NVIDIA Orders Up 25% Encourages TSMC‘s Performance Expectations

NVIDIA has increased its order for Blackwell platform architecture GPUs from TSMC by 25% due to strong customer demand, boosting TSMC's performance expectations for the second half of the year.

According to reports, NVIDIA's new Blackwell architecture GPU has seen substantial customer purchases, leading to a situation of high demand outstripping supply. As a result, NVIDIA recently added an additional 25% to its wafer orders from TSMC, with the ripple effect extending to backend testing factories.

Analysis indicates that this growth not only highlights an unprecedented boom in the AI market but also provides strong momentum for TSMC's performance in the latter half of the year, forcing its annual outlook appearing more optimistic.

On July 18, TSMC will hold an earnings conference call to announce its second-quarter performance and third-quarter expectations.

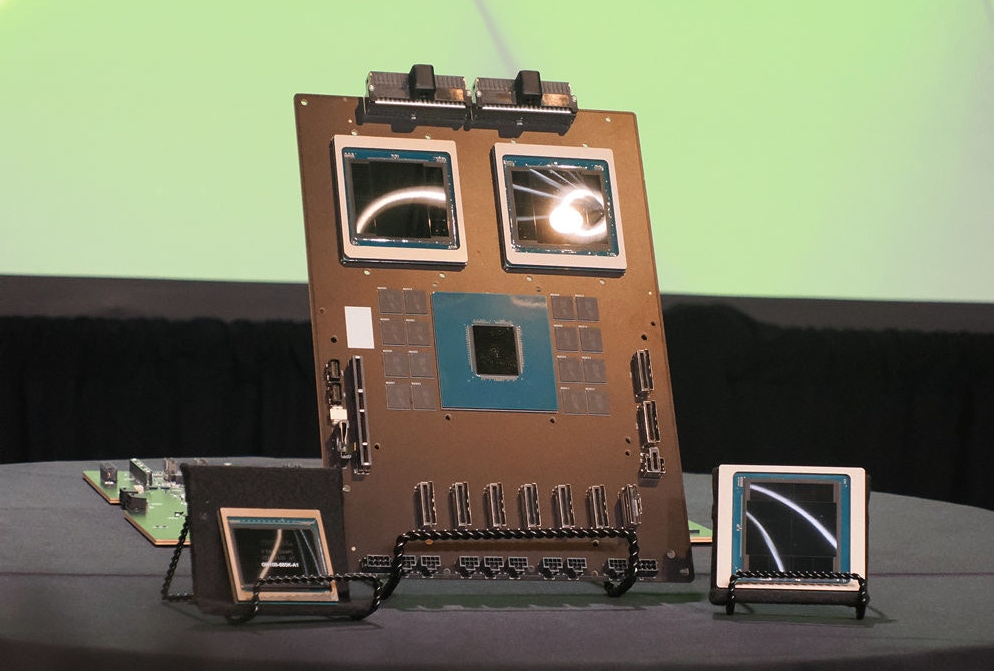

NVIDIA's Blackwell platform architecture GPU, dubbed the "world's most powerful AI chip," features approximately 208 billion transistors and is manufactured using TSMC's customized 4nm process. It utilizes 10TB/s inter-chip communication technology to form a unified GPU supporting AI training and LLM inference, with models scalable to 100 trillion parameters.

Currently, the "North America Four Cloud Giants" (Amazon, Microsoft, Google, Facebook) have all expressed plans to increase capital expenditures in 2024, focusing heavily on the AI sector. Combined capital expenditures are expected to reach $47.6 billion, a 39% year-on-year increase, with total annual capital expenditures expected to exceed $200 billion, up 32% year-on-year.

Moreover, international giants have revealed plans to adopt numerous Blackwell architecture GPUs for building AI servers, driving a surge in demand that necessitates timely responses throughout the supply chain.

Industry estimates suggest that the average selling price of NVIDIA's B100 GPU will range between $30,000 and $35,000, while the GB200 may fetch prices from $60,000 to $70,000 or higher, making it one of the most expensive chips manufactured by TSMC.

However, a research report indicates that due to TSMC's full capacity utilization of 3/4/5nm nodes and ongoing expansion of CoWoS advanced packaging capacity, Blackwell architecture GPUs may see limited shipments and testing by the fourth quarter of this year, with substantial market entry not expected until the first quarter of 2025.

With the accelerated production of NVIDIA's Blackwell architecture GPUs, shipments of complete server racks (including GB200 NVL72 and GB200 NVL36 models) have also significantly increased, initially expected to reach 40,000 units, now surged by 50% to 60,000 units. Among these, GB200 NVL36 dominates, accounting for 50,000 units.

The report estimates that the average selling price of GB200 NVL36 server racks is $1.8 million, while GB200 NVL72 racks command a higher price of $3 million. These orders contribute significantly to TSMC's revenue growth.

This June, former TSMC chairman Mark Liu predicted optimistically before stepping down: "Demand for AI applications is more optimistic than a year ago."Current chairman C.C. Wei echoed this sentiment, stating, "AI applications are just beginning, and I am as optimistic as everyone else."

In the latest development, NVIDIA is reportedly facing an investigation into alleged anti-competitive behavior. As one of the biggest beneficiaries of the AGI boom, the company's dominant share in the AI chip market has drawn regulatory scrutiny.

French Finance Minister previously noted that NVIDIA holds a 92% market share in GPUs, intensifying international inequalities and severely impacting fair competitive market environments.

Chairman of the French Competition Authority, Benoit Coeure, stated unequivocally at a press conference that if the investigation confirms the allegations, NVIDIA could face legal action. Under French antitrust laws, offending companies may face fines of up to 10% of their global annual turnover, although NVIDIA could potentially negotiate to avoid such penalties.

The French Competition Authority is the world's first enforcement agency to take formal action against NVIDIA, highlighting global regulatory attention to the computer chip manufacturing industry, particularly in the areas of antitrust and market competition.

Whatsover, in the United States, the Department of Justice is reportedly leading its own investigation into NVIDIA, while in the EU, despite initial requests for information, further investigations may be limited due to the ongoing French inquiry.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.