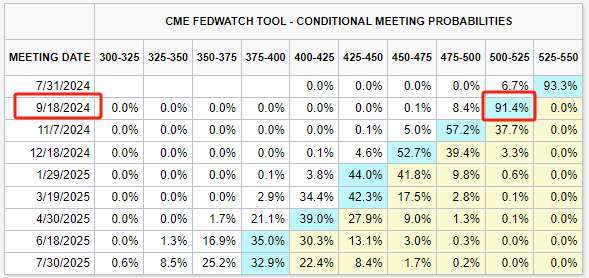

Multiple Data Points Exceed Expectations, Probability of Fed Rate Cut in September Exceeds 90%

According to data from CME FedWatch, the probability of the first interest rate cut in September has exceeded 90%, compared to only 70% a month ago.

Now, investors seem overly confident in the prospect of the Federal Reserve cutting interest rates in September.

After a satisfactory round of macro data in June (including unexpected CPI and further cooling of the labor market), data from CME FedWatch now shows that the probability of the first interest rate cut in September has exceeded 90%, compared to only 70% a month ago.

Matthew Luzzetti, Chief US Economist at Deutsche Bank, wrote in last week's research report that recent data shows a sustained weakness in the labor market and a significant reduction in inflationary pressures, particularly in the crucial housing category. These developments will have a significant impact on the prospects of monetary policy.

Previously, some Wall Street figures called on the Federal Reserve to start cutting interest rates before high rates hurt the US economy, in order to avoid plunging the labor market into chaos. However, in the face of macroeconomic data that repeatedly exceeded expectations in the first half of the year, including a persistently hot job market, this view is more like an expression of excessive anxiety and a warning lacking evidence.

However, as the labor market and price levels eventually began to cool down, coupled with Powell's softening attitude, these views began to become active again in the market.

Goldman Sachs Chief Economist Jan Hatzius stated in a recent report, "Based on the latest unemployment and inflation data, we estimate that the median monetary policy rules for Federal Reserve staff now mean a funding rate of 4%, far below the actual range of 5.25% to 5.50%. Based on this observation, as well as encouraging June CPI data and Chairman Powell's testimony in Congress last week, we expect interest rate cuts to begin soon.

It is worth noting that Hatzius even believes that the Federal Reserve should start cutting interest rates at the end of this month's FOMC meeting, rather than delaying until September. Firstly, if the reason for the interest rate cut is clear, why wait seven weeks before implementing it? Secondly, monthly inflation is volatile and there is always a risk of short-term re acceleration, which may make the September rate cut difficult to explain. This risk can be avoided from July onwards.

Hatzius also pointed out that although the Federal Reserve has promised that its monetary policy decisions will be independent of the results of the presidential elections in the second half of the year, only by starting to cut interest rates in July can speculation about the political motivations behind its policy decisions be effectively avoided.

Of course, for the Federal Reserve, external noise and anxiety do not seem to have changed their stance - Powell and his colleagues still insist on their vague statements. For example, on Monday, the Federal Reserve Chairman stated that recent data has increased the central bank's confidence that inflation will fall to the target level. However, he still refuses to specify what this means for the Fed's interest rate cut schedule.

Powell said in an interview, "I won't signal at any specific meeting. We will make these decisions one by one based on constantly changing data and risk balance.

However, regardless of whether a rate cut is possible in July, investors' confidence in future interest rate trends is driving a broader rebound in the stock market. The US stock market continued to rise this week, with the S&P 500 index hitting a new high and the Dow Jones index rising more than 740 points on Tuesday, its best daily gain in over a year.

Meanwhile, funds have also begun to shift from tech giants to small cap and value stocks. For example, the real estate (XLRE) and industrial (XLI) sectors, which are sensitive to interest rates, became the biggest winners in the market during the same period - both rising by about 5%. The Russell 2000 Index (RUT), which covers small cap stocks, rose more than 10%, breaking through its 2022 high for the first time.

In response, Tom Lee, head of research at Fundstrat Global Advisors, pointed out that the decline in the Consumer Price Index in June gave the green light for a rebound in small cap stocks, and this sector rotation could bring up to 40% of the index's gains.

Callie Cox, Chief Market Strategist at Ritholtz Wealth Management, also said on Monday, "If this kind of trading continues, and if the prospect of interest rate cuts this fall still exists, then we may eventually see a bull market recovery, which is good news for all investors.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.