Fed's May Meeting Minutes: Officials Express Concern Over Progress Against Inflation

Since the May announcement, Fed officials have spoken with caution.

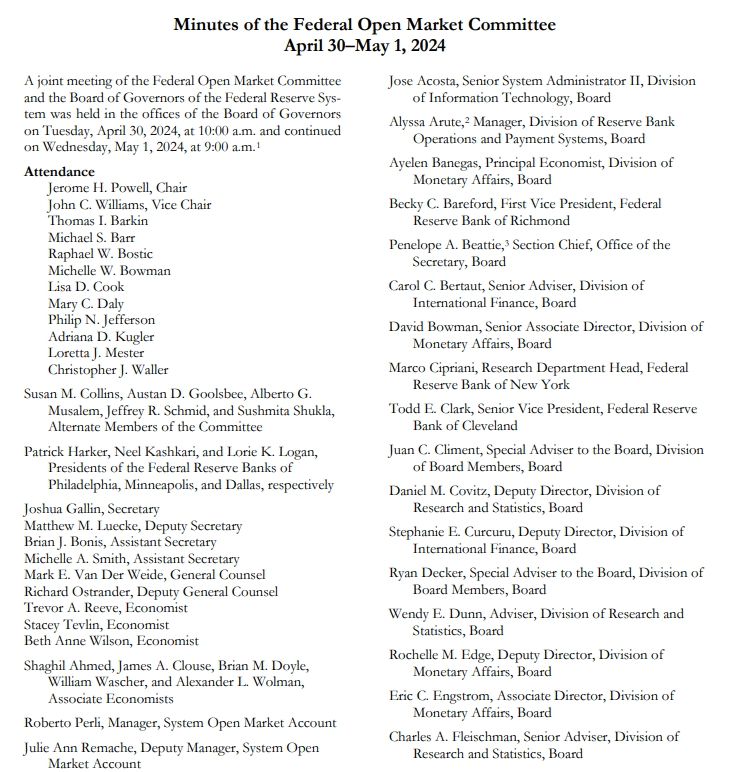

On May 23, the Federal Reserve released the minutes from its May policy meeting. According to the May interest rate decision, the Fed decided to keep the policy rate unchanged in the 5.25%-5.50% range and slow down the balance sheet reduction process, with the meeting minutes revealing more details.

Regarding the interest rate level, Fed officials generally believe that the policy rate is in a reasonable position. However, due to the fluctuation of inflation data in the first quarter, some participants expressed that they need more time to maintain confidence in the reduction of inflation. Some even suggested that if inflation worsens, they are willing to adopt tightening policies to deal with it.

This record is basically consistent with the situation faced by the Fed at that time. First, the inflation data in the United States in the first quarter was fluctuating, the PCE data greatly exceeded expectations, and the CPI data remained high for a long time, leading many officials to become hawkish. Second, in the Fed's press conference in May, Powell's attitude was ambiguous, neither believing that the Fed would raise interest rates again, nor believing that the sustainability of inflation reduction would be achieved in the short term. Finally, although the Fed was facing inflation like a flood beast at that time, a series of data after the May meeting brought good news to the central bank: the CPI increased by 3.4% year-on-year, lower than the previous value of 3.5%; the core CPI increased by 3.6% year-on-year, lower than the previous value of 3.8%; the non-agricultural data was unexpectedly low, and the U.S. job market cooled down.

Regarding the slowdown of the balance sheet reduction process, the minutes indicate that almost all participants expressed support for the aforementioned halving of the reduction scale of Treasury bonds starting from June. Although this decision was unanimously voted in favor by the FOMC members, "some" participants said that they could have supported maintaining the current pace of balance sheet reduction, or supported setting the upper limit of the reduction of U.S. Treasury bonds slightly higher than the resolution. Many participants emphasized that the decision to slow down the pace of balance sheet reduction will not affect the stance of monetary policy. Several participants also emphasized that the decision to slow down the pace of balance sheet reduction does not mean that the final scale of balance sheet reduction will be less than originally planned.

According to the Fed's May announcement, starting from June, the Federal Open Market Committee responsible for open market operations will reduce the monthly upper limit of U.S. Treasury bond reduction from $60 billion to $25 billion. At the same time, the committee will maintain the monthly upper limit of agency debt and agency mortgage-backed securities reduction at $35 billion, and use any principal exceeding this limit for reinvestment in U.S. Treasury bonds.

This means that the Fed has cut the upper limit of the monthly planned reduction of U.S. Treasury bonds by more than half. Some comments said that the Fed's announced reduction of $35 billion exceeded Wall Street's expectation of $30 billion. At that time, this resolution became a highlight of the Fed's announcement.

Regarding the inflation level, the minutes stated that inflation has eased over the past year but remains high, and in recent months, the committee's 2% inflation target has not made further progress. The committee is striving to achieve maximum employment and a 2% inflation rate in the long term. The committee judged that the risks to achieving employment and inflation targets have been better balanced over the past year, but the economic outlook is not clear, and the committee is still highly concerned about inflation risks.

Although officials expect economic growth to slow down this year, they are basically optimistic about the economic growth prospects. They also said that they expect the inflation rate to eventually return to the 2% target, but they are increasingly uncertain about how long it will take and how much the high interest rates will affect this process.

After the minutes were released, Nick Timiraos, a reporter known as the "New Fed Communicator," wrote that the U.S. inflation data published for three consecutive months up to April was disappointing, and the reduction of inflation encountered setbacks. Therefore, Fed officials expected that the interest rate cut would have to wait longer, and some officials were also open to raising interest rates in the case of accelerating inflation.

Indeed, since the May announcement, the speeches of Fed officials have been cautious. On Tuesday of this week, Fed Governor Waller indicated that although he expected the FOMC would not have to raise interest rates, he warned that he needed to see "several months" of good data before voting for a rate cut. Last week, Powell also expressed a similar view: as the inflation rate rises, the Fed "needs to be patient and strive to let restrictive policies take effect."

At present, the market's expectations for the Fed's interest rate cut have cooled again. The probability of a rate cut in September is 59%, lower than the previous trading day's 65.7%. The annual rate cut is about 38 basis points, compared to 41 basis points at the close of trading on Tuesday.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.