Interactive Brokers: Wise Direct ACH deposit complete process introduction

This article describes the Wise Direct ACH remittance deposit Interactive Brokers process and compares other deposit methods to find the most cost-effective channel for deposit Interactive Brokers。

Tracker Securities(IBKR) is one of the largest and oldest securities dealers in the world, facilitating the participation of many investors in overseas stock market transactions.。

This article provides a complete step-by-step guide on how to remit money to Interactive Brokers via Wise Direct ACH, allowing you to easily understand the entire process in a multi-graphic way。In addition, we will discuss the related costs and matters needing attention。Finally, we will compare it with another way to deposit money - Wise wire transfer + Singapore bank deposit to help you choose a more economical and reasonable way.。

Interactive Brokers Deposit Channel

Common Interactive Brokers deposit methods include (i) bank wire transfer (Bank Wire), (ii) Direct ACH, (iii) Wise wire transfer + Singapore Bank, and for Malaysian users, there is another faster and cheaper deposit method - direct ACH to Interactive Brokers via Wise, which not only saves high foreign exchange fees, but the deposit process involves only two platforms, Wise and IBKR。

The following is a detailed description of the whole process of Wise Direct ACH's deposit into Interactive Brokers in the form of multiple graphics and texts, with the U.S. dollar (USD) as a demonstration, the whole process is operated in the English interface of the Client Portal, the official website of Interactive Brokers.。You can switch to Traditional, Simplified Chinese or other languages at any time。

Wise Direct ACH Bonus Interactive Brokers Process (Full Illustration)

◇ Applicable object: Have a Wise account

Fees: Wise foreign exchange fees, Wise ACH fees (Note: IBKR does not impose any fees)

Arrival time: one working day on average

◇ Currency of arrival: US Dollar (USD)

Step 1: Obtain IBKR Direct ACH deposit information

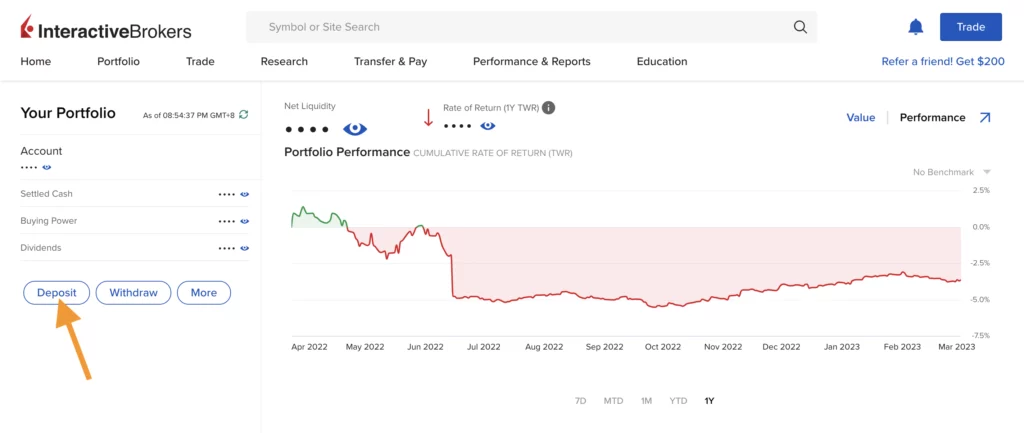

First, log in to the Interactive Brokers Client Portal and click Deposit to enter the deposit process.。

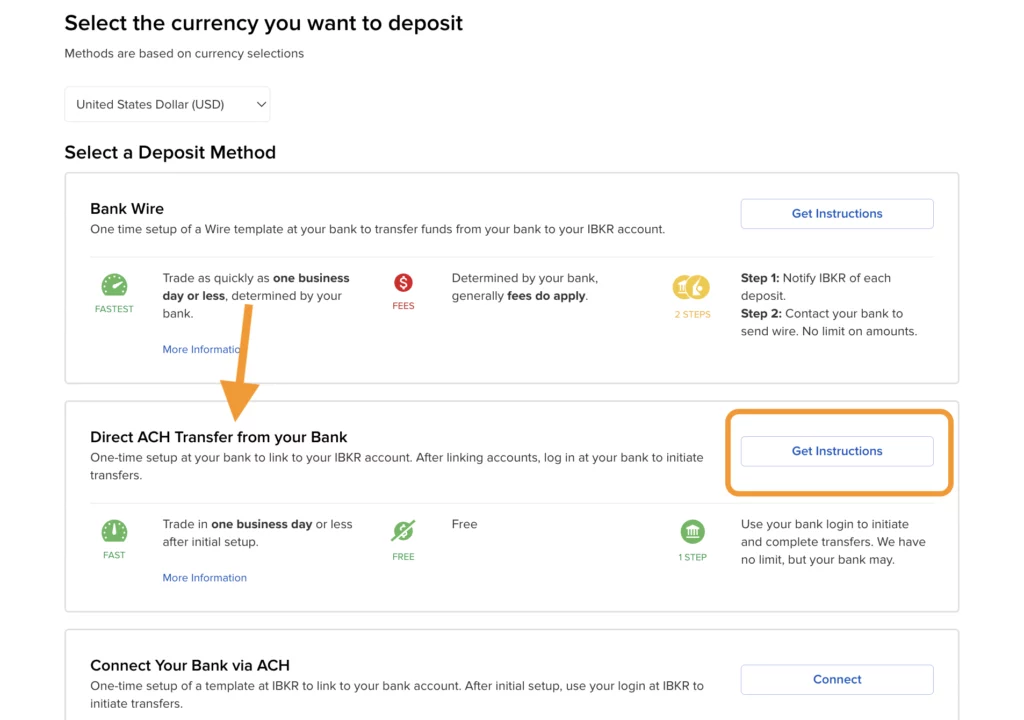

Select the currency you want to deposit. IBKR supports users to transfer to USD, SGD, HKD, etc.。This process commentary will explain how to deposit gold dollars, so here we choose the U.S. dollar (USD).。

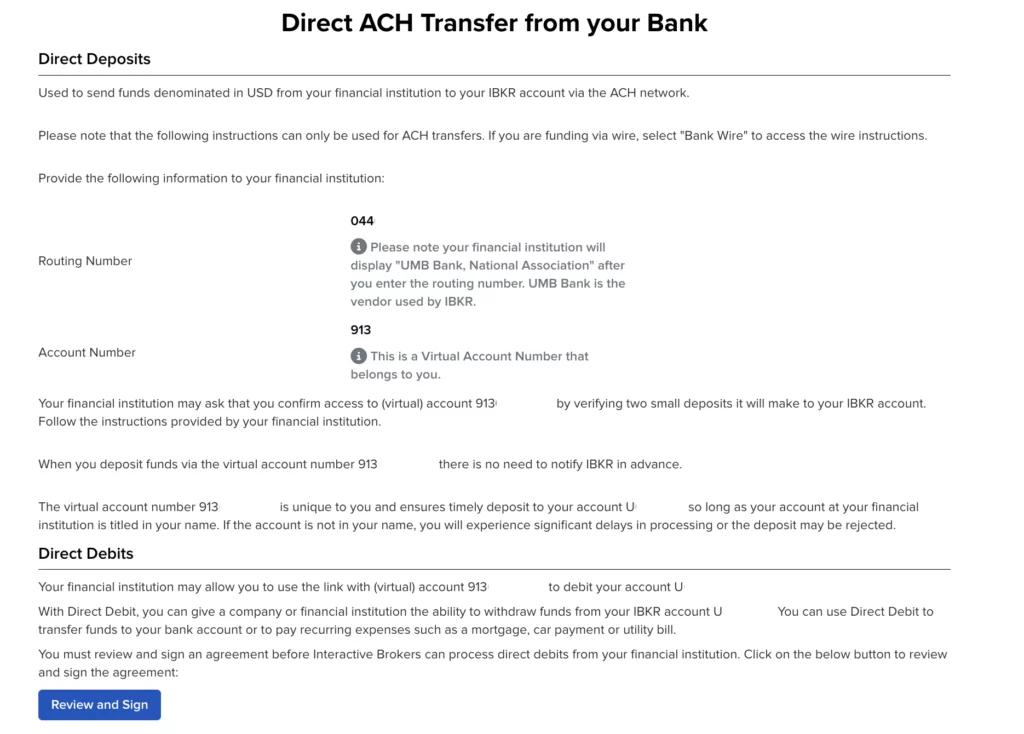

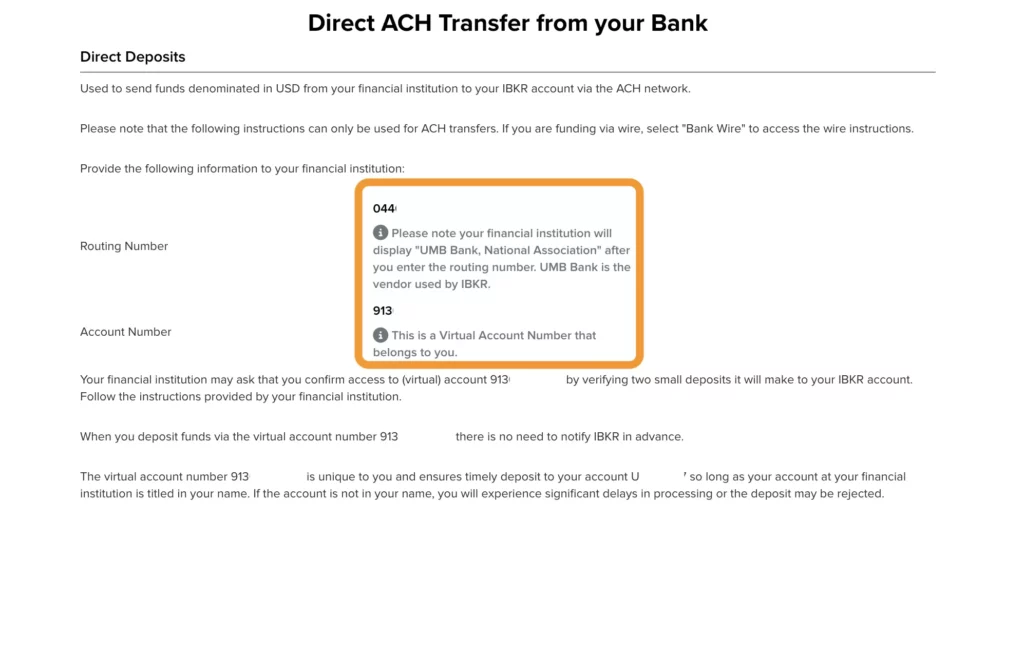

The deposit method is Direct ACH, click Get Instructions to get information about the transfer。

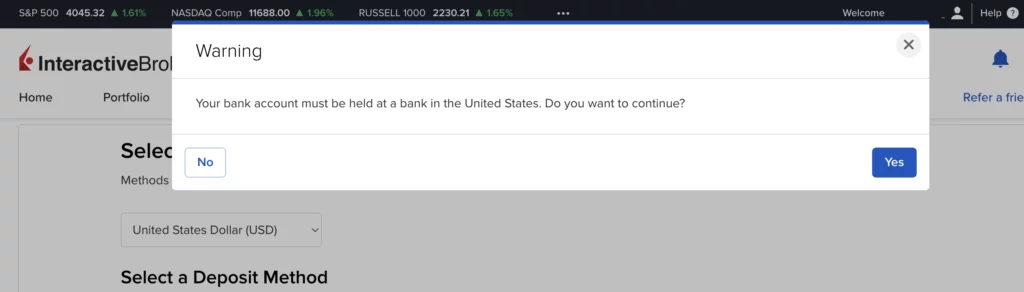

The system will pop up a warning message reminding you that you must complete this deposit through your U.S. bank account, click Yes to go to the next step。

You will get two important information: Routing Number, Virtual Account Number, please record or save the information for the third step of deposit。

* Note that the above information may change without notifying the user. It is recommended to confirm the latest information again and again before each deposit。

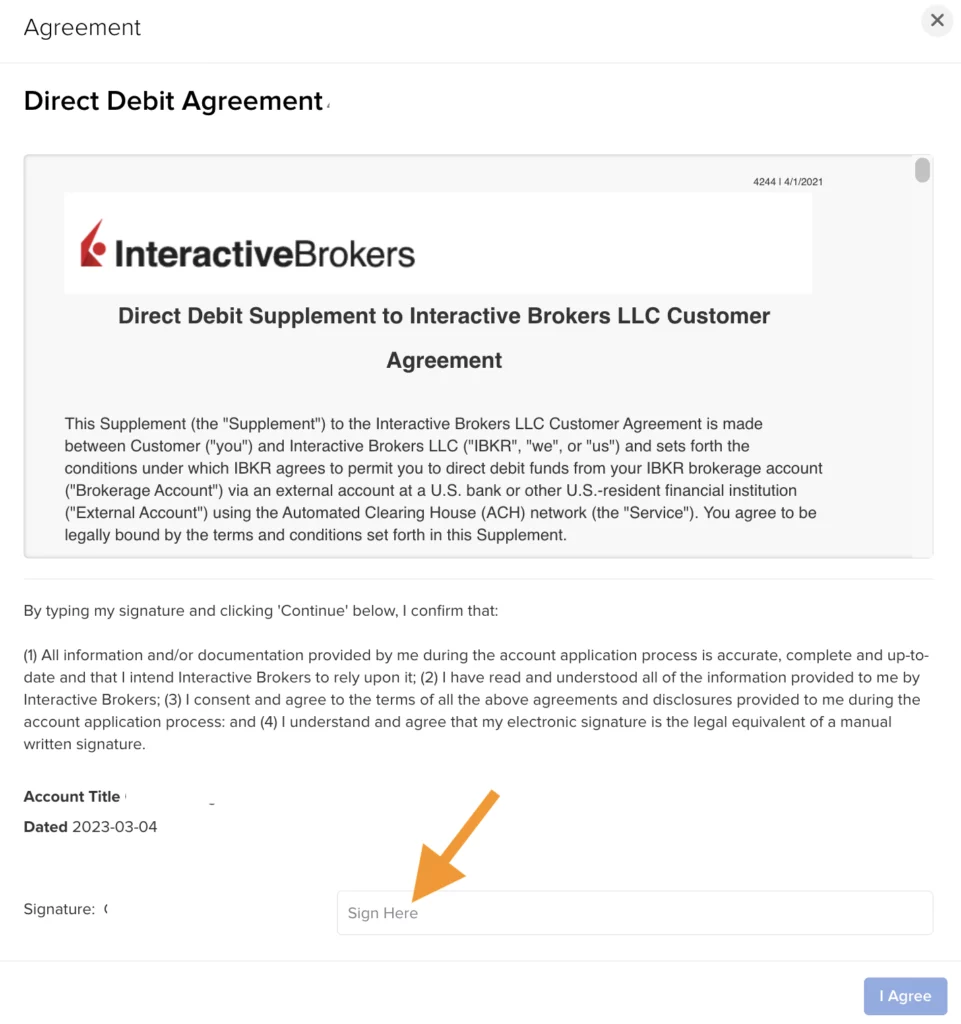

If you are using Direct ACH for the first time, you must sign the IBKR Direct Debit usage agreement.。Please click Review and Sign to go to read the usage agreement and sign to agree。

Step 2: Transfer the initial funds to the Wise Multi Currency Balance USD account

Next, log into the Wise account and remit the funds in ringgit。

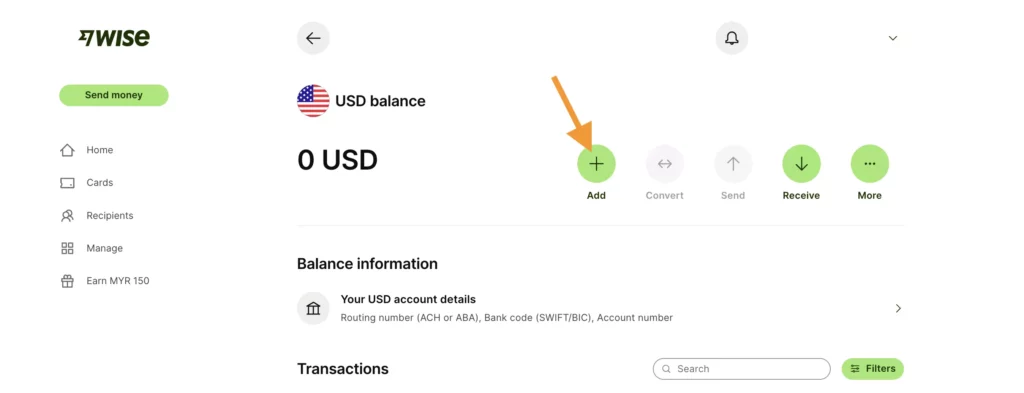

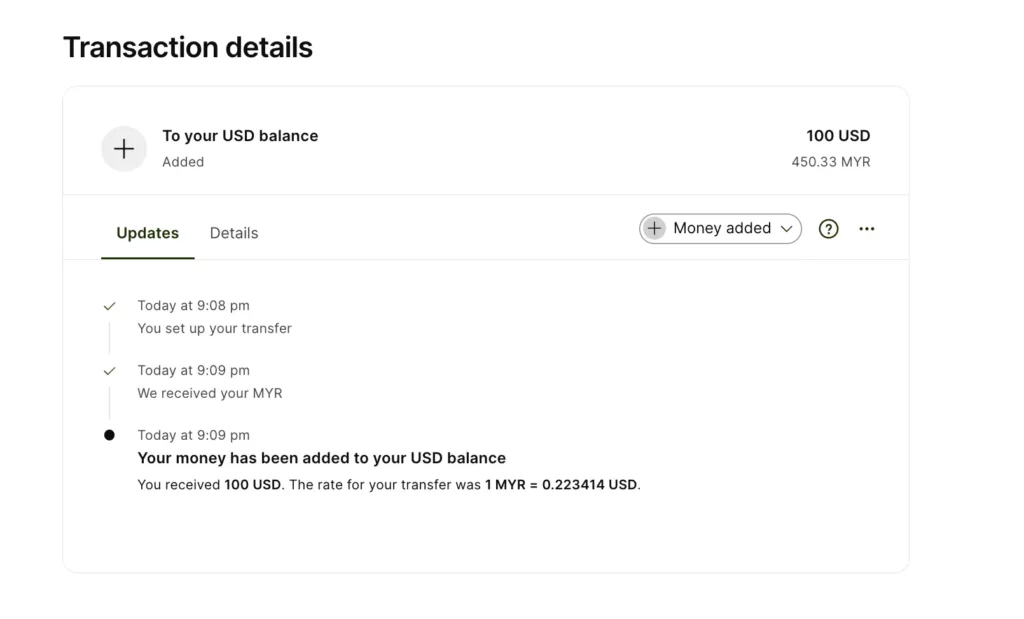

Select USD balance in your Wise account and click Add to transfer new funds。

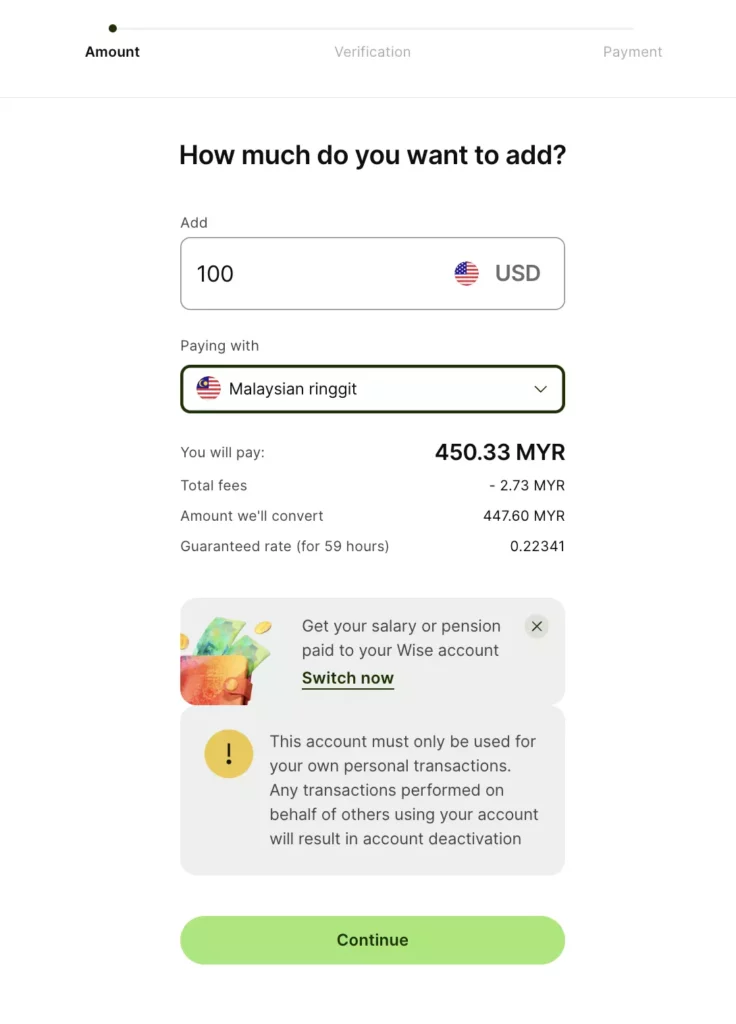

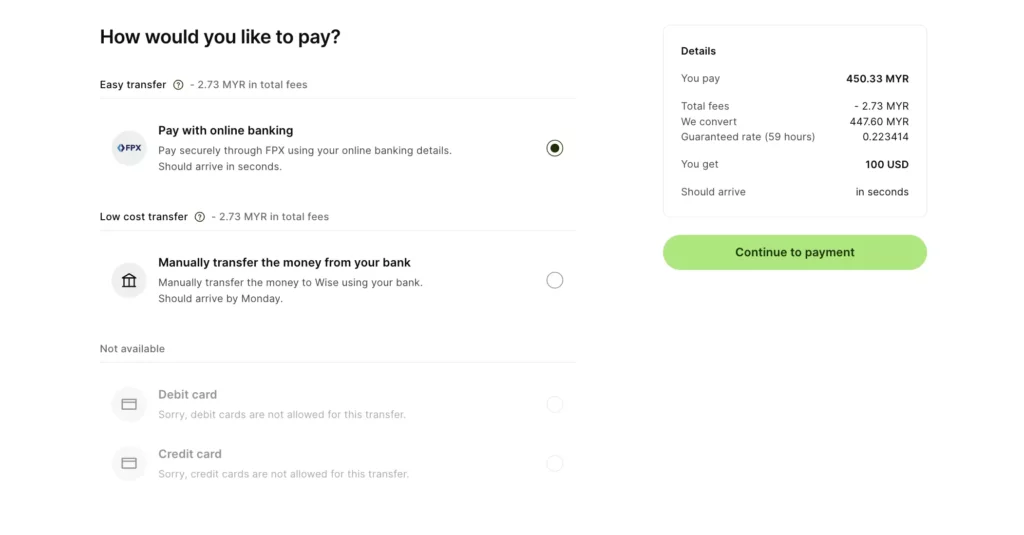

Enter the deposit amount, here the model deposit of $100, and pay with Malaysian Ringgit (Paying with Malaysian Ringgit), Wise shows the deposit amount, Wise foreign exchange fee (MYR - USD), USD to Ringgit exchange rate.。Click Continue to continue to the next step。

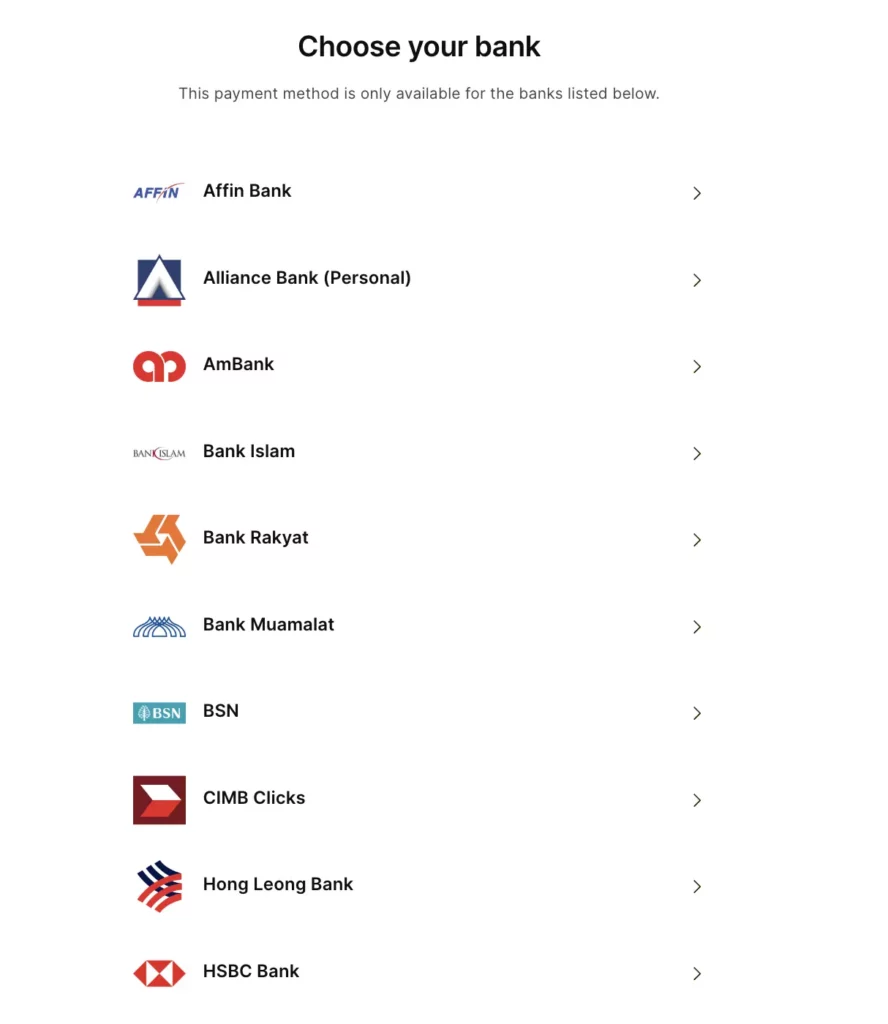

Select the deposit method. It is recommended to use Paying with online banking. The payment is fast (the actual measurement is that the payment is quick in seconds) and there are no other charges.。Click Continue to payment, log in to your personal online banking account and complete the remittance。

Step 3: Deposit in the form of Wise Direct ACH

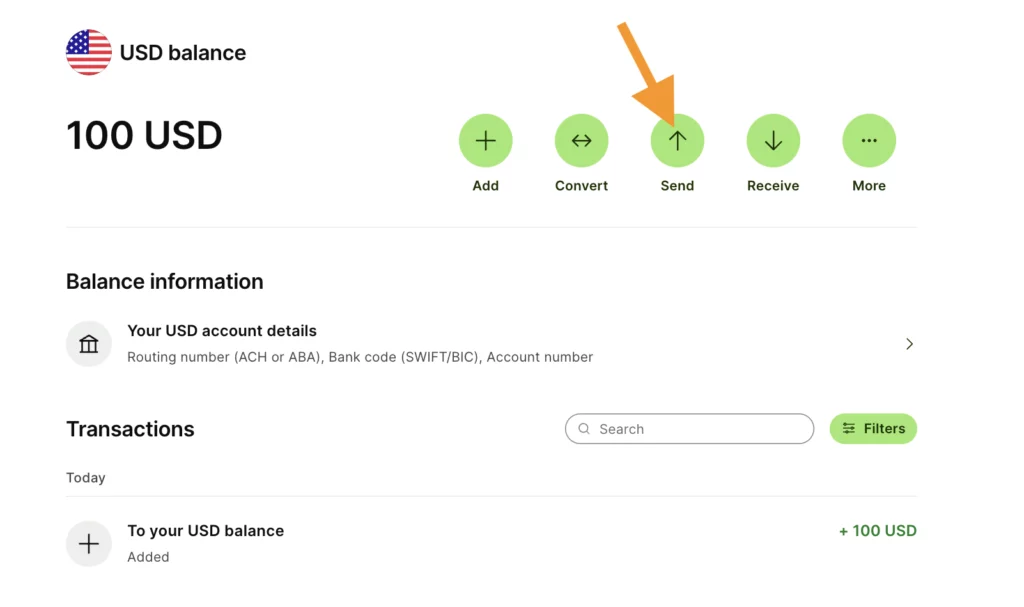

In Wise USD balance, click Send to remit USD。

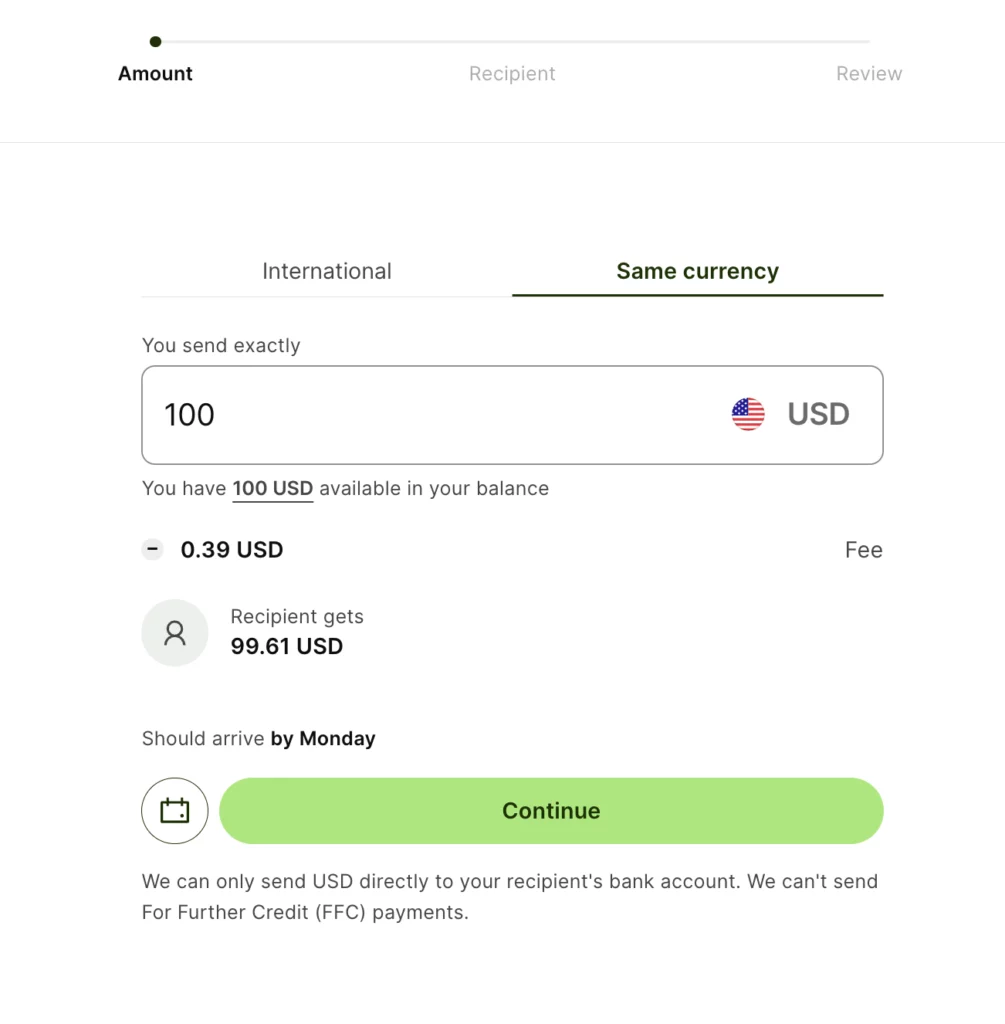

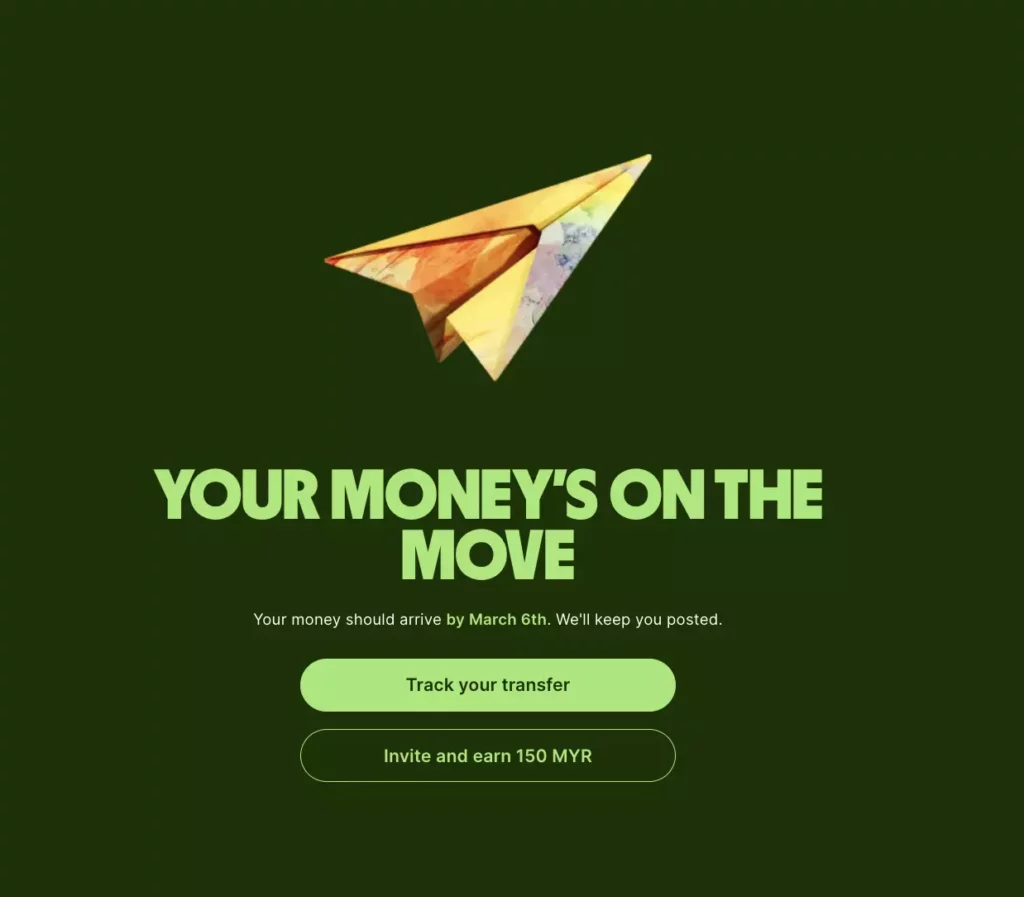

Select Same currency and enter the amount, Wise displays the ACH fee, the expected IBKR last dollar amount, and the expected date of arrival.。

Note that each time a Direct ACH form deposit is initiated, Wise will levy a fixed ACH transfer fee (0.39 USD)。

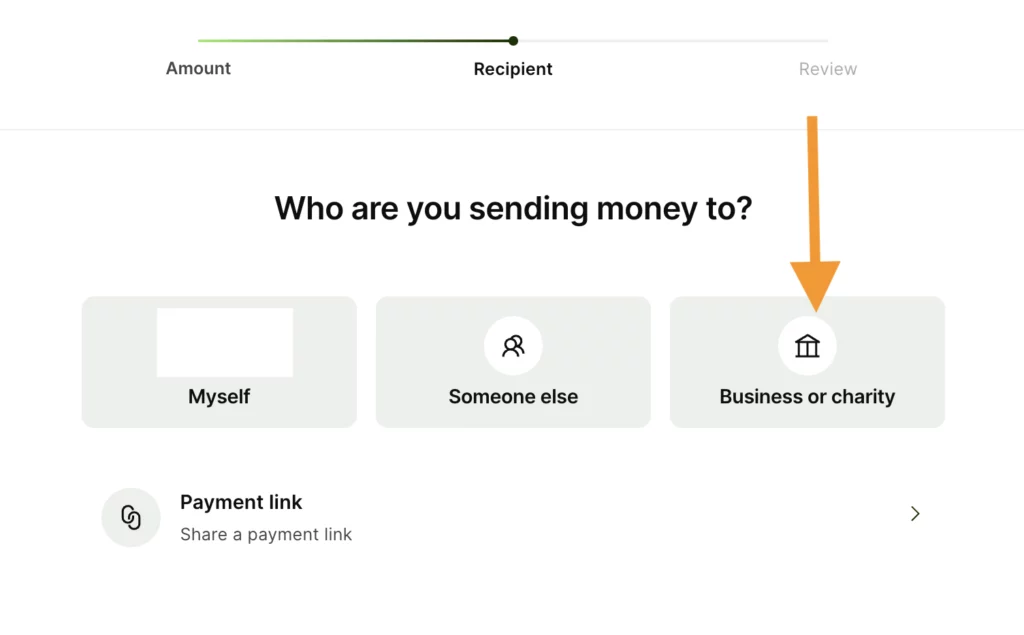

In the Payee column, select Business or charity。

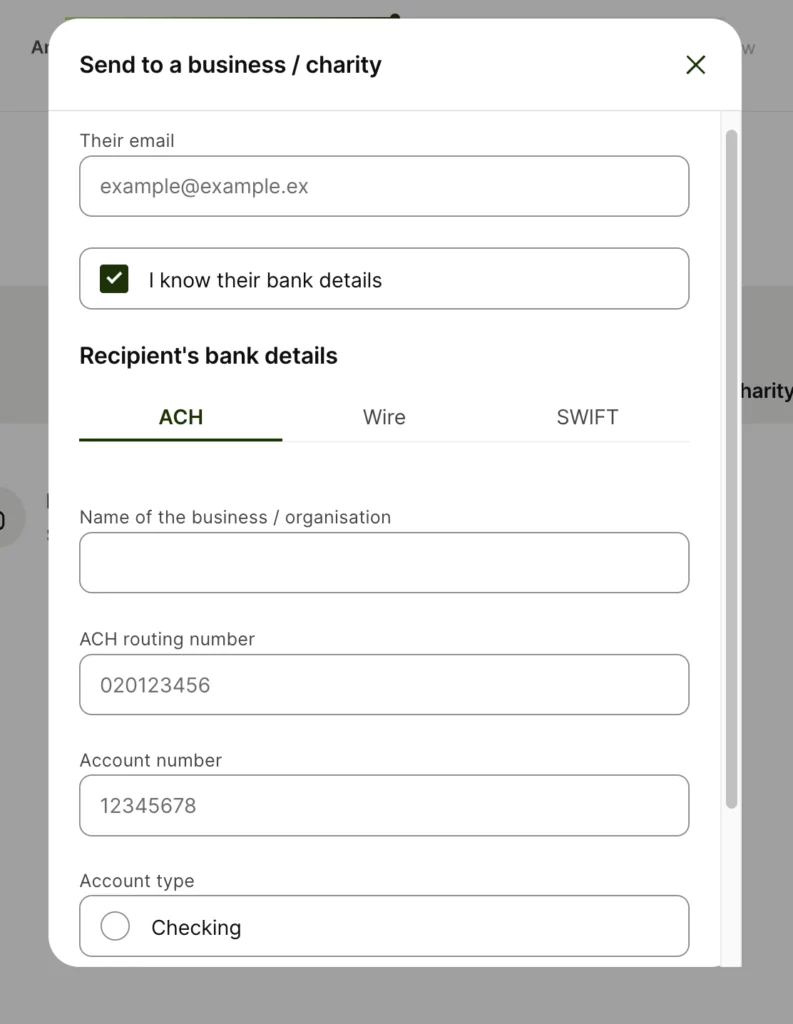

Enter the IBKR Direct ACH deposit information obtained in the first step。Email column can be left blank。

◇ Recipient’s bank details: ACH

◇ Name of the business / organization: Interactive Brokers LLC or UMB Bank, National Association

◇ ACH routing number: Fill in according to the Routing Number in the first step

◇ Account number: Fill in according to the Virtual Account Number in the first step

◇ Account type: Checking

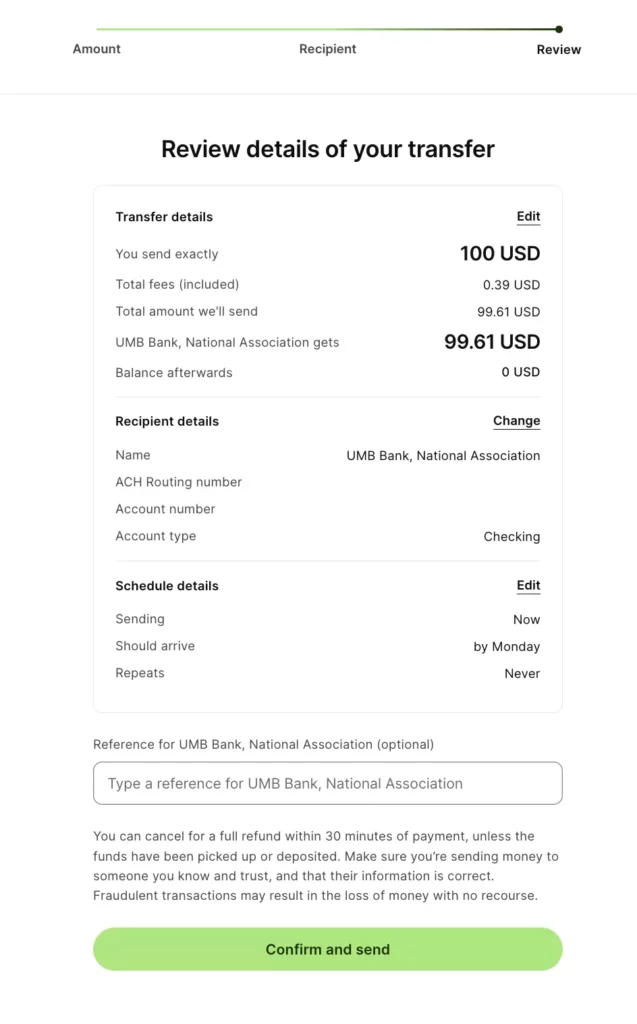

Check all remittance information, after confirmation, in the Reference column, you can fill in your IBKR account number, such as U1234567。

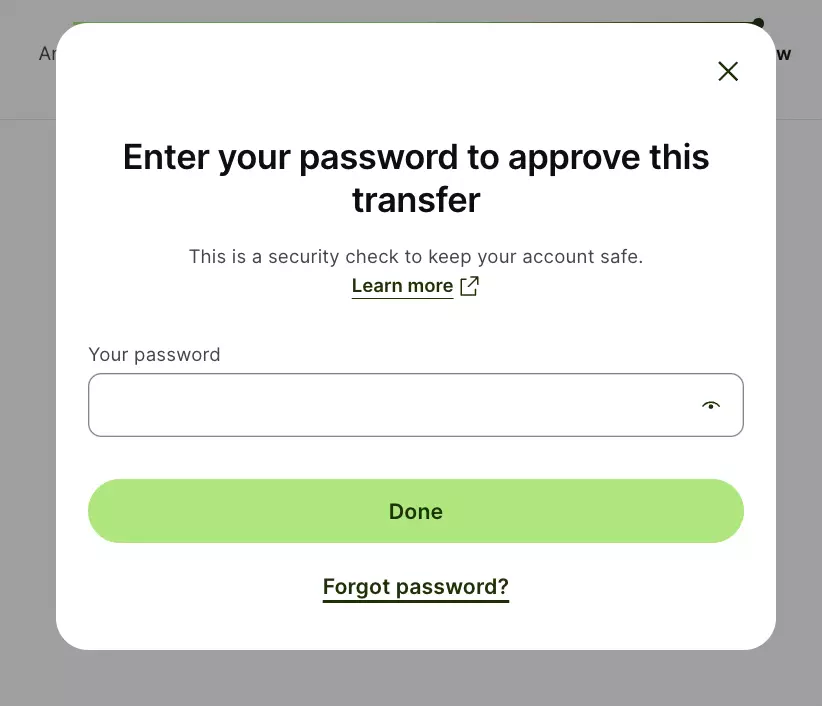

Finally, click Confirm and send, enter your Wise login password and approve the transaction on the Wise App to complete the Direct ACH deposit.。

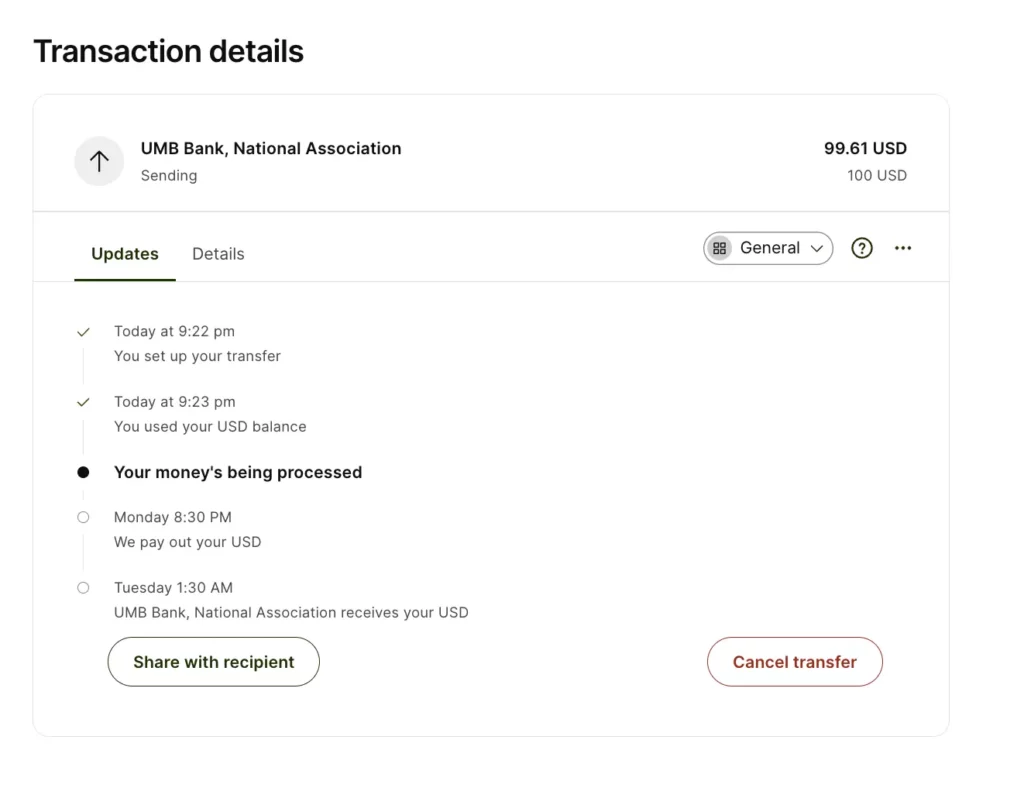

Step 4: successful remittance to the account, complete the deposit

Direct ACH deposit usually takes 1 to 3 working days to arrive, and IBKR will inform you by email when the payment arrives.。Our actual measurement is that the remittance will arrive in 1 working day.。If you have not been notified for more than 3 working days, it is recommended to contact Interactive Brokers customer service as soon as possible。

Which deposit method is more cost-effective than Wise wire transfer + Singapore bank deposit?

In our earlier IBKR deposit article, we introduced the remittance portfolio between Wise and Bank of Singapore, which is done by first sending money through Wise to an individual's Singapore bank account, then by wire transfer from Bank of Singapore to IBKR, to the Singapore dollar.。Finally, use IBKR's built-in currency exchange feature to convert SGD to USD。

So, is it cheaper for Wise Direct ACH to invest in IBKR, or is it more cost-effective for Wise Wire Transfer + Singapore Bank to invest in IBKR??Let's compare the actual trial calculation。

Method 1: Wise Direct ACH into IBKR, final dollar trial balance.

| Initial deposit (MYR) | Wise Foreign Exchange Charges (MYR) | Actual Exchange (MYR) | Wise USD - RMJ exchange rate | Actual deposit IBKR (USD) | Wise ACH Fee (USD) | IBKR Last Arrival (USD) |

| 450.33 | (2.73) | 447.60 | 0.223414 | 100.00 | 0.39 | 99.61 |

| 500 | (5.21) | 494.79 | 0.223414 | 110.54 | 0.39 | 110.15 |

| 1,000 | (8.24) | 991.76 | 0.223414 | 221.57 | 0.39 | 221.18 |

| 3,000 | (20.37) | 2,979.63 | 0.223414 | 665.69 | 0.39 | 665.3 |

| 5,000 | (32.49) | 4,967.51 | 0.223414 | 1,109.81 | 0.39 | 1,109.42 |

| 10,000 | (62.81) | 9,937.19 | 0.223414 | 2,220.11 | 0.39 | 2,219.72 |

| 20,000 | (123.44) | 19,876.56 | 0.223414 | 4,440.70 | 0.39 | 4,440.31 |

| 30,000 | (184.07) | 29,815.93 | 0.223414 | 6,661.30 | 0.39 | 6,660.91 |

The above trial balance shows the last amount paid into IBKR through Wise Direct ACH, with a trial amount of MYR 450.33 to MYR 30,000

The platforms involved are Wise and IBKR。

The costs involved include:

◇ Wise Foreign Exchange Fee (MYR): The exchange fee for the conversion of the ringgit to the US dollar.

◇ Wise ACH fee (USD): ACH transfer fee to IBKR

Then look at the second deposit method trial balance.。

Method 2: Wise wire transfer + Singapore bank deposit IBKR, final to USD trial balance

| Initial deposit (MYR) | Wise Foreign Exchange Charges (MYR) | Actual Exchange (MYR) | Wise SGD-ringgit exchange rate | Bank of Singapore (SGD) | IBKR SGD-USD exchange rate | IBKR Foreign Exchange Charges (USD) | IBKR Last Arrival (USD) |

| 450.33 | 5.06 | 445.27 | 0.300313 | 133.72 | 0.7421 | 2.00 | 97.23 |

| 500 | 5.35 | 494.65 | 0.300313 | 148.55 | 0.7421 | 2.00 | 108.24 |

| 1,000 | 8.28 | 991.72 | 0.300313 | 297.83 | 0.7421 | 2.00 | 219.02 |

| 3,000 | 20.01 | 2,979.99 | 0.300313 | 894.93 | 0.7421 | 2.00 | 662.13 |

| 5,000 | 31.74 | 4,968.26 | 0.300313 | 1,492.03 | 0.7421 | 2.00 | 1105.24 |

| 10,000 | 61.07 | 9,938.93 | 0.300313 | 2,984.79 | 0.7421 | 2.00 | 2213.01 |

| 20,000 | 119.72 | 19,880.28 | 0.300313 | 5,970.31 | 0.7421 | 2.00 | 4428.57 |

| 30,000 | 178.38 | 29,821.62 | 0.300313 | 8,955.82 | 0.7421 | 2.00 | 6644.11 |

The above trial balance shows the final amount of IBKR via Wise wire transfer + Singapore bank deposit, with a trial amount of MYR 450.33 to MYR 30,000。

The platforms involved include: Wise, Bank of Singapore and IBKR。

The costs involved include:

◇ Wise Foreign Exchange Fee (MYR): Exchange fee for RM11 to SGD

◇ IBKR foreign exchange fee (USD): the exchange fee for the conversion of SGD to USD

Comparison of the final amounts received for the two deposit methods.

| Initial deposit (MYR) | Wise Direct ACH(USD) | Wise + Bank of Singapore (USD) | Total savings (USD) |

| 450.33 | 99.61 | 97.23 | 2.38 |

| 500 | 110.15 | 108.24 | 1.91 |

| 1,000 | 221.18 | 219.02 | 2.16 |

| 3,000 | 665.3 | 662.13 | 3.17 |

| 5,000 | 1,109.42 | 1105.24 | 4.18 |

| 10,000 | 2,219.72 | 2213.01 | 6.71 |

| 20,000 | 4,440.31 | 4428.57 | 11.74 |

| 30,000 | 6,660.91 | 6644.11 | 16.80 |

The above comparison list shows that investing in IBKR through Wise Direct ACH is indeed more economical than Wise wire transfer + Singapore bank investment in IBKR, and the platforms involved are only Wise and IBKR, so there is no need to open a Singapore bank account, which is more suitable for Malaysian investors.。

In terms of costs, there is little difference in the costs saved by the two deposit methods。The gap is more pronounced only if investors make frequent deposits and each deposit is large。Therefore, investors can choose the appropriate deposit method according to their own usage habits.。

SUMMARY

The introduction of Wise has made it easier to transfer funds to IBKR, lowering the threshold for investors to enter overseas securities markets, especially the US and Hong Kong markets。For investors using IBKR, it is highly recommended to choose Wise for fund deposit to experience faster and more convenient fund transfer services.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.