InteractiveBrokers withdrawal process complete instruction!

Interactive Brokers offers a variety of withdrawal methods, including wire transfers, ACH (Automated Clearing Account), checks, and more. In this article, we will explain in detail the withdrawal process of Interactive Brokers, including the required fees and minimum withdrawal thresholds.

Today we will introduce the withdrawal process of Interactive Brokers in detail, the platform supports more than 20 currencies, including the U.S. dollar, Singapore dollar, Hong Kong dollar, Australian dollar, Japanese yen, British pound, offshore RMB and so on, which provides users with great convenience.

We will comprehensively introduce Interactive Brokers' withdrawal process through multi-graphics, taking SGD withdrawal to Singapore banks as an example, with full online network operation.

The content includes:

◇ Interactive Brokers withdrawal methods, fees, minimum threshold details

◇ Interactive Brokers withdrawal process teaching: withdrawing SGD to Singapore bank.

How to withdraw funds from Interactive Brokers?

Log in to the Client Portal on the official Interactive Brokers website and it takes about 5 minutes to complete your withdrawal request. At the moment, withdrawals can only be made to a bank account or brokerage account in the name of an individual. If you wish to withdraw funds to a third party account, you can contact IBKR Customer Service for more information and will be subject to IBKR's compliance review.

Withdrawal Methods

Interactive Brokers supports the following 7 withdrawal methods. Note that the withdrawal methods available vary depending on the currency in which the funds are withdrawn, and are based on the withdrawal methods shown in the system.

Interactive Brokers main withdrawal methods:

- Bank Wire

- US Automated Clearing House (ACH) Transfer Initiated at IBKR

- Direct Debit / Electronic Money Transfer

- BACS/ GIRO/ ACH

- Check

- Canadian Electronic Funds Transfer (EFT)

- Single Euro Payment Area (SEPA)

Deposit Support Currencies

In terms of withdrawal currencies, Interactive Brokers supports more than 20 currencies such as USD, SGD, HKD, AUD, JPY, GBP, and Offshore RMB.

Users must ensure that the bank account to which the funds are credited can receive the funds in that currency. For example, if you want to withdraw SGD, the receiving bank account must be able to support receiving SGD; to withdraw USD, the receiving bank account must be able to support receiving USD. It is recommended that you check with your receiving bank before making a withdrawal to see if they are able to receive funds in this currency.

Minimum Threshold for Withdrawal

The minimum threshold for withdrawal depends on the currency of the withdrawal, for example, the minimum threshold for withdrawing SGD is SGD 1.

Maximum withdrawal limit

The maximum withdrawal limit is $50,000 in a single day and $100,000 within 5 business days.

The maximum withdrawal limit will be increased if the User participates in the Secure Login System designated by Interactive Brokers. The Secure Login System provides users with additional account security settings to enhance the security of their Interactive Brokers account.

Users can choose from the following 3 settings:

◇ Temporary Mobile Two-Factor Authentication: A passcode is sent via cell phone every time you log in, and after you enter your user name and password, you will need to enter the passcode in order to log in successfully.

◇ IBKR Mobile Authentication:Using IBKR Mobile Mobile App for 2-Factor Authentication (2FA), users need to download IBKR Mobile App.

◇ Physical Security Devices: Apply to Interactive Brokers for physical security devices, such as Digital Security Card+ (account assets must always exceed 1 million USD).

Refer to the table below for the maximum withdrawal limit:

| Secure Login Device | One-day maximum | Maximum within 5 working days |

| None | $50,000 | $100,000 |

| SMS | $200,000 | $600,000 |

| IBKR Mobile Authentication | $1 million | $1 million |

| Security Code Card* | $200,000 | $600,000 |

| Digital Security Card* | $1 million | $1.5 million |

| Digital Security Card+ | No limit | No limit |

| Platinum*/Gold* | No limit | No limit |

Withdrawal Fee

Withdrawal fees vary depending on the method of withdrawal. For example, Interactive Brokers charges a fee of SGD1 for ACH/GIRO withdrawals and SGD15 for bank wire transfers. In addition, charges may be levied by the transferring bank, receiving bank and other banks, and will be deducted directly from the amount submitted for withdrawal.

Interactive Brokers offers one free withdrawal request per calendar month, excluding bank charges.

Withdrawal speed

Typical withdrawal times are 1 to 2 business days, depending on the processing bank and whether the cut-off time has passed at the time of the withdrawal request. Requests made before the cut-off time will be processed on the same day; requests made after the cut-off time will be processed on the next day.

Measured withdrawal of SGD to a Singapore bank will be processed within one working day.

IB Withdrawal Process Instruction (Multi-graphic)

Next, we will introduce the withdrawal process of Interactive Brokers in the form of multi-graphics, the teaching will be based on the Client Portal, the withdrawal process is about 5 minutes, divided into two parts:

◇ Setting the withdrawal bank information

◇ Sending a withdrawal request

Because it is an online operation, it is recommended that you apply for withdrawal in a stable network state to ensure that the withdrawal process is smooth. You can switch to Traditional Chinese, Simplified Chinese or other languages at any time.

The withdrawal steps are as follows:

◇ Withdrawal method: ACH/ GIRO

◇ Arrival Currency: New Zealand Dollar (SGD)

◇ Applicable to: Singapore bank account holders

◇ Fees: Interactive Brokers fee of SGD 1

◇ Delivery Time: 1 working day

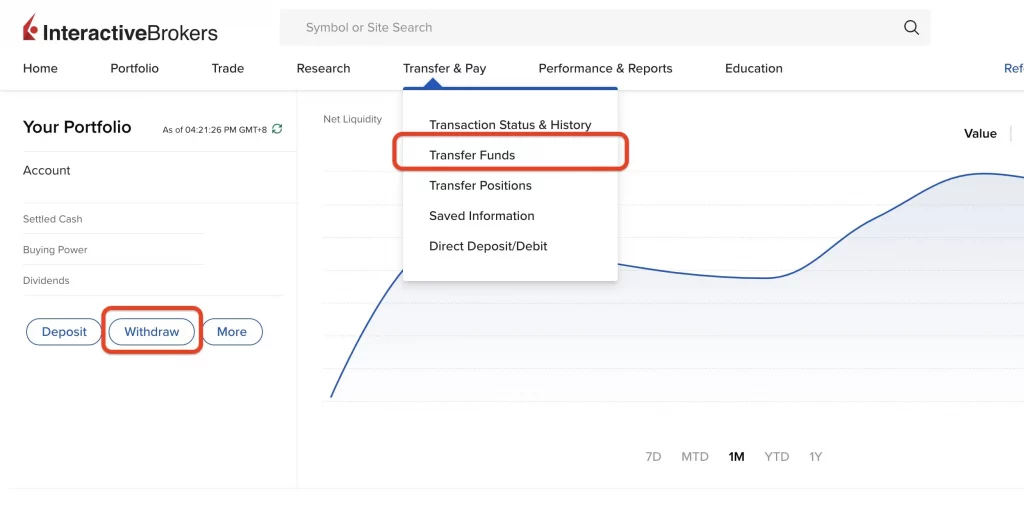

Step 1: Login to your account and initiate a withdrawal request

First, Log in to the Client Portal of Interactive Brokers website and choose one of the following paths to initiate a withdrawal request:

1. On the home page of your account, click on the "Withdraw" shortcut button to initiate a withdrawal request directly from your account. /2. In the main toolbar at the top of the account homepage, click "Transfer & Pay" and select Transfer Fund > Make a Withdraw to enter the withdrawal page.

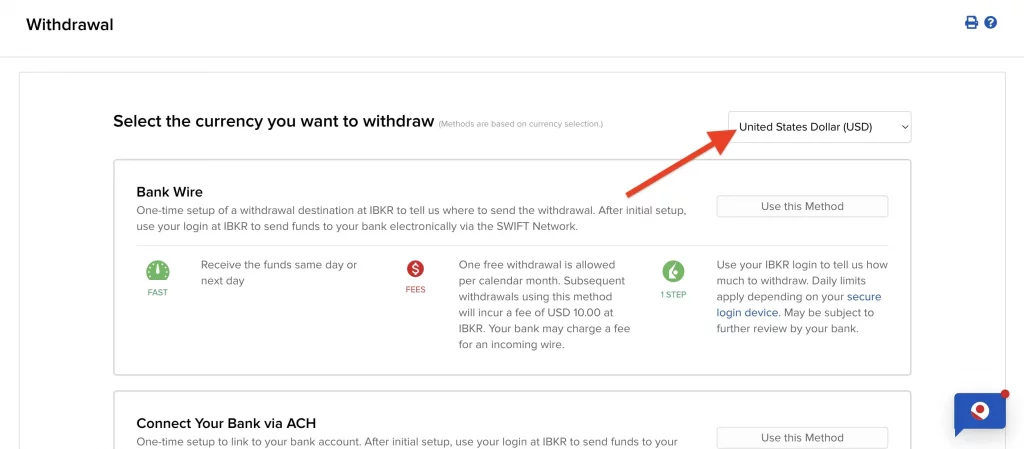

Step 2: Choose the currency of remittance

We support remittance of USD, SGD, HKD, AUD, JPY, GBP, offshore RMB and other currencies, you can choose according to your needs.

Here we choose "Singapore Dollar (SGD)".

Note that the currency you want to deposit must match the cash asset type of Interactive Brokers. For example, if you want to deposit SGD, you must have SGD in your Interactive Brokers account. You can use Interactive Brokers' built-in currency exchange feature to exchange funds.

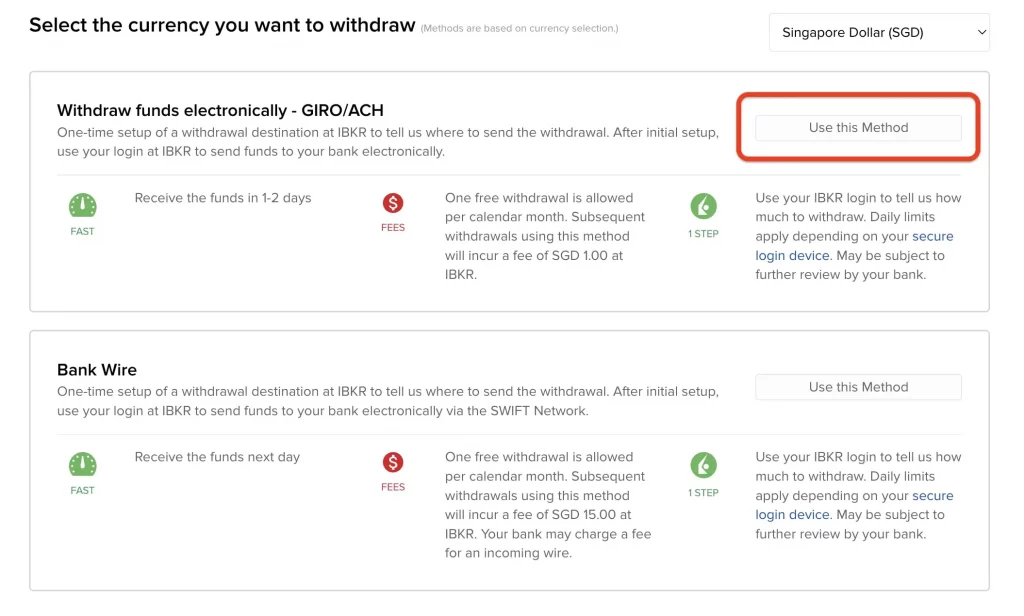

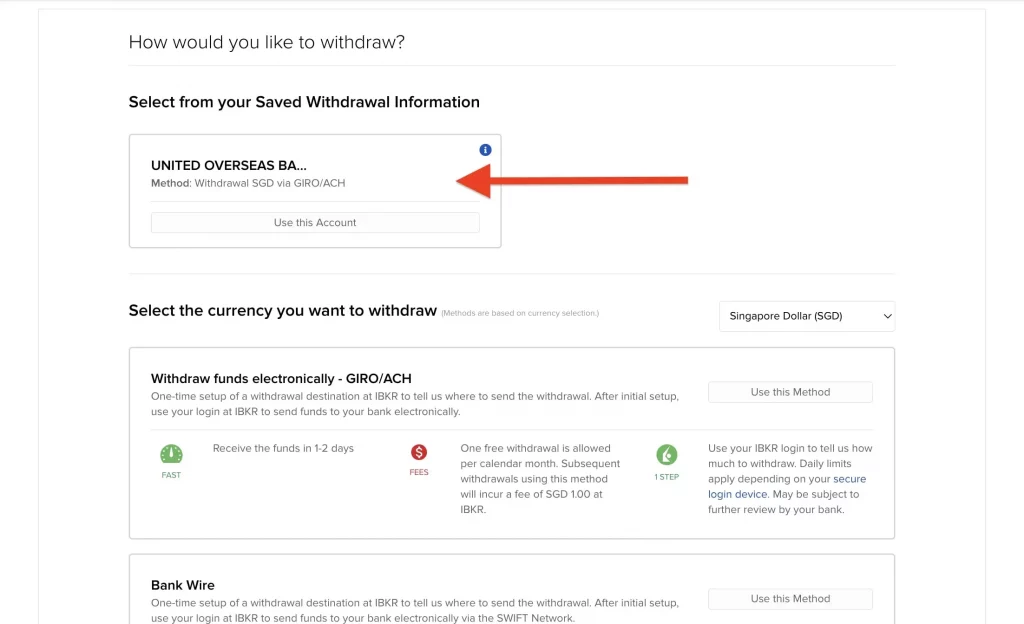

Step 3: Choose a withdrawal method

There are two ways to withdraw SGD: ACH/GIRO and Bank Wire.

Here we choose "ACH/GIRO", which is a direct remittance to a Singapore bank.

If you want to send SGD to a non-Singapore bank, you can choose "Bank Wire".

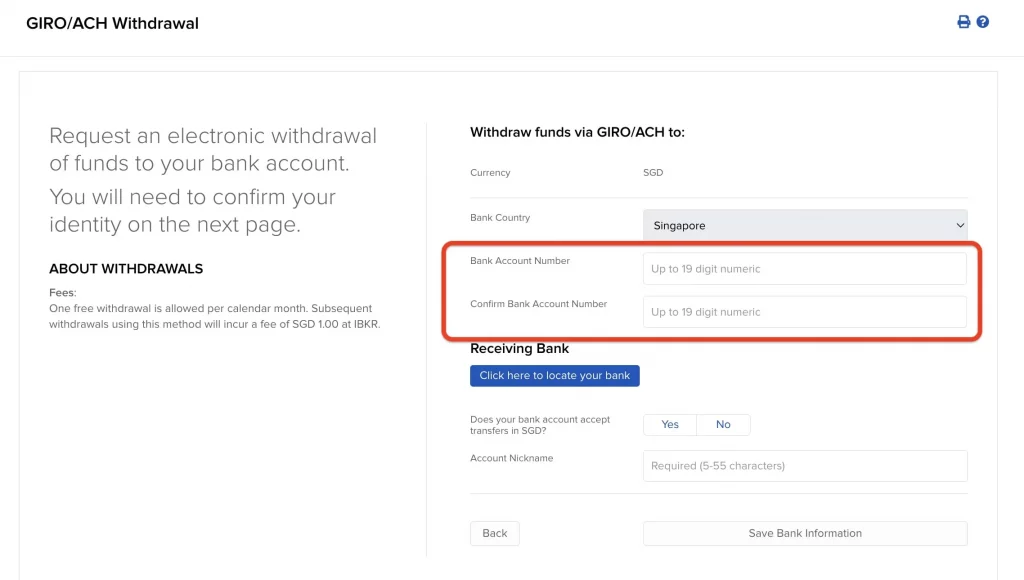

Step 4: Setting up bank details (first withdrawal)

The first time you make a withdrawal from Interactive Brokers, you must set up your bank details. If you are making a withdrawal in a different currency, you will also need to set up new bank details.

Fill in the account number of the receiving bank for this withdrawal.

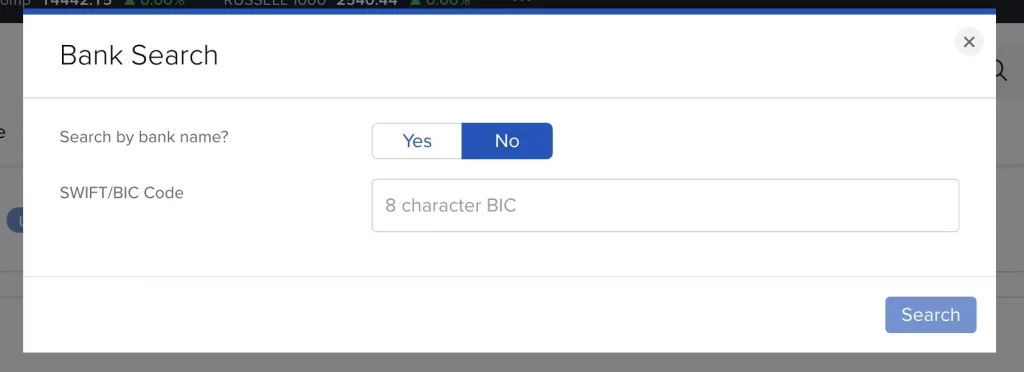

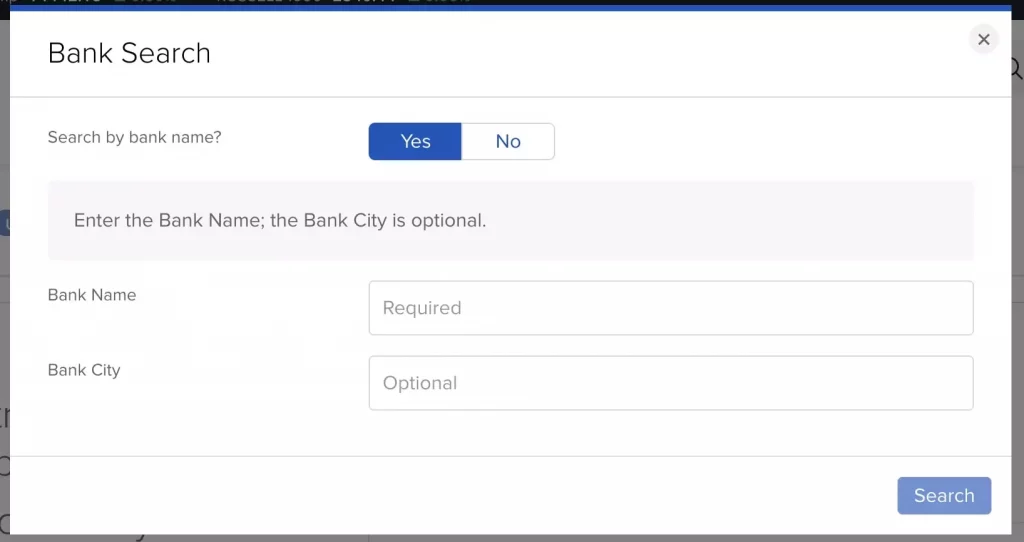

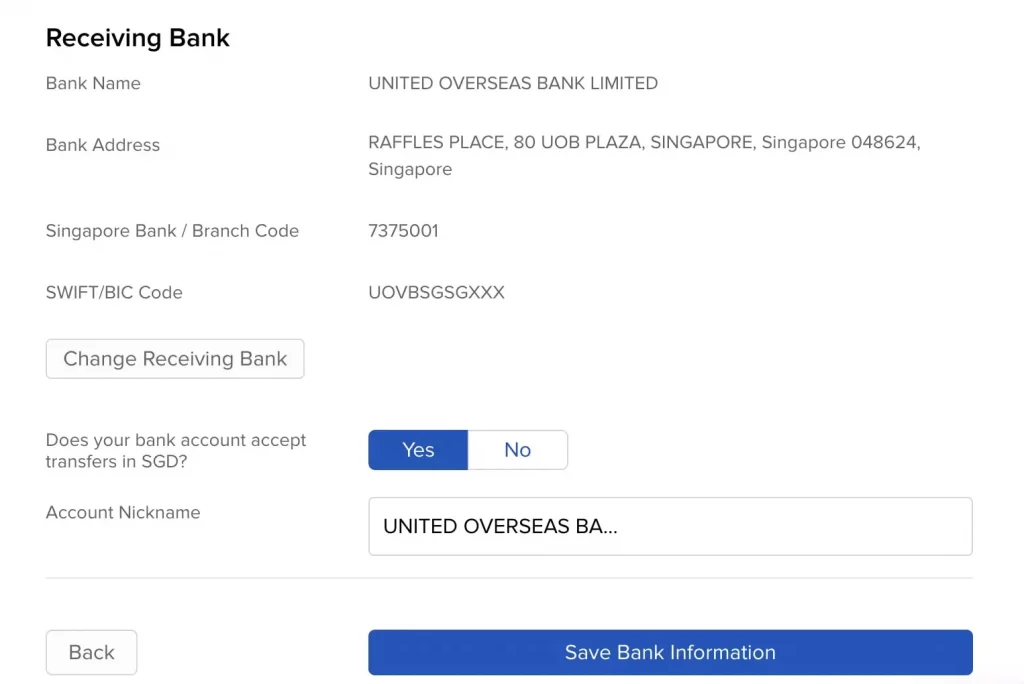

Under "Receiving Bank", click "Click here to locate your bank" to select the receiving bank, e.g. UOB Singapore, CIMB Singapore, you can choose to use "SWIFT/ BIC Code" or "Bank Name" as your bank name. You can choose to confirm the beneficiary bank by "SWIFT/BIC Code" or "Bank Name".

You can check your bank's SWIFT Code on the bank's website or ask the bank's customer service.

Does your bank account accept transfers in SGD?

The system will need to confirm if your receiving bank account can accept transfers in SGD, click Yes.

If you are using a wire transfer to a non-Singaporean bank, such as Maybank Malaysia, it is recommended that you check with your bank account to see if it can accept funds in SGD to avoid having your funds reversed.

For Account Nickname, enter any reference information.

Once you have filled in the information, click "Save Bank Information" to save the account information.

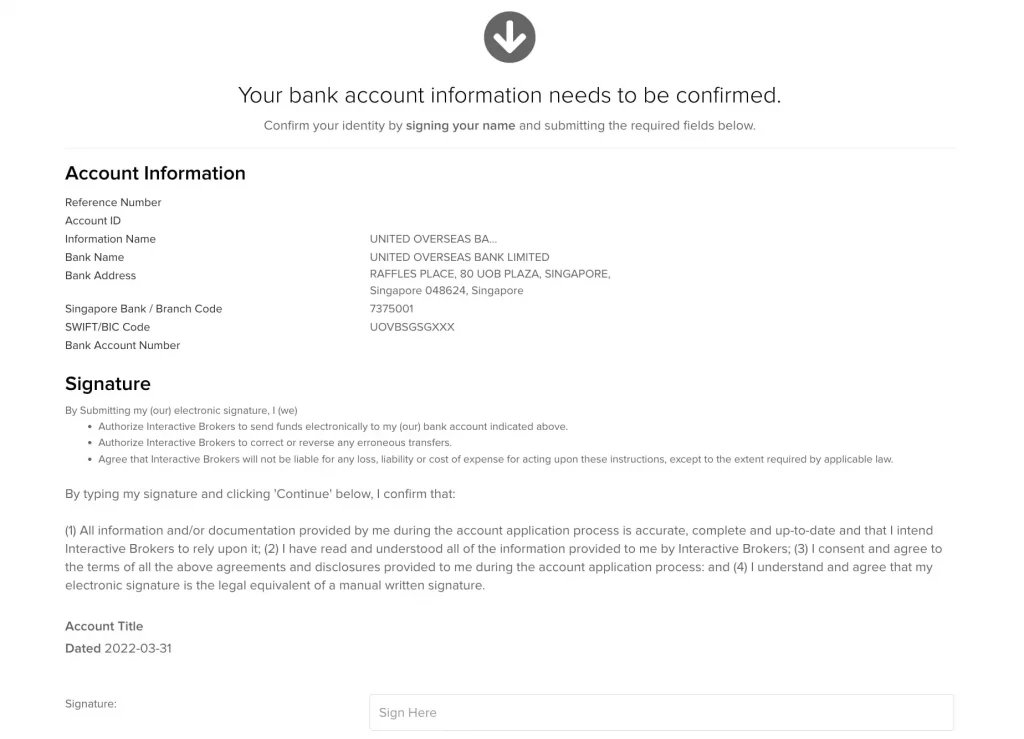

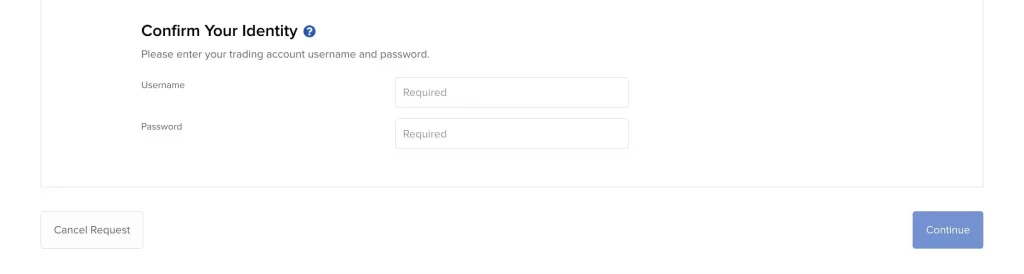

On the next page, after checking your bank account information, sign your full name in English at the bottom to indicate that you agree to all withdrawal terms and conditions, and enter your username and login password.

When finished, click "Continue" to proceed to the next step.

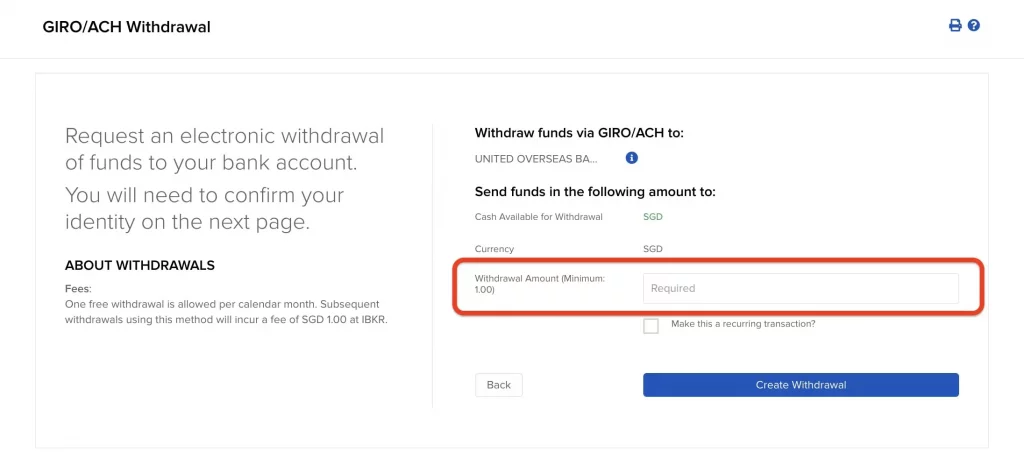

Step 5: Fill in the withdrawal amount

Continue to the next step, fill in the withdrawal amount.

Choose the bank to which you want to withdraw funds, the system will display the saved bank account, click "Use This Account" to transfer funds to this bank.

If you need to add another bank account, click "Use this Method" in the option column of the withdrawal method and repeat the previous action of setting bank information.

On the withdrawal information page, the system will show you the currency you have chosen to withdraw and how much cash you can withdraw.

The minimum withdrawal amount is S$1. Interactive Brokers charges a fee of S$1, which is deducted from the withdrawable cash amount. There is one free withdrawal per month.

Fill in the Withdrawal Amount according to your needs and click "Create Withdrawal" to proceed to the next step.

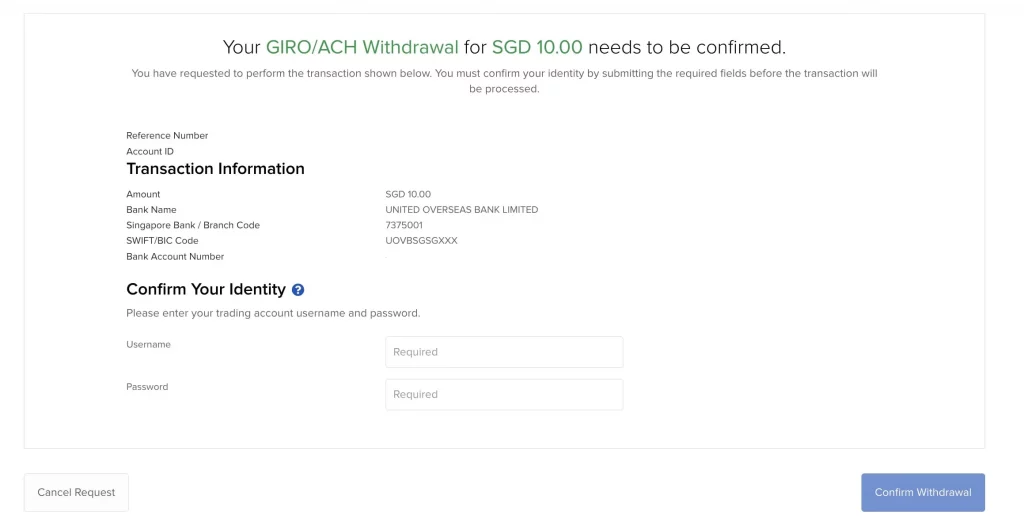

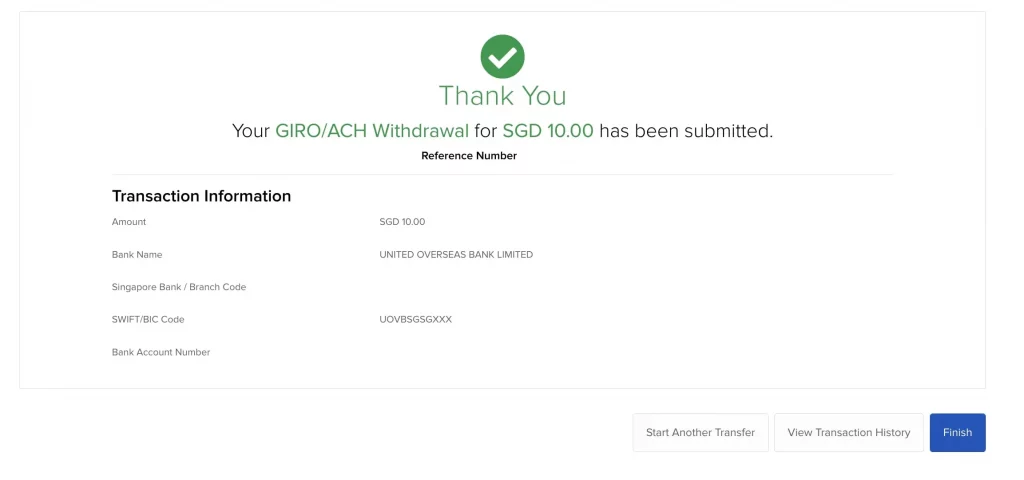

Step 6: Confirm Withdrawal Information and Submit Application

Confirm the withdrawal information, enter your user name and login password to confirm the withdrawal application, and finally click "Confirm Withdrawal" to complete the withdrawal application.

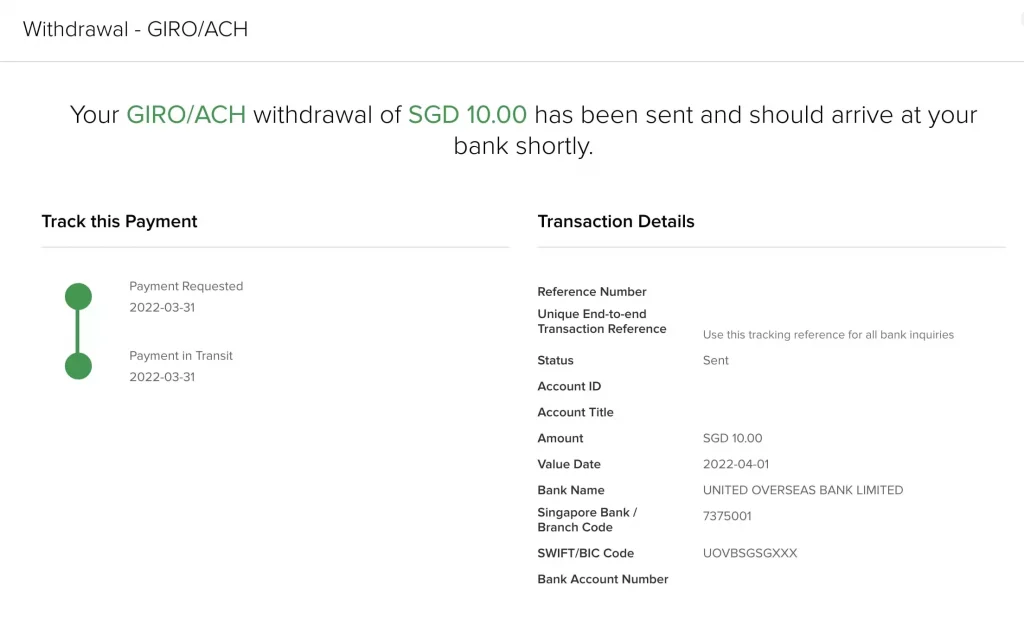

Step 7: Successful withdrawal, receive notification

The withdrawal takes between 1 and 3 business days depending on the processing bank. You will receive an email notification from Interactive Brokers when your withdrawal is successful.

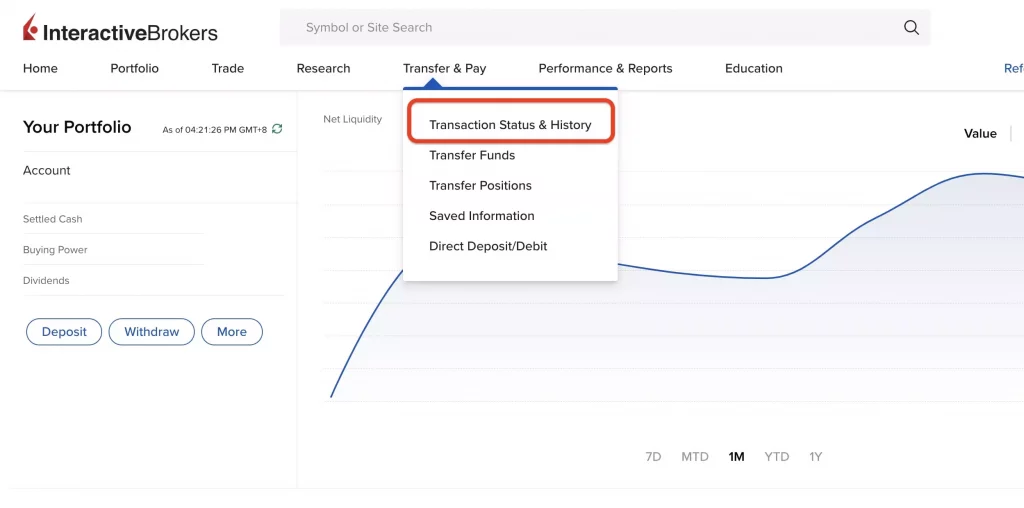

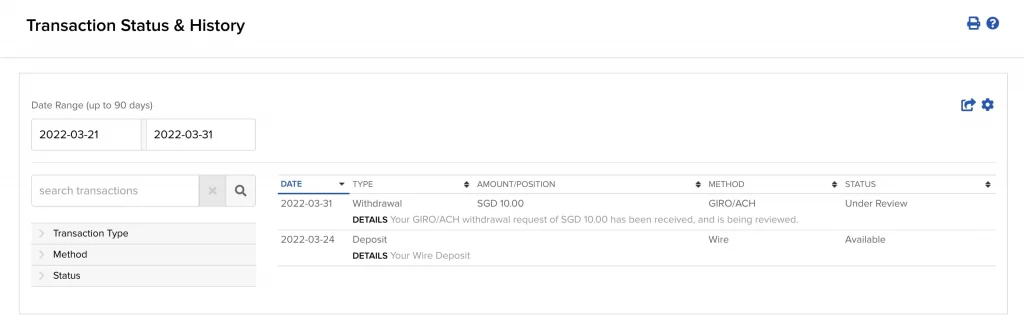

Transaction Status Inquiry

To view your withdrawal history, click Transfer & Pay > Transaction Status & History on the main toolbar at the top of your account homepage to see the status of all withdrawal requests or cancel them.

SUMMARY

Below is the complete withdrawal process for Interactive Brokers, which is very easy and quick, taking less than 5 minutes to complete. Interactive Brokers offers a free withdrawal request once a month, so you can take advantage of this free withdrawal opportunity.

If you choose to withdraw by wire transfer, due to the high fees associated with it, we recommend that you withdraw a larger amount to ensure a better value for money. Often, banks will routinely call users to find out the source of the money whenever a larger amount is wired into the account. Therefore, we recommend that you prepare an investment account statement in advance so that you can provide proof of the source of funds when asked. This step will help ensure a smooth withdrawal process.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.