How CGS CIMB iTrade Platform Trades Horse Stocks?

CGS CIMB iTrade is a platform that provides real-time stock market information and trading functions for Malaysian stocks, bonds, eIPOs, futures, etc.。Today this article collates the CGS CIMB iTrade order trading process of buying and selling horse stocks, to help you easily trade to your favorite horse stocks!

CGS CIMB iTrade is a platform that provides real-time stock market information and trading functions for Malaysian investors, covering multiple sectors such as stocks, REITs, bonds, eIPOs, futures, etc.。

The platform not only provides comprehensive financial data of investment targets, but also provides users with important information such as quarterly or annual statements, press releases, management comments and other important information of listed companies.。With CGS CIMB iTrade, investors have easy access to key data to help make informed investment decisions。

In addition, CGS CIMB iTrade offers a range of investment trading tools, including iScreener, iBillionaire, iFilter, Stock Filter and more。These tools provide users with a wealth of advisory and analytical functions that help them make sound investment decisions by conducting adequate research before investing and better managing risk.。

Overall, CGS CIMB iTrade provides investors with comprehensive support through its comprehensive platform and diversified tools, enabling them to participate more flexibly and deeply in the stock market and achieve more informed investment strategies.。

Today this article collates the CGS CIMB iTrade order trading process of buying and selling horse stocks, to help you easily trade to your favorite horse stocks!

Content includes:

① CGS CIMB iTrade Horse Stock Trading Process Teaching

② What order types and validity periods are provided by CGS CIMB iTrade

③ Commissions and other fees for CGS CIMB iTrade horse stock transactions

④ CGS CIMB iTrade Horse Stock Trading FAQ

Small reminder before buying and selling stocks

After successfully opening an account and merging it into Gold CGS CIMB iTrade, you can choose to log in to the CGS CIMB iTrade APP mobile app or the official website to place an order.。

The author actually uses the mobile phone APP, you can go to the App Store or Google Play Store to download CGS-CIMB iTrade (MY)。

Introduction of CGS CIMB iTrade Trading Platform Interface

After successfully opening an account, in addition to horse stocks, CGS CIMB iTrade will automatically open trading markets for users such as U.S. and Hong Kong stocks.。Log in to the CGS CIMB iTrade App and view the total assets information of the account on the Portfolio page, such as the market value of the position, the profit and loss of the position, and the cash balance.。

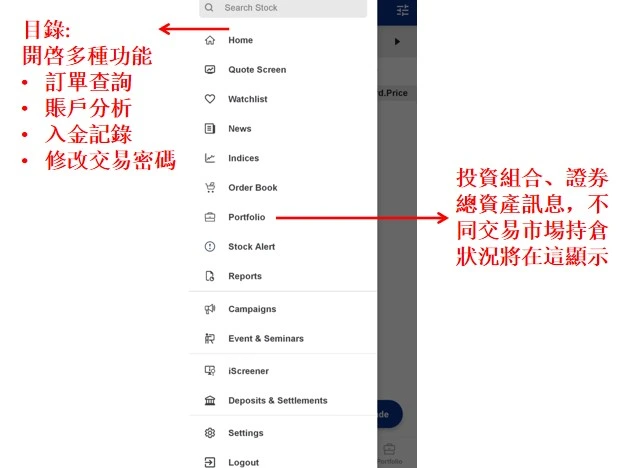

On the Quote page, you can view stock prices on markets in different countries。When you click "Catalog," you can browse other account information and functions, such as order inquiries, deposit records, change account numbers, etc.。

Hong Kong stocks, U.S. stocks, Singapore stocks and other position accounts are also displayed in the portfolio, so that users can track the trading and profit and loss of individual markets under the same page.。

CGS CIMB iTrade Order Process

After registering an iTrade account and successfully depositing money, you can start trading horse stocks。The process for CGS CIMB iTrade to place an order to buy or sell horse stocks is simple.

◇ Click on the subject you want to buy or sell, press trade, and choose to buy or sell

◇ Set order data (order type, price, quantity, validity period, etc.)

◇ Confirm the order information and send it out

Next, we will introduce the process of CGS CIMB iTrade placing an order to buy and sell horse stocks step by step in a multi-graphic form.。The order process will be based on the CGS CIMB iTrade App interface, which takes only 1 minute to complete the order transaction。

If you use the official website, you can switch to Simplified Chinese or English at any time。Only English interface can be selected using mobile phone App。

Method is, after logging into the official website, to the upper right corner, click "English" or "Chinese"。

Step 1: Select the subject you want to place an order with

Log in to the CGS CIMB iTrade personal account, the main interface is the user's portfolio, self-selection list, etc. (i.e., stock watch list Watchlist)。At the top left, click "Catalog" to enter the name or code of the stock in the search bar.。For example, Maybank Malaysia Bank Limited (code MAYBANK), Public Bank Malaysia Public Bank Limited (code PBBANK)。

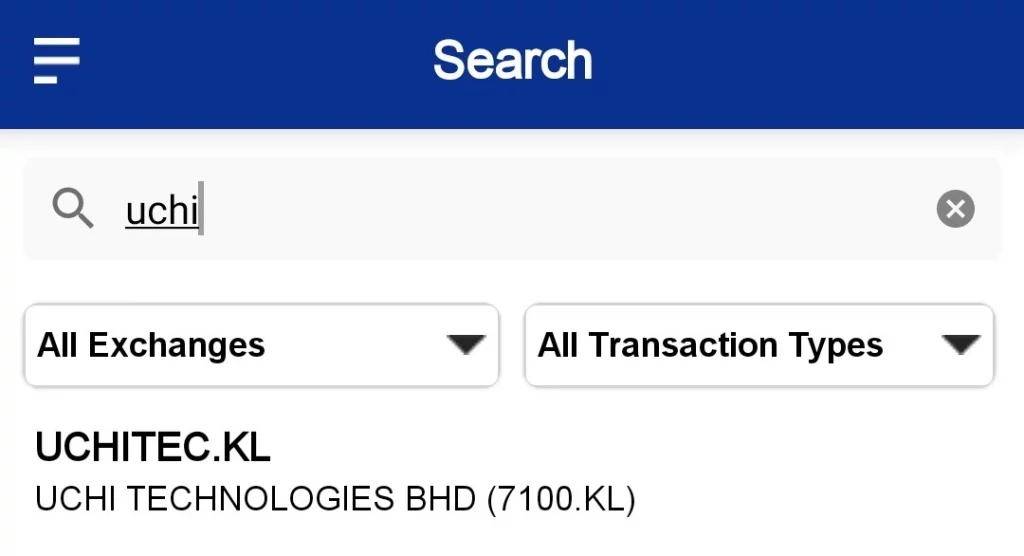

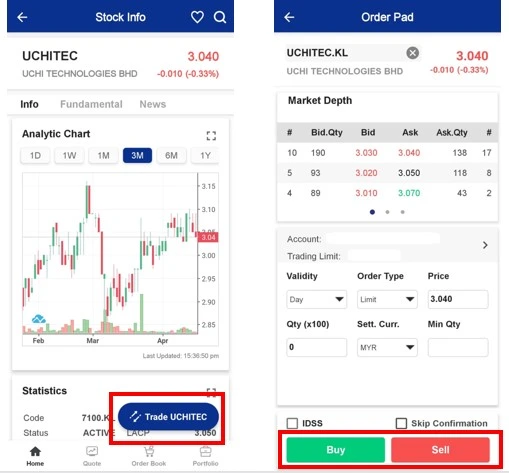

Take UCHITEC as an example, enter UCHITEC in the search bar and click UCHITEC stock to enter the underlying detailed market page。At this time, the page will display the underlying price fluctuations, company information, etc.。

Note: The following shares are for demonstration purposes only and are not investment advice。All investments are risky and it is recommended that you do your homework and risk planning before entering the market.。

You can also find the target you want to trade from the Watchlist and trade it.。

Step 2: Choose the trading direction "Buy" or "Sell"

On the "Info, Fundamental, News" page of the investment target, you can check the market content of the target, including the latest quotes, buy and sell quotes and orders, stock price trends, individual stock information, chip distribution, capital flow analysis, the latest trends and news earnings information.。

At the bottom of the page, click on "Trade UCHITEC" and select the trading direction: Buy / Long, or Sell / Short。

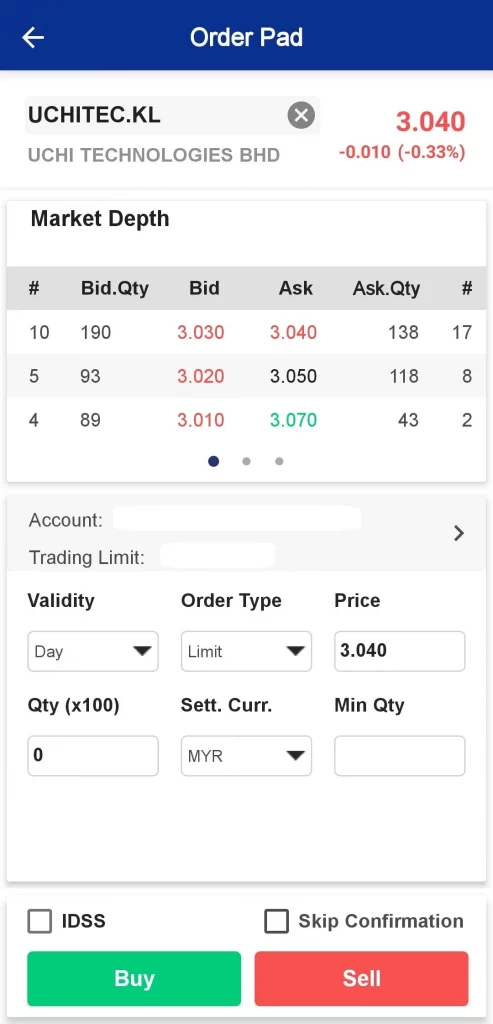

Here's an IDSS for Intraday Short Selling。This allows you to choose to sell on behalf of the underlying asset without holding the underlying asset, i.e. short the stock, borrow the stock with CGS CIMB iTrade first, buy the stock back before the close of the day, and return it to CGS CIMB iTrade to earn the difference from selling high and buying low.。

As a reminder, the use of this feature must comply with CGS CIMB iTrade rules, for example, only Bursa Malaysia stocks can be shorted, and you must also be in the same day (on the same day 3.30pm before) to complete the shorting operation and so on。

Step 3: Set the order data (order type, price, quantity, validity period)

Before setting up the order data, I will introduce you to the relevant settings of the trade order, including order type, price, quantity and validity period.。

Order Type

CGS CIMB iTrade offers 3 types of orders, including limit orders, market orders and stop-loss limit orders。The following will explain the differences between these three orders in detail.。

Price

If you want to buy or sell the underlying at what price, you must set a limit (or trigger price) if you choose an order type that is not a market order, such as a limit order or a stop order.。

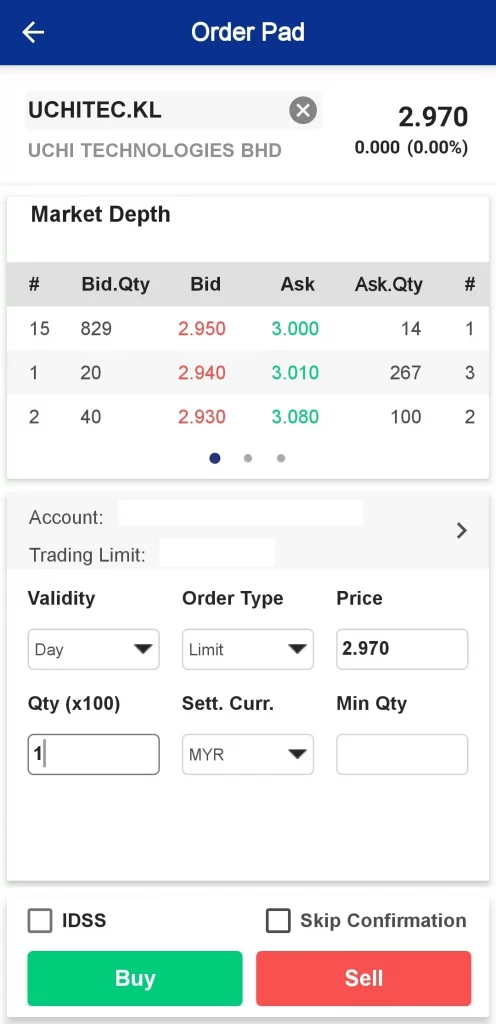

Quantity

Number of units bought or sold。The minimum unit of horse shares is 1 (1 Qty = 100 shares)。

Some securities dealers can let you choose to buy whole or non-whole number of shares.。But in CGS CIMB iTrade, you can only buy whole numbers of shares, which means you have to buy at least 1 Qty (100 shares).。

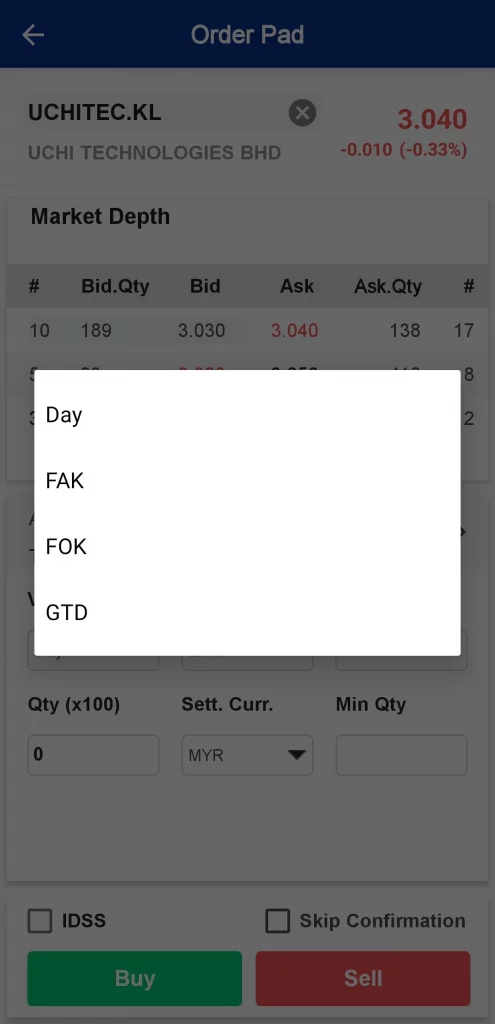

Validity

At the time of pending orders (non-market orders), you can select the validity period of the order, including Day, GTD, Fill-And-Kill (FAK), and Fill-Or-Kill (FOK).。

According to their own investment strategy, set the order type, price, quantity, validity period, click to buy "Buy" or sell "Sell"。

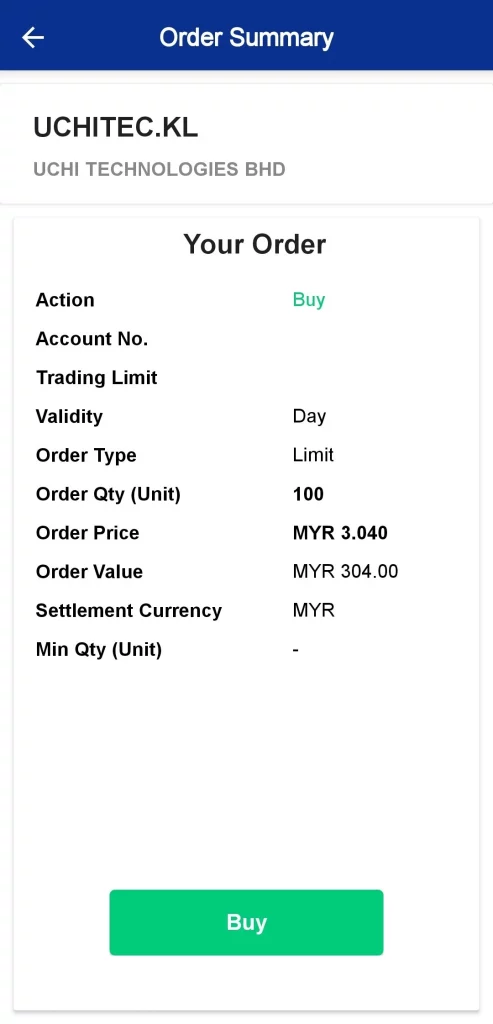

Step 4: Confirm the order information and open the transaction

Check the order details, confirm all the information, click "confirm" to complete the order。

CGS CIMB iTrade Order Type

CGS CIMB iTrade supports 3 order types, the following one explains the difference between different orders。

Limit Order

Limit Order (Limit Order) is an order to buy and sell at a specific price.。Orders are executed and closed only in two cases:

① When the specified price is reached or

② When a better price is reached (lower than the specified buy price, or higher than the specified sell price)

Advantages: You can lock in the presentation price range and even trade at a better price, i.e. buy at a lower price or sell at a higher price.。

Note: If the price has not reached the specified price, the order will not be executed。Therefore, this order may not be able to close, and miss the investment market.。

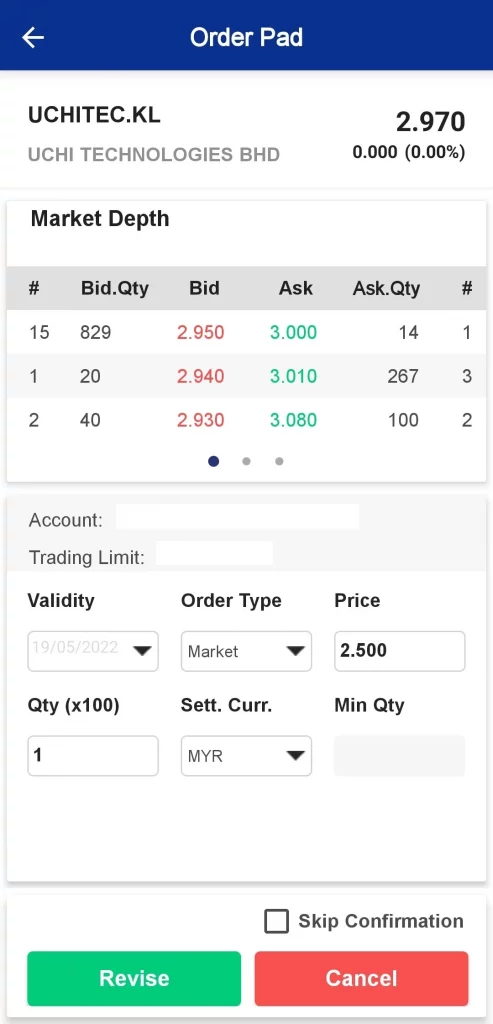

Market Order

Market Order (Market Order) is the current market price to place an order to buy and sell, do not need to set their own price, decide the number of transactions can be。

Advantages: can be the fastest speed to close orders, to seize market opportunities, stop loss or take profit purpose。

Note:

◇ Market orders can only be placed at the opening of the stock market.。And a market order guarantees a deal, but not a deal price。Simply put, the price of the transaction fluctuates with the market and may be executed at a higher or lower price

◇ Market orders can only be replaced by changing the order data after placing an order (usually using a limit order first).

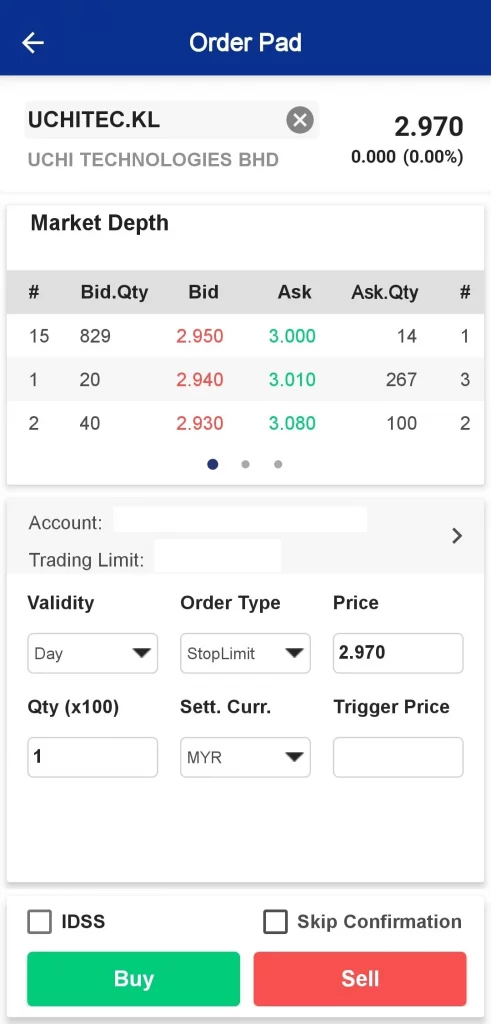

Stop Limit Order

Stop Limit Order (Stop Limit Order) refers to the setting of a specified stop-loss trigger price (Stop Price) and Limit Price (Limit Price) in the order, when the stock price reaches the trigger price, the system automatically submits a buy or sell limit order.。

A stop-loss limit order will be used as a pending order to guarantee the closing price, but there is no guarantee that the order will be closed.。

Advantages: to limit orders, you can avoid the transaction price and the expected price has too much difference。

Note: When placing a buy order, the limit price (Limit Price) should be greater than the trigger price (Stop Price); when selling, the trigger price (Stop Price) should be less than the limit price (Limit Price) to avoid rapid price declines leading to widening losses。

CGS CIMB iTrade Order Expiration

CGS CIMB iTrade offers 4 types of order validity (Validity), which are valid on the day (Day), valid before the due date (GTD), closed and revoked (FAK) and closed or revoked (FOK).。

Valid for the day (Day)

Orders are only valid during the stock market trading session on the day the order is placed, and at the close of the stock market, if the order is not filled, the system will automatically withdraw the order.。

Valid before maturity (GTD, Good Till Date)

The order will remain valid until the set validity period.。If the order is not closed before the expiration date, the system will automatically withdraw the order.。

Deals and Cancellations - Effective Immediately (FAK, Fill-and-Kill)

The transaction and cancellation order (FAK) will match the order volume at the set price as much as possible, and the system will automatically cancel the order if the quantity is not matched.。

Deal or Revocation - Effective Immediately (FOK, Fill-or-Kill)

The transaction or cancellation order (FOK) will immediately match all the volume of the order at the set price or cancel the order directly.。

CGS CIMB iTrade Horse Stock Trading Fees

CGS CIMB iTrade's horse stock transaction costs are divided into the following three items。The commission fee will be determined by the amount of the transaction.。

| Trading volume | < RM 2 million | RM 2 million to RM 4 million | > RM 4 million |

| Commission (Brokerage Fee) | Minimum is RM 8 or 0.1% of trading volume | 0.09% of transactions | 0.01% of trading volume |

| Stamp Duty (Stamp Duty) | RM 1 must be paid per RM 1000.00 | RM 1 must be paid per RM 1000.00 | RM 1 must be paid per RM 1000.00 |

| Clearing Fee | 0.03% turnover | 0.03% turnover | 0.03% turnover |

The author's measurement is to buy 1 Qty (100 shares), RM 3 per share..04, the transaction volume is RM 304 and the transaction cost is RM 9.60 ( RM 8 + RM 1.50 + 0.03% x RM 304 = RM 9.60 )。

Total paid RM 313.60。

Note: As of July 2023, the stamp duty on shares in Malaysia has increased from 0.15% down to 0.1%。

CGS CIMB iTrade Horse Stock Trading Hours

CGS CIMB iTrade trades horse stocks at:

Malaysia time 9 AM - 12.30 PM

Malaysia time 2 PM - 5 PM

SUMMARY

CGS CIMB iTrade provides a simple and complete stock trading process, users can easily complete the transaction through the mobile app。The interface design is clear and the operation guidelines are clear, making the whole buying and selling process more convenient.。

However, the investment itself carries risks and it is important to conduct adequate market research and risk assessment before proceeding with the transaction.。Investors should make prudent decisions to ensure that they understand the nature of the assets they invest in and market fluctuations。

If you have any questions, please leave us a message or contact CGS CIMB iTrade customer service or stockbroker directly for professional advice。In the investment world, timely and accurate information and opinions are essential to help investors make informed decisions.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.