CGS CIMB iTrade: Advantages and Disadvantages & Security Analysis

Malaysian users can now choose a long-established and trusted investment platform to invest in foreign stocks, known as CGS CIMB iTrade.。

Malaysian investors interested in investing in foreign stocks will generally consider using Rakuten Trade, a domestic online securities dealer, to invest in U.S. stocks。However, if you plan to get involved in foreign options, futures and other areas, you usually first think of cross-border Internet brokerages, such as Tiger Securities, TD Ameritrade Demelli Securities, and Futu Securities moomoo.。However, it cannot be ignored that Malaysian investors have another option, namely CGS CIMB iTrade, a long-established and trusted investment platform for users.。

In Asia, CGS CIMB iTrade has operations in more than 20 countries, covering Singapore, Thailand, Indonesia and other places。It is worth mentioning that in 2020, CGS CIMB iTrade Malaysia won the Best Malaysian Broker Award in the FinanceAsia National Awards.。In addition, Singapore, Thailand and Indonesia were honored as the best institutional broker in the 14th Alpha Southeast Asia Best Financial Institution Awards.。This shows the excellent performance and user recognition of the platform in various national markets。

Today's financial review series introduces CGS CIMB iTrade Galaxy-Lianchang Securities, focusing on Trade Beyond cash accounts.。

Evaluation content includes:

① Advantages of CGS CIMB iTrade

② CGS CIMB iTrade Disadvantages

③ CGS CIMB iTrade Trading Commission and Other Fees

④ CGS CIMB iTrade account security

⑤ CGS CIMB iTrade for whom to use?

What is CGS CIMB iTrade?

CGS CIMB (Galaxy-Lianchang) is a company providing integrated financial services, jointly invested by CIMB and China Galaxy Securities.。The two parties announced the partnership in 2017 and completed the equity transfer in 2021。According to the source, CIMB will transfer the remaining 25.01% of the shares were transferred to China Galaxy Securities。

CGS CIMB now operates in more than 20 countries around the world through a network of national branches and partners。In addition to providing a range of investment and financial solutions to retail and institutional clients, its businesses include retail brokerage, institutional equities, equity research, wealth management and more.。

In Malaysia, CGS CIMB is regulated by Bursa Malaysia, the Securities Commission Malaysia and the Securities Industry Dispute Resolution Centre.。

CGS CIMB iTrade is CGS CIMB's trading platform, featuring a one-stop investment service that allows users to invest in stock targets on 8 different exchanges at the same time.。This includes Singapore Exchange, Malaysia Exchange, Hong Kong Exchange, Stock Exchange of Thailand, Indonesia Stock Exchange, Nasdaq, American Stock Exchange and New York Stock Exchange。

The following is a brief summary of the CGS CIMB iTrade highlights:

| Year of Establishment | 2017年 |

| Trading platform | CGS CIMB iTrade Web Edition CGS CIMB iTrade Mobile APP Edition |

| Account Type | Managed Account (Custodian Account) |

| tradable market | Malaysia, Singapore, Hong Kong, Thailand, Indonesia, NASDAQ, US and NYSE。 |

| Investment products | Equities, ETFs, Options, Futures, FX, Bonds, Mutual Funds (Support Malaysia IPO Subscription) |

| Minimum account opening threshold | RM 0 |

| Access mode | Bank of Malaysia Online Transfer Deposit / Withdrawal Through Stockbroker |

| Minimum amount of deposit and withdrawal | Minimum deposit RM1 / no minimum deposit |

| Access fee | None |

| Account idle fee | None |

Is CGS CIMB iTrade easy to use?

4 great advantages to see at once

One platform to invest in 8 exchanges and multiple investment products

CGS CIMB iTrade enables users to directly invest in five Asian markets and three US markets through a single platform, making it easy for customers to manage their portfolios.。This includes Singapore Exchange, Malaysia Exchange, Hong Kong Exchange, Stock Exchange of Thailand, Indonesia Stock Exchange, Nasdaq, American Stock Exchange and New York Stock Exchange。

At the same time, it invests in a wide variety of products, such as stocks, ETFs, options, futures, foreign exchange, bonds, mutual funds, etc.。CGS CIMB also provides financial services to users, including Margin Financing and securities lending services.。

CGS CIMB stockbrokers are attentive and help with quick deposits and withdrawals

CGS CIMB iTrade's deposit method is generally through the Bank of Malaysia online transfer, notify the stockbroker, you can quickly deposit success.。In this way, users no longer need to worry about not being able to make a deposit in the face of appropriate investment opportunities.。Compared to other securities dealers, it often takes a few days to make a successful deposit, and there are many steps to make a deposit, and you may not be able to find customer service when you encounter problems.。

Similarly, withdrawals are only required to receive the amount on the same day with the assistance of a stockbroker.。

Buy and sell shares of other countries in ringgit and reduce exchange rate conversion risk.

CGS CIMB iTrade users can trade shares of other countries on the platform, such as Singapore, the United States, Hong Kong, etc.。When placing an order, the system will automatically convert ringgit into other foreign currencies to execute the transaction and use a ringgit exchange rate that is better than most banks.。

Users can also retain their selling price in foreign currencies when they decide to sell foreign shares。For example, after selling U.S. stocks, users do not have to convert them immediately, but wait until a good ringgit exchange rate, and then convert them to ringgit.。

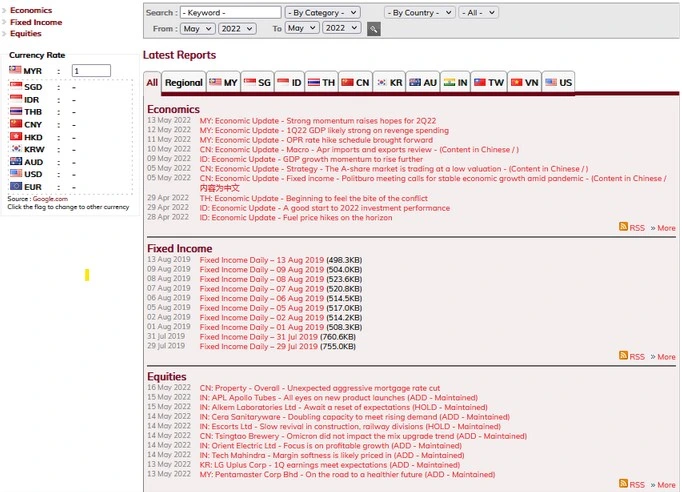

Provide comprehensive technical analysis charts, comprehensive fundamental data and research reports published by the research team

CGS CIMB iTrade provides users with comprehensive investment tools, including pre-built indicators, mapping capabilities, comparing stocks in different markets, etc.。

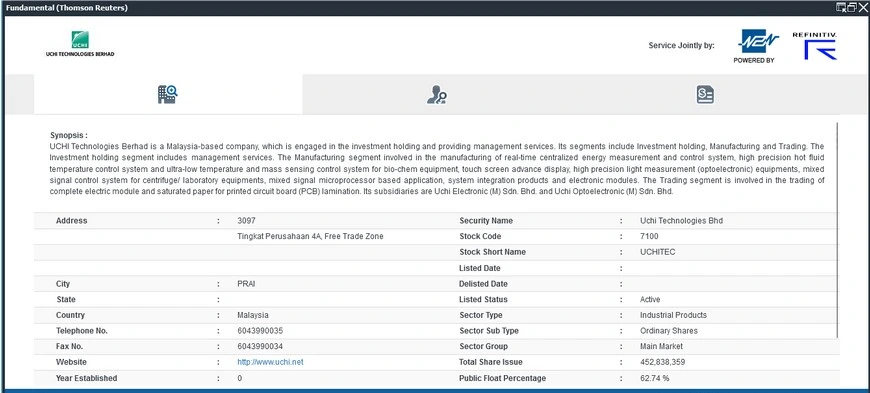

In addition, users can also obtain comprehensive fundamental data directly from the CGS CIMB iTrade interface, such as basic information about the underlying investment, key management, financial statements, etc.。This data is provided by REFINITIV。

In addition to technical analysis charts and fundamental data, the CGS CIMB iTrade research team also brings users a variety of research reports, allowing users to review news and research reports related to each stock for professional advice.。

Is CGS CIMB iTrade easy to use?

3 shortcomings you need to pay attention to

1.Unable to complete account opening within 1 working day

Although there is no minimum deposit requirement for opening an account in CGS CIMB, it is not possible to complete the account opening process within 1 working day and takes 4-5 working days to complete.。

Compared to Rakuten Trade, another horse stock brokerage, Rakuten Trade can pass the audit and complete the account opening within 2 working hours.。Since Rakuten Trade is a Nominee CDS Account and CGS CIMB is a Direct CDS Account, the account opening time of Rakuten Trade must be faster than that of CGS CIMB。

However, compared with Maybank Investment, although both Maybank Investment and CGS CIMB are direct accounts, CGS CIMB supports any eligible person to open an account online, while Maybank Investment only allows existing customers to open an account online, otherwise they need to submit documents to the Maybank office and wait 1-14 working days to complete the account.。

2.U.S. stock market quotes are not real-time information, you need to pay for real-time information (Real-Time Quote)

CGS CIMB iTrade does not provide real-time quotes on the U.S. stock market, users must pay a subscription to enjoy real-time quotes on the U.S. stock market.。

3.High transaction fees for trading U.S. stocks

CGS CIMB and local brokerage Rakuten Trade, overseas brokerage TD Ameritrade compared to CGS CIMB commission fees, although slightly higher, but CGS CIMB is regulated by the Securities Commission Malaysia (Securities Commission Malaysia), and overseas brokerage firms are not within its jurisdiction, so the use of CGS CIMB iTrade is not subject to local regulatory risk。

The following shows a comparison of CGS CIMB iTrade, Rakuten Trade and TD Ameritrade commissions。

| Brokers | CGS CIMB iTrade | Rakuten Trade | TD Ameritrade |

| Minimum commission for horse shares | RM 8; or 0.1% of trading volume | RM 7 | Horse stock trading not supported |

| Minimum U.S. Stock Commission | USD 18; or 0 of the transaction amount.25% | RM 7 ≈ USD 1.60 | USD 0 |

However, if you compare CGS CIMB with other local bank investment accounts, CGS CIMB U.S. stock commissions are relatively low。The following shows that the minimum commission for CGS CIMB US stocks is only USD 18, but the local Fenglong Bank and Bank of Malaysia need USD 25.。

| Brokers | CGS CIMB iTrade | Hong Leong Investment Bank | AmInvestment Bank(AmEquities) |

| Minimum commission for horse shares | RM 8; or 0.1% of trading volume | RM 8; or 0.1% of trading volume | RM 8; or 0.05% of trading volume |

| Minimum U.S. Stock Commission | USD 18; or 0 of the transaction amount.25% | USD 25; USD 0 per share.05; or 0.2% of transactions | USD 25; 0.35%|Volume < = RM 100,000; 0.25%|Volume > RM 100,000 |

Is it safe and legal to invest in CGS CIMB iTrade??

It is safe and legal to invest with CGS CIMB iTrade。In Malaysia, CGS CIMB is regulated by Bursa Malaysia, the Securities Commission Malaysia and the Securities Industry Dispute Resolution Centre.。

CGS CIMB iTrade trading platform by China Galaxy Securities Co..Ltd) and CIMB Group Holding Berhad。

With the approval of the State Council of the People's Republic of China, China Galaxy Securities manages the securities business departments of China Huarong, Great Wall, Oriental and other trust and investment companies, and is supervised by the Central Financial Work Commission.。In addition, the company is listed on the Hong Kong Stock Exchange, China Galaxy Securities Co., Ltd. - H Shares (6881)。

The familiar Lianchang Bank is Malaysia's second-largest bank, founded in 1924 and now 98 years old, and one of the world's largest Islamic banks by assets.。At the same time, CIMB is also regulated by the Malaysian central government and, in addition to being listed on the Malaysian Exchange, is also listed on NASDAQ in the United States under the code CIMDF, CIMB Group Holdings Berhad.。

In summary, the CGS CIMB iTrade platform is regulated as it should be, and it is relatively safe to invest in this platform under the management of China Galaxy Securities and Lianchang Bank.。

How to open an account at CGS CIMB iTrade?

CGS CIMB iTrade can apply for opening an account online, free of charge, can be completed in about 15 minutes, 4 to 5 working days will receive the approval notice。

How much does CGS CIMB iTrade water cost??What are commissions and fees??

CGS CIMB iTrade's access fees, platform fees, data fees and account idle fees are all zero.。The following is a list of commissions and fees (commonly known as water money) for trading in CGS CIMB iTrade horses and U.S. stocks.。

Trading Horse Stock Commission and Fees

| Trading volume | < RM 2 million | RM 2 million to RM 4 million | > RM 4 million |

| Commission (Brokerage Fee) | Minimum is RM 8 or 0.1% of trading volume | 0.09% of transactions | 0.01% of trading volume |

| Stamp Duty (Stamp Duty) | RM 1 must be paid per RM 1000.00 | RM 1 must be paid per RM 1000.00 | RM 1 must be paid per RM 1000.00 |

| Clearing Fee | 0.03% turnover | 0.03% turnover | 0.03% turnover |

Commissions and fees for trading U.S. stocks

| Expense type | Expense items | Amount | Remarks |

| Trading Commission | Commission (Brokerage Fee) | Minimum USD 18 or 0 of turnover.25% | |

| Clearing Fee | French FTT(Financial Transaction Tax in France) | 0 of turnover.30% | Equity transfer fees payable for the purchase of the French subject matter |

| Italian FTT(Financial Transaction Tax in Italy) | 0 of turnover.10% | Equity transfer fees payable for the purchase of the Italian subject matter | |

| Other Charges | SEC Fee (SEC Compliance Fee) | 0 of turnover.0008% | The SEC will levy this fee when selling shares Note: there is no SEC compliance fee for buying shares |

| Bank Charges | RM 20 | This fee will be levied by the bank when buying shares Note: there will be no such fee for selling shares | |

| Malaysia Contract Stamps | 0 of turnover.1% or up to RM 1000 |

Who is suitable for CGS CIMB iTrade?

CGS CIMB iTrade's trading platform, whether on the web or on mobile apps, is popular for its relative ease of use.。The platform provides free technical indicators, company financial information and research reports, making it ideal for novice investors。At the same time, CGS CIMB iTrade is also an ideal platform for investors who want to spread their investment risk to different countries, as it supports simultaneous investment on 8 exchanges.。

However, it should be noted that one of the biggest disadvantages of CGS CIMB iTrade is the higher transaction fees, so it is more suitable for long-term investors。For short-term investors, using this platform may not be cost-effective due to relatively high transaction costs。

CGS CIMB iTrade is a highly recommended option if you want to choose a brokerage firm that is regulated by the Malaysian Securities and Futures Commission and want to be able to quickly deposit and withdraw funds and invest in other countries' equity targets in ringgit dollars.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.