Interactive Brokers assessment of U.S. stock brokerages: Is it safe to trade securities??

Interactive Brokers is ranked number one among U.S. brokerages and can trade many overseas markets and a variety of financial commodities, as well as zero-share trading.。This article delves into the advantages and disadvantages of IB, commission architecture, security。

The first brokerage firms that investors will contact when they enter the U.S. stock market and open a U.S. stock trading account must be Interactive Brokers and TD Ameritrade, two long-established and large securities firms.。

Interactive Brokers (IB) is the world's largest securities service provider and is supported by Investopedia, StockBrokers.com, BrokerChooser ranked first as the best Internet brokerage of 2022, with a high reputation。IB features securities trading services in up to 150 markets, covering more than 200 countries and regions, 23 currencies, tradable financial commodities including stocks, ETFs, options, futures, foreign exchange, bonds, indices, CFD, funds, etc., and provides Chinese interface and Chinese customer service support.。

Today's financial evaluation series is for you to open the box, the main evaluation of IBKR PRO account, the evaluation content includes:

◇ Advantages of Interactive Brokers

◇ Disadvantages of Interactive Brokers

◇ Interactive Brokers trading commissions and other fees

◇ Interactive Brokers account security

Who is Interactive Brokers for??

Interactive Brokers background

Interactive Brokers is one of the world's largest securities service providers and its Singapore subsidiary, Interactive Brokers Singapore Pte..Ltd is known for its low cost and high efficiency, providing investors with the lowest commissions in the market, enabling investors to obtain the maximum return on investment at the lowest cost。

In 1977, Thomas Peterffy, founder and chairman of the Interactive Brokers Group, bought a seat on the American Stock Exchange (AMEX) and became a member, starting trading stock options.。In 1993, Interactive Brokers was founded.。In 2007, Interactive Brokers LLC was listed on the Nasdaq Exchange (NASDAQ: IBKR) and is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).。

The core competitive advantage of Interactive Brokers is its securities trading services covering up to 135 markets, covering 33 countries and territories, including the United States, Taiwan, the United Kingdom, Hong Kong, Singapore, Japan, Australia, India and other European countries, and supporting 23 currencies.。Users can trade a variety of financial commodities including stocks, ETFs, options, futures, foreign exchange, bonds, indices, contracts for difference (CFD), funds, etc. with only one investment account.。

In addition, Interactive Brokers officially opened cryptocurrency trading in September 2021, and users can trade Bitcoin (Bitcoin), Ethereum (Ethereum), Litecoin (Litecoin) and Bitcoin Cash (Bitcoin Cash) on the platform.。

Its trading platform Trader Workstation (TWS) is rich in features, providing in-depth analysis, custom investment strategies and other functions to meet the different needs of novice to professional active traders.。

The following is a brief summary of the highlights of Interactive Brokers:

| Year of Establishment | Founded in 1993 and listed on the Nasdaq Exchange in 2007 (NASDAQ: IBKR) |

| Trading platform | Client Portal Web Trader Workstation Desktop IBKR Mobile Mobile IBKR APIs |

| Account Type | Managed Account (Custodian Account) |

| tradable market | United States, Taiwan, Canada, Mexico, United Kingdom, Singapore, Hong Kong, Australia, Japan, India, Germany, France, Sweden, etc |

| Investment products | Stocks, ETFs, Options, Futures, Forex, Bonds, Indices, CFD, Funds |

| Cryptocurrency | Bitcoin, Ether, Litecoin, and Bitcoin Cash |

| Minimum account opening threshold | 0 USD |

| U.S. Stock Commission | IBKR Lite: Zero Commission IBKR Pro: 0.$005 / share, minimum $1 per trade, maximum 1% * trade value |

| US Stock Option Commission | IBKR Lite and IBKR Pro: 0.$65 / contract, minimum $1 per transaction |

| Access mode | Wire Transfer, Direct ACH, Checks, Online Bill Payment |

| Minimum amount of deposit and withdrawal | None |

| Access fee | Brokers do not charge fees, remittance banks and transit banks impose fees |

| Account idle fee | |

| Inactivity Fee | None * Cancelled from 1 July 2021 |

IBKR LITE vs. IBKR PRO

Interactive Brokers has two commission fee schemes: IBKR LITE and IBKR PRO。

● The IBKR LITE account is a lite version of IBKR, launched in 2019, targeting average investors, novice investors, and investors who don't care about the best order price。LITE users are able to trade U.S. stocks and ETFs with zero commissions, no account minimum requirements and account idle fees, high interest rates on idle cash in their accounts, and free access to U.S. exchange-listed stock data。

For the time being, however, IBKR LITE is only open to retail investors in the US and India.。Malaysia, Singapore, Taiwan and other countries and regions users can only use IBKR PRO account (IBKR Professional Edition)。

● IBKR PRO account is a professional version of IBKR, in order to be different from IBKR LITE and add the "PRO" name, the target customers are senior and professional investors, PRO users can enjoy Interactive Brokers Smart Routing order intelligent delivery technology, in order to get the best price to execute orders, maximize the return on investment。

IBKR PRO trades US stocks and ETFs with a commission of 0 per share.$005, minimum $1 per transaction。For small orders (within hundreds of shares), IBKR PRO's commission rate is attractive, but if the number of shares traded is high, commissions can be a significant cost。

Interactive Brokers Benefits

Brokers are large and prestigious

Interactive Brokers is the world's largest and number one securities service provider, founded in 1993 and has a history of 29 years.。Interactive Brokers was named the best Internet broker by Barron's for the fourth year in a row, and also won by Investopedia, StockBrokers.com, BrokerChooser ranked first as the best Internet brokerage of 2022, with a reputation for。

In addition, Interactive Brokers is the first broker of many brokerages around the world, such as Rakuten Trade's U.S. stock trading is connected to Interactive Brokers, by Rakuten Trade will transfer your order to Interactive Brokers to place an order.。

Therefore, the use of Interactive Brokers is very safe and reliable, and there is no need to worry about the risk of security or brokerage failure.。

Open an account on the whole line is quick and convenient, there is no minimum threshold for opening an account

Nowadays, opening an account on the whole line has almost become the standard of brokerage firms, Interactive Brokers can also register and open an account online, there is no cost to open an account, and there is no minimum deposit threshold for opening an account.。When opening an account, users can use the Chinese interface to fill in the information, there are simplified Chinese and traditional Chinese options, any questions can also be asked at any time Chinese customer service。

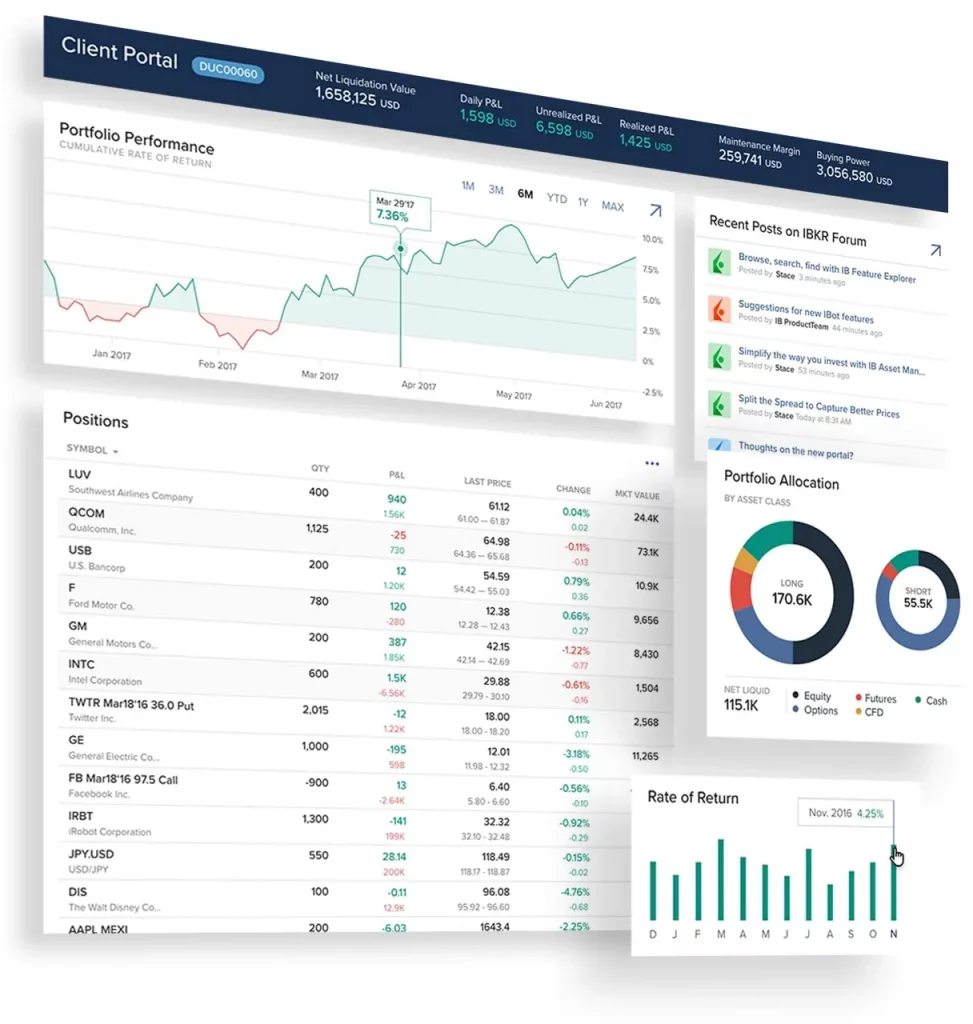

After opening an account successfully, you can choose to use Client Portal web version, Trader Workstation desktop version, IBKR Mobile mobile version, IBKR APIs to perform account management, trading transactions, access to gold, query market quotes, investment analysis, etc.。

The author measured the account opening process, the overall fast and smooth, need to fill in the information is not complicated, about 3 to 5 minutes to complete the account filling information, upload identification documents, a working day to pass the audit, complete the account opening。

If you want to experience the platform before officially opening an account, you can apply for Interactive Brokers' free trial Free Trial Account with a free $100,000 virtual account.。After using it, I feel comfortable, from Free Trial to real account (Live Account) is also very convenient, login Interactive Brokers account can apply.。

Can participate in trading 150 capital markets and investment products around the world (Taiwan shares can be traded from July 2023!)

Interactive Brokers features a single account trading globally, allowing users to trade in up to 150 markets, covering more than 200 countries and territories, such as the United States, Taiwan, Canada, Mexico, the United Kingdom, Singapore, Hong Kong, Australia, Japan, India, Germany, France, Sweden, etc., and support the use of 23 currencies。

Tradable financial commodities include stocks, ETFs, options, futures, foreign exchange, bonds, indices, CFD, funds, etc.。In addition, you can trade cryptocurrencies, including Bitcoin, Ether, Litecoin and Bitcoin Cash.。

Lowest-cost brokerage, U.S. stock commissions as low as 0 per share.005美元

Interactive Brokers has the reputation of "lowest cost brokerage," trading U.S. stocks and ETFs, IBKR Lite users enjoy zero commission;.$005, a minimum of $1 per transaction, and no platform fees, can be said to be one of the lowest-cost brokerages in the market (after TD Ameritrade and Firstrade), with a great price advantage.。

Interactive Brokers (IB) officially launched its Taiwan stock trading service in July 2023! If you want to trade both the Taiwan and U.S. stock markets in one account, consider opening an Interactive Brokers investment account.。

Advanced trading platform function, high degree of professionalism

Interactive Brokers' trading platform is rich and comprehensive, providing in-depth analysis, custom investment strategies and other functions to meet the needs of novice to professional active traders, and is quite famous in the industry.。

Users can choose to access the Interactive Brokers trading platform through Client Portal web, Trader Workstation (TWS) desktop, IBKR Mobile mobile, IBKR APIs。

Client Portal web version: a relatively simple web version of the trading platform, suitable for beginners, novice investors to use, can query the real-time quotes of investment targets, financial information, trading, portfolio management, in different timelines to develop charts, the use of stock filters, reading the latest market news, financial calendar, analyst research reports, etc.。

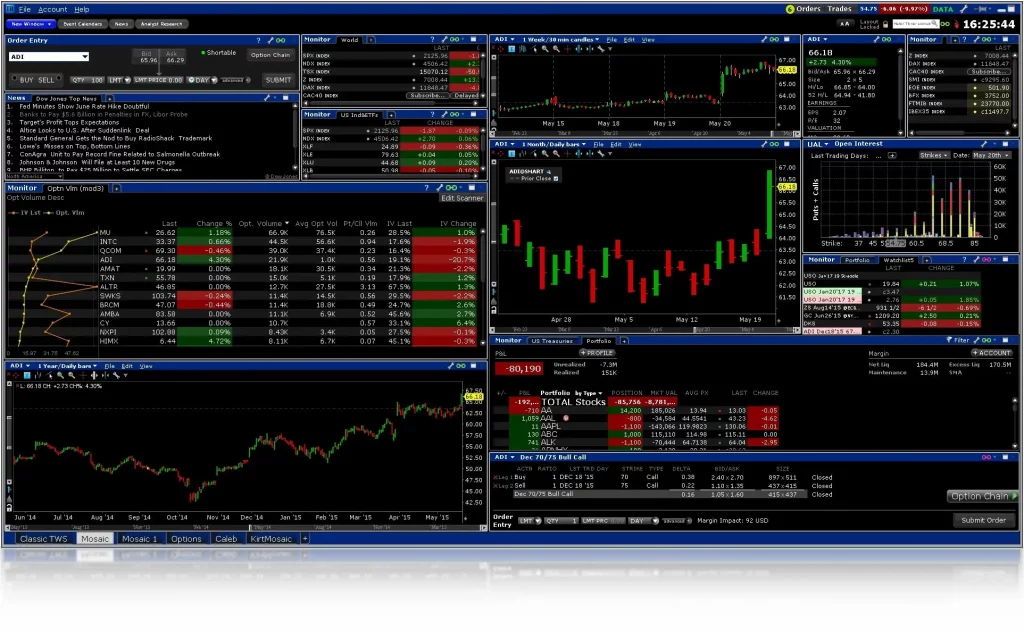

● Trader Workstation (TWS) Desktop Edition: TWS is Interactive Brokers' flagship trading platform, rated as the best trading platform, providing a variety of advanced trading tools and analysis functions, designed for active traders who need to trade a variety of products and have high requirements for functionality and flexibility.

More than 100 orders and algorithms

◇ Customize the access interface through TWS Mosaic (TWS Rubik's Cube) (trading, managing orders, using charts, watch lists, technical analysis, etc.)

◇ Get it from Reuters, Dow Jones, flyonthewall.Real-time news of com etc

◇ Read analyst reports such as Morningstar and Zacks

◇ Risk management tools: IB Risk Navigatorsm, Options Analytics, Advanced Options Analytics, Model Navigator

◇ Advanced trading and analysis tools: Options Strategy Lab, Volatility Lab, FXTrader, Social Market Analytics, "SpreadTrader, OptionTrader, Market Scanners, Advanced Fixed Income Scanner, Strategy Builder, Portfolio Builder, and more

Support trading zero shares Fractional Share

Interactive Brokers is one of the few brokerages that offers fractional trading of U.S. stocks, allowing users to trade fractional shares (Fractional Share), which is less than one share (or the minimum trading unit threshold), also known as zero-share trading.。For example, the user can buy 0.1 share of Tesla, 0.3 shares of Microsoft。Zero-share trading increases portfolio diversity and is particularly suitable for small-capital investors, who do not need to invest large sums of money at once and can also participate in trading stocks with strong fundamentals but relatively high share prices (e.g. blue chips).。

Interactive Brokers Disadvantages

Trading platform interface is relatively complex

Trader Workstation (TWS) desktop version of the collection of a variety of investment products and functions, so the trading interface is relatively complex, novice learning costs are relatively high, the first use may not know where to start, need to spend a lot of time to explore and run-in, but as long as the problem is not big after getting started.。

Novice investors may consider starting with the relatively simple Client Portal web version, executing order trades, and then taking the time to learn to use the TWS desktop version.。

Online customer service response is slow

Interactive Brokers has Chinese customer service, but online customer service is slow to respond and requires some patience。

Non-zero commission trading

Here mainly for IBKR Pro accounts, although commissions as low as 0 per share.$005, a minimum of $1 per transaction, remains an investment cost that cannot be ignored。If investors are looking for zero commission trading, consider another veteran U.S. brokerage, TD Ameritrade。

Is it safe and legal to invest with Interactive Brokers??

Investing with Interactive Brokers is safe and legal。Interactive Brokers is a public company in the United States, with subsidiaries in Canada, the United Kingdom, Australia, Hong Kong, Singapore, Japan, India and other countries, has obtained a capital market operating license in that country, is legally regulated, and strictly abides by the regulatory laws of that country.。In addition, Interactive Brokers enforces a strict asset segregation policy that separates the assets of users and brokerages.。

Interactive Brokers LLC is regulated by the U.S. Securities and Exchange Commission (SEC) and the U.S. Financial Industry Administration (FINRA) and is a member of the U.S. Securities and Investment Protection Corporation (SIPC).。SIPC offers users a maximum guarantee of up to $500,000, including $250,000 in cash.。

Interactive Brokers U.K.Limited is regulated and authorised by the Financial Conduct Authority (FCA) under registration number 208159;

Interactive Brokers Australia Pty.Ltd.regulated by the Australian Securities and Investments Commission (ASIC), registration number AFSL: 453554;

Interactive Brokers Hong Kong Limited is regulated by the SFC;

Interactive Brokers Singapore Pte.Ltd.regulated by the Monetary Authority of Singapore (MAS), registration number CMS100917;

How to open an account with Interactive Brokers?

Interactive Brokers can apply for opening an account on the whole line, free of charge, about 3 to 5 minutes to complete, about 1 working day will receive the approved email。

What are commissions and fees for Interactive Brokers accounts??

Transaction fees for Interactive Brokers IBKR Pro accounts are based on commissions (commissions), with the elimination of account idle fees and account minimum funding requirements from July 1, 2021。There is no platform fee and no dividend fee.。

In terms of commission fees for stocks, ETFs and warrants (warrants), Interactive Brokers has two options: tiered, fixed fixed。Users can choose which charging method to use according to their needs.。

● Tiered rate Tiered: the higher the trading volume, the lower the commission per share, plus exchange, regulatory and clearing fees charged at the exchange's request.。If the exchange offers rebates, Interactive Brokers will return some or all of the rebates to the user。

● Fixed rate Fixed: a fixed rate per share, or a fixed percentage of the total transaction value.。

Commission Ladder Rate Tiered

The following are commission charges for U.S. market stocks, ETFs and warrants。

| Monthly Trading Volume | Commission | Minimum commission (per order) | Maximum commission (per order) |

| ≤ 300,000 shares | 0.0035 USD | 0.35美元 | 1% * transaction value |

| 300,001 - 3,000,000 shares | 0.002 USD | 0.35美元 | 1% * transaction value |

| 3,000,001 - 20,000,000 shares | 0.0015 USD | 0.35美元 | 1% * transaction value |

| 20,000,001 - 100,000,000 shares | 0.001 USD | 0.35美元 | 1% * transaction value |

| > 100,000,000 shares | 0.0005 USD | 0.35美元 | 1% * transaction value |

As for the commission aspect of Taiwan stock trading, Interactive Brokers is calculated as a step-by-step Tiered, as follows.

| Monthly Transaction Amount (NT $) | Commission | Minimum amount of a single transaction (NT $) |

| ≤ 50,000,000 | Transaction Amount * 0.08% | 80 |

| 50,000,000.01 – 1,000,000,000 | Transaction Amount * 0.06% | 60 |

| 1,000,000,000.01 – 3,000,000,000 | Transaction Amount * 0.05% | 30 |

| > 3,000,000,000 | Transaction Amount * 0.03% | 30 |

Commission Fixed Rate Fixed

The following are commission charges for U.S. market stocks, ETFs and warrants。

| Commission | Minimum commission (per order) | Maximum commission (per order) |

| 0.005美元 | 1 USD | 1% * transaction value |

Who is suitable for an Interactive Brokers account?

◇ Professional investors: Interactive Brokers provides a rich and diversified trading market and financial commodities, with a powerful trading platform and free real-time financial news and analysis research reports, which is very suitable for professional investors.。

Investors who want to participate in overseas markets: Interactive Brokers covers 150 trading markets, including major markets around the world, and is suitable for investors who want to participate in overseas markets.。

◇ Novice Investors: Even for novice investors, Interactive Brokers is an option worth considering。Client Portal web version is relatively simple and easy to use, which solves the problem of complex interface and function of TWS desktop version。In addition, users can trade fractional shares at Interactive Brokers, and small funds can participate in trading the U.S. stock market.。

Overall, Interactive Brokers offers a wide range of options for both professional and novice investors to find the right tools and resources on its platform。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.