What is the Fear and Greed Index??What does it mean?

Developed by CNN Money, the Fear and Greed Index is a measure of investor greed and fear.。

What is the Fear and Greed Index??

Developed by CNN Money, the Fear & Greed Index is a measure of investor greed and fear.。

When investors begin to show greed, the stock price is prone to be inflated and then oversold; and when investors begin to show fear, the stock price usually falls below the level that should normally be there, creating an opportunity to buy value.。

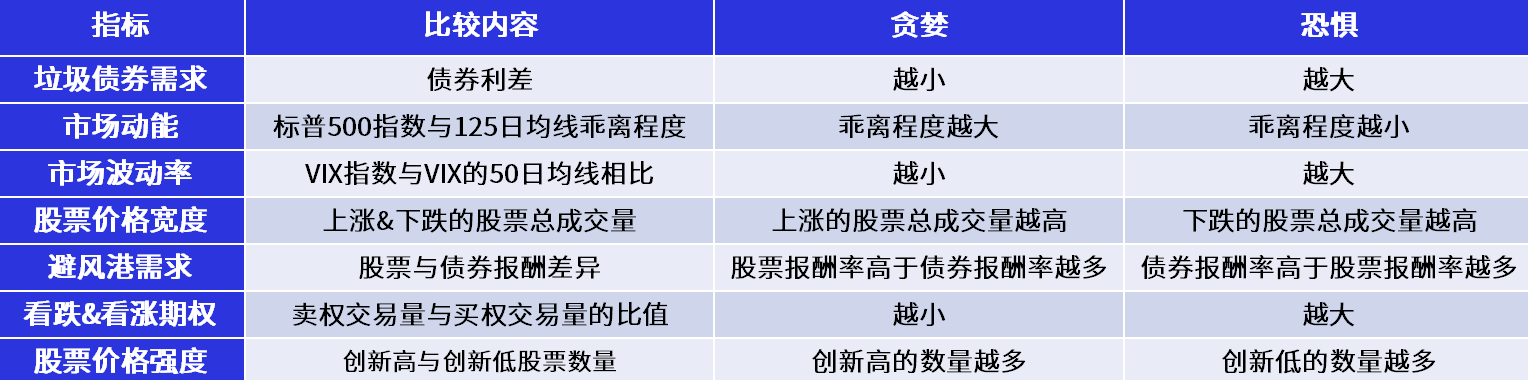

The Fear and Greed Index, unlike the S & P 500, Dow Jones, and Nasdaq, is made up of a variety of components, but is based on statistical changes in investor sentiment in the stock market and is weighted with seven indicators to calculate the Fear and Greed Index, which are.

- Junk bond demand

- market kinetic energy

- market volatility

- stock price width

- Safe haven demand

- Put and Call Options

- stock price strength

What does the fear and greed index represent??

The fear and greed index ranges from 0 to 100, and the closer the value is to 0, the more fearful the investor sentiment in the market is; and the closer it is to 100, the more greedy the investor sentiment in the market is.。The results of this data can be subdivided into five states: extreme fear, fear, neutrality, greed, and extreme greed.。

- 0-25: Extreme Fear

- 26-44: Fear

- 45-55: Neutral

- 56-74: Greed

- 75-100: Extreme Greed

7 major evaluation indicators

Junk Bond Demand

Junk bond demand indicator is measured by the spread between junk bonds (high yield bonds) and investment grade bonds。

When the market is in panic, the market is concerned about the risk of default on junk bonds, so yields rise (prices fall) and spreads widen;。

Market Momentum

The market momentum indicator is a comparison of the S & P 500 with its 125-day moving average (125 MA) to arrive at the degree of deviation between the two。

The more the S & P 500 is above the 125-day moving average, the greedier the sentiment of investors in the market; conversely, the more the S & P 500 is below the 125-day moving average, the more panic the sentiment is.。

Market Volatility

Market volatility is measured by the Chicago Board Options Exchange Volatility Index VIX (also known as the Panic Index) and the 50-day moving average (50 MA) of the VIX, with higher values representing more panic in market sentiment and lower values representing more greed.。

Stock Price Breadth

The stock price width indicator measures the total volume of stocks that have risen versus the total volume of stocks that have fallen over the past period of time based on the McClellan Volume Summit Index.。If the total volume of the rise is larger, the more greedy, if the total volume of the fall is larger, the more panic.。

Safe Haven Demand

The safe haven demand indicator means that when market risk increases, funds will be transferred to safe haven commodities, such as bonds, gold, cash, etc., so this indicator is based on the difference in compensation between stocks and bonds as a judgment.。

When the stock reward is higher than the bond reward, the more greedy the market is; conversely, if the bond reward is higher than the stock reward, the higher the demand for risk aversion, the more "panic" the market is.。

Put and Call Options

The put call option indicator is based on the ratio of put put (Put) volume to call (Call) volume in the market.。

When the Put / Call Ratio value result is larger, it means that the higher the sale volume, indicating that the market is more panicky; conversely, if the value is smaller, it means that the higher the purchase volume, the more greedy the market is.。

Stock Price Strength

The stock price strength indicator is based on the number of stocks that hit a 52-week high compared to the number of stocks that hit a 52-week low of all stocks listed on the New York Stock Exchange.。

When the number of new highs exceeds the number of new lows, it represents greed; otherwise, it represents panic.。

What does each of the seven indicators represent??

The relationship between the values of the seven indicators consisting of the Panic and Greed Index and greed and panic is summarized in the following table.

The relationship between the fear and greed index and the stock market?

Looking at the period from 2019 to 2021 when the fear and greed index fell below 25 (extreme fear), which occurred during the 2020 neo-crown outbreak, shows that the mood of market investors was very panicked at the time。

However, after the epidemic caused a sharp correction in global stock markets, countries scattered money, the U.S. Federal Reserve System (FED) in the implementation of quantitative easing (QE), the influx of funds into the market, so that the four major U.S. stock indices continue to hit high out of a wave of big market。

The fear and greed index in the end of 2020 and the second half of 2021 have been the index showed "extreme greed (> 75)" situation, if investors because of this situation and think that the stock market has overheated to sell stocks, but will miss the latter part of the market.。

Cryptocurrencies also have fear and greed index?

Yes, cryptocurrencies also have the Fear and Greed Index (Crypto Fear & Greed Index)。Like the stock market fear and greed index, a score of 0 represents extreme fear and a score of 100 represents extreme greed.。

Unlike the fear and greed index of the stock market, the indicators used to measure the fear and greed index of cryptocurrencies are:

- Volatility (Volatility): measures Bitcoin's volatility and maximum drawdown (Max Drawdown) and compares it to its average over the past 30 and 90 days.

- Market Momentum / Volume: measures cryptocurrency market volume and compares it to its average over the past 30 and 90 days

- Social Media: Measuring the discussion of cryptocurrencies on social media

- Survey: Using Strawpoll.com to conduct a weekly market survey to measure voting results (currently suspended)

- Dominance: Measuring Bitcoin's dominance as a safe haven in the market

- Trends: Data to measure the search volume of Bitcoin in Google Trends

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.