Tracker Securities (IB) deposit teaching: How Tracker Securities deposits in Malaysia?

This article introduces Interactive Brokers2's teaching of the complete process of deposit, bank wire transfers and cheaper ways to deposit funds through Wise and Bank of Singapore, deposit fees and considerations to help you easily invest in U.S. stocks.。

After opening an account with Interactive Brokers, users first need to remit real funds to an investment account in order to trade in the U.S., U.K., Singapore, Hong Kong and other trading markets.。

Today's article will introduce Interactive Brokers's two main methods of deposit, with a multi-graphic detailed record of deposit steps, deposit fees and precautions, and a full network of online operations.。Content includes:

* Detailed description of Interactive Brokers deposit methods and fees

* Interactive Brokers deposit teaching (I): domestic bank wire transfer

* Interactive Brokers deposit teaching (II): Wise + Singapore Bank remit funds

How to get to Interactive Brokers?

Interactive Brokers currently has the following five main methods of deposit, but some currencies can only support some of the deposit methods depending on the user's region and the currency of deposit.。

Interactive Brokers main deposit method:

1.Bank Wire Transfer (Bank Wire)

2.Direct ACH

3.Connect Bank via ACH

4.Online Bill Pay

5.Check (Mail a Check)

Supported user transfer currencies include US dollar, Singapore dollar, Hong Kong dollar, Australian dollar, euro, RMB, Japanese yen, etc.。

Interactive Brokers does not charge any fees when users remit money, but fees may be charged by the remitting bank used by the user and the receiving bank of Interactive Brokers.。Fees vary depending on the currency of arrival and are subject to the bank's actual charges.。

Which method of deposit to choose?

Generally, most countries and regions of the Interactive Brokers users will be bank wire transfer (Bank Wire) deposit, wire transfer fees are relatively expensive。

If you are a Malaysian user with a Singapore bank account, you will recommend a combination of Wise and Bank of Singapore remittances: first send money through Wise to your personal bank account in Singapore, Wise uses the medium-market rate (Mid-Market Rate) to process international remittances, so the exchange rate is lower than the bank.。

Then in Singapore dollars (SGD) into Interactive Brokers, to the account of Singapore dollars, IB and the bank are not charged, here can save a bank fee.。When the funds arrive, you can use the IB's built-in currency exchange function to convert the Singapore dollar into U.S. dollars (USD) and start buying U.S. stocks.。This is the relatively most cost-effective way to invest money with Interactive Brokers。

Interactive BrokersNotes on deposit

1. You can deposit money only after you have successfully opened an account.。

2. Interactive Brokers has no minimum or maximum deposit.。

3. Interactive Brokers does not charge any fees at the time of deposit, but remittance banks and transit banks will charge international wire transfer fees.。

4. In order to prevent money laundering activities, Interactive Brokers only accepts bank accounts with the same name as IB accounts to initiate deposits, and does not accept bank accounts of third parties.。

Interactive Brokersdeposit process teaching

Next, we'll detail two ways to gold Interactive Brokers in a multi-graphic format:

1, bank international wire transfer (TT) deposit (in Malaysia Maybank description)

2, Wise wire transfer and Singapore bank deposit.

Today's teaching will be conducted on the Client Portal, the official website of Interactive Brokers. The deposit process takes about 10 minutes. The whole network works online. It is recommended to deposit the deposit when there is a stable network.。You can switch to Traditional, Simplified Chinese or other languages at any time。

Bank international wire transfer (TT) deposit process (described in Maybank, Malaysia)

Applicable object: have a Malaysian bank account

Handling fee: The handling fee for Interactive Brokers is $0, which is charged by the remitting bank and the receiving bank.

Arrival time: 1 to 3 working days

Currency of arrival: US Dollar (USD)

Bank wire transfer (Telegraphic Transfer, T / T) is the most common way of cross-border remittance deposit, you can go to any local bank counter, or your own home online banking (online banking) processing.。

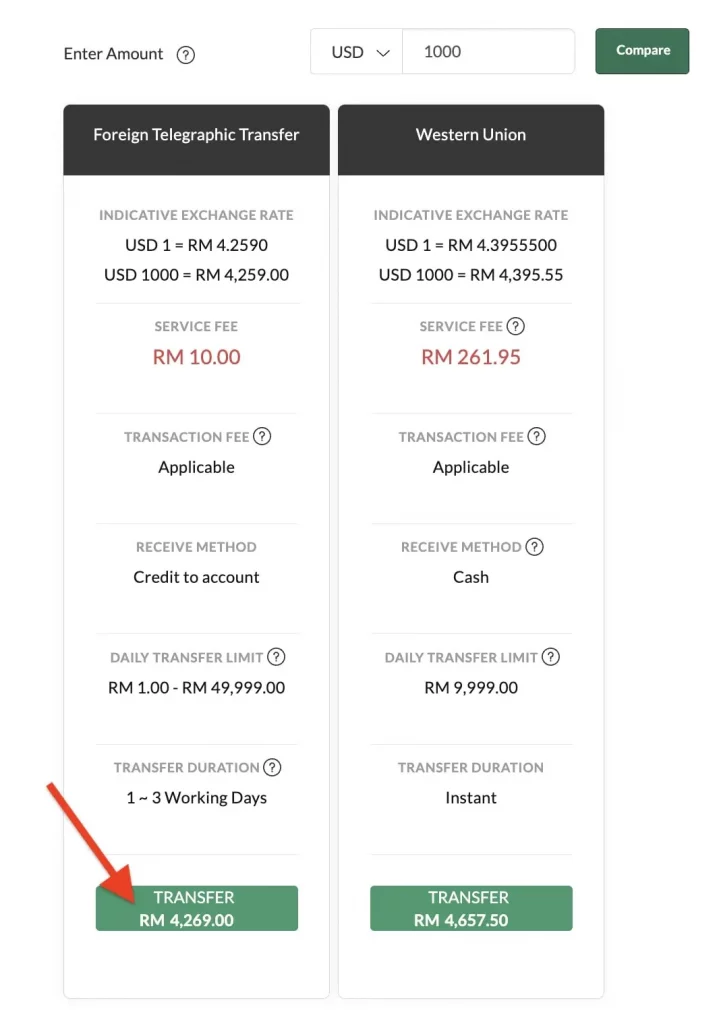

Telegraphic transfers require payment of wire transfer fees from local remittance banks, China Transfer Banks, and overseas receiving banks, such as Service Fee and Cable charges.。For example, Maybank charges a service fee of RM10 (online banking wire transfer) for each wire transfer.。If the counter for wire transfer, need to pay the postage RM30。Different banks charge different fees, it is recommended to check with the bank before wire transfer。

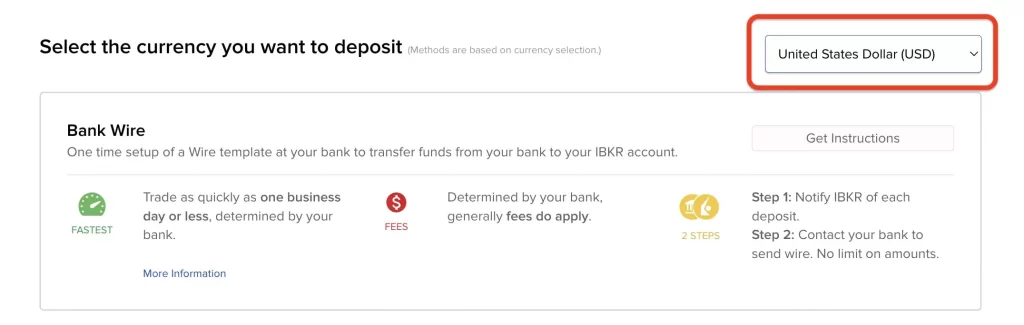

Step 1: Log in to your IB account and select the currency to be credited (USD)

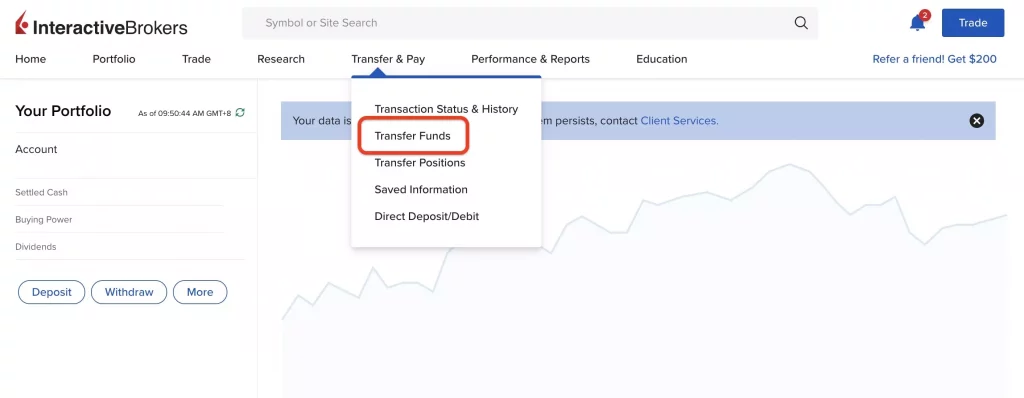

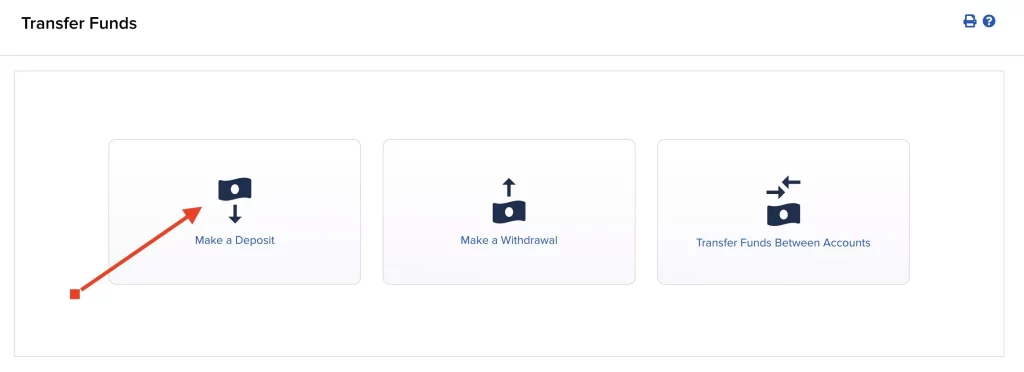

Step 1: Log in to the Interactive Brokers website Client Portal > Click Transfer & Pay > Transfer Fund > Make a Deposit, then select the currency you want to deposit。

Supported user transfer currencies include US dollar, Singapore dollar, Hong Kong dollar, Australian dollar, euro, RMB, Japanese yen, etc.。

Here we choose "United States Dollar (USD)"。

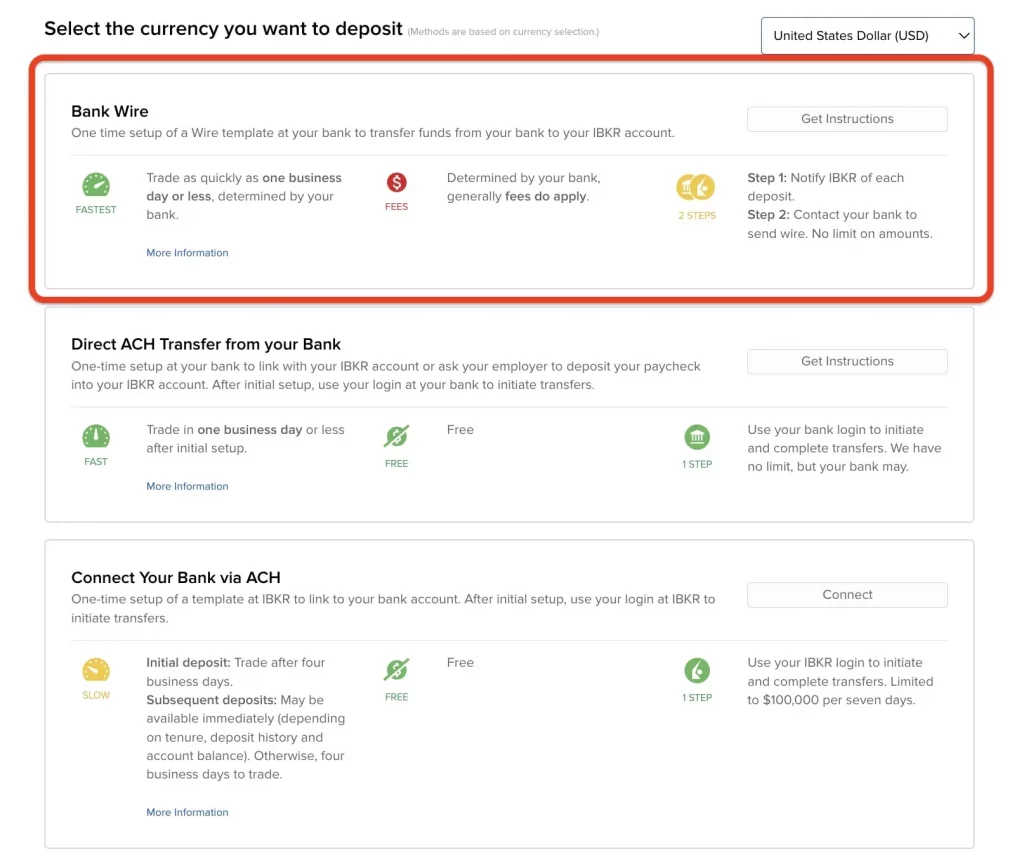

Step 2: Choose a deposit method - Bank Wire

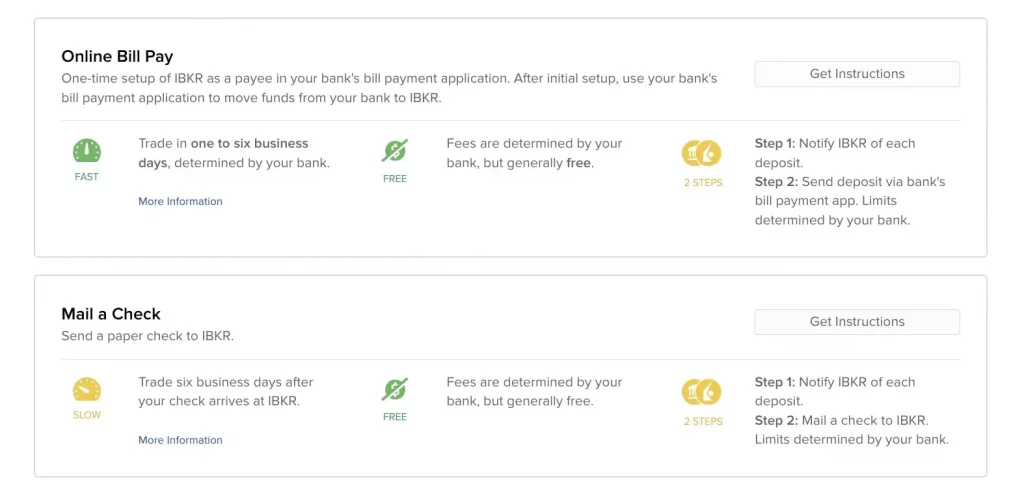

Transfer to USD with 5 deposit options: Bank Wire, Direct ACH, Connect Your Bank via ACH, Online Bill Pay and Check Mail a Check。

Here we select "Bank Wire" and click "Get Instructions" to go to the next page。

Step 3: Obtain Bank Wire Transfer Information

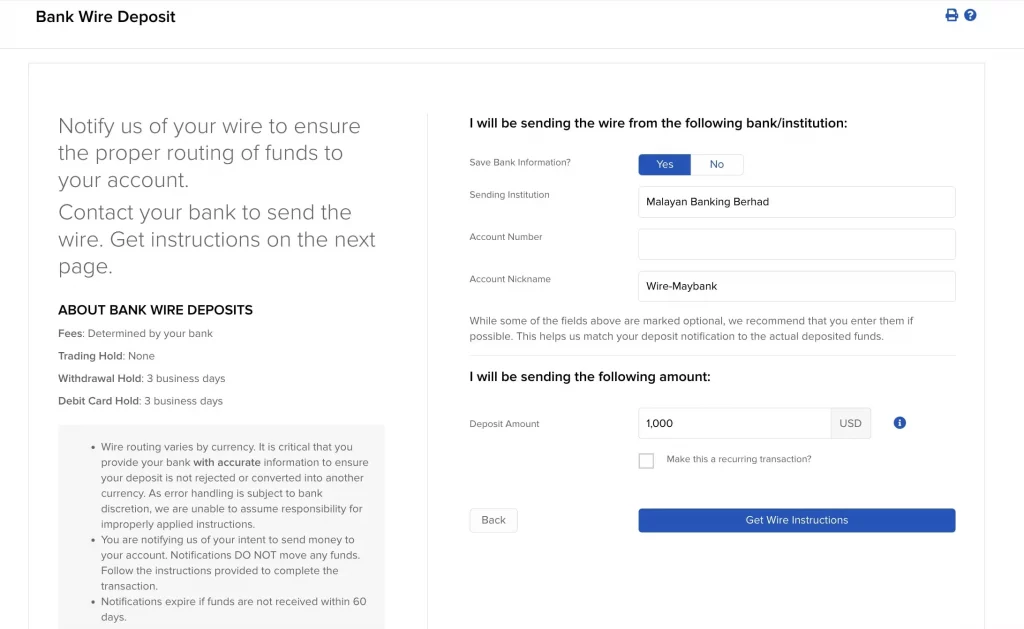

On the Bank Wire Deposit page, fill in the bank information used for this wire transfer:

Sending Institution: Name of the remittance bank, such as Malayan Banking Berhad, Public Bank, Hong Leong Bank

Account Number: Your bank account number

Account Nickname: Enter any reference information

Deposit Amount (USD): Deposit Amount (USD)

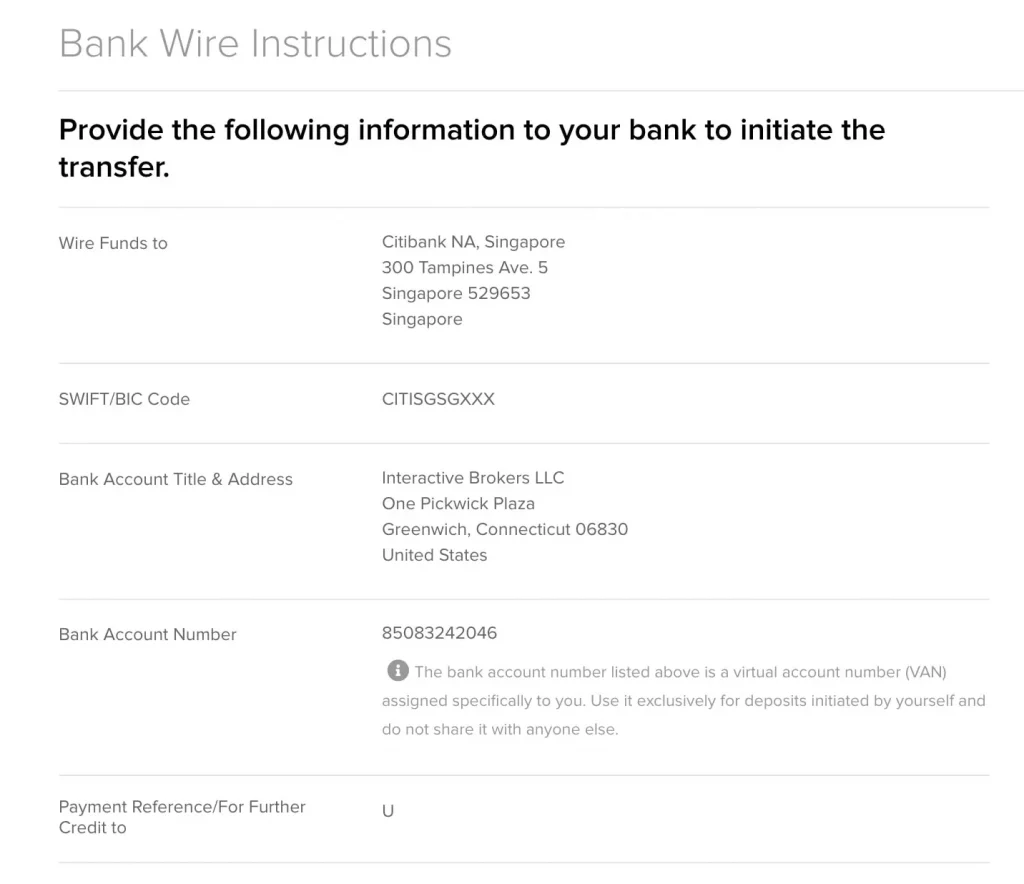

Then click "Get Wire Instructions" to get the receiving bank information for Interactive Brokers。

* The wire transfer fee is calculated on a per-view basis and will not be adjusted according to the size of the wire transfer amount. The charges for wire transfer of US $1,000 and US $30,000 are the same。Therefore, it is recommended that you wire a higher amount to avoid multiple small deposits and drive up investment costs.。

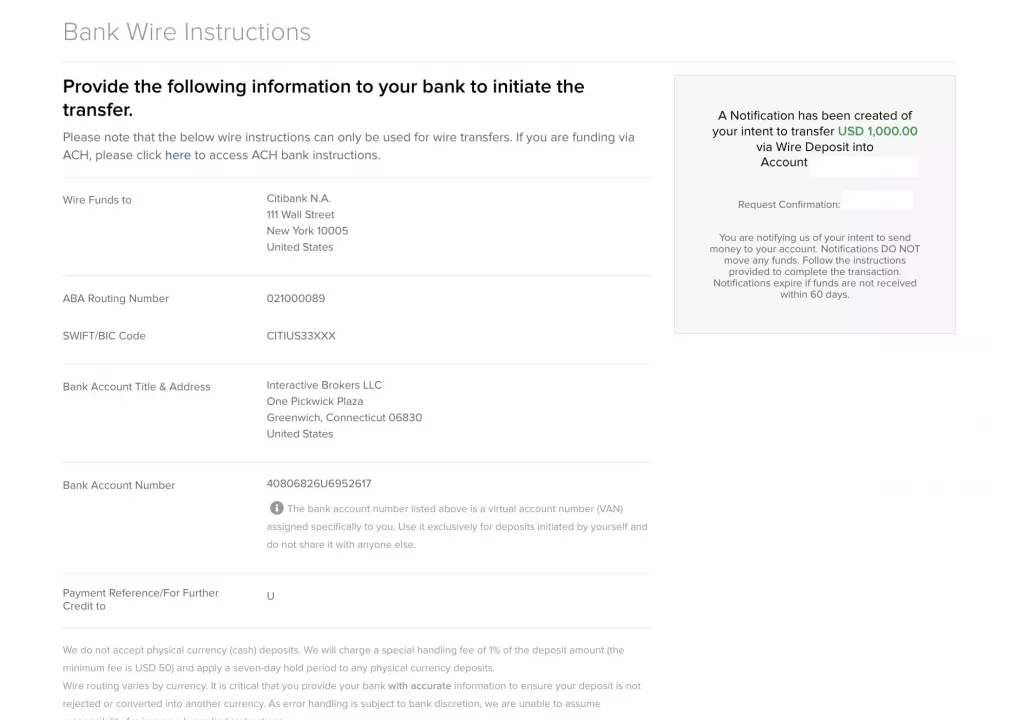

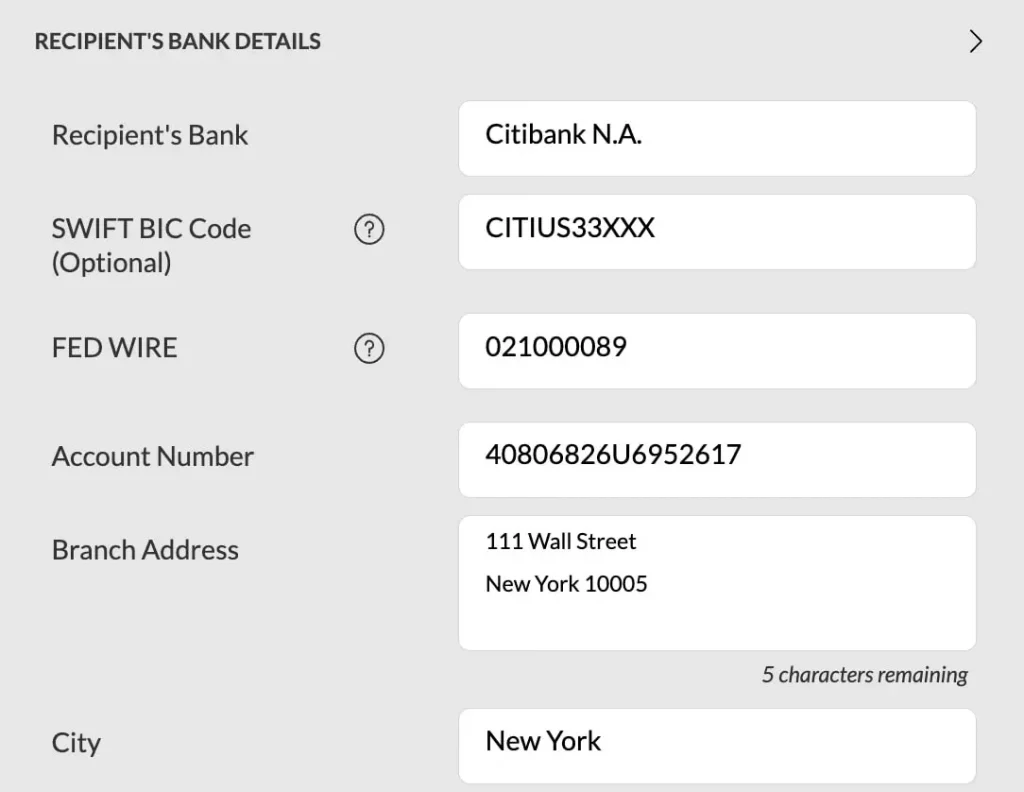

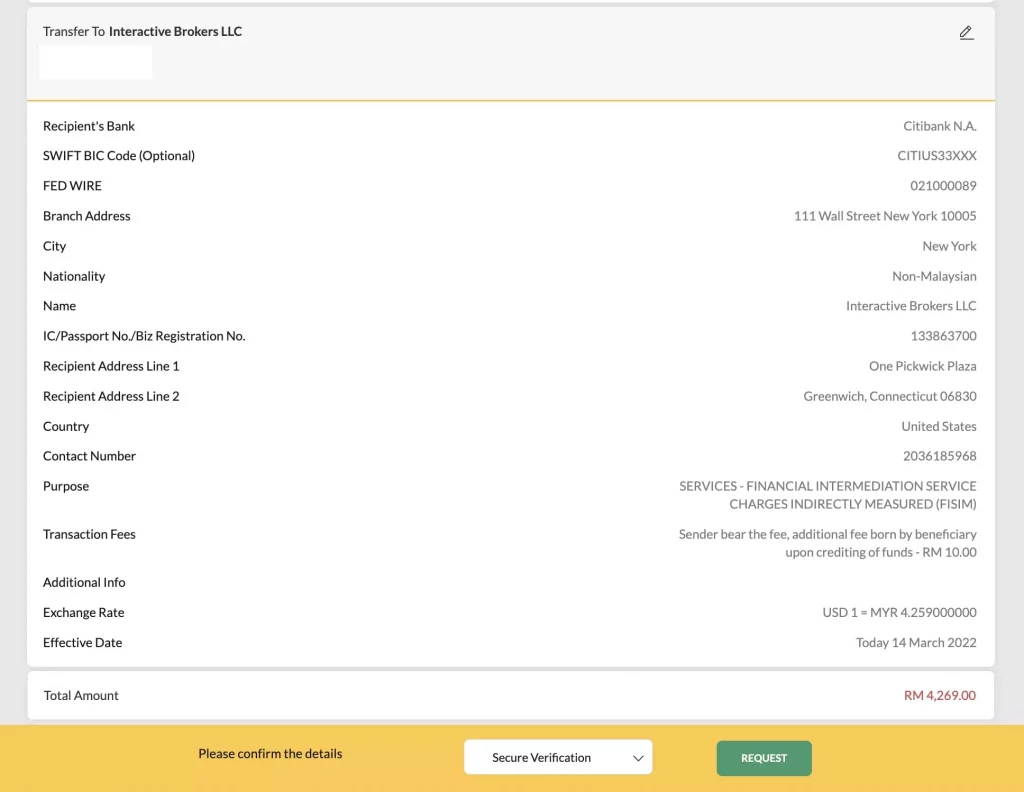

The system displays detailed bank wire transfer information, including the recipient bank, ABA Routing Number, SWIFT / BIC Code, payee name, address, and bank account number, and Payment Reference。

The receiving bank is Citibank of the United States.。* * The receiving bank may change, please refer to the bank wire transfer information displayed in your Interactive Brokers account

* Payment Reference (remittance postscript) is an important basis for brokers to distinguish and reconcile the source of funds, so be sure to fill in。

These are the information that needs to be filled in when making a remittance, and it is recommended that you keep this page closed until the bank wire transfer is completed; or write down the remittance information so that it can be filled in when making a remittance.。

Step 4: Start Bank Wire Transfer

The next step is to make a wire transfer, which can be done using online banking or at the bank's counter (ATM Machine).。We will demonstrate the wire transfer process using Maybank Online Banking。Other banks have similar wire transfer processes.。

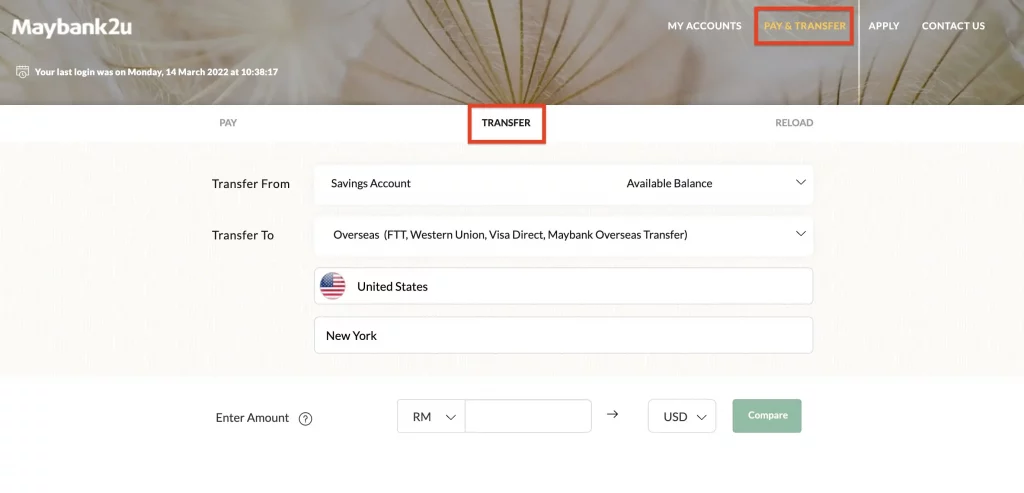

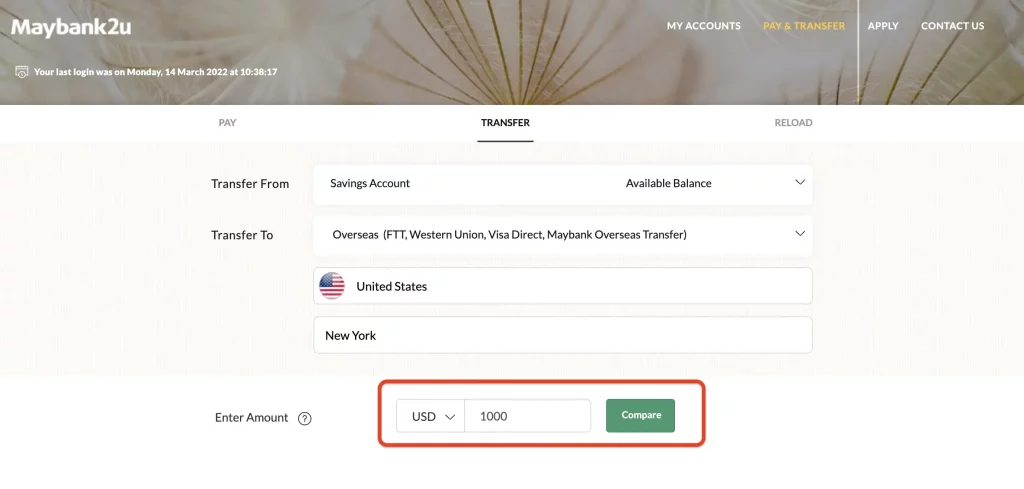

Log in to Maybank Online Banking > Click Pay & Transfer > Transfer > Transfer to: Overseas (FTT, Western Union, Visa Direct) > United States > New York

Then enter the wire transfer amount (Amount)。The bank offers 2 currency options: remit the specified amount in ringgit or receive the specified amount in a foreign currency.。Select USD here and enter the amount of USD to the account。

Click on "Compare"。Maybank offers two wire transfer channels, Foreign Telegraphic Transfer and Western Union.。Here we choose Foreign Telegraphic Transfer。Click "Transfer" at the bottom to continue to the next step。

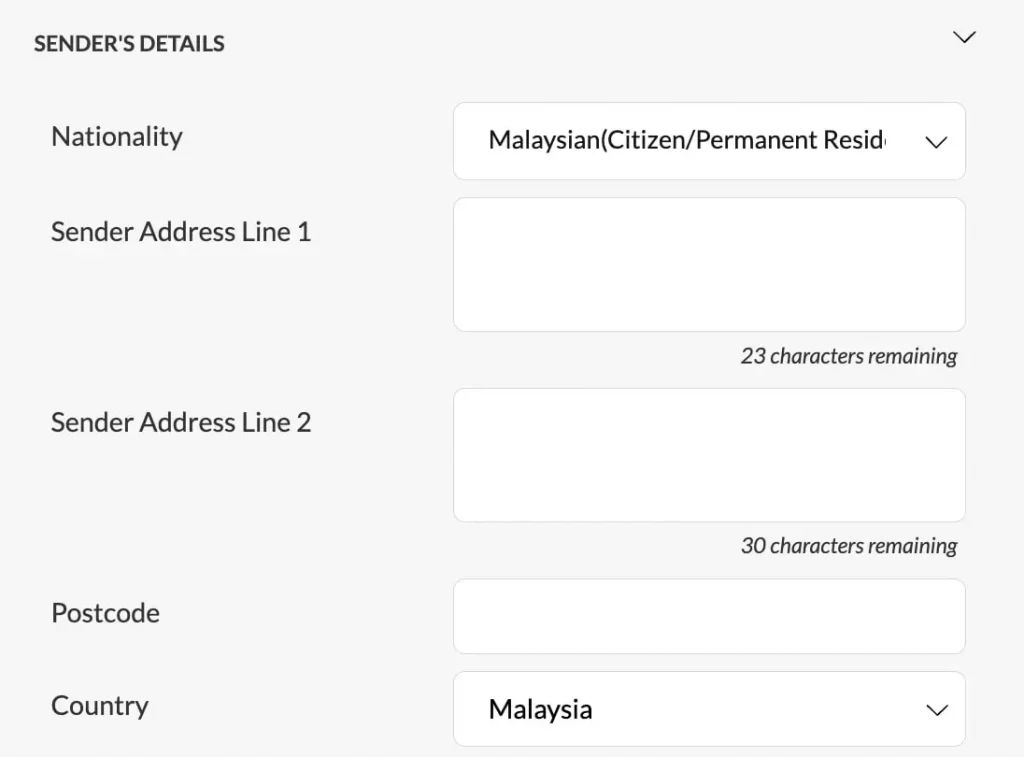

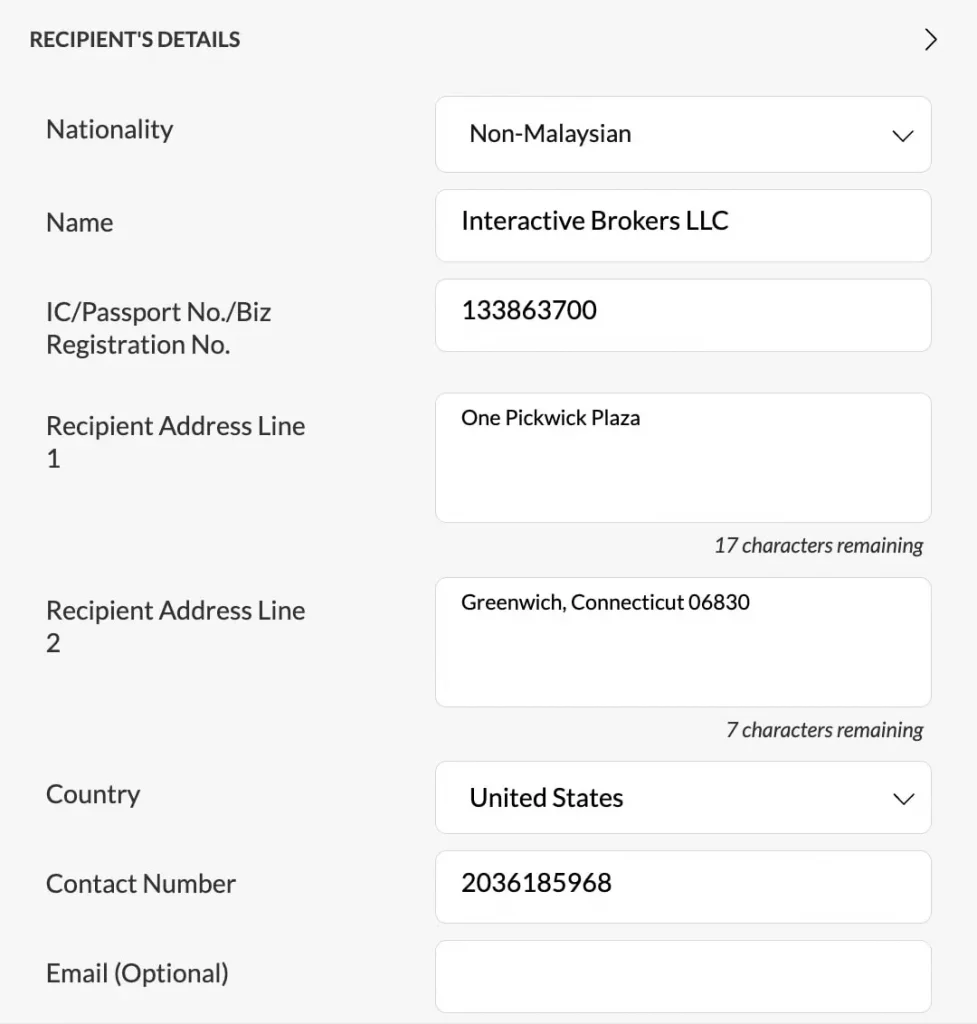

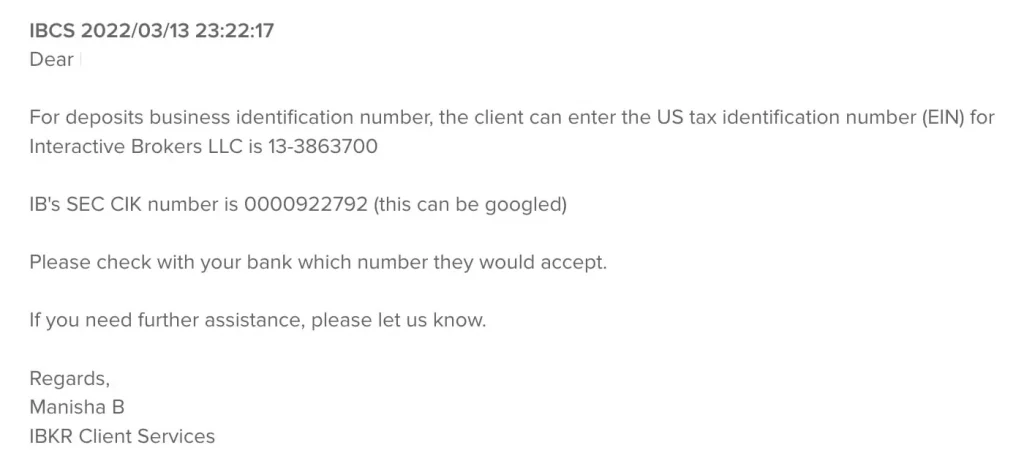

Enter Personal Information (Sender's Details), Recipient's Bank Details, Recipient's Details。

Receiving bank information and payee information are filled in according to the wire transfer information just displayed by Interactive Brokers。

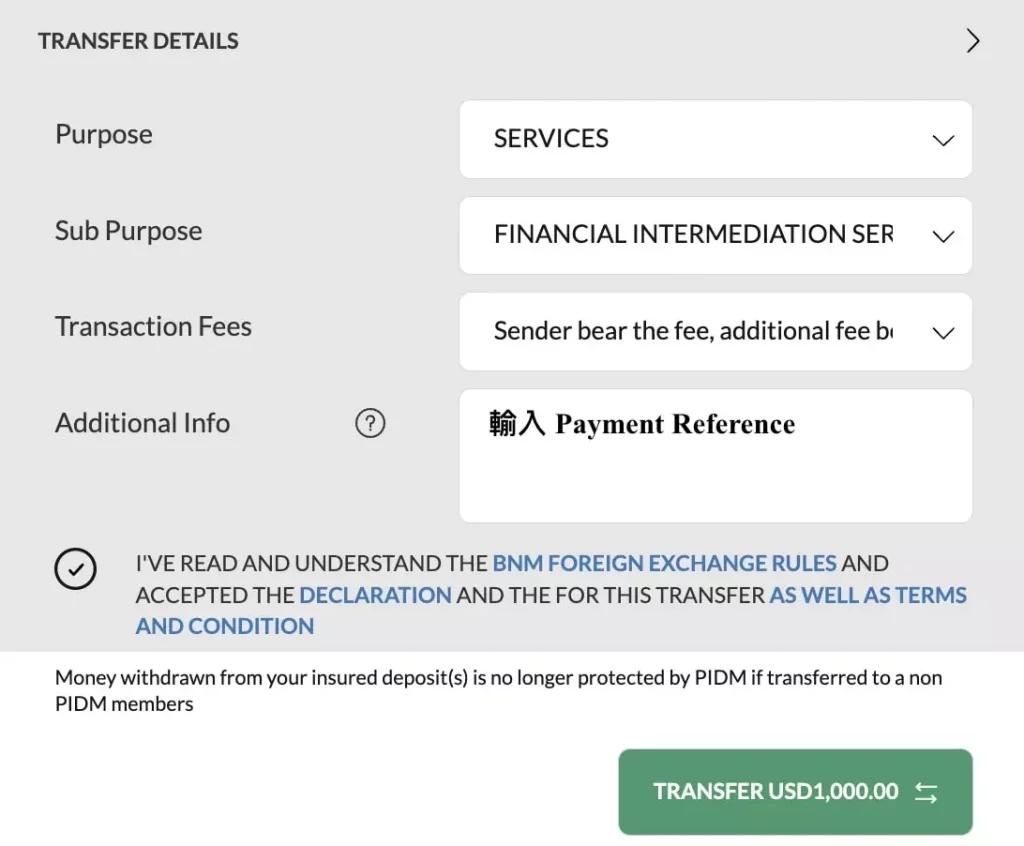

Then enter the wire transfer details:

Purpose: the purpose of this wire transfer, here we choose Services

Sub Purpose: Select Financial Intervention Service Charges

Transaction Fees: Select Sender bear the fee, meaning that we are responsible for all costs of this wire transfer ourselves

Additional Info: Enter the Payment Reference provided by Interactive Brokers, usually your account number + full English name, such as U1234567 / your name

To agree to the Rules and Conditions, click Transfer to continue to the next step.。

Check all remittance information, after confirming that it is correct, click Request SMS TAC, enter the six-digit TAC verification code, click Confirm, and the wire transfer is completed。

Remember to take a screenshot or download this remittance voucher (Receipt) as proof of deposit。

Step 5: Successful wire transfer to the account and completion of the deposit

It usually takes 1 to 3 working days for wire transfer transfer to arrive at the account.。If you have not been notified for more than 3 working days, it is recommended to contact Interactive Brokers customer service as soon as possible。

What is the cost of wire transfer??

This wire transfer costs a total of 2:

* Local bank service fee (Service Fee) and postage (Cable charges)

* Receiving Bank Citibank Collection Fee (Wire Fee) $15

WiseWire transfer + Singapore bank deposit process (more money!)

◇ Applicable to: Wise account and Singapore bank account

◇ Handling fee: Interactive Brokers' handling fee is $0, Wise levies wire transfer fees

◇ Arrival time: It will be displayed when the deposit is made.

◇ Currency of arrival: New Dollar (SGD)

Using bank wire transfers, wire transfers are more expensive。If you are a Malaysian user and have any Singapore bank account, you will recommend a combination of Wise and Bank of Singapore remittances to your personal Singapore bank account through Wise, followed by a wire transfer from Bank of Singapore to Interactive Brokers to the Singapore dollar.。Finally, you can use Interactive Brokers' built-in currency exchange function to convert Singapore dollars into US dollars to start trading the US stock market.。

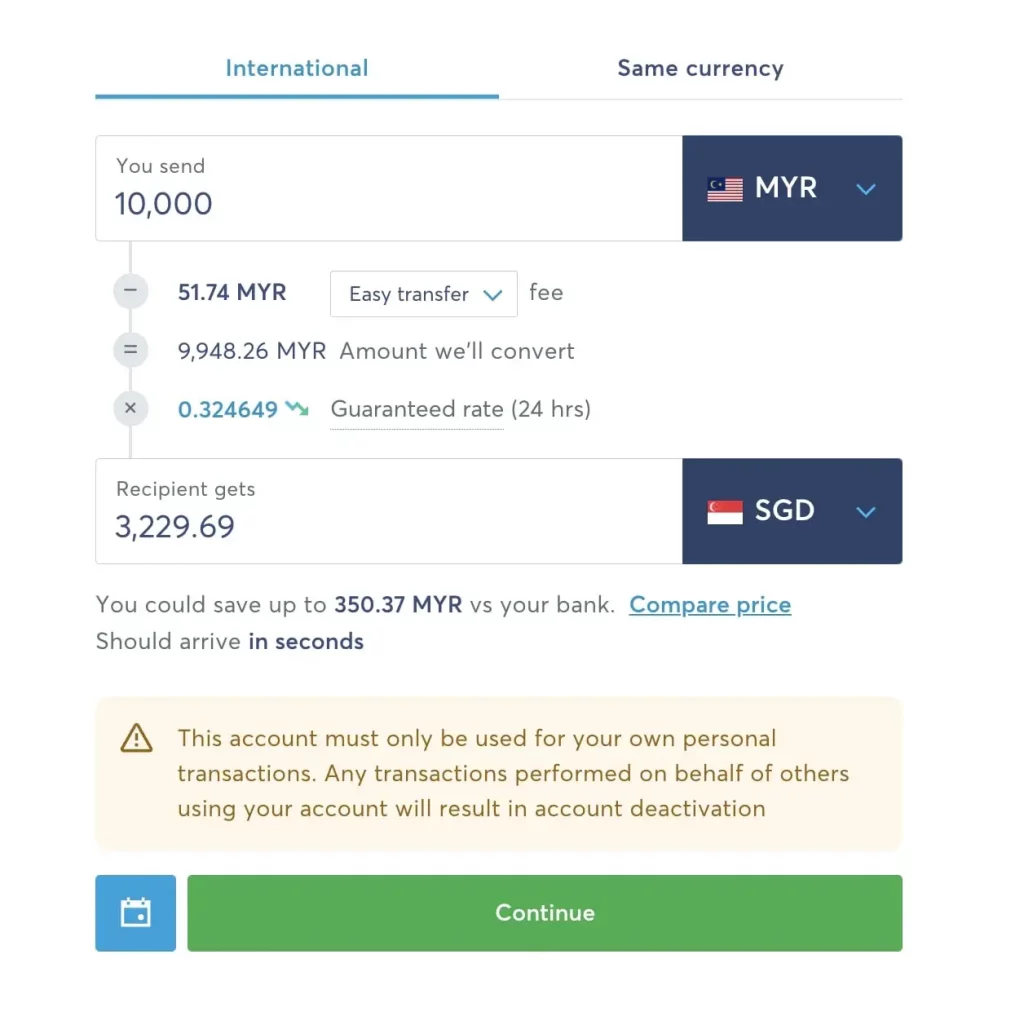

Step 1: Use Wise Transfer to send money to Bank of Singapore (Ringgit to SGD)

The steps to use Wise Transfer to send money to a Singapore bank are as follows:

1.Log in to Wise

2.Click Send Money to initiate remittance application

3.Enter remittance amount, currency (from Ringgit MYR to SGD)

4.Select a remittance method Easy Transfer > Personal transfer

5.Enter the bank account information of the remittance recipient, which is your Singapore bank account information.

6.Finally log into your Malaysia Online Banking (FPX) to make the transfer

7.Complete remittance from Wise to Personal Singapore Bank

8.Remittances usually arrive within a few minutes.

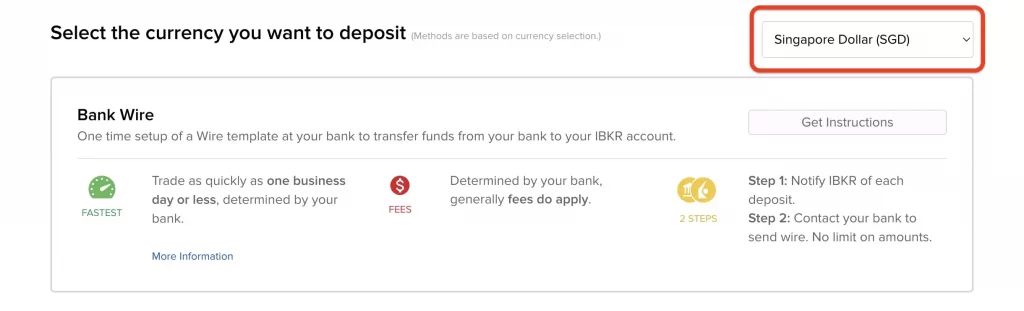

Step 2: Initiate a deposit application at Interactive Brokers (SGD to SGD)

After the funds arrive in the Singapore bank account, you will then need to initiate a deposit application at Interactive Brokers.。The steps are the same as for the previous telegraphic import to Ringgit:

1.Log on to the Interactive Brokers website Client Portal

2.Click Transfer & Pay > Transfer Fund > Make a Deposit

3.Select the currency you want to deposit: Singapore Dollar (SGD)

4.Deposit method: bank wire transfer Bank Wire

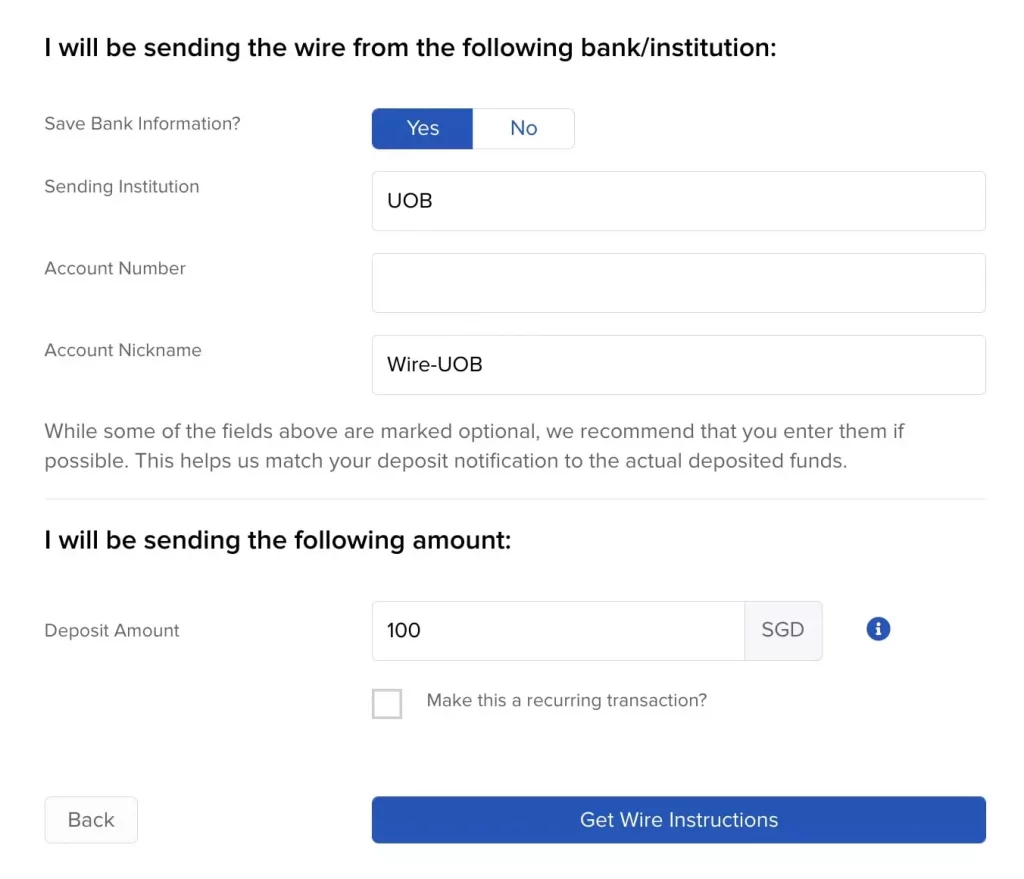

5.Fill in the bank information used for this wire transfer: your Singapore bank account information.

6.Enter deposit amount (S $)

7.Obtain the payee bank information of Interactive Brokers: The payee bank of SGD is Hongkong & Shanghai Banking Corp LTD, Singapore

Similarly, the receiving bank may change, please refer to the bank wire transfer information displayed in your Interactive Brokers account。

Step 3: Send money from Singapore Bank to Interactive Brokers (SGD to SGD)

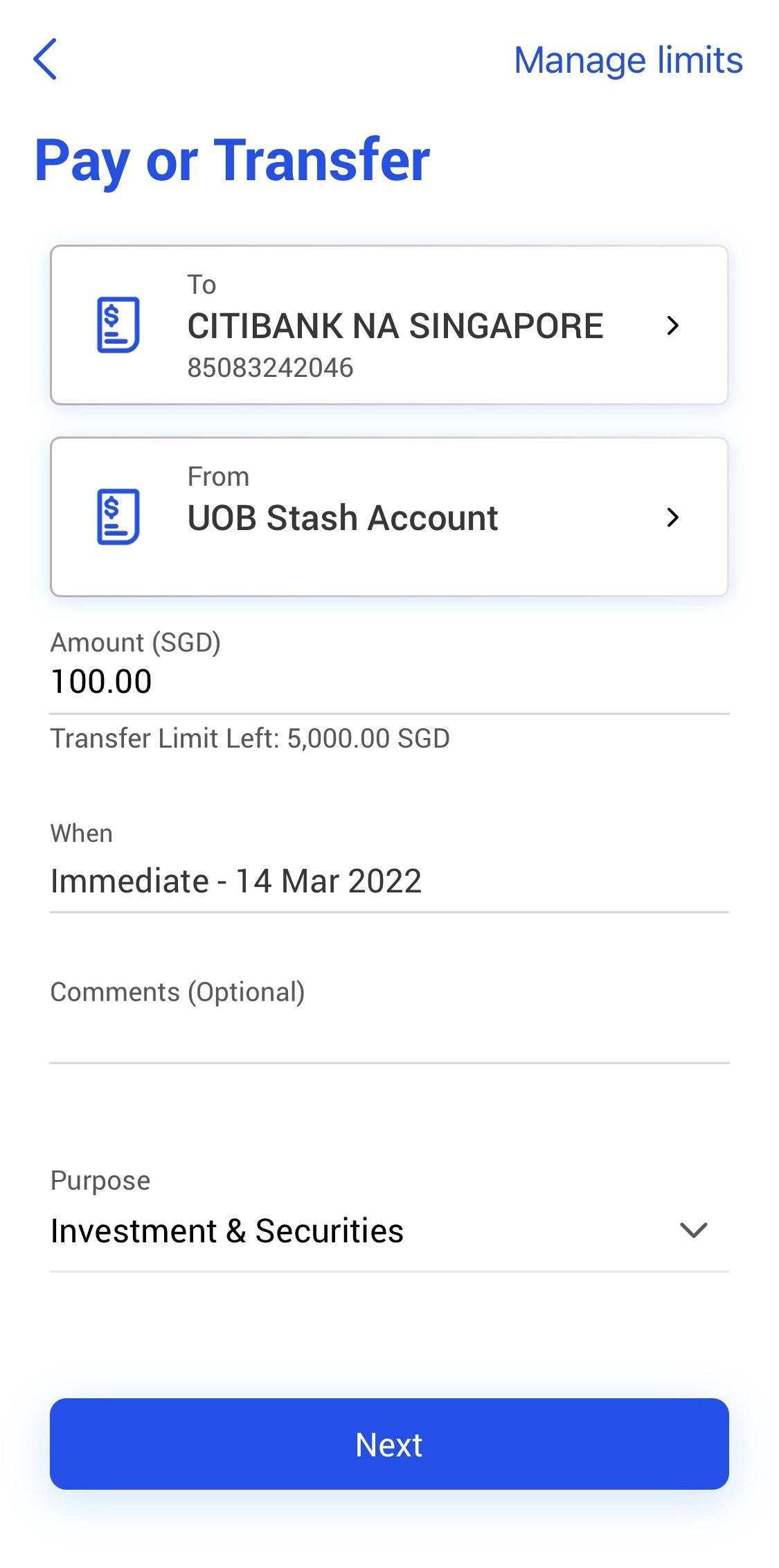

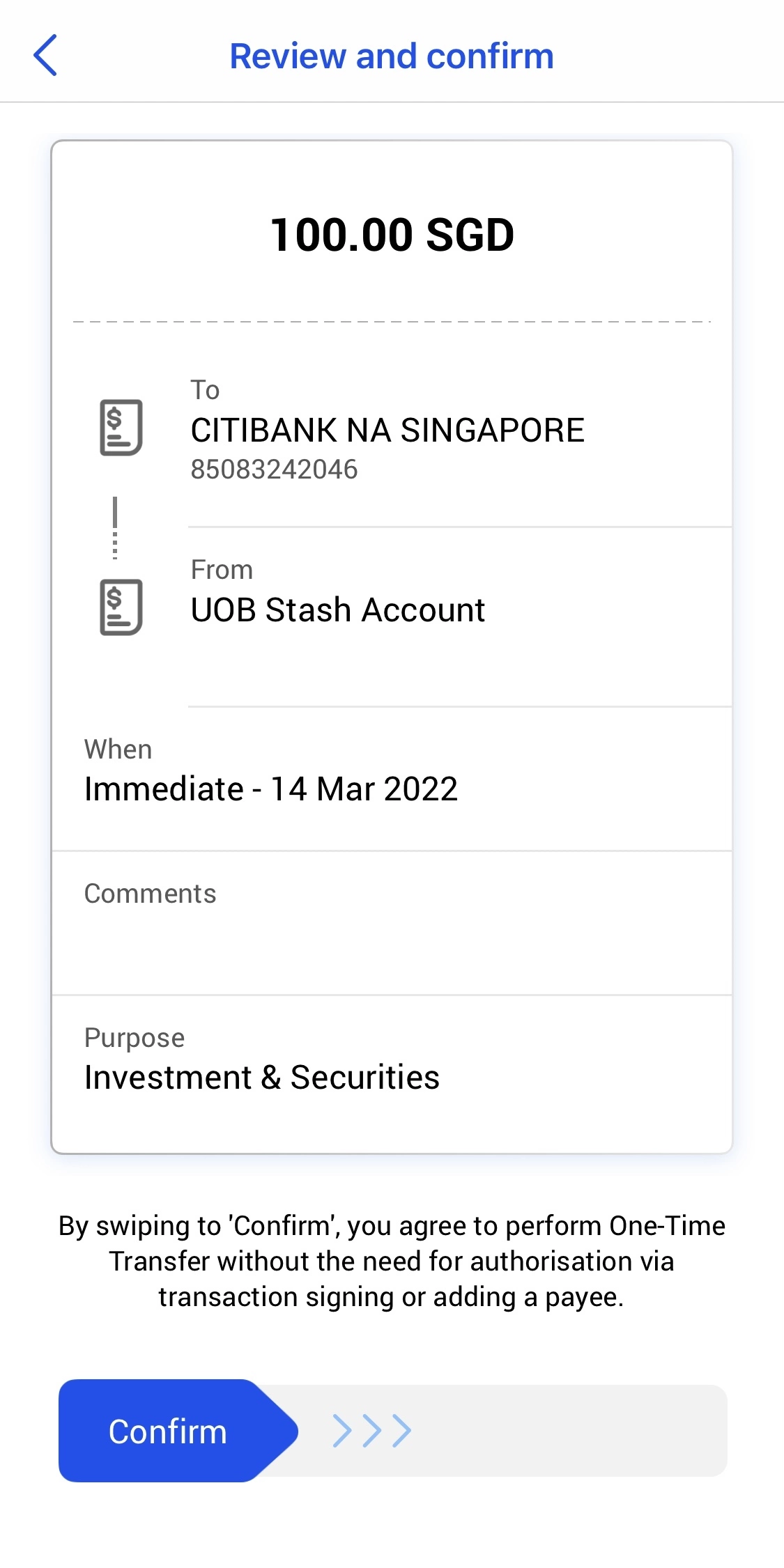

Log in to Bank of Singapore's online banking and transfer funds from Bank of Singapore to Interactive Brokers Bank of Singapore using the general transfer deposit method.。

I am using Singapore UOB (UOB) to transfer money and the steps are as follows:

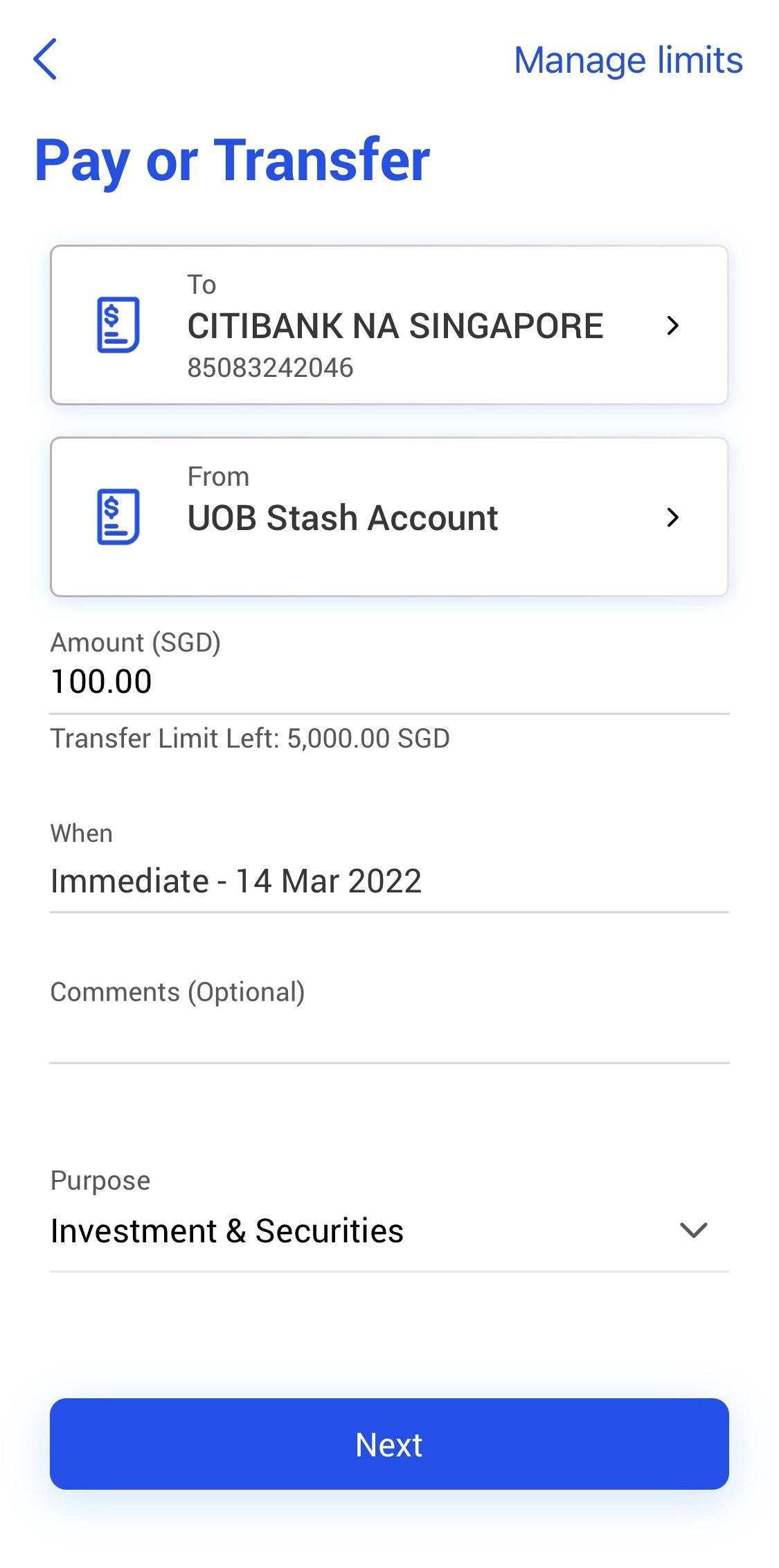

1.Sign in to the UOB TMRW Online Banking App

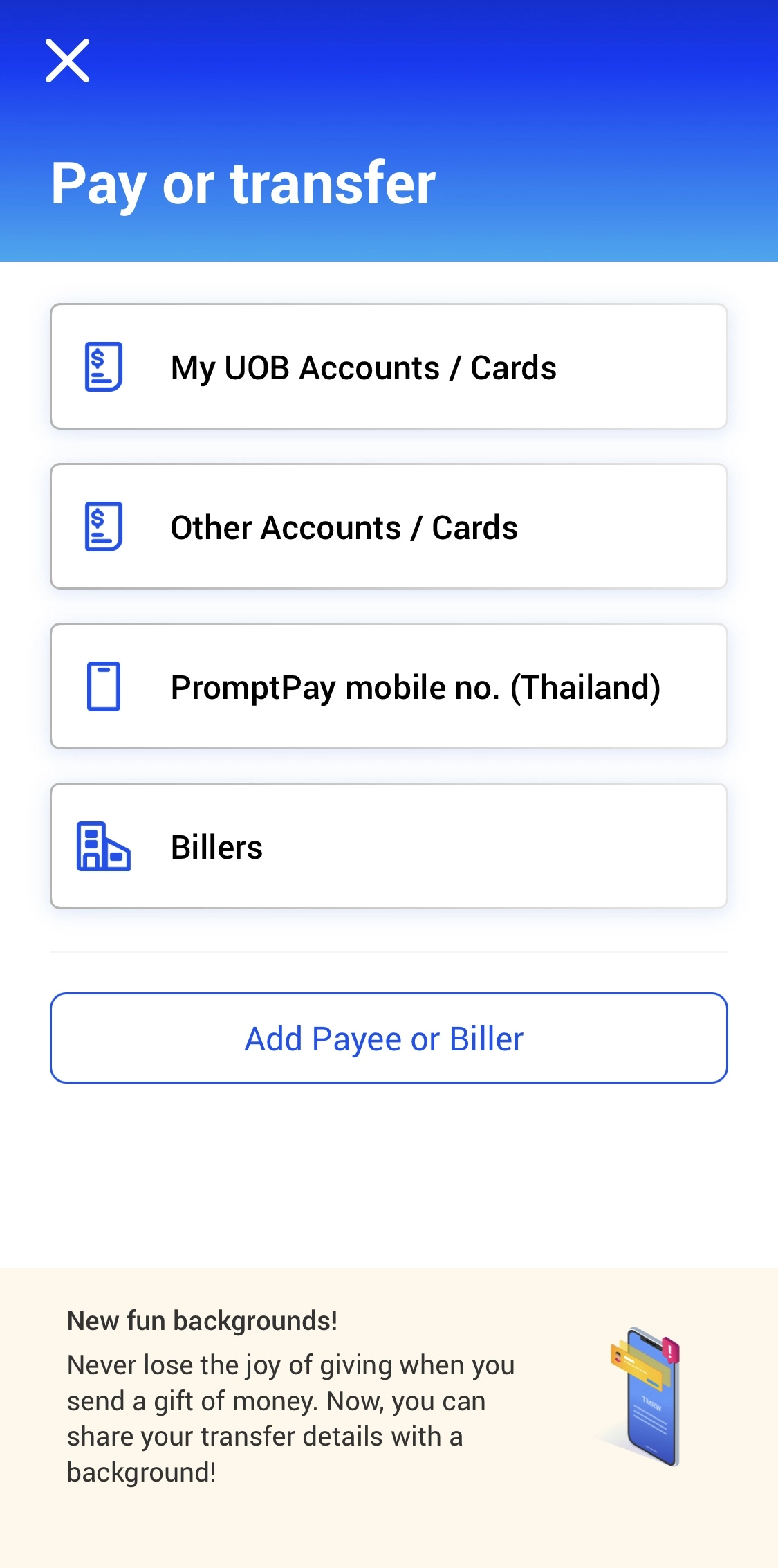

2.Click Pay & Transfer > Other Accounts / Cards

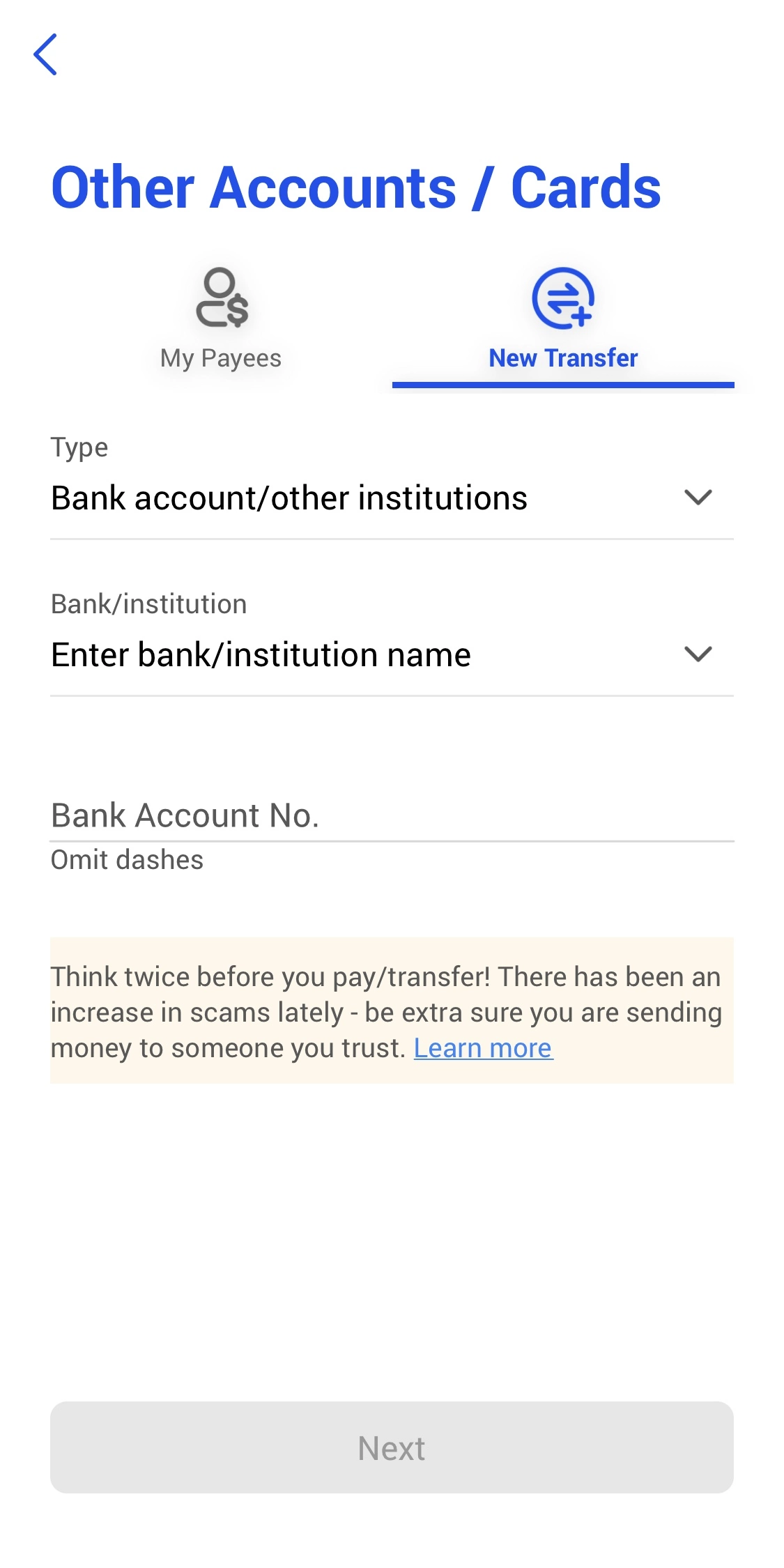

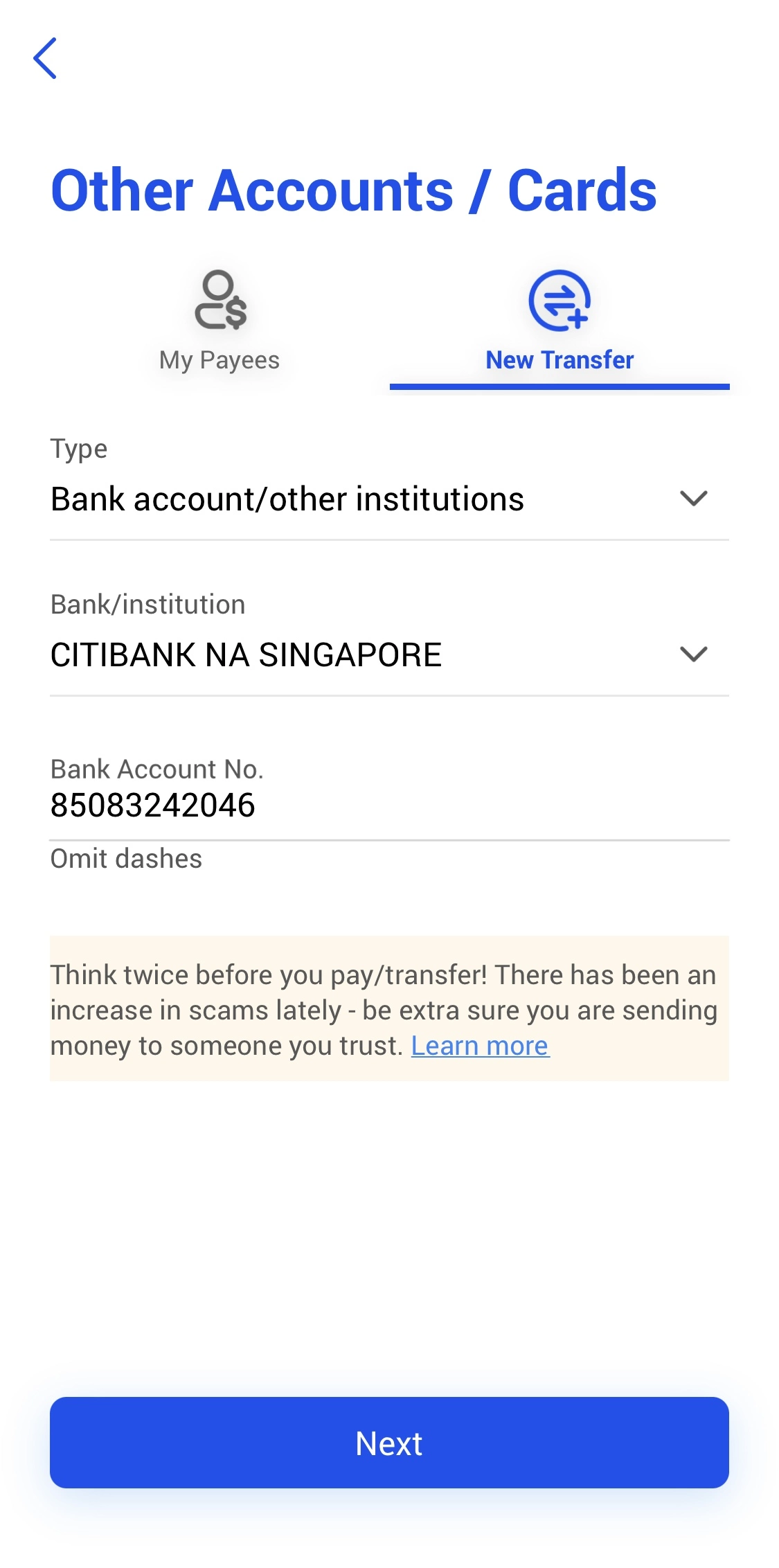

3.Go to the Transfer page and enter your Interactive Brokers Singapore bank information and transfer amount

4.Click Next > Confirm to complete the transfer

5.Remittances usually arrive within one working day.

Remember the screenshot or download the remittance voucher (Receipt)。

* If you use CIMB SG deposit, you can select Transfer via FAST at Cimb Clicks Singapore and send money to Interactive Brokers Singapore Bank。

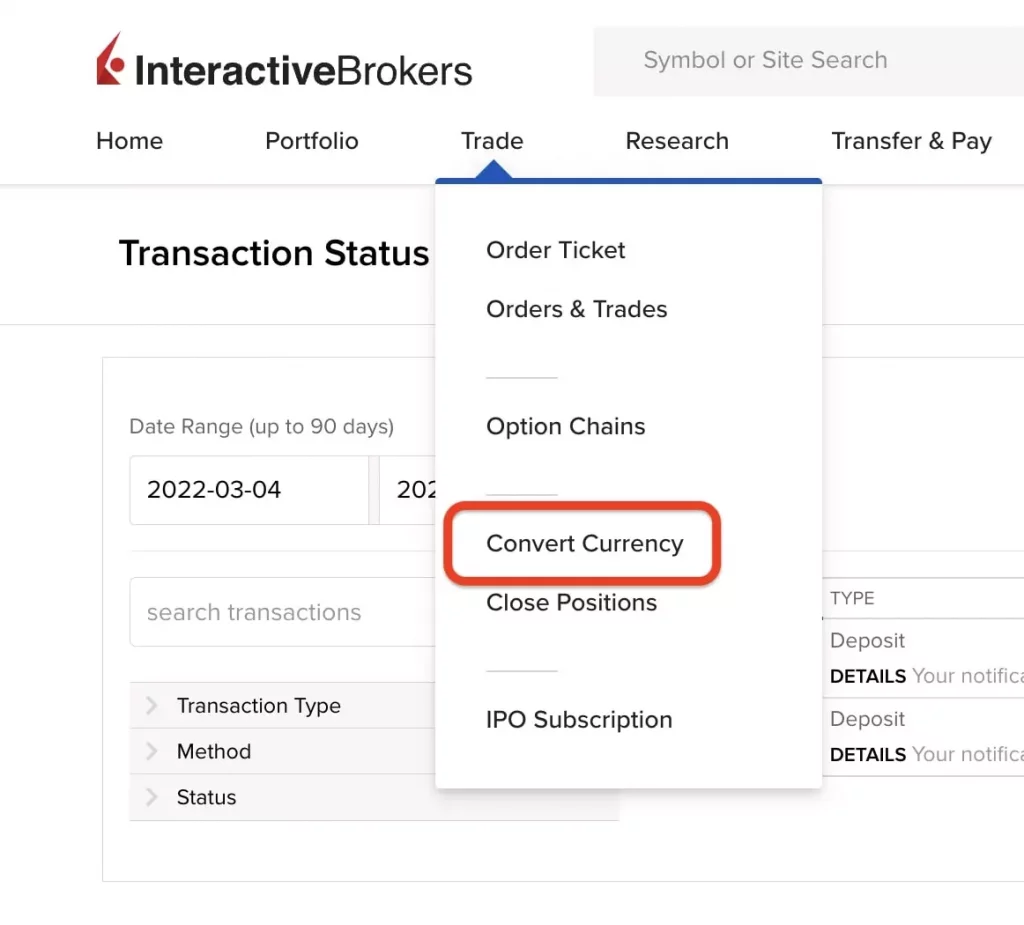

Step 4: Exchange Currency (New Dollar to Other Currencies) at Interactive Brokers

Simply put, investing in the U.S. stock market at Interactive Brokers requires trading in U.S. dollars; investing in the Hong Kong stock market requires trading in Hong Kong dollars。When the New Dollar funds arrive at Interactive Brokers, you can use the IB's built-in currency exchange function to convert the New Dollar to the desired currency.。

If the currency is not exchanged before the transaction, Interactive Brokers will charge a currency exchange fee of $2 per transaction.。Therefore, it is recommended that you must first exchange your money and make sure you hold the currency before you start trading.。

What is the cost of wire transfer??

This wire transfer costs a total of 2:

◇ Wise wire transfer fee

◇ Exchange rate differentials are generated when Interactive Brokers exchange currencies

SUMMARY

There are advantages and disadvantages to using Malaysian bank e-remittance and using Wise and Singapore bank remittance combinations.。The former only need to hold Malaysian banks can easily deposit money, the disadvantage is that the cost of wire transfer is relatively high;。

Moreover, assuming you have a securities trading account with other U.S. stock brokerages, such as TD Ameritrade, Futu Securities (Singapore), etc., opening a Singapore bank account can also add convenience to other U.S. stock brokerages.。Therefore, it is highly recommended that you take some time to open a Singapore bank account.。

If you encounter any problems in the process of deposit, you are welcome to leave a message to communicate with us.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.