2024 M + Global Full Teaching

After successfully opening your M + Global account, you can deposit money into your investment account and start trading in the US and Hong Kong markets.。This article will use the M + Global App to demonstrate the process of depositing and withdrawing gold in English, and attach the relevant screenshots.。

After successfully opening the M + Global investment account, users can deposit money into the account and start trading financial derivatives such as stocks, Warrants, CBBCs, ETFs and REITs in the US and Hong Kong markets.。

This article will use the M + Global App to demonstrate the process of depositing and withdrawing gold in the Chinese interface, and attach the relevant screenshots.。The teaching content of deposit and payment is recommended for Malaysian users to use for reference, including:

○ M + Global's Complete Step Teaching of Gold Deposit and Gold Deposit

○ M + Global Notes on Deposit and Withdrawal

○ M + Global and M + Online Inter Transfer

M + Global deposit considerations

1.Users can only deposit money in Malaysian currency and must transfer money from a Malaysian bank account.。

2.The name of the deposit and withdrawal bank account must match the name of the M + Global account。

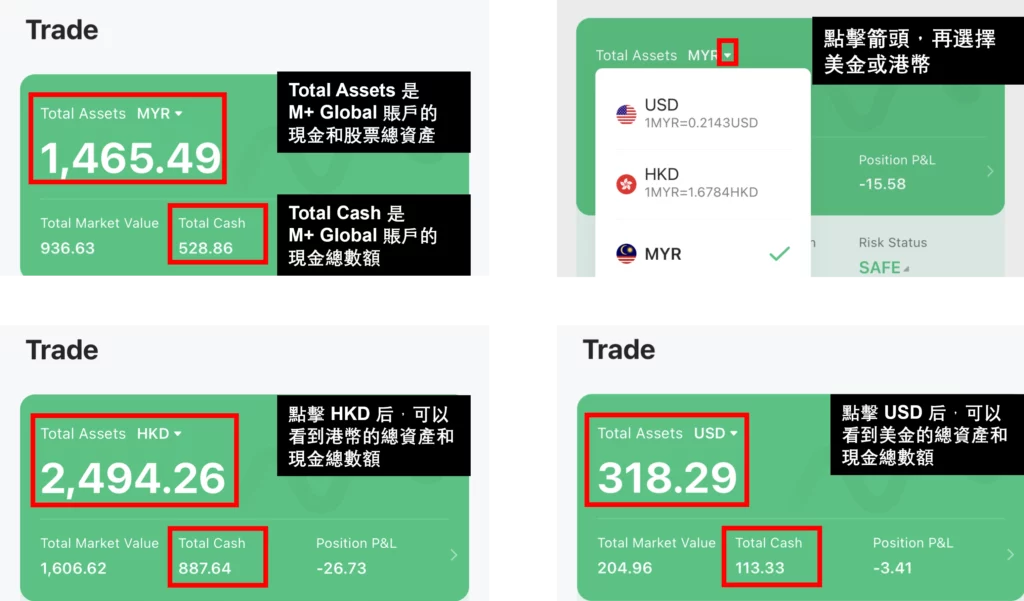

3.Users can directly view how many US dollars or Hong Kong dollars the amount of ringgit deposit corresponds to through the trading interface of the M + Global account.。

Process teaching of M + Global deposit (multi-graph)

○ Deposit method (transfer method): bank transfer (FPX Transfer)

○ Estimated Transfer Time: 1 working day, depending on the bank's processing schedule

Service Charge: Free

Step 1: Log in to your account and set a trading pin

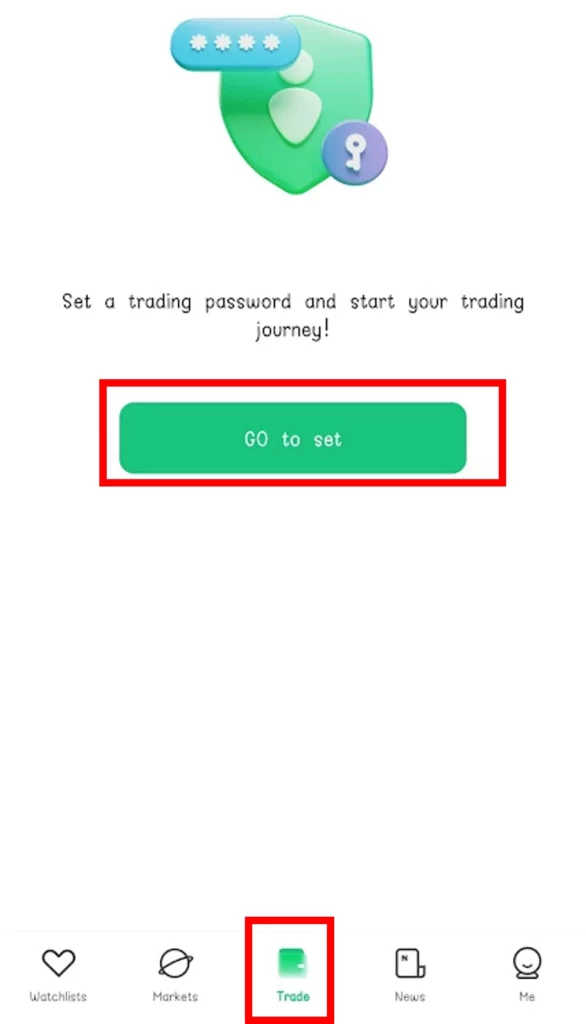

After logging into the M + Global application, click "Trading"。

If you are using M + Global App for the first time, you need to click "Go To Set" to set the trading pin.。

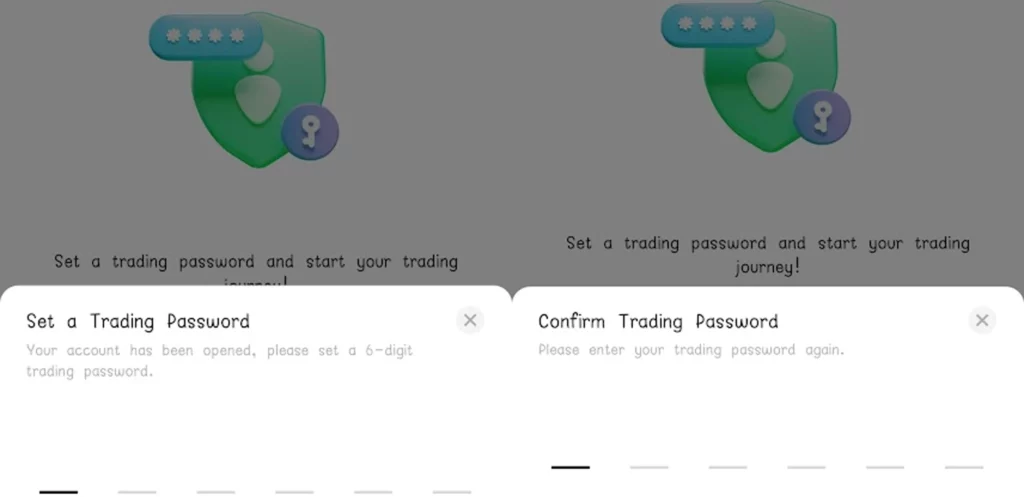

Enter your 6-digit transaction password and enter it one more time to confirm。

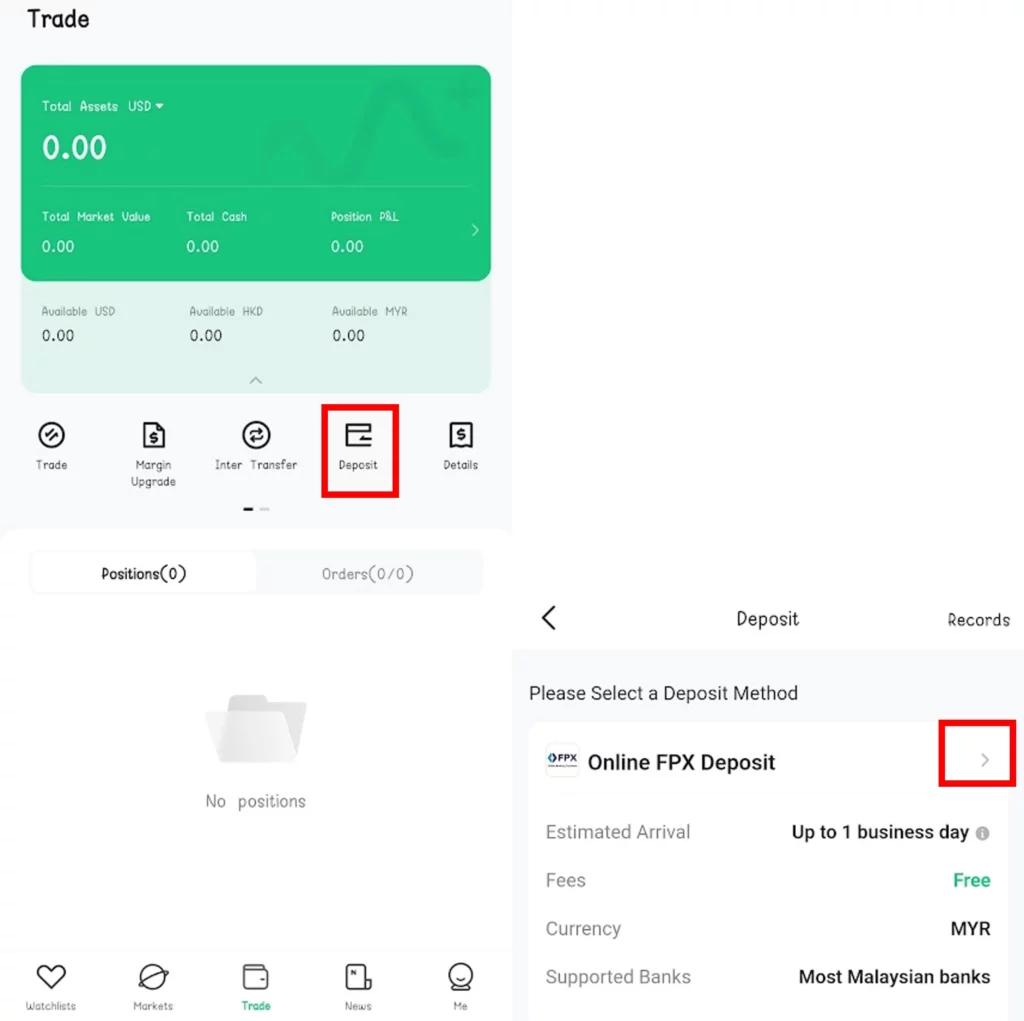

Step 2: Select the deposit option

After clicking "Deposit," click "Online FPX Deposit"。

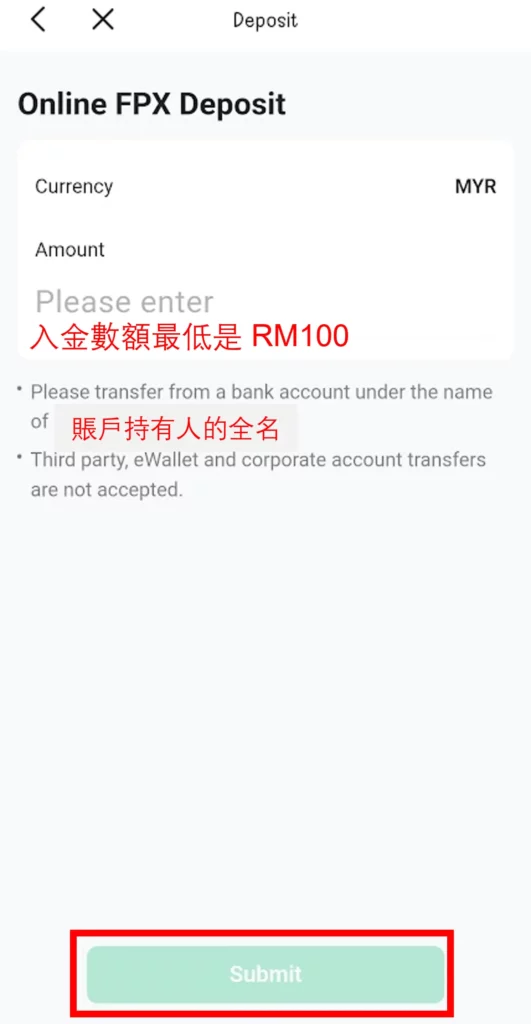

Step 3: Enter the deposit information

Enter deposit amount in Amount。

The minimum single deposit amount for M + Global is RM 100, while M + Global limits the maximum daily deposit amount to RM 200,000.。FPX turns another depending on your bank account settings, there is a certain limit to the amount, generally a single day can transfer up to RM 30,000。

Note: Users can only transfer money from their bank account to M + Global's account, not through a third party, e-wallet or corporate account.。

Next, click "Submit" to go to the next step。

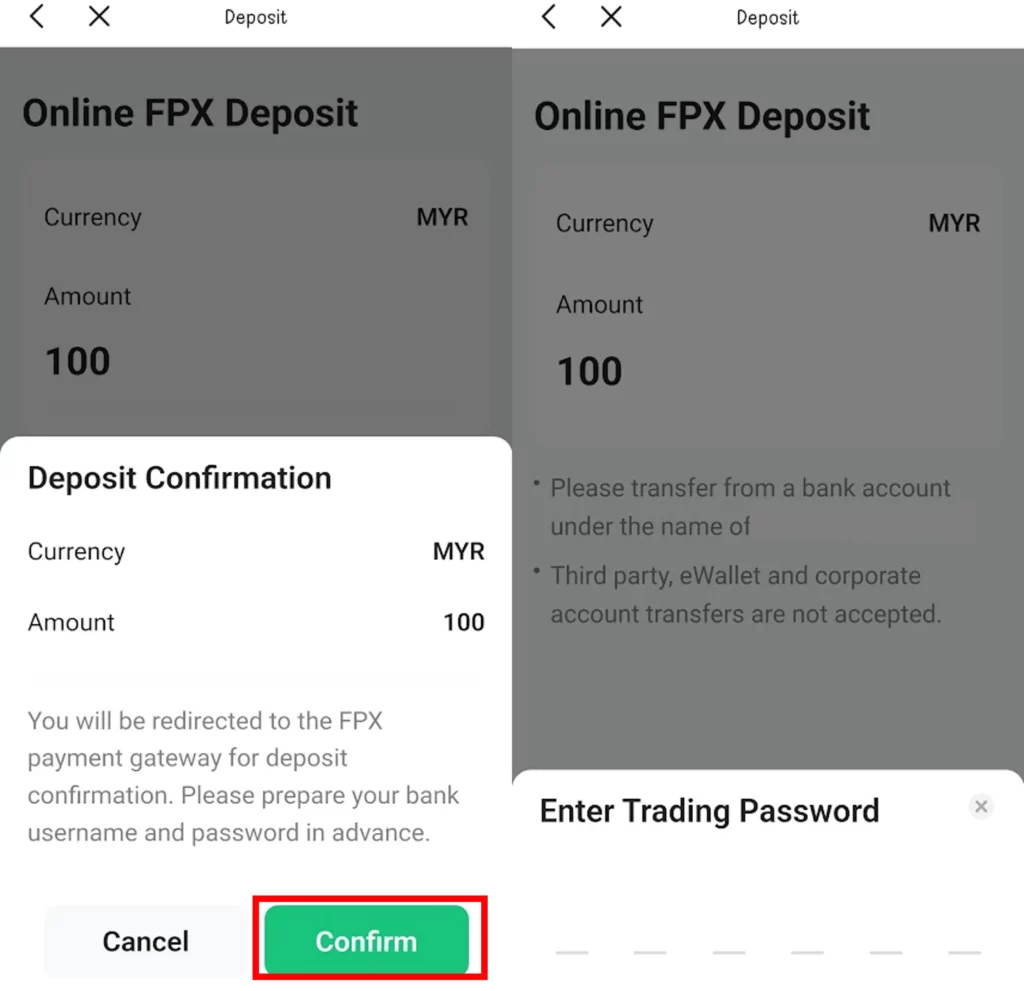

After checking whether the deposit information is accurate, click "Confirm" and enter the transaction password to confirm the deposit.。

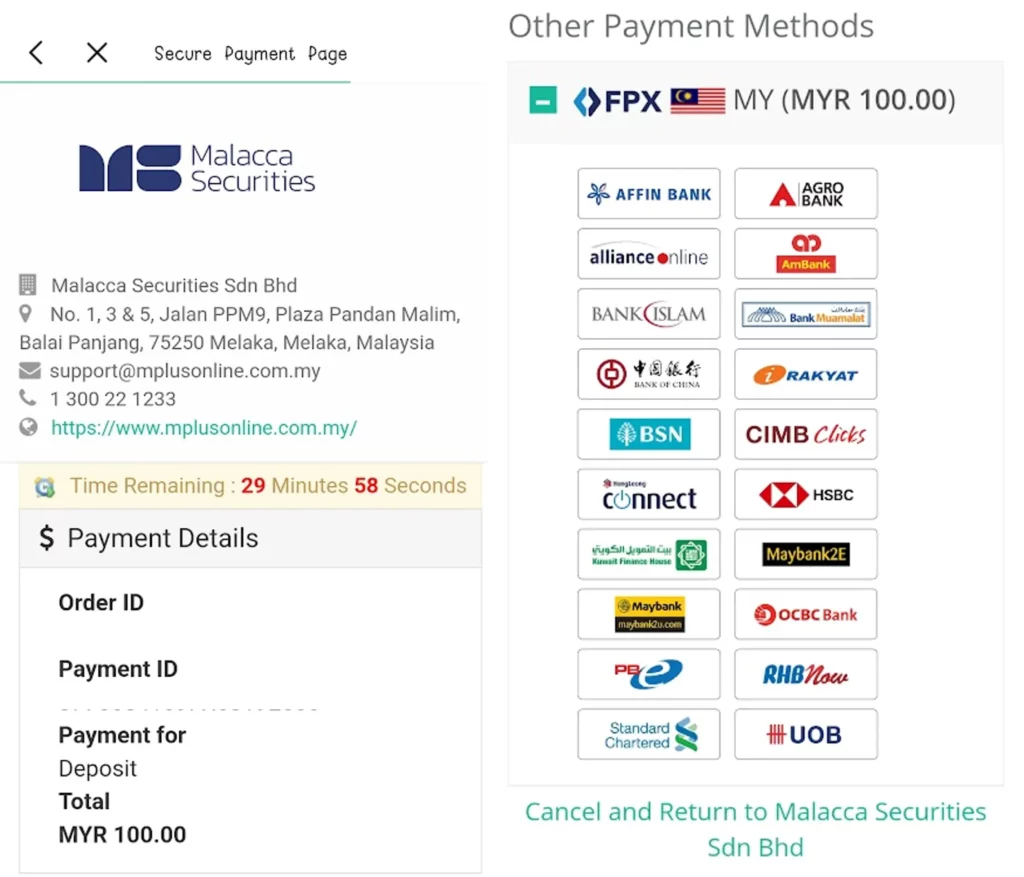

Step 4: Make an online bank transfer

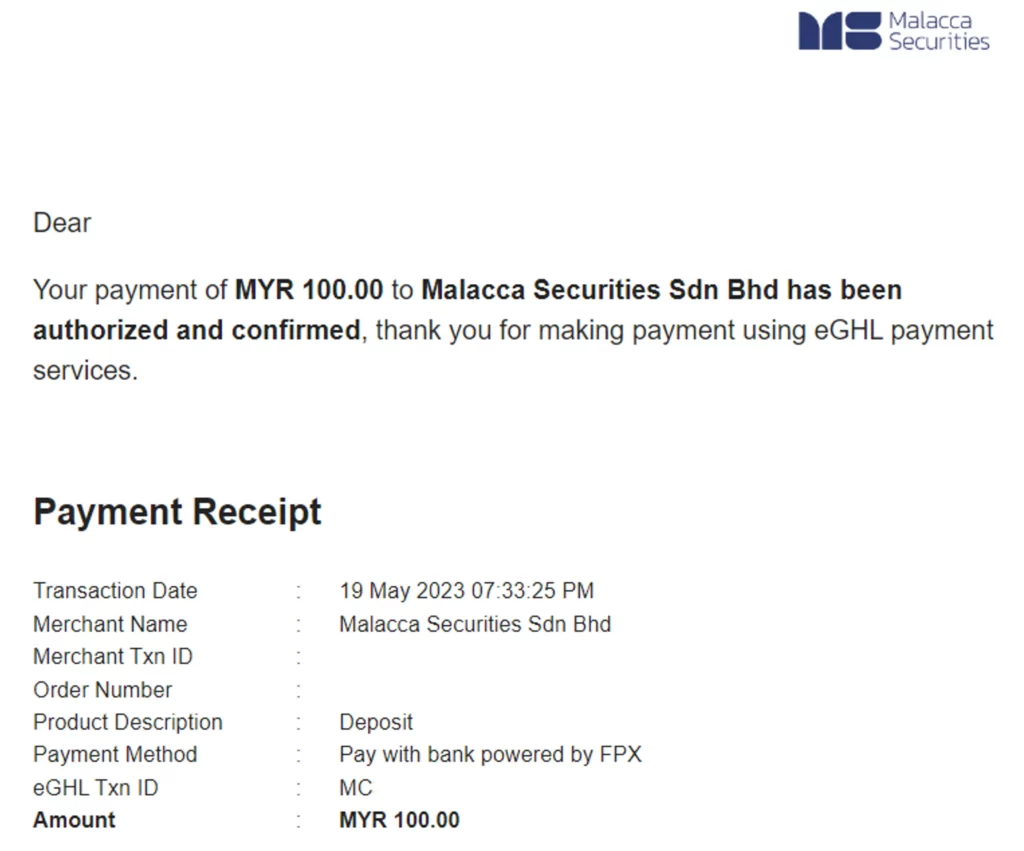

Next, go to the eGHL transfer page。You need to log in to your bank account and transfer money to M + Global's account via online transfer.。

After completing the transfer, you will receive a deposit notice。

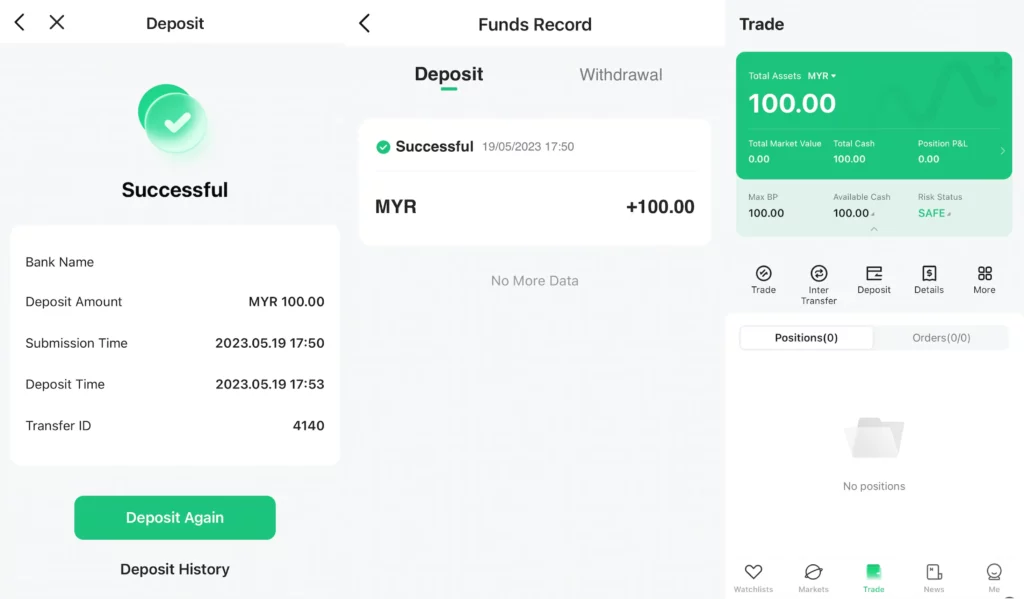

Step 5: Complete the deposit

The length of time the deposit arrives varies from person to person.。Generally, user-initiated deposits will arrive within 1 working day.。

The author measured that the bank transfer was completed at 5: 53 p.m. and found that the funds arrived immediately and that the amount of the deposit was immediately reflected in the M + Global account。

M + Global and M + Online Inter Transfer

Malacca Securities Sdn Bhd offers Inter Transfer convenience to users who launch M + Online and M + Global applications, and the fees charged for the services are free.。

As long as the accounts of M + Global and M + Online are held by the same person, users can transfer between 8: 30 a.m. and 5: 30 p.m. on weekdays.。

If you have an M + Online investment account and have a sufficient balance in your account, you can directly use the Inter Transfer function to transfer investment funds from your M + Online account to your M + Global account for Hong Kong-US stock transactions without the need for bank transfers.。

Similarly, if you have a sufficient balance in your M + Global account, you can transfer funds from your M + Global account to your M + Online account to trade horse shares.。

The author will demonstrate the steps to transfer investment funds from M + Online to M + Global.。

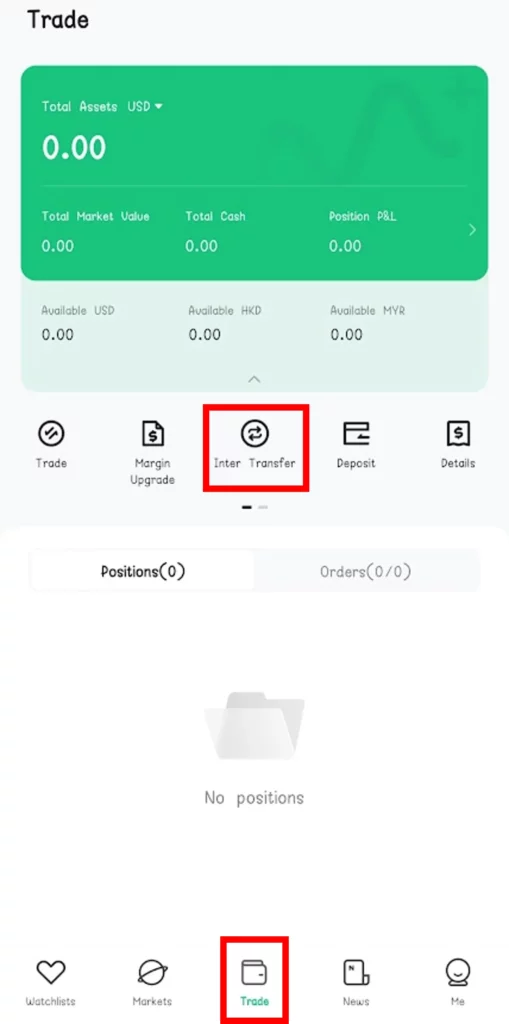

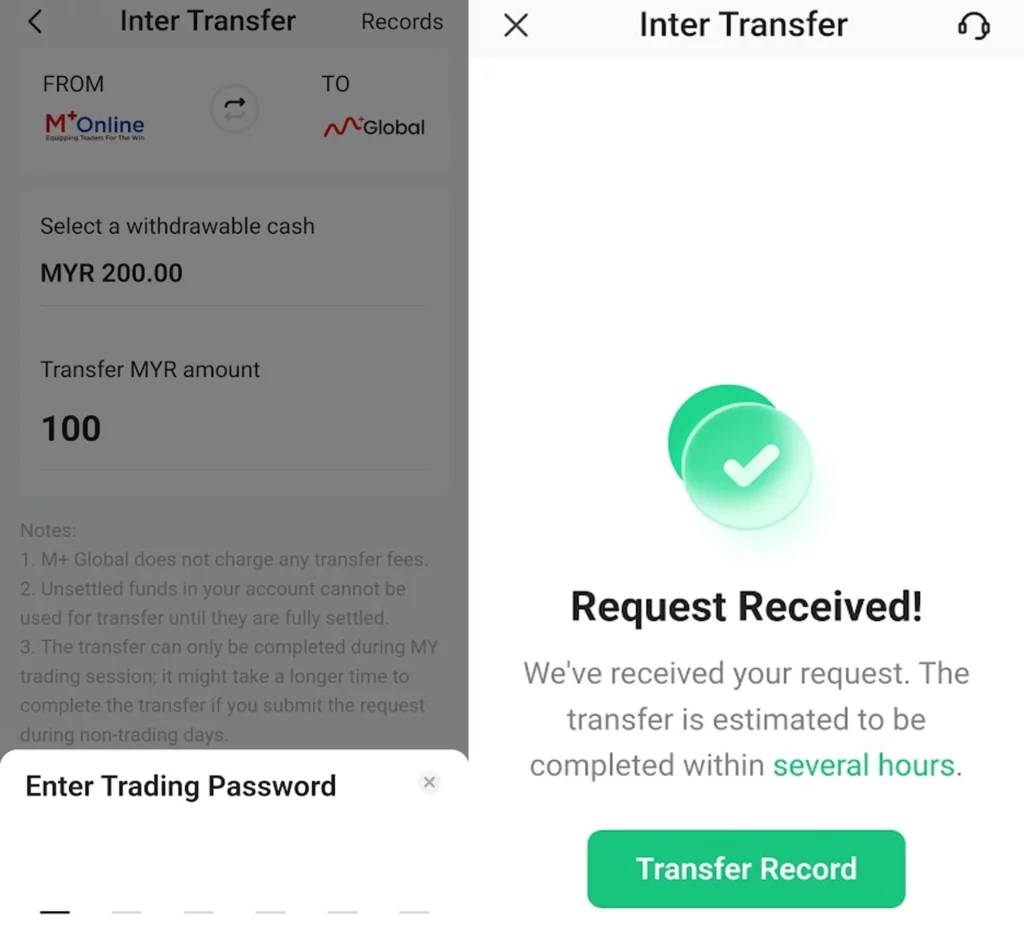

Step 1: Initiate an application for mutual transfer of funds

After clicking "Trade," click "Inter Transfer"。

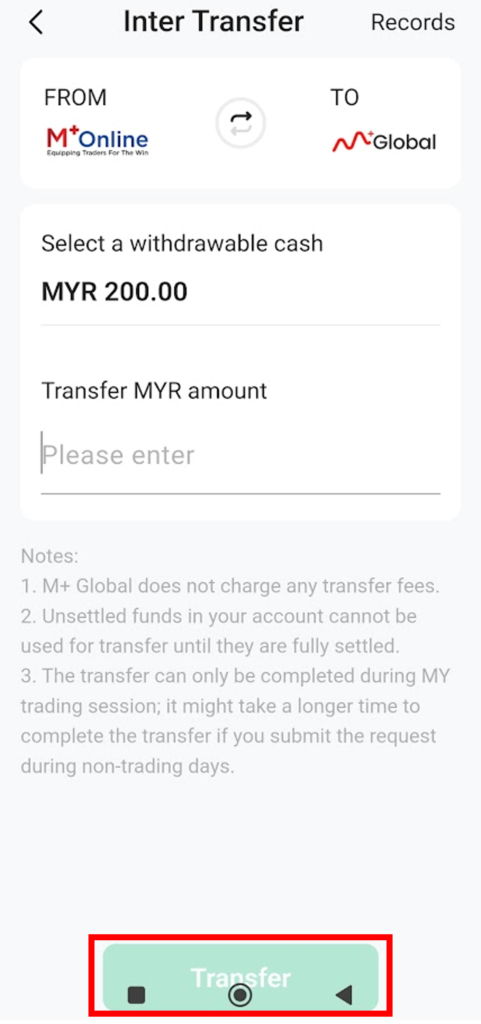

If you choose to transfer funds from M + Online to M + Global, then the column in Inter Transfer must be "From M + Online" M + Global "。

Next, after entering the funds you want to transfer (ringgit), click "Transfer"。

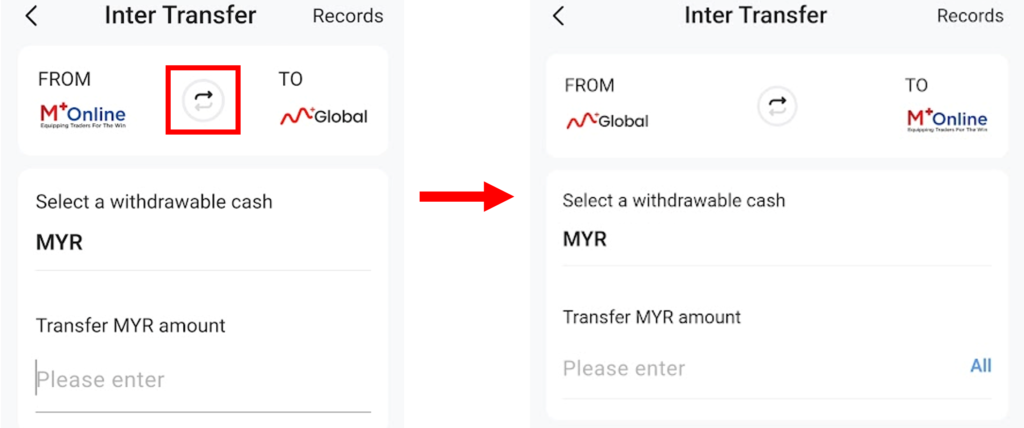

If you want to transfer funds from M + Global to M + Online, click the arrow in the middle, change to "from M + Global to M + Online," enter the transfer amount, and submit the fund transfer application。

It is important to note that the user cannot transfer unsettled funds in the investment account to each other until the transaction is fully settled。In addition, user-initiated fund transfer applications can only be accepted from 8: 30 a.m. to 5: 30 p.m. on Malaysian weekdays.。

Step 2: Complete the transfer of funds

Next, just enter the trading pin and the transfer application will be submitted.。

Generally speaking, the user's transfer application will be completed within a few hours。When the transfer request is approved, the user will receive an information notification from M + Global。

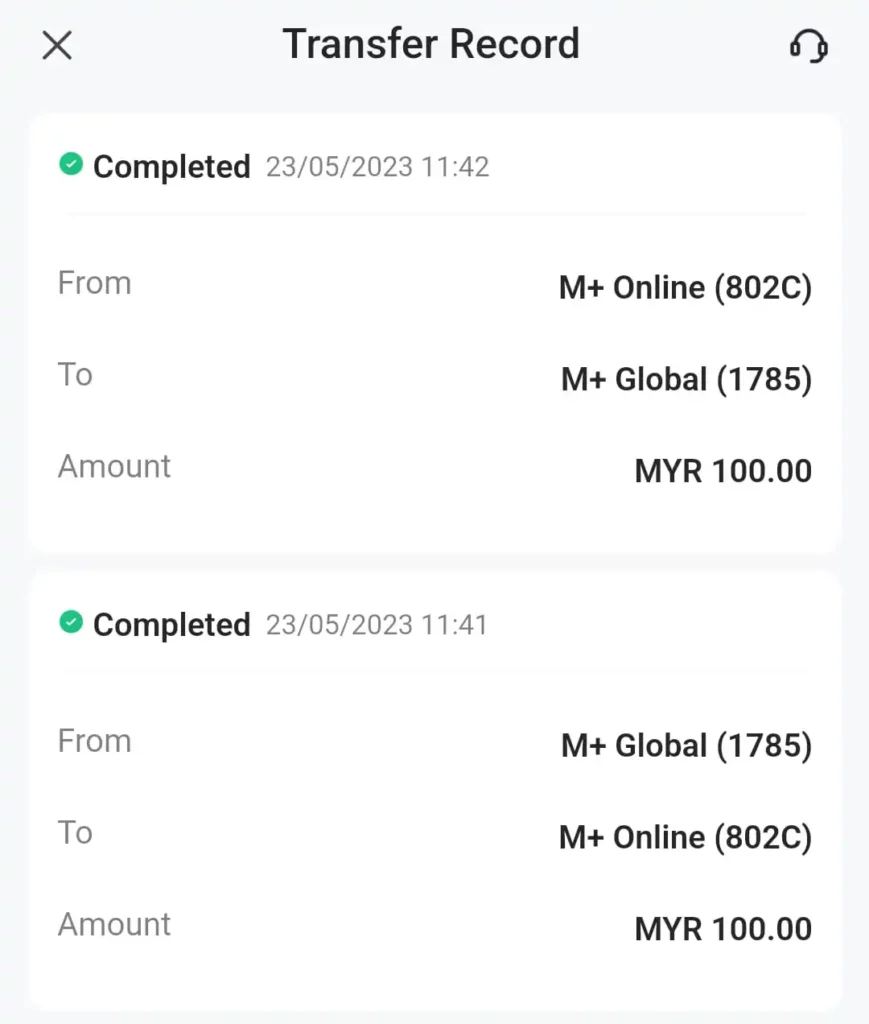

Users can also click "Transfer Record" to view the transfer records between M + Online and M + Global.。

The author measured the process of mutual transfer, whether from M + Global to M + Online, or from M + Online to M + Global, are immediately successful mutual transfer。

Notes on M + Global's Payment

1.Users are not allowed to contribute money to accounts with virtual banks or third-party payment platforms.。

2.Users can only pay to their own account in the Bank of Malaysia, and can only pay in ringgit.。

3.If the payment is less than RM 100, the user will be charged a handling fee of RM 1.。

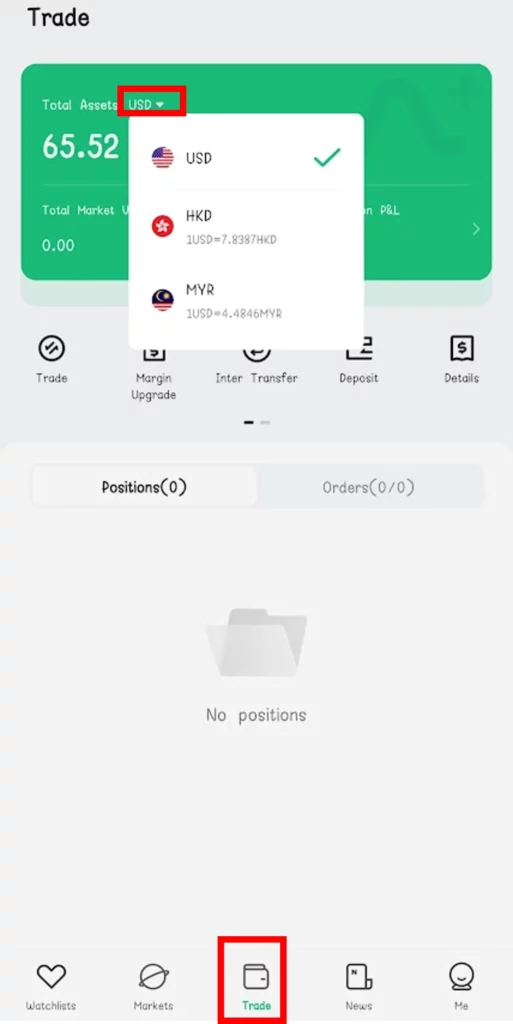

4.If you have US Dollars (USD) or Hong Kong Dollars (HKD) in your account, the system will automatically convert the foreign currency into Malaysian ringgit (MYR) before issuing the gold.。Reference usage of the exchange rate seen by the user on the system。

Users can click the "transaction" in the lower directory, click the "arrow next to total assets" in the upper cyan column to view the exchange rate。

M + Global out of the process of teaching (multi-graph)

○ Transfer Method: Bank transfer

○ Estimated Transfer Time: 1-3 working days, depending on the bank's processing details

Service Charge: Free

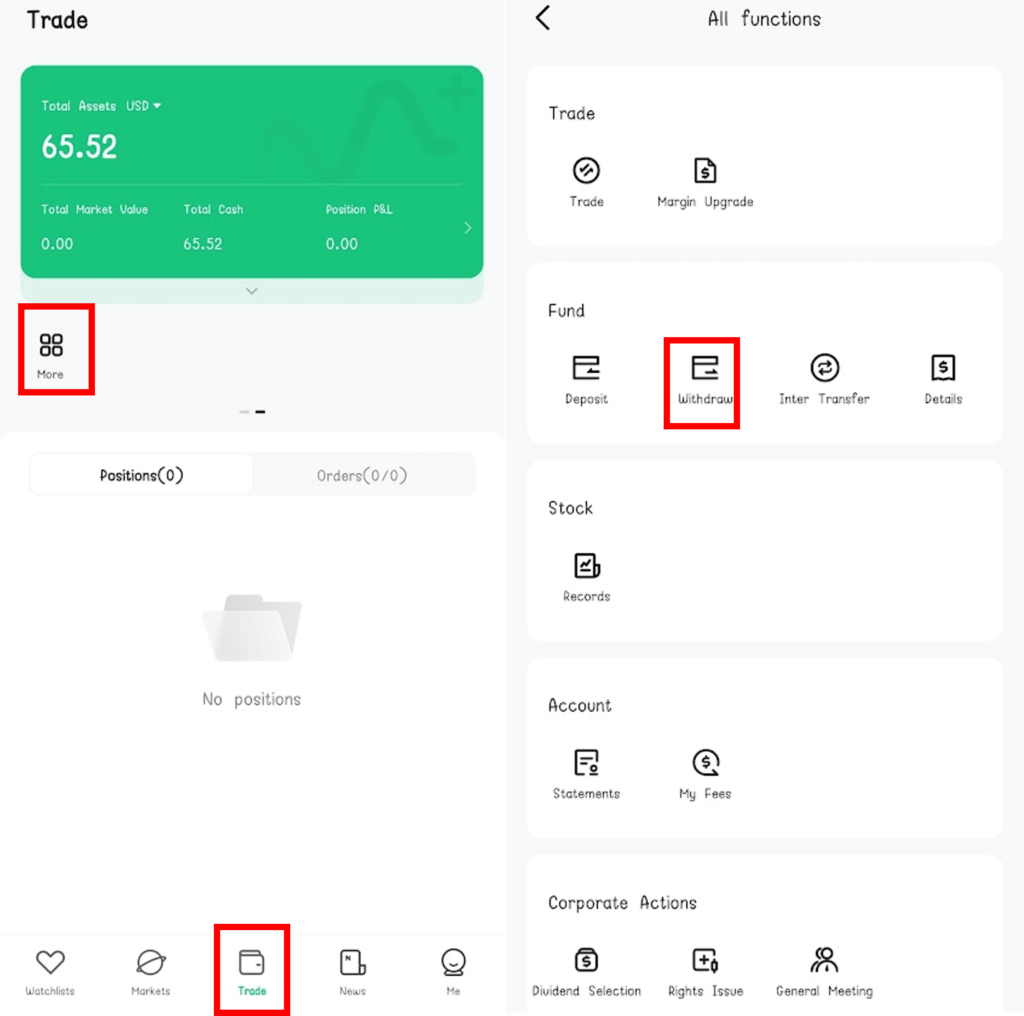

Step 1: Log in to your account and select the payout

Log in to the M + Global application, click "Trade" and enter the transaction password "Trading Pin"。Next, click "More" and then click "Withdraw"。

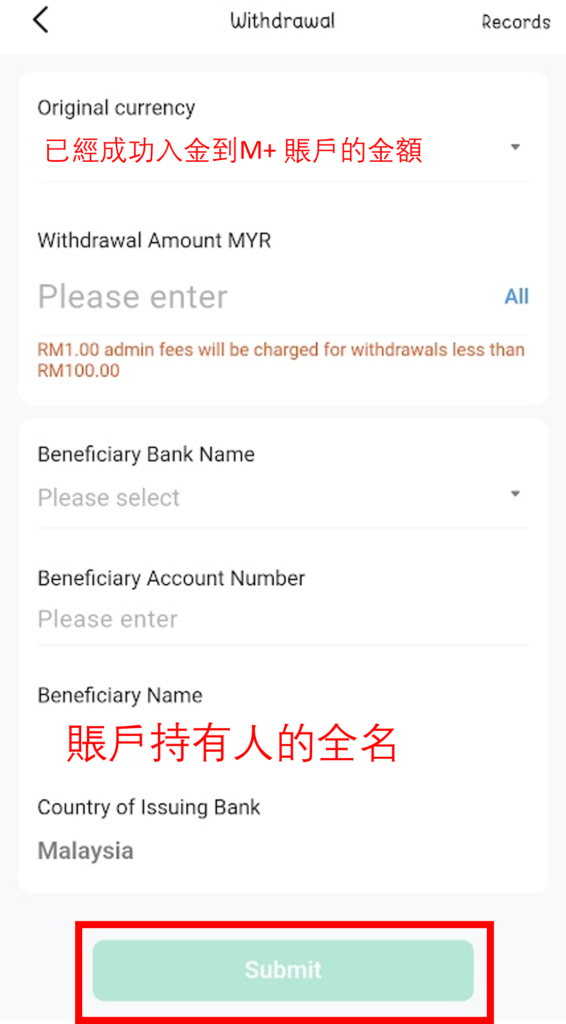

Step 2: Enter the cash-out information

View the RMB available in different currencies in the Original Currency display account。In Withdraw Amount MYR, enter the name of the Malaysian bank to be paid, enter the name of the Malaysian bank to be paid, and enter the bank account number in Beneficiary Account Number.。After confirming whether the Beneficiary Name column is your full name, click "Submit"。

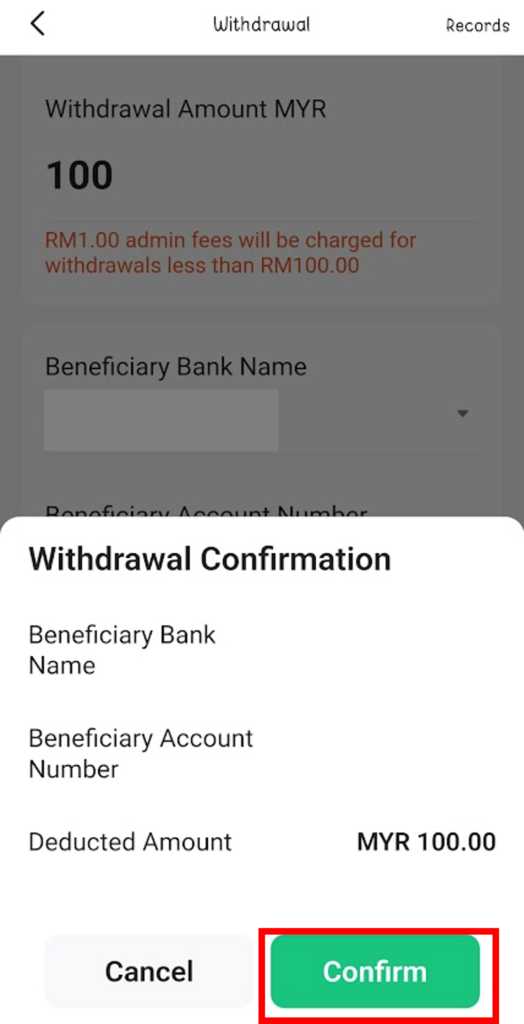

After viewing the deposit information, click "Confirm"。

Step 3: Complete the application for payment

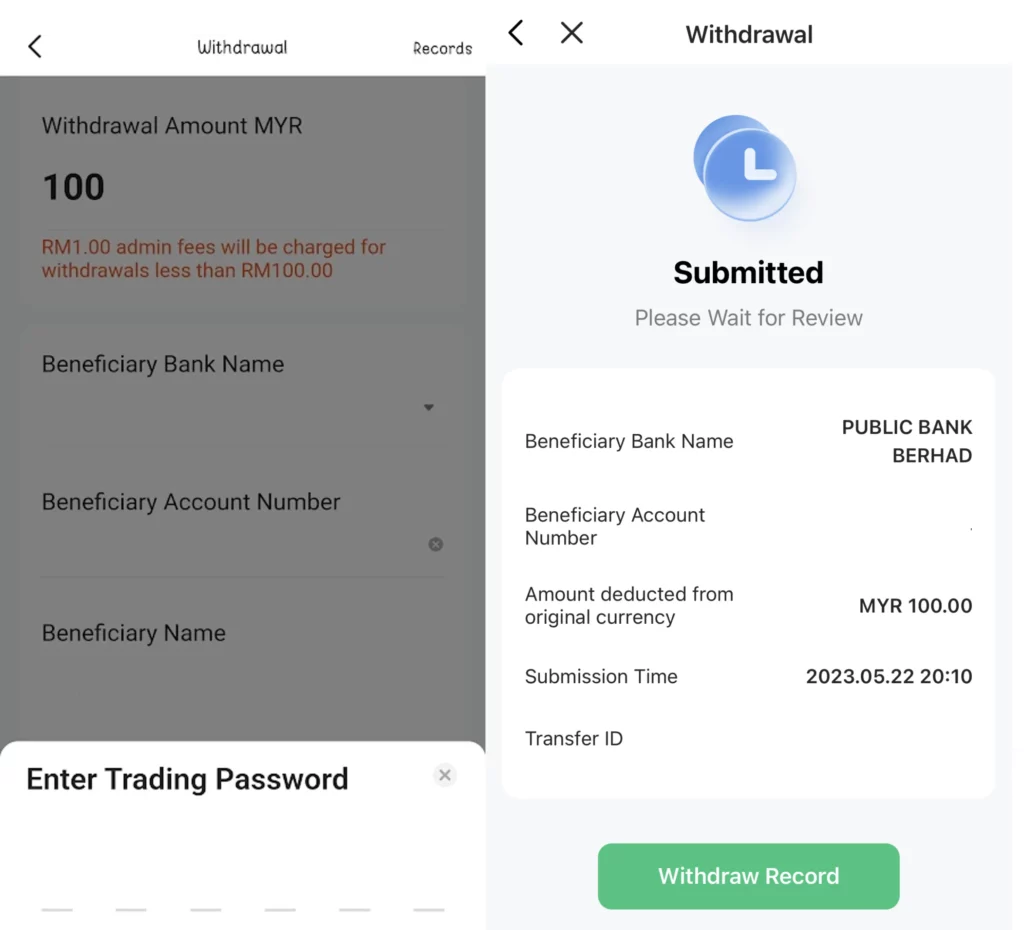

Enter the transaction password (Trading Pin) to submit the withdrawal application。

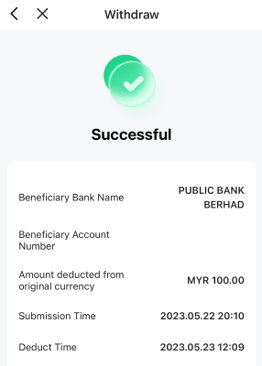

The user's application for payment will be approved within 1 to 3 working days。The bank's processing schedule will affect the time it takes a user to withdraw money from the M + Global application to a bank account。

According to M + Global's withdrawal instructions, M + Global will charge RM 1 administrative fees when the number of withdrawals is less than RM 100。

The author measured that the application for payment was initiated at 8: 10 p.m. on a weekday, and the payment was made at 12: 09 p.m. the next day, and the funds were successfully deposited into the bank account on the same day.。

SUMMARY

M + Global provides Malaysian investors with convenient investment channels, allowing them to participate in cross-border investment with low commissions and enter the Hong Kong and US stock markets.。At the same time, the platform supports the use of ringgit for funds deposit, and there is no need to pay additional bank or remittance fees, thus effectively reducing investment costs。

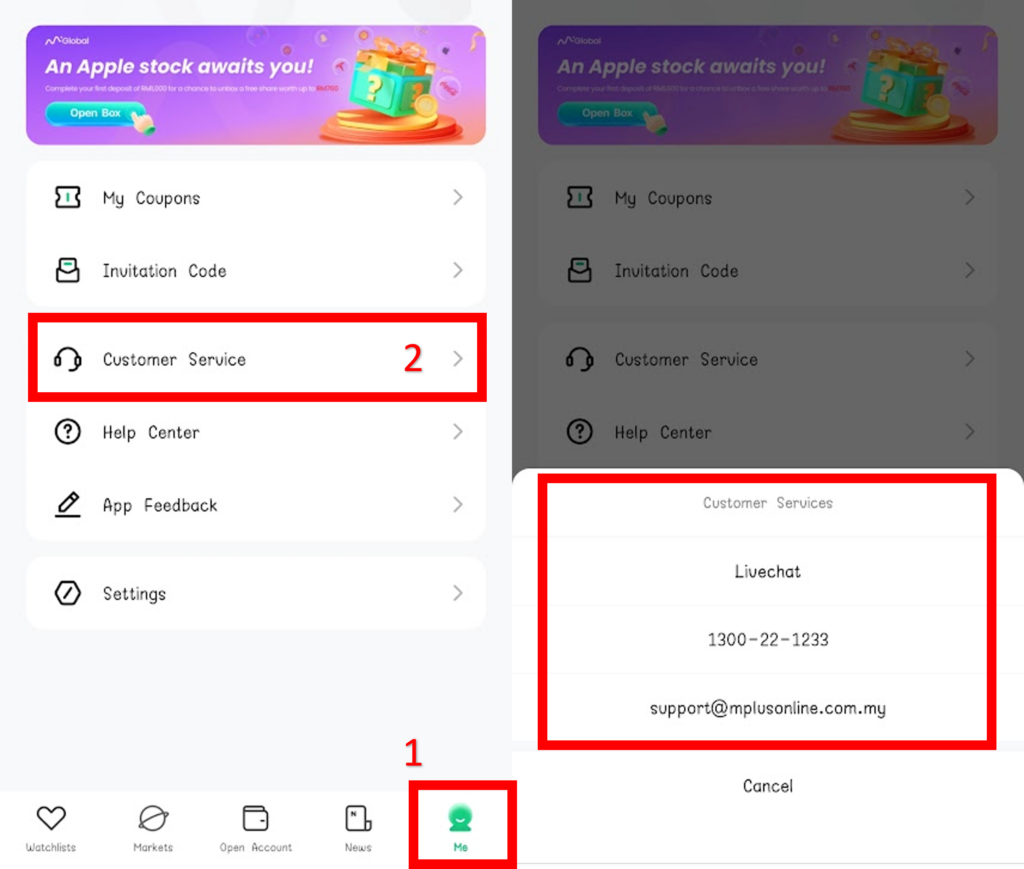

When using M + Global for money operations, transfers or cross-border transfers, if you have any questions, you can easily click "Me" in the M + Global app and select "Customer Service" to get contact details。

M + Global's customer service team provides round-the-clock service, 24 hours a day to solve your problems。You can choose to get timely help by calling the customer service hotline, live chat on the M + Global app, or other means。This makes it easy for investors to ensure they have access to professional support at all times.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.