The B300 's upgrade to HBM3E memory is revolutionary.

On March 17, well-known technology analyst Guo Minghao updated his personal social media.He said that NVIDIA is about to mass produce a new generation of AI chip B300 in the third quarter-this chip not only jumps HBM (high-bandwidth memory) capacity from 192GB to 288GB, but also improves computing performance by 50% compared with the previous generation B200.

From the perspective of technical parameters, the upgrade of the B300 goes far beyond paper data.Its CoWoS-L (Chip-on-Wafer-on-Substrate with Large Interposer) and CoWoS-S (Small Interposer) packaging technologies mark a further breakthrough for NVIDIA in the field of chip heterogeneous integration.CoWoS-L achieves multi-chip interconnection through a larger size interposer, while CoWoS-S focuses on high-density packaging with a small size. The combination of the two can not only meet the data center's needs for high-performance computing, but also take into account power consumption and cost optimization.In conjunction with TSMC's 4NP process technology, the B300 not only improves computing power, but also increases the power consumption of a single GPU to 1400 watts, an increase of 200 watts compared with the B200. However, through dynamic power allocation technology, the system-level energy efficiency ratio is still significantly optimized.This design idea of "giving priority to performance and taking into account efficiency" is in line with the explosive growth of current AI model parameters.

It is worth noting that the B300 's upgrade of HBM3E memory is revolutionary.The 288GB video memory capacity and 8TB/s bandwidth allow a single card to carry larger-scale model reasoning and training tasks, which is especially significant for generative AI applications that require long-sequence processing (such as multimodal large models).It is estimated that its reasoning cost can be reduced to one-third of that of the previous generation, which has a direct driving force for cloud computing vendors 'TCO (total cost of ownership) optimization.This technological dividend has triggered a chain reaction in the market: several supercomputing centers have been exposed to be planning B300-based cluster architectures, and leading organizations such as OpenAI are also evaluating their adaptability to next-generation language models.

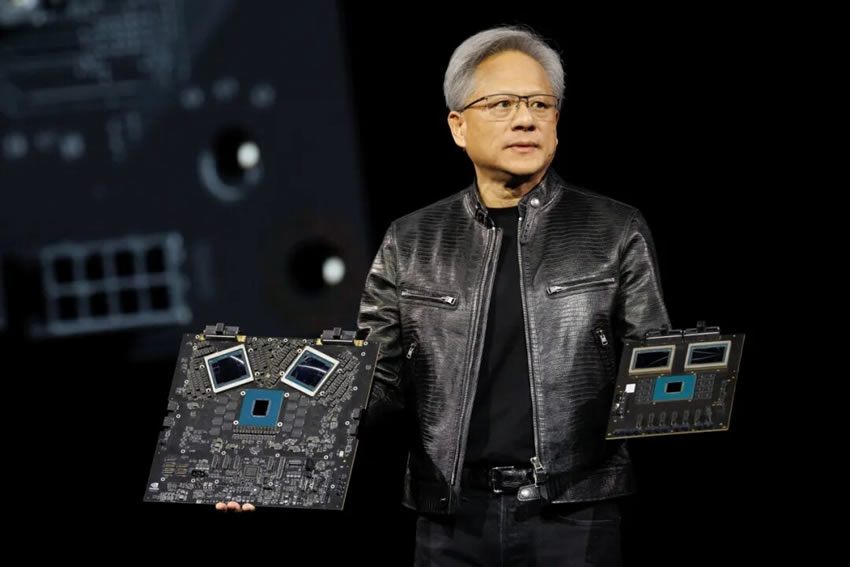

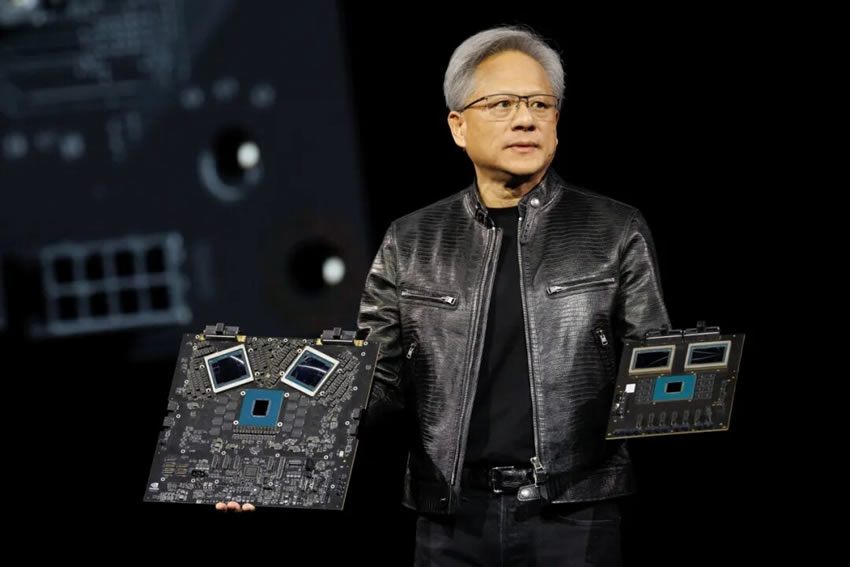

The mass production process and supply chain adjustment are another important focus.This time, Nvidia abandoned the traditional complete machine sales model and turned to a modular design-providing B300 GPUs in the form of SXMPuck daughter boards, paired with Grace CPUs and third-party HMC chips. This not only lowered the entry threshold for OEMs, but also attracted more players through the open ecosystem.Behind this strategic shift is not only considerations to deal with the fragmentation of supply chains caused by geopolitics, but also the ambition to accelerate global penetration by decentralizing production risks.However, the lessons learned from the current difficulties in mass production of GB200 NVL72 still remind the market that the "valley of death" of chips from trial production to scale delivery still needs to be crossed.

The comprehensive introduction of liquid cooling technology is another industrial change triggered by the B300.In order to cope with the peak power consumption of 1400 watts, NVIDIA abandoned the air-cooling solution in the GB300 series and switched to a high-density water-cooling system.According to supply chain news, the number of water-cooled pipelines in the GB300 has increased by more than 30% compared with the GB200. The surge in demand for quick connectors may push the order volume of QDC (Quick Disconnect Connector) manufacturers to double in the next two quarters.IDC predicts that China's liquid-cooled server market will exceed US$10 billion in 2028, with a compound annual growth rate of 48.3%. Nvidia's technological shift will undoubtedly press the acceleration button for this "second cold revolution."From cold plate manufacturers to coolant suppliers, business opportunities have been smelled in all aspects of the industrial chain. The recent intensive disclosure of liquid-cooling-related capacity expansion plans by many A-share listed companies is evidence.

From an investment perspective, although the appearance of the B300 has injected a short-term catalyst into Nvidia's share price, market doubts have not yet dissipated.The three major risks pointed out by Guo Ming-chi-the effectiveness of the scaling law, the ability of mass production to climb, and geopolitical disturbances--are the sword of Damocles hanging over the heads of the bulls.Especially in the context of the continued increase in U.S. export controls on high-end chips to China, how Nvidia maintains China's market share within the compliance framework will become a key variable affecting its valuation center.In addition, the attack between AMD MI300X and Google TPU v5 is gradually emerging. The former has eroded some cloud computing customers with its 192GB HBM3 memory and open ecosystem, while the latter has demonstrated cost-effective advantages in specific scenarios through vertical integration.If Nvidia fails to demonstrate the B300 's mass production cases and conversion benefits as soon as possible, it may be difficult to dispel investors 'concerns about "technological leadership ≠ commercial success."