a world-renowned credit card company, American Express has a large customer base and a good brand image around the world.。American Express has a stable business and an important position in the credit card market, with stable earnings and huge growth potential, which makes Buffett confident about the future of American Express。Buffett once told the company's CEO, Stephen Squire, "What matters most about American Express is the brand and the customers who want to be associated with that brand.。"

Beverage Unit Coca-Cola Coca-Cola (KO) -6.76%

The Coca-Cola Company is one of the world's leading brands。As of 2024, Coca-Cola sells more than 200 brands of beverages in more than 200 countries, such as Costa Coffee, Fanta, Minute Maid, Sprite, and more.。

Coca-Cola successfully sits on strong brand values and consumer loyalty through large-scale advertising and marketing campaigns with iconic names and global influence.。Coca-Cola's business model is relatively stable, able to maintain a competitive advantage in a competitive market, resulting in relatively stable profitability, sustained cash flow and earnings growth potential, and fairly solid financial performance.。

Buffett knows no competitor can take away market share from Coca-Cola.。Instead, the Coca-Cola Company has been absorbing potential competitors for years and expanding on new trends by buying Ayataka green tea, Bodyarmor sports drinks and Dasani drinking water, among others.。

Oil Stocks Chevron Chevron (CVX) -5.33%

Chevron is a company with a solid financial performance, a relatively solid balance sheet, low debt, and stable cash flow and profitability.。

Chevron is also a world-renowned oil and gas production company with technological advantages and active efforts in environmental protection and sustainable development, making Chevron more competitive and able to maintain its market position and profitability in a highly competitive industry.。Chevron also continues to invest heavily in expanding its traditional and new energy businesses to drive future profit growth.。

In the fourth quarter of 2023, Buffett increased his Chevron holdings by 16 million shares.。Buffett will raise Chevron, partly because Chevron is the most powerful of the world's mega-energy companies, with a balance sheet that is superior to rivals Exxon Mobil and large European rivals such as Royal Dutch Shell.。On the other hand, because it is difficult to increase production capacity, the move is seen as a signal to bet that the oil industry will grow more than supply in the future.。

Occidental Petroleum (OXY) -4.24%

In addition to his large stake in Chevron, Buffett also holds a large stake in Occidental Petroleum。Occidental Petroleum is the leading oil producer in the United States, with significant operations in Texas and New Mexico.。

Occidental is also the largest owner of land in the Permian Basin。According to the Energy Information Administration, the Permian Basin in western Texas and eastern New Mexico is one of the world's most prolific oil and gas producing regions.。The Permian Basin, which spans more than 75,000 square miles, has a larger share of wells to be developed (63%) than rival basins, accounting for 60% of total U.S. growth.。Production in the basin surged from 890,000 barrels a day to 4.3 million barrels, more than double the growth rate of total U.S. crude oil production.。

Another reason Buffett is bullish on Occidental Petroleum is its technical capabilities, which makes it one of the best drilling efficiencies in the industry。Occidental CEO Vicki Hollub noted that Occidental was able to increase well productivity for seven consecutive years, with wells in 2022 producing 205% more oil equivalent per day than wells in 2015。Vicki Hollub also pointed out that Occidental Petroleum has unique and advanced recovery technologies and has been using an advanced enhanced oil recovery technology (EOR) since the 1980s to increase production and well efficiency.

Packaged food company Kraft Heinz The Kraft Heinz (KHC) -3.45%

Kraft Heinz (The Kraft Heinz) is a large packaged food company with a number of well-known brands, products are widely sold around the world, such as: Kraft Cheese (Kraft Cheese), Heinz Ketchup (Heinz Ketchup), Oreo (Oreo), KFC sauce (KFC Sauce) and so on。These brands have a strong market position and consumer loyalty, generating a steady stream of cash flow and revenue for Kraft Heinz.。

Kraft Heinz CEO Miguel Patricio sold underperforming brands, made improvements to the packaging, marketing and operations of Kraft Heinz products, and paid off debts。Adjusted, Kraft Heinz sales improved and demonstrated superior pricing power in an inflationary environment。

One of the reasons Buffett likes Kraft Heinz is the company's ability to raise prices over time, offsetting the long-term erosion of inflation on shareholder returns。Under Patrio's leadership, Kraft Heinz's stock has risen 28% since the end of June 2019, putting Kraft shares ahead of the S & P 500's (S & P 500's) 23 during the three-year period..4% return。

Credit rating agency Moody's (MCO) - 2.76%

Founded in 1900, Moody's is one of the three largest commercial credit rating agencies in the United States.。Moody's has two main divisions called Moody's Investors Service and Moody's Analytics.。

Moody's Investors Service publishes credit ratings, provides debt assessment services, and operates in 140 countries.。Moody's Investment Services has rated thousands of borrowers, allowing investors to assess risk.。

Moody's Analytics provides risk management services for institutional investors and offers a variety of research and data tools on a subscription basis.。

Moody's reported first-quarter earnings on May 2, 2022, with revenue down 5% to $15.2 billion and adjusted earnings per share at 2.89 USD。Moody's noted that lower global debt issuance due to sharply higher interest rates reduced Moody's revenue。However, revenue from Moody's analytics business surged 23% to 6.$9.5 billion。

Citigroup Inc.(C) - 0.81%

(Citigroup Inc.).) is one of the world's largest investment banks and financial institutions, founded in 1812 and headquartered in New York, USA.。It primarily serves global consumer banking and institutional client groups.。

It provides traditional banking services to retail customers through retail banking for global consumer banks, including: credit card borrowing, investment services, and more.。

For the institutional client group business, it provides a full range of wholesale banking products and services to corporate, institutional, public sector and high net worth clients around the world, including: fixed income and equity sales and trading, foreign exchange, gold and other commodities brokerage, derivatives services, equity and fixed income research, corporate lending, investment banking and advisory services, private banking, cash management, trade finance and securities services.。

Reduced internal red tape as Citigroup is undergoing its largest full-scale restructuring in 20 years, giving Buffett a $3 billion bet on Citi in 2022 to become Citi's top 5 shareholder, boosting Citi's stock price。

Devitt DaVita Inc.(DVA) - 0.77%

DeWitt Inc (DaVita Inc.) is a healthcare provider founded in 1979 and headquartered in Denver。It does not produce dialysis drugs and medical devices, only focus on providing dialysis services, is the leading supplier of kidney health care in the United States.。

Devitt currently has the following three major businesses:

- Dialysis services: this is Devitt's main business and accounts for 90% of Devitt's total revenue。This business includes: Out-patient hemodialysis services, hospital inpatient hemodialysis services, home-based hemodialysis (HHD) and peritoneal dialysis (PD), end-stage renal disease (ESRD) laboratory services。By the end of 2020, Devitt had 3,137 dialysis centers and approximately 900 hospitals worldwide, providing kidney dialysis services and management to more than 200,000 patients, making it the second largest dialysis service operator in the United States.。

- Health Care Partners business (HCP): On December 1, 2012, Devitt established a new business model through the acquisition of Health Care Partners Holdings。Instead of owning a hospital, the company builds a platform to become a matchmaker between doctors and patients, and enters into apportionment contracts with health insurance agencies to provide medical services。

- Other ancillary services: including pharmacy services, disease management services, vascular access services, ESRD clinical investigations, physician services, direct primary care, and international dialysis operations。

After analyzing Buffett's top 10 positions, it can be seen that his investment strategy has been based on long-term holdings, focusing on selecting companies with stable returns and competitive advantages, all of which are industry leaders with sound financial conditions and sustainable business models.。His success also proves that such an investment strategy is feasible and provides a reference for investors to learn from.。

▍ How to view Buffett's latest position?

Every year, Buffett's investment firm, Berkshire Hathaway, publishes a public report on its positions at the end of the first or second quarter.。This report will list Berkshire Hathaway's (Berkshire Hathaway) top 10 stock positions and holdings.。

In addition, Berkshire Hathaway (Berkshire Hathaway) will also file 13F-HR documents, as required by the SEC (U.S. Securities and Exchange Commission), providing information on stock positions, the number of purchases and sales, costs and market capitalization.。

Some professional investment research institutions, such as WhaleWisdom, MorningStar, GuruFocus, etc., will analyze and study Berkshire Hathaway's portfolio and provide detailed reports on positions and investment strategies.。

Not only that, but the media will also cover Berkshire Hathaway's portfolio, especially for Buffett's large-scale investments or portfolio adjustments。

It's important to note that Buffett's positions change frequently, and you may not be able to get Buffett's most immediate positions through the above channels。

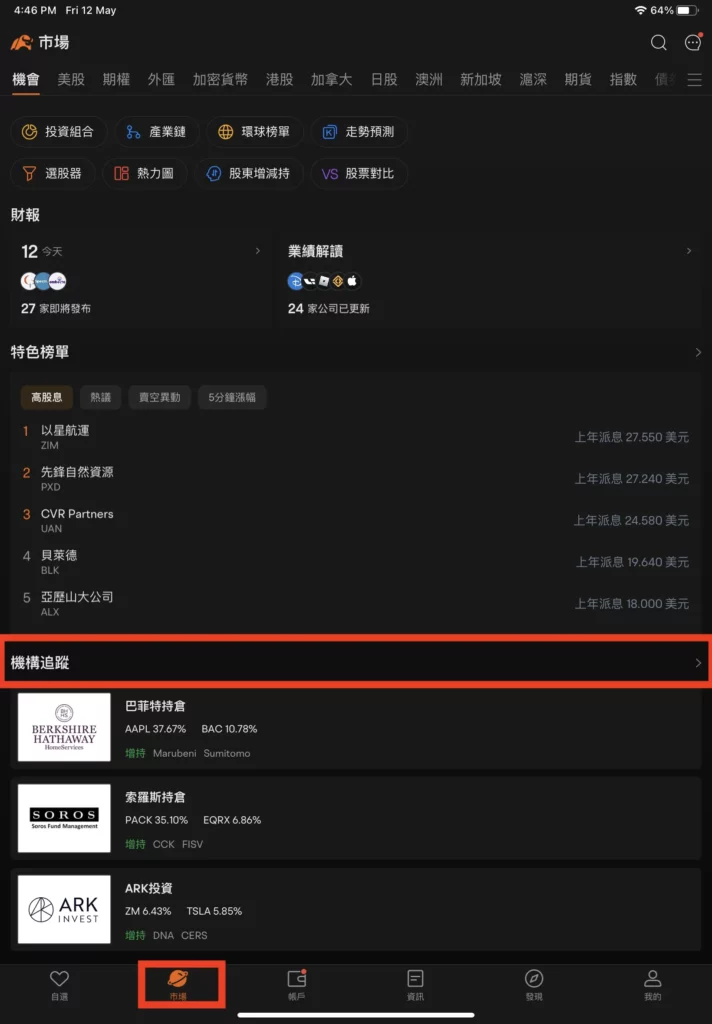

The good news is that Buffett's investment firm - Berkshire Hathaway's most immediate positions - can now be viewed anytime, anywhere via the moomoo app.。

Moomoo APP provides real-time updated portfolio information, you can quickly see the latest position information in Buffett's portfolio.。In addition, the interface of moomoo APP is simple and clear, easy to use, and even novice investors are very easy to use。If you haven't downloaded the moomoo app yet, you can sign up for a moomoo account by clicking the link below and use the various features within the moomoo app for free, including viewing Buffett's latest positions。Singapore Malaysia User Registration Hong Kong User Registration

After installing the moomoo app, it only takes 2 simple steps to view Buffett's latest position list。The author will give you a demonstration:

Step 1: Find the classification of Institution Tracking

After logging into the moomoo App, click "Market" and then go down until "Institutional Tracking"

Step 2: Select "Buffett Position" to view the position information.

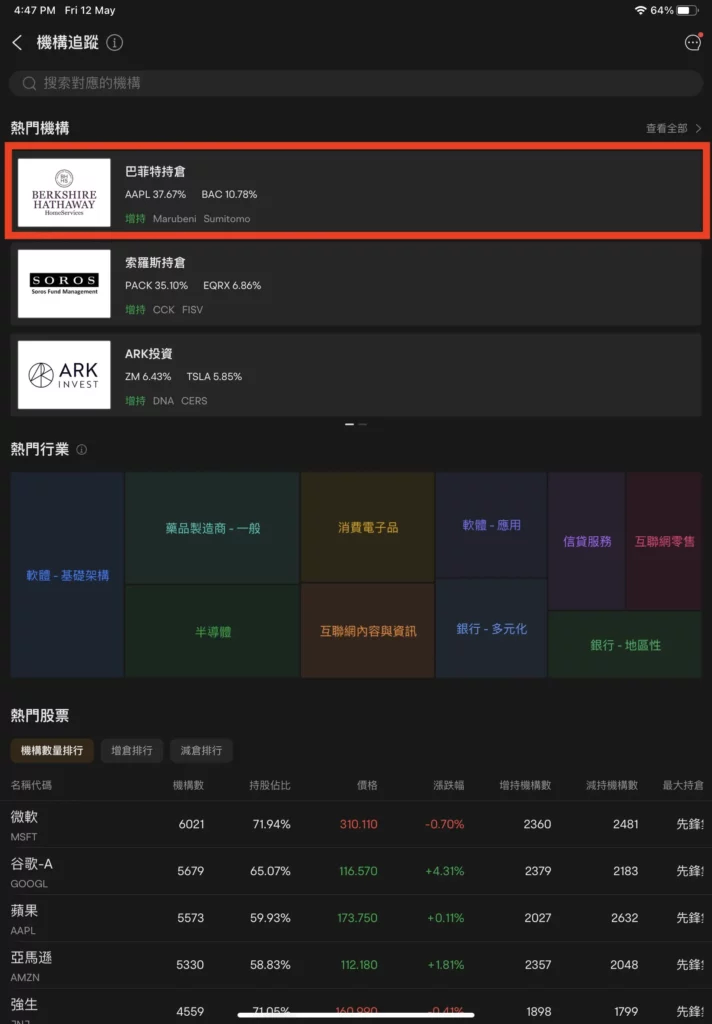

Through the moomoo app, you can view the positions of well-known institutions, such as Buffett, Soros, Sister Wood's ARK, and more.。You can click "View All" to browse well-known institutions and select the institutional positions you want to view.。

The author chose to view the "Buffett position" in this demonstration.。

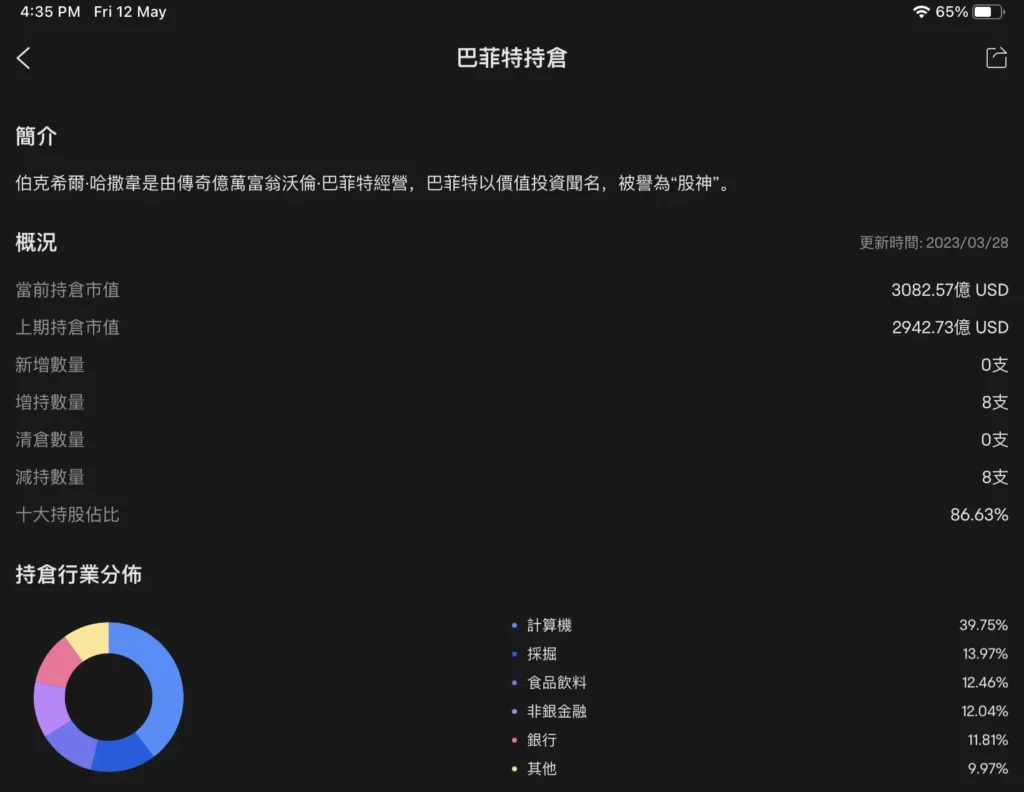

After clicking, you can view information about Buffett's latest current positions, including: current position market value, previous position market value, number of new additions, number of increases, number of liquidations, number of reductions, percentage of top 10 holdings and industry distribution of holdings。

Then go down and see Buffett's latest list of positions and related data。

If you use a mobile phone to view, you need to slide to the right to view the complete data, which includes: position percentage, change shares, change percentage, market value of holdings, percentage of total equity, industry, position date, price and ups and downs。

It is very convenient to use the moomoo APP to view position data directly, and this feature is free, you don't need to make any deposits or transactions in the moomoo APP, you can use it。

If you also want to use this feature of moomoo APP, you can click the link below to register a moomoo account。Singapore Malaysia User Registration Hong Kong User Registration

▍ Conclusion

As one of the most successful investors in the world, Buffett is a committed value investor with a strong focus on data analysis of company fundamentals, such as profitability, cash flow, management team, competitive advantage, brand value, etc.。For good companies, Buffett emphasizes continuous investing and investing when their market value is undervalued。

Buffett's investment decisions in the stock market usually reflect market trends.。By observing his holdings, you can learn and refer to market hotspots, trends and risks to better grasp the market。

Buffett's investment principles and value investing philosophy are worth learning.。However, Buffett's success cannot simply be replicated, and investing is risky, and simply blindly following others' portfolios does not guarantee success。Investors need to conduct adequate research and analysis on their own to understand their risk tolerance and investment objectives and develop appropriate investment strategies.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.