Bank of Malaysia (Public Bank) to TD Ameritrade tutorial

This article will show you how to transfer money from a Malaysian bank to your TD Ameritrade investment account and how to transfer money from TD Ameritrade to your bank.。

What's new: TD Ameritrade Singapore wants to focus on servicing Accredited Investors and will stop providing investment services to Retail Investor from December 2023。If you are not an Accredited Investor, you do not meet the conditions for opening an account with TD Ameritrade Singapore, and it is recommended that you open an account with another brokerage firm.。

After successfully opening an account with TD Ameritrade (Demerit Securities), the user then needs to invest in an investment account to start trading stocks, ETFs and other financial derivatives listed on the U.S. trading market.。

This article will show you how to transfer money from Public Bank to TD Ameritrade's investment account and how to transfer money from TD Ameritrade to your bank.。We will attach a multi-graphic deposit and withdrawal steps, deposit and withdrawal fees and their considerations, including.

◇ TD Ameritrade's Deposit and Payment Methods ◇ TD Ameritrade Deposit and Payment Precautions ◇ TD Ameritrade Deposit and Payment Complete Step Teaching ◇ TD Ameritrade Deposit and Payment Expenses ◇ TD Ameritrade Deposit and Payment Arrival Time

The teaching content of this deposit and payment is recommended for reference by Malaysian users.。

How to Earn Gold to TD Ameritrade?

TD Ameritrade has a branch in Singapore and is primarily responsible for operations in Southeast Asia。Therefore, all new horse registered users will be handled by TD Ameritrade Singapore branch, the transfer of funds will also be based in Singapore.。

TD Ameritrade main deposit method:

◇ DBS / POSB electronic transfer

◇ Check deposit

Bank International Wire Transfer (Wire)

TD Ameritrade only supports user transfers to USD。

TD Ameritrade does not charge users a deposit fee, but the remittance bank used by the user, as well as TD Ameritrade's receiving bank, charges a wire transfer fee。

Which deposit method to choose?

If you are a Singaporean or a Malaysian working in Singapore and have a DBS / POSB bank account, you can directly use DBS / POSB to transfer funds to TD Ameritrade's DBS bank account。

However, Malaysian users do not have DBS / POSB bank accounts, and Malaysians cannot open DBS / POSB bank accounts.。In addition, TD Ameritrade only accepts cheques from Singapore banks to remit funds to Singapore branches.。

Therefore, the use of bank wire transfer (Wire Transfer) is the most suitable for Malaysian users who do not have a Singapore account.。Although the cost of a local bank wire transfer will be slightly higher, it is the most convenient method for Malaysian users and the deposit time is also faster.。

TD Ameritrade Deposit Considerations

1. You can deposit money only after you have successfully opened an account.

2, TD Ameritrade will not charge a deposit fee, but the sending bank will charge a wire transfer fee, and TD Ameritrade's receiving bank will charge a $25 fee.。3. In order to prevent money laundering activities, TD Ameritrade does not accept third-party banks or payment platforms (such as Wise), but only accepts bank accounts with the same name as TD Ameritrade accounts to initiate deposits.。

TD Ameritrade Gold Entry Process Teaching

Next, we'll go into more detail in a multi-graphic format on how to use Bank of Malaysia to wire money into a TD Ameritrade investment account.。

Users need to obtain deposit instructions through TD Ameritrade's official website first.。The following teaching will be TD Ameritrade mobile phone version of the official website, English interface, about 10 minutes to complete the gold action。However, when using online banking for wire transfers, you need to use a computer because the mobile app is not available for wire transfers.。

Bank international wire transfer (TT) deposit process

Illustrated by Public Bank Malaysia

◇ Applicable object: have a Malaysian bank account ◇ Handling fee: TD Ameritrade's handling fee is 0 yuan, the remittance bank, the receiving bank charge fees ◇ Arrival time: 1 to 3 working days ◇ Arrival currency: USD (USD)

Step 1: Log on to the TD Ameritrade website

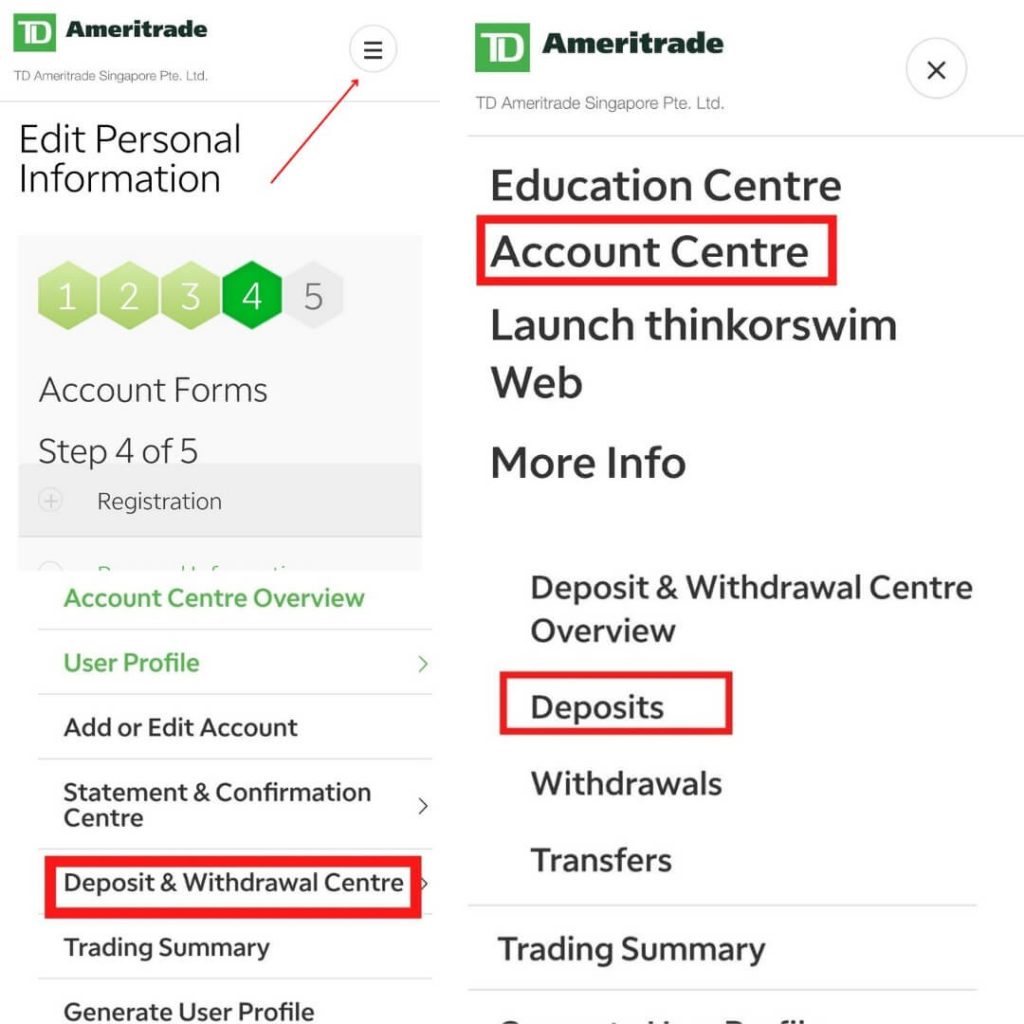

Log in to TD Ameritrade official website with your mobile phone > click on the upper right corner option > Account Centre > Deposit & Withdrawal Centre > Deposits

Step 2: Select a remittance method and obtain wire transfer information

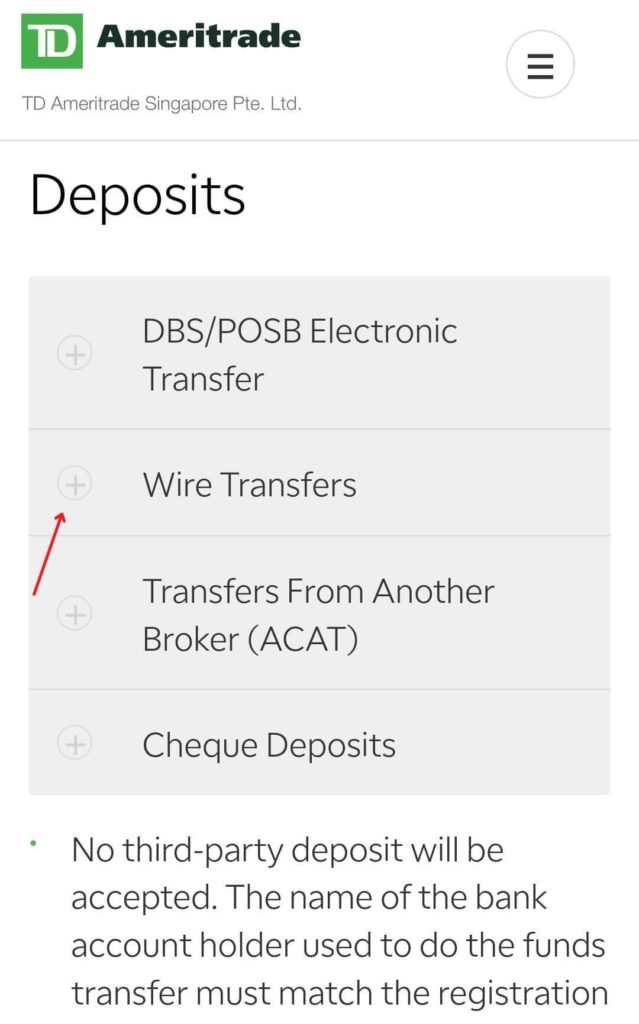

Choose the remittance method we want - "Wire Transfer"

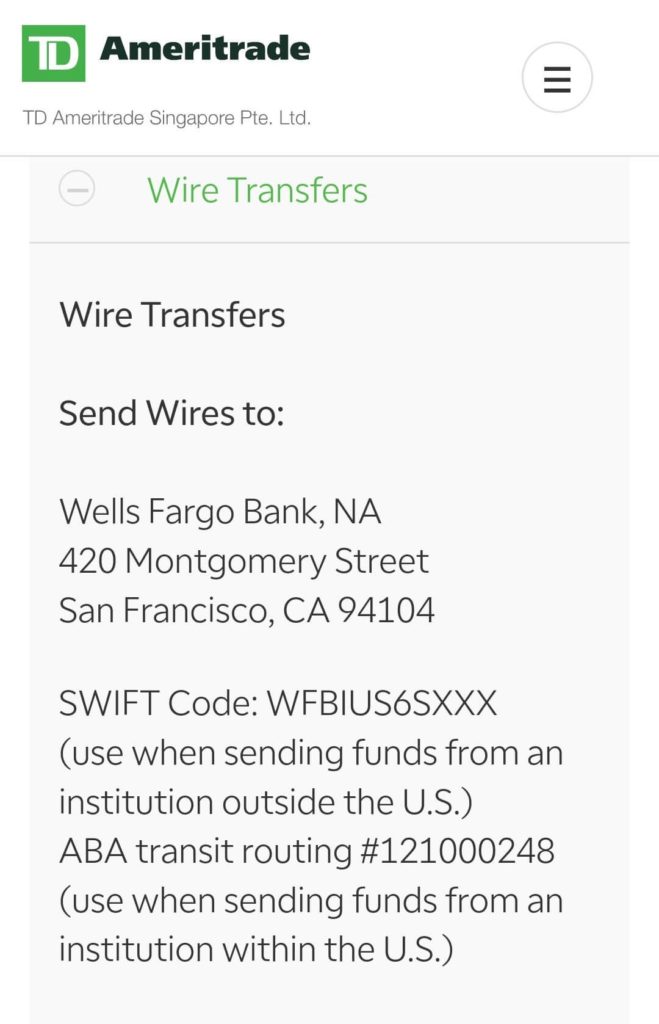

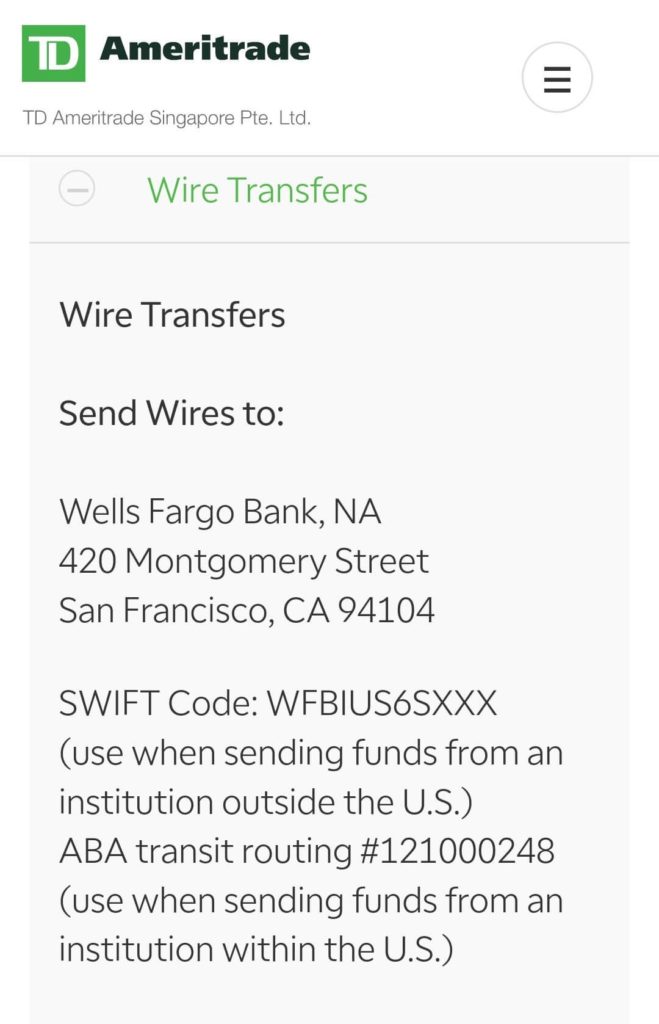

Then, the system will display the information that needs to be entered when transferring funds, including the receiving bank, the receiving bank SWIFT Code, ABA Routing Number, the payee's name, address, bank account number, and Payment Reference.。

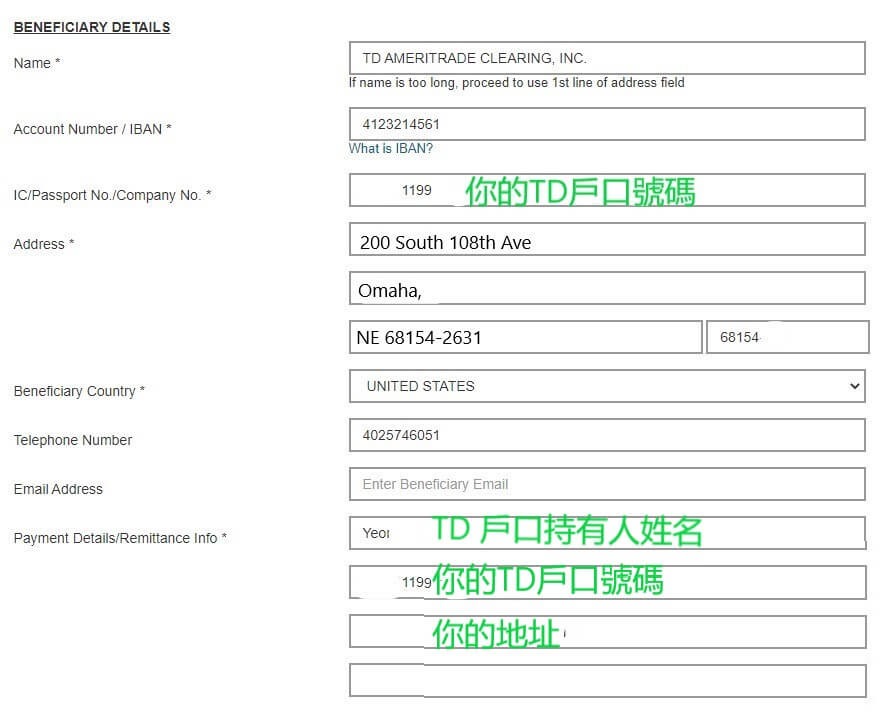

Note: Payment Reference (remittance note) is the basis used by brokers to distinguish and reconcile the source of funds, you need to fill in your name, TD Ameritrade account number, and address in the note.。

These are the information you need to fill in when making a remittance, and it is recommended that you keep this page open until you complete the bank wire transfer; or copy the following remittance information in your phone's notebook for the convenience of filling in when making a remittance。

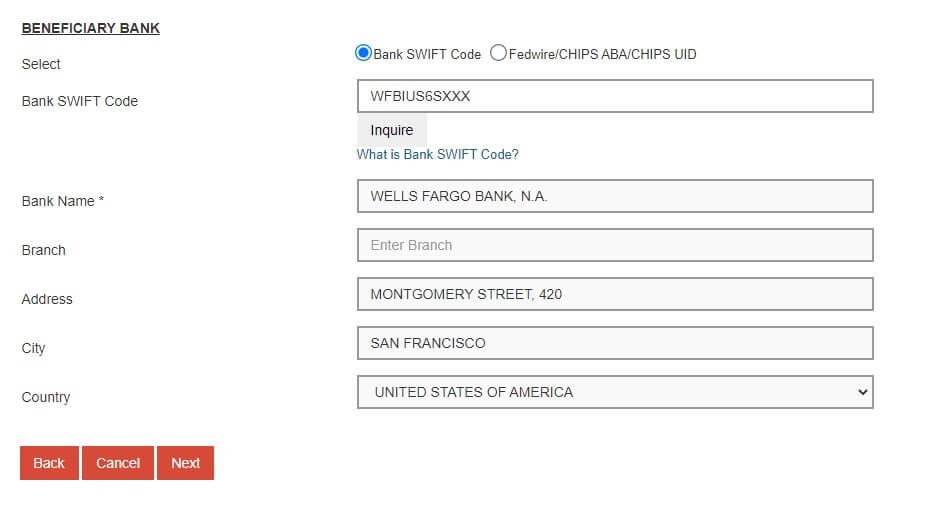

Beneficiary Bank:Wells Fargo Bank, NA

SWIFT Code:WFBIUS6SXXX

ABA Transit Routing:121000248

Branch Address Line 1:420 Montgomery Street

Branch Address Line 2:San Francisco, CA 94104

Beneficiary Name:TD Ameritrade Clearing, Inc.

Beneficiary Address Line 1:200 South 108th Ave.

Beneficiary Address Line 2:Omaha, NE 68154-2631

Account Number: 4123214561

Step 3: Make a Malaysian Bank Wire Transfer

Next, we can use online banking (e-Banking), or wire transfer to the bank counter / ATM.。

We will demonstrate the wire transfer process using Public Bank Online Banking (computer version of the web page).。Other banks have similar wire transfer processes.。

Log in to Public Bank Online Banking > Click on Fund Transfer > Foreign Remittance > Telegraphic Transfer > ️ Agree to the Regulations and Terms, click on "Accept" to go to the next step。

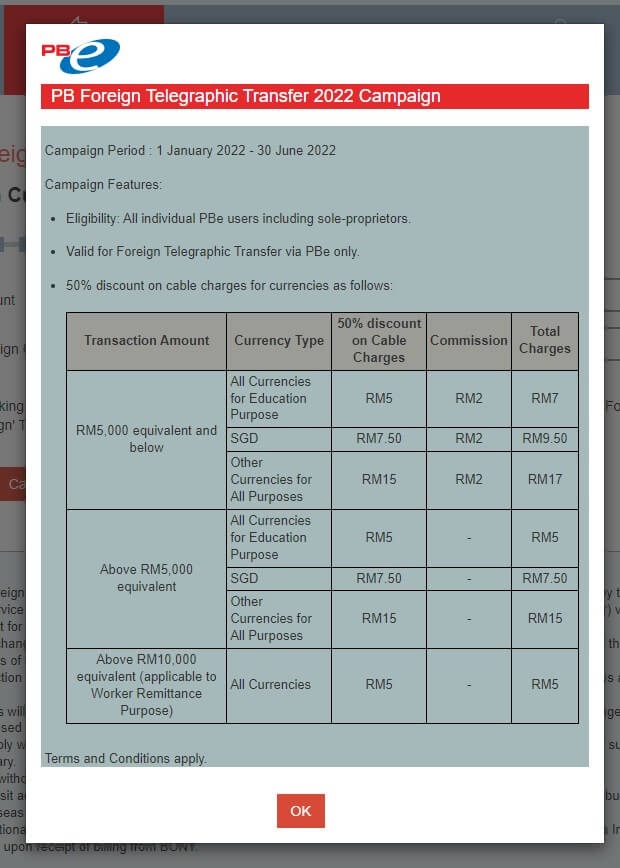

Before entering the wire transfer page, the system displays the wire transfer offer of Public Bank in the first half of 2022, as long as the use of Public Bank wire transfer between January 2022 and June 2022, you can enjoy a 50% discount on postage (Cable Charges)。Click "OK" to proceed to the next step。

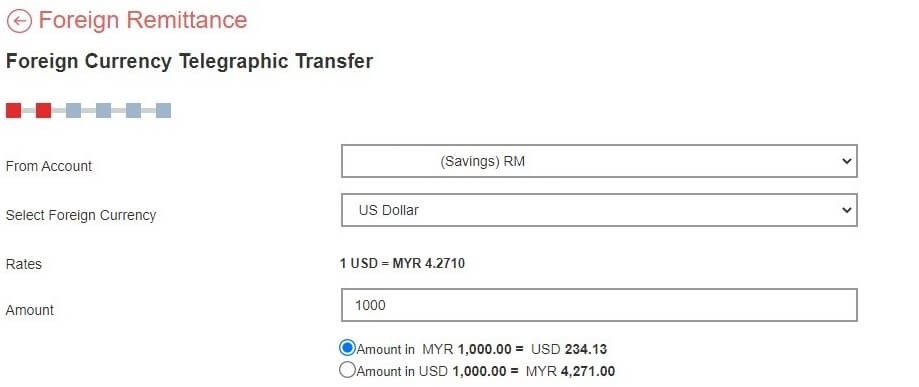

Enter the wire transfer page, select the bank account for the remittance, select US Dollar in the currency of receipt (Foreign Currency), and enter the wire transfer amount (Amount)。

The system will provide 2 amount options: remit the specified amount in ringgit, or the specified amount in US dollars, which can be selected according to individual needs.。Here I choose to remit the specified amount in ringgit.。

◇ Amount in MYR 1,000.00 = USD 234.13

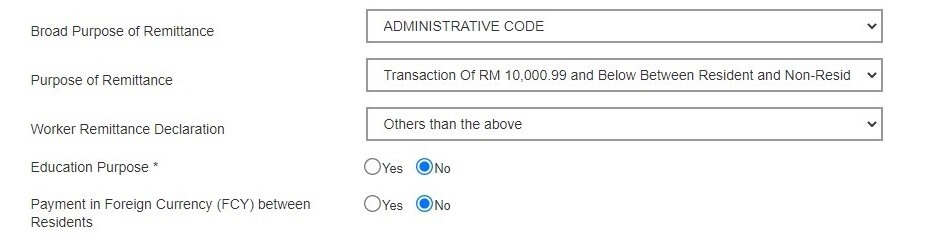

Then, declare the purpose of this wire transfer.。

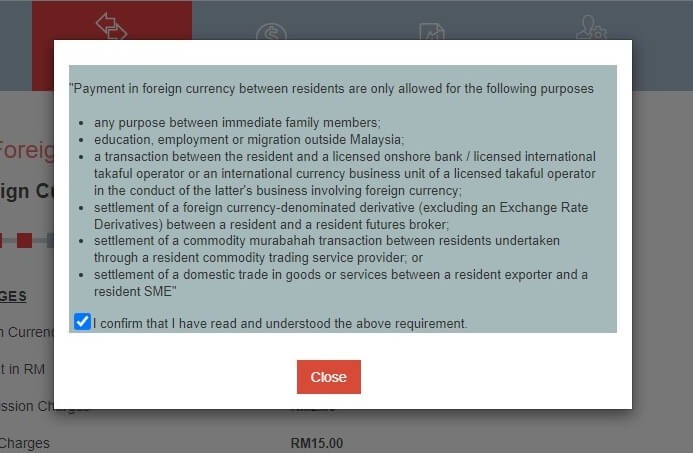

◇ Broad Purpose of Remittance Choose "Administrative Code" ◇ Purpose of Remittance Choose "Transaction Of RM10000.99 and Below Between Resident and Non-Resident "◇ Worker Remittance Declaration Choose" Others than the above "◇ Education Purpose Choose" No "◇ Payment in FCY between Residents Choose" No "

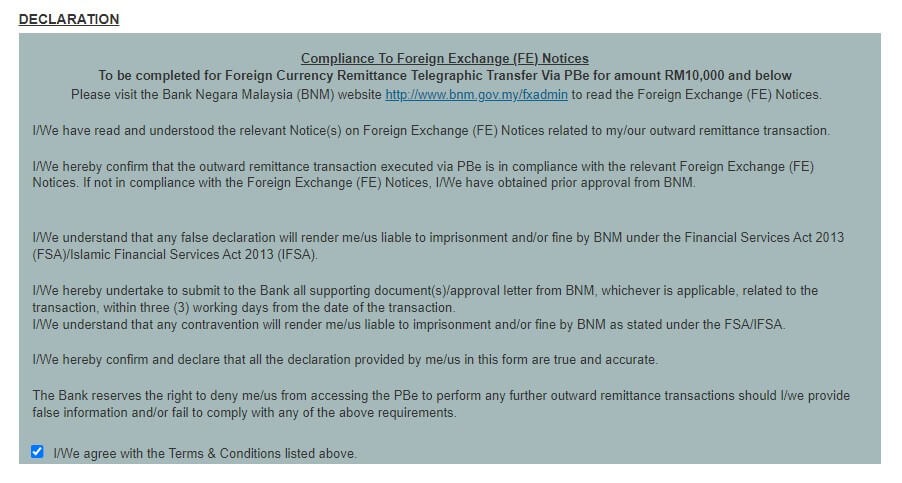

Consent to Regulations and Terms

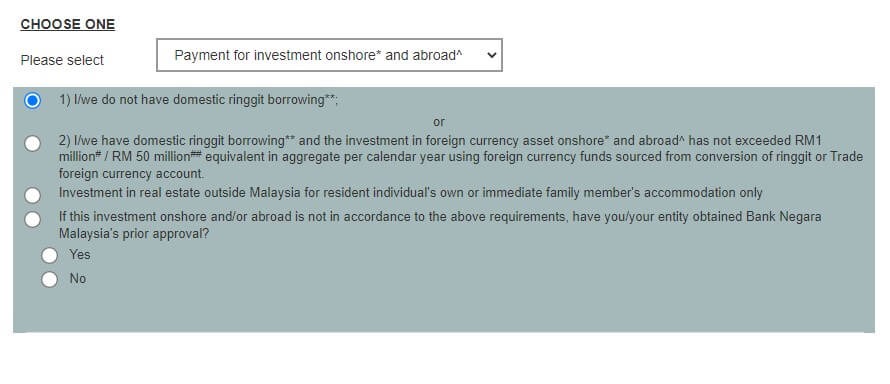

Next, select "Payment for investment onshore * and abroad ^"。

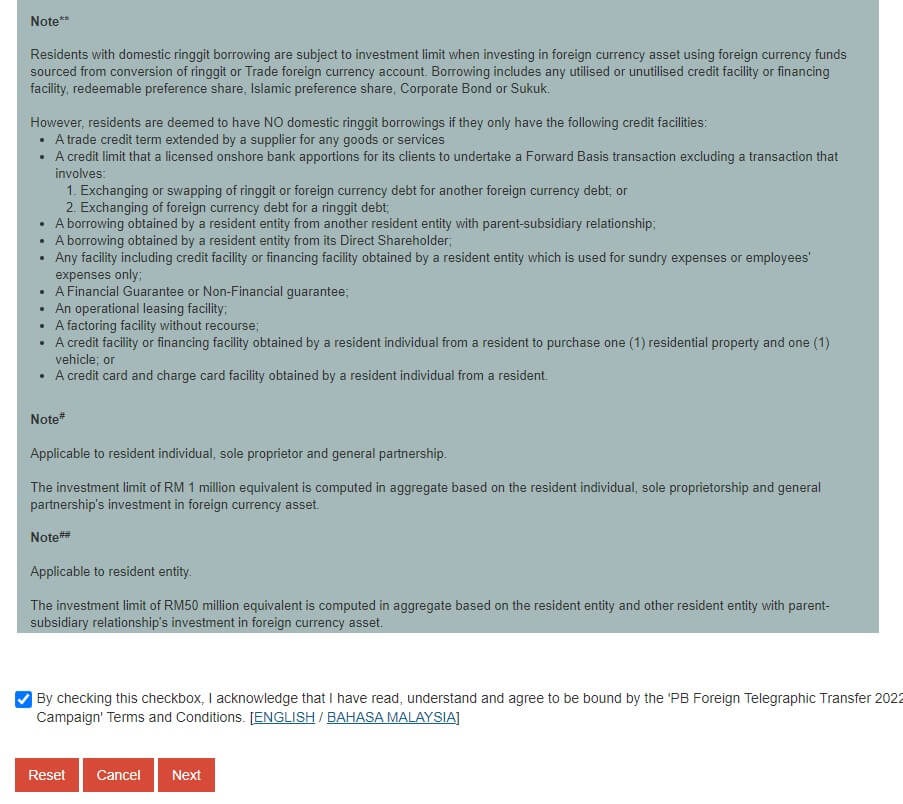

Subsequently, declare on a personal basis whether any domestic Ringgit Borrowing is involved (Domestic Ringgit Borrowing)。According to the regulations of the National Bank of Malaysia, basically if you have more than one home loan and one car loan, or if you have an education loan, you are involved in domestic Ringgit Borrowing (Domestic Ringgit Borrowing).。

If no Domestic Ringgit Borrowing is involved, select 1);

If it involves Domestic Ringgit Borrowing and the total value of your overseas investment does not exceed one million ringgit, choose 2)

Finally, you agree to the Regulations and Terms and click "Next" to go to the next step.。

To understand the above rules, click "Close"。

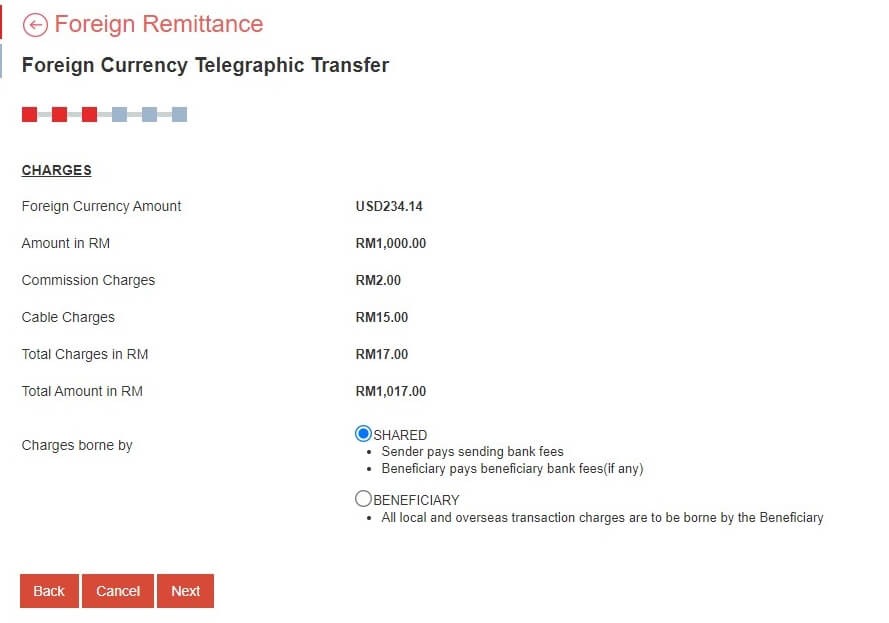

After confirming the amount of the wire transfer and the handling fee, click "Shared" (co-payment procedure for the remitter and the payee).。

Click "Next" for the next step。

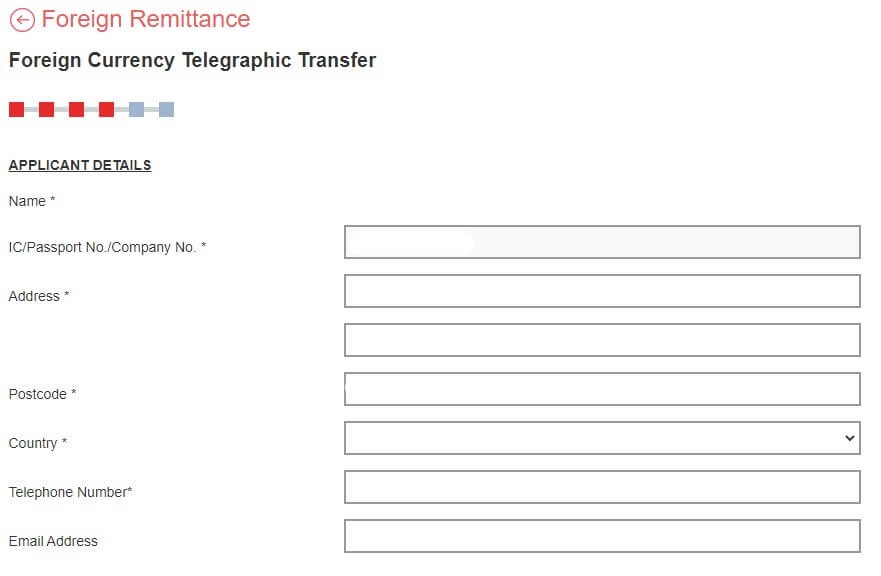

In the next steps, fill in the personal information of the sender (yourself)。

Fill in the payee information (according to TD Ameritrade wire transfer information)。

Note, fill in your TD Ameritrade 9-digit account number at IC / Passport No / Company No.。

Fill in the payee's bank information (according to TD Ameritrade's wire transfer information)。

After completing, click "Next" to go to the next step。

The system will then display the information you filled in.。After confirming that all information is correct, click "Request PAC Now"。After receiving the PAC, enter it into the grid and click "Confirm" to complete the transfer。Remember the screenshot or download the remittance voucher (Receipt)。

Step 4: Wire transfer successfully to the account, complete the deposit

It usually takes 1 to 3 working days for wire transfer to be transferred to your thinkorswim investment account.。You can go to thinkorswim to see if the funds have arrived.。If you have not received a notification for more than 3 working days, it is recommended to contact TD Ameritrade customer service as soon as possible。

What is the cost of wire transfer??

This wire transfer costs a total of 3 items:

Expense Details |

Amount |

Receiving Party |

Commission (Commission Fee) |

2 ringgit |

Public Bank |

Postage (Cable Charges) |

15 ringgit |

Public Bank |

Collection Fee (Wire Fee) |

15美元 |

Wells Fargo (receiving bank) |

-- wire transfer fee details

This time the team only measured the deposit of 1,000 ringgit at Public Bank's exchange rate (1 ringgit = 0.23414), 1000 ringgit to USD is 234.$14, while the final amount to the account was only 219.$14, a difference of $15。So, this $15 is the collection fee (Wire Fee) levied by the Wells Fargo receiving bank.。

My TD Ameritrade Gold Experience

This time, the electricity remittance will arrive in only one working day.。The SSF team actually applied for a deposit on Thursday afternoon and found the funds on the thinkorswim platform the next morning.。

Compared to other brokers that support Wise's deposit, such as Tiger Brokers and moomoo, the cost of using a wired deposit to TD Ameritrade is relatively high。We suggest that you should deposit more money, at least RM5000 per deposit, so as to reduce the cost of wire transfer fees。

How to withdraw gold from TD Ameritrade?

TD Ameritrade only accepts wire transfers。

Below we will share the payment to the bank account by wire transfer.。

Applicable object: have a Malaysian bank account

◇ Handling fee: TD Ameritrade's handling fee is $25, which is charged by the remitting bank and the receiving bank.

Arrival time: 1 to 3 working days

◇ Currency of arrival: Malaysian ringgit (MYR)

TD Ameritrade Payment Considerations

1, there is no minimum amount of payment requirements.

2, can only be paid to the personal bank account (must be the same name as the brokerage account)

3. TD Ameritrade does not accept payments to third-party accounts / payment platforms.

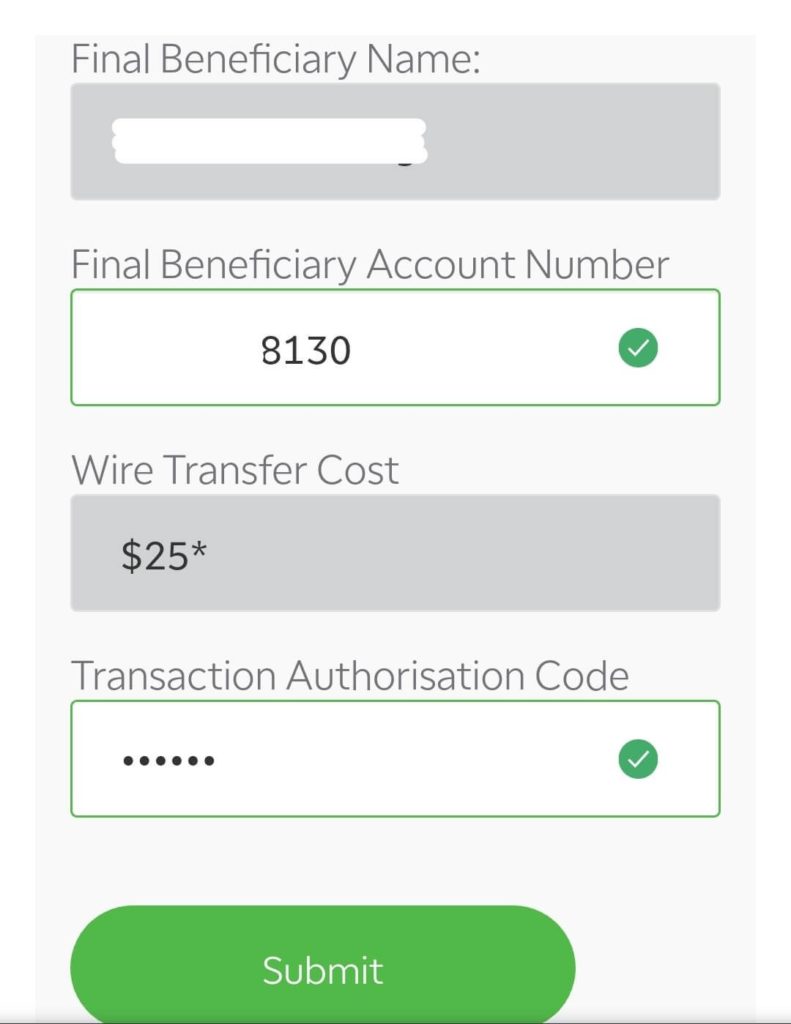

4, TD Ameritrade will levy a $25 fee.

5, prepare the statement of the receiving bank.

TD Ameritrade cash flow teaching (with diagram)

Step 1: Log on to the TD Ameritrade website

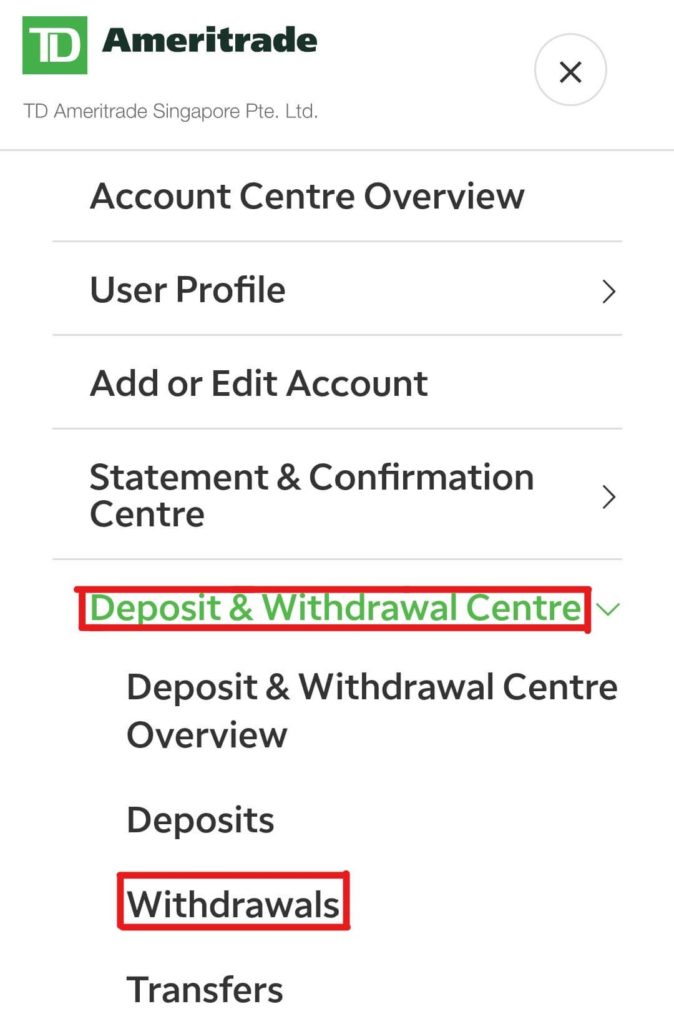

Log in to TD Ameritrade official website with your mobile phone > click on the upper right corner option > Account Centre > Deposit & Withdrawal Centre > Withdrawal

The second step: choose the way to pay

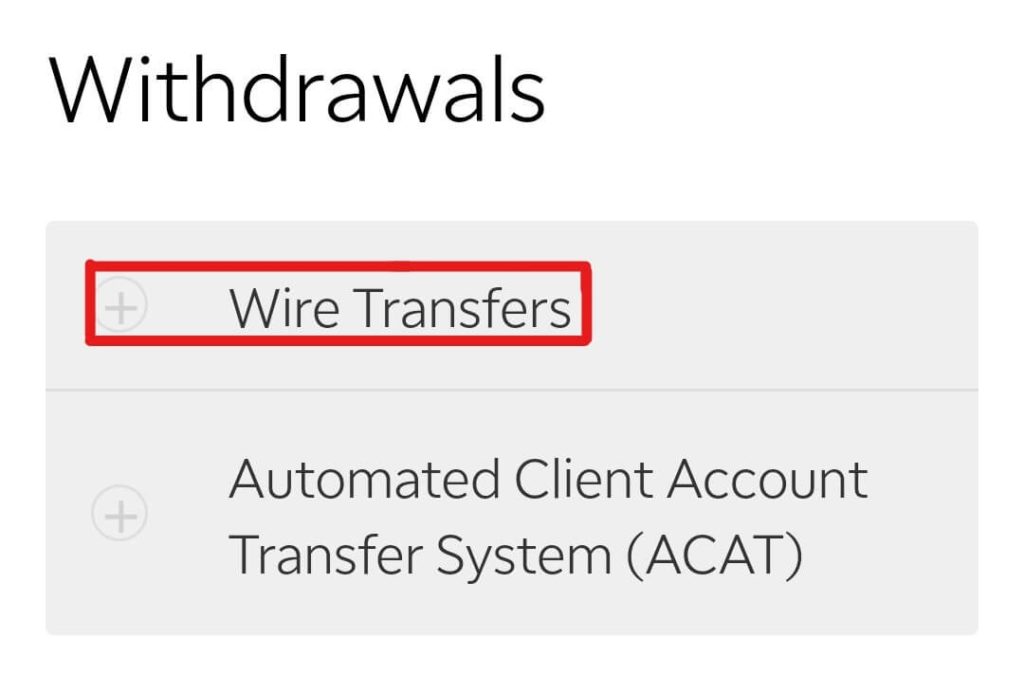

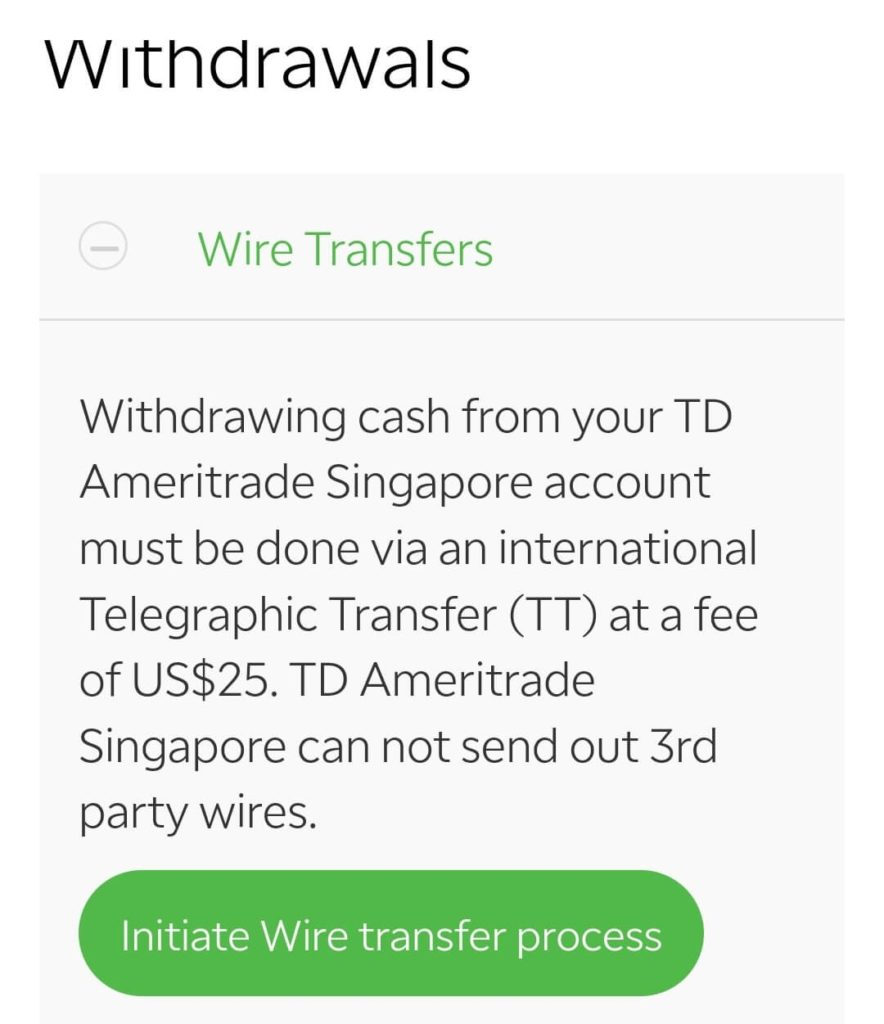

Select Wire Transfers, and after reading the wire transfer notes, click "Initiate Wire Transfer Process" to start the payment.。

Step 3: Fill in the remittance bank information

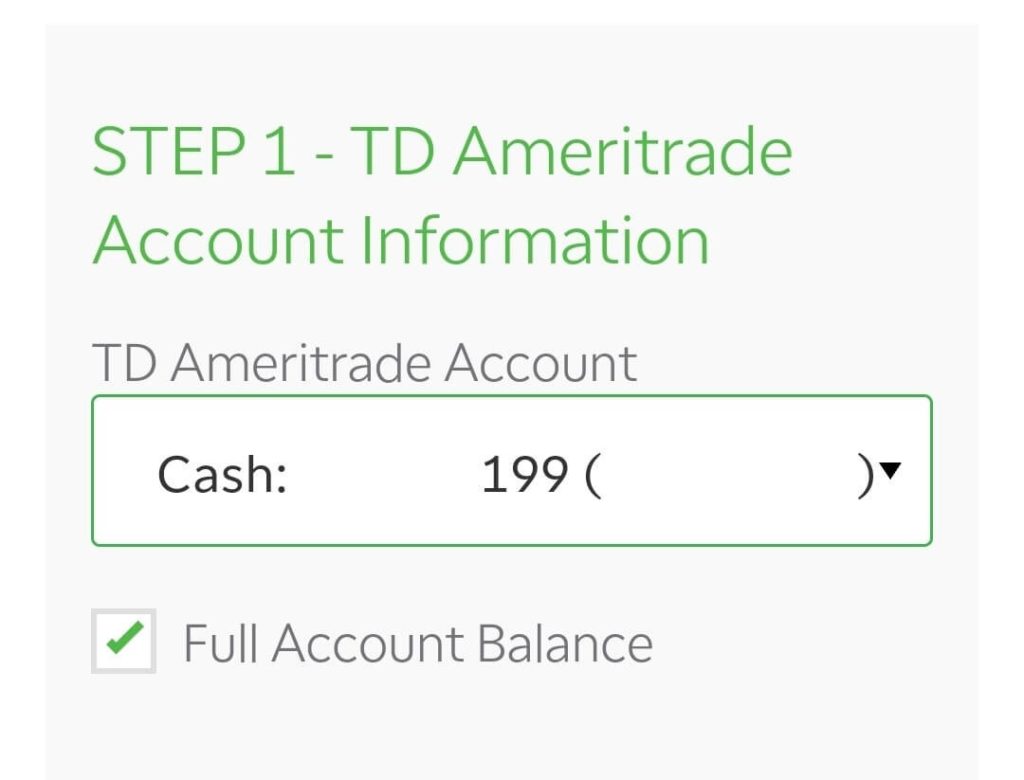

Select the investment account you want to pay out.。Next, if you want to pay the full amount in your account, ️ Full Account Balance。

If your bank is a non-US bank, on the side ✓ ️

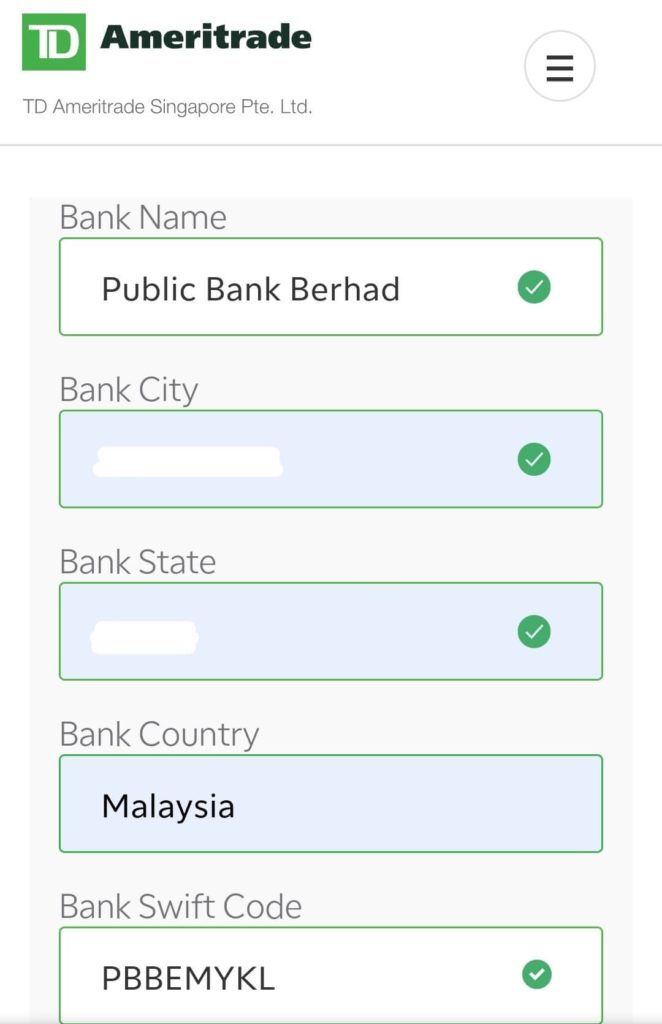

Fill in the name of the payee bank, branch city, state, country, and SWIFT Code。

Bank SWIFT Code can be found on the bank's official website, or ask the bank's customer service。

If your bank account does not have an intermediate beneficiary, you do not need to

Fill in your (bank account holder's name), bank account number, and transaction authorization code。

Click "Submit" to complete the withdrawal process。

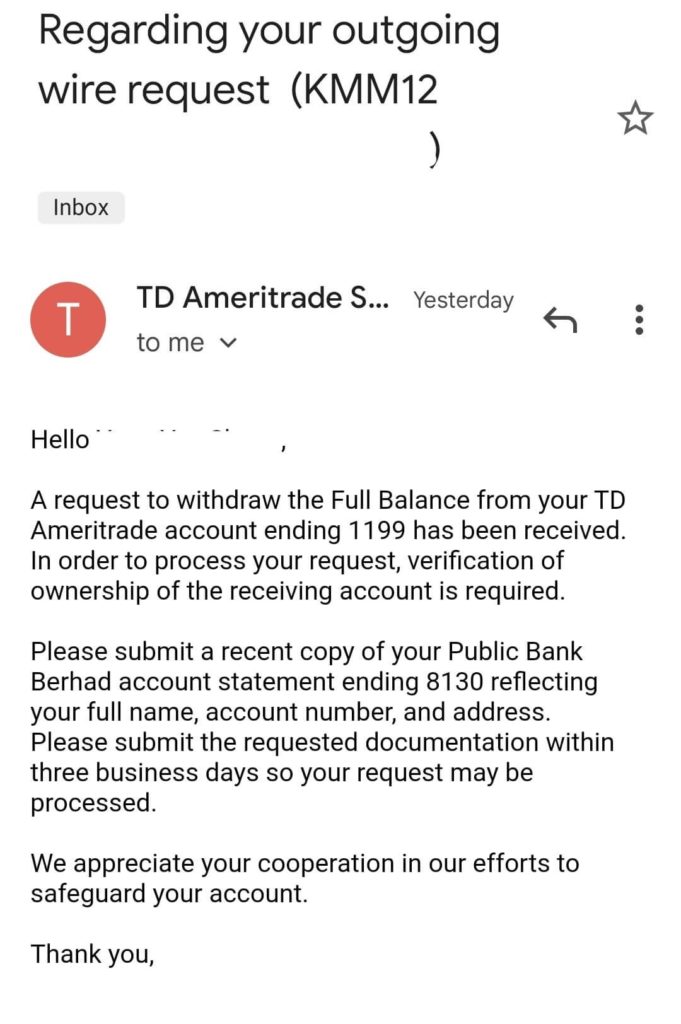

Step 4: Submit bank statements to TD Ameritrade

TD Ameritrade needs to confirm that the bank account for this payment collection belongs to an individual.。So you need to submit your bank statement (showing your name, account number and address)。

The fifth step: the success of the gold

The time required for disbursement is 2 to 4 business days, depending on the processing bank.。

What is the cost of wire transfer??

This wire transfer costs a total of 2:

| Expense Details | Amount | Receiving Party |

| Handling fee (Wire Fee) | 25美元 | TD Ameritrade |

| Commission (Commission Fee) | 5 ringgit | Public Bank |

-- wire transfer fee details

My TD Ameritrade Gold Experience

TD Ameritrade's cash-out process is fairly simple and takes less than 5 minutes to complete。It only takes 2 working days for the electricity remittance to arrive.。The SSF team applied for the money on Friday and received it on Monday.。

As above, TD Ameritrade will charge $25。The amount I paid this time is 212.At $37, the cost of the payment accounted for 11.77% of the withdrawal amount。Plus the receiving bank, Public Bank also has a RM5 fee.。Therefore, we suggest that a relatively large amount of money will be relatively cost-effective.。

SUMMARY

The above is the complete process of TD Ameritrade deposit and withdrawal.。The whole process is very simple, the deposit, the deposit to the account time is not long, generally 1 to 3 working days can be to the account。

For Malaysians who do not have a Singapore bank account, we can only use wire transfer for deposit and withdrawal, and the cost of wire transfer will be higher, it is recommended that you deposit, withdraw a larger amount of money, and do not frequently deposit, withdraw money so that it will be more cost-effective.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.