Latest Forecast: AI Phones To Account For 54% Of Global Shipments By 2028

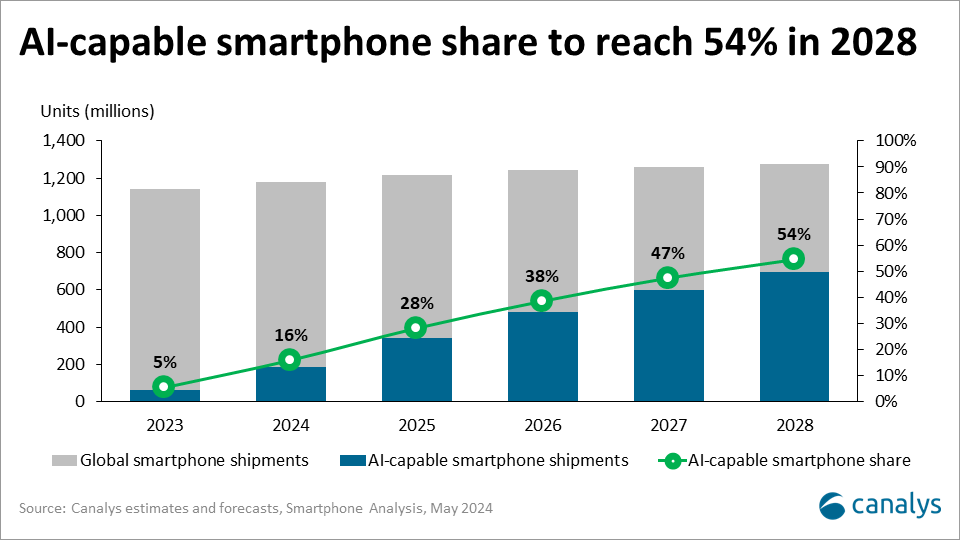

Canalys predicts that AI phones will account for 54% of total smartphone shipments by 2028. To put this in perspective, the CAGR from 2023 to 2028 is 63%.

With Apple's release of its AI-enabled iPhone 16 series phones, the world's two largest mobile operating systems now have corresponding AI phones available to consumers. In its latest report, Canalys argues that the transformative potential of AI smartphones, driven by AI technology, heralds a new era for the mobile industry.

Canalys predicts that by the end of 2024, 16% of new smartphones shipped will have next-generation AI capabilities. This growth is being driven by a combination of rapid advances in chip technology and growing consumer demand. By 2026, cumulative shipments of AI phones will exceed 1 billion units. Thanks to iterative improvements in system-on-chips (SoCs), especially on the Android platform, AI phones will realize significant growth in the mid- to high-end market.

Canalys predicts that AI phones will account for 54% of total smartphone shipments by 2028. Extrapolating this to a CAGR of 63 percent from 2023 to 2028, Canalys said it expects this shift to occur first in high-end models and then gradually expand to mid-range smartphones.

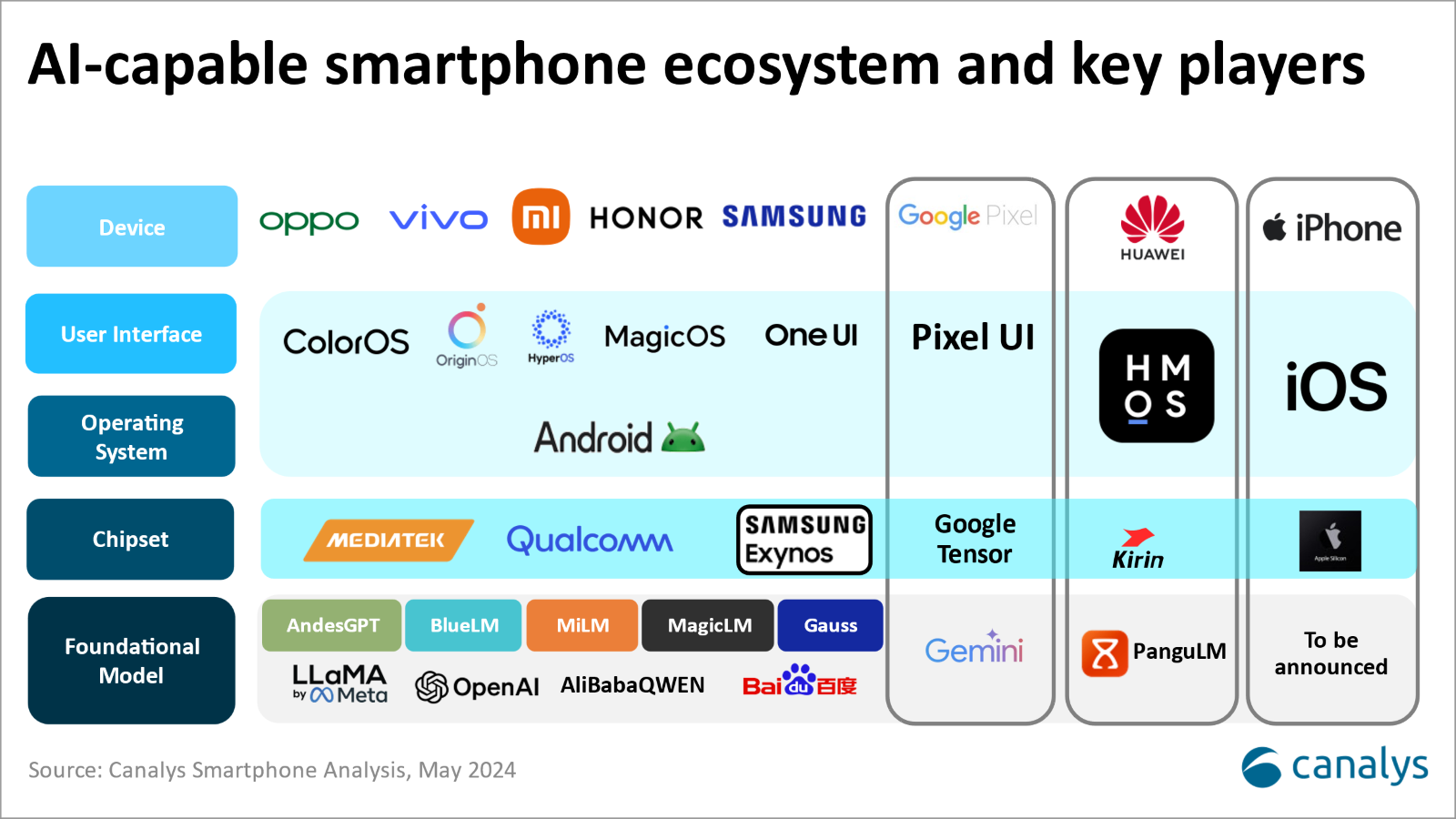

The report also notes that major global manufacturers such as Apple, Google and Samsung, as well as leading Chinese manufacturers such as Honor, OPPO, Xiaomi and Vivo are at the forefront of integrating generative AI capabilities into their devices.

● Apple

Canalys predicts that iOS will likely capture 55 percent of the AI phone market in 2025, thanks to its share of the high-end market, its highly optimized software experience for hardware, and Apple's support of third-party software developers.

In its report, Canalys mentioned that Apple's strategy will emphasize end-side processing to provide iOS users with differentiated solutions that improve productivity and overall user experience. For more demanding tasks, Apple will likely rely on cloud solutions from partners such as OpenAI or Google Gemini, continuing to focus on leveraging its hardware and software integration strengths to enhance core services such as Siri, for example.

● Samsung

According to Canalys, Samsung has adopted a hybrid AI model called “Galaxy AI” that utilizes both end-side and cloud-side technologies. This approach not only improves the user experience by utilizing cloud computing capabilities, but also addresses privacy concerns by handling sensitive data such as personal information directly on the device.

In addition, Samsung's strategic partnership with Google to integrate Gemini and Imagen 2 models into Galaxy devices has delivered significant economic and business benefits.

Samsung updated more than 100 million older flagship devices with Galaxy AI features, which were primarily implemented through cloud AI model processing due to hardware limitations.Canalys noted that most Galaxy AI features had to be logged into a Samsung account and integrated with Samsung's native apps, increasing user dependence on Samsung's ecosystem and providing valuable feedback for future AI app development. provides valuable feedback.

● Huawei

At the Huawei Analyst Conference (HAS) in April, Huawei revealed HarmonyOS Next, its self-developed next-generation Harmony OS.

HarmonyOS Next will reportedly no longer be compatible with Android and will launch an upgraded version of the system on its flagship Mate 70 series later this year. What's more, the new OS aims to enable system-level AI capabilities, not just AI-enabled apps.

Canalys noted that Huawei may use its own chip architecture to optimize HarmonyOS Next and leverage the PanguLM AI Big Model to deliver a differentiated user experience.

● Xiaomi and Honor

Xiaomi and Honor are at the forefront of an ecosystem-centric strategy aimed at creating a seamless AI experience across multiple devices, Canalys' report writes.

Both companies have invested heavily in expanding their hardware ecosystems in China and international markets. This expansion involves both hardware and partnerships with third-party hardware providers. The foundation of this strategy is aimed at fostering user loyalty and providing an edge to its generative AI strategy, making ecosystem dominance a key aspect of its go-to-market strategy.

● OPPO and vivo

In contrast, OPPO and vivo's strategy focuses on smartphones as the primary interface for AI features and services. Moreover, their investments are deeply rooted in the smartphone value chain, covering AI models of all sizes.

Both OPPO and vivo actively support their developer communities. Both companies offer tools such as zero-code development platforms and provide financial incentives to developers focused on smartphone-centric AI apps.Canalys believes that such support initiatives foster innovation and reinforce the role of the smartphone as a core platform for AI services.

It's worth noting that both companies have already developed strong internet service models in mainland China for advertisers, merchants and app developers. This smartphone-centric AI strategic focus facilitates a smoother transition to an “AI as a service” business model, reinforcing one of their core revenue streams.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.