Rakuten Trade Contra Account Application & Trading Teaching

Rakuten Trade has launched a Contra trading account, which makes it easy to open an account and provides investors with up to 5x leverage and very low trading commissions.。This article shows Contra Account's trading mechanism, fees, account opening process, and methods for submitting settlements to help you fully understand how Contra Account invests.。

In stock trading, many investors are familiar with the Cash Upfront Account.。This method requires investors to deposit their money into an investment account through online transfer before they can successfully purchase shares.。However, there is another way to invest that allows investors to buy shares first and then pay for them later, and that is Contra Account。

This article will use Rakuten Trade Contra Account as an explanation, showing Contra Account's trading mechanism, fees, account opening process, method of submitting settlement, and differences from Cash Account and Margin Account to help you fully understand Contra Account's investment methods.。

What is a Contra Account short-term leveraged account??

Investors can buy shares through Contra Account, using limited funds or shares as collateral, in exchange for a few times the trading limit from a brokerage firm.。

For example, if your Contra Account has only RM 20,000, the broker gives you a leverage multiple of 3 times, so you get RM 60,000, which means you can buy up to RM 60,000 total value of shares。

Contra Account can give you a higher trading limit and you can buy more shares。The higher the trading limit, the more shares you can buy.。

You can make a profit from the spread between buying and selling stocks by buying stocks that are rising in price and selling them before settlement (Contra Gain)。Conversely, if the stock price falls, when you sell the stock, you need to pay the difference in arrears (Contra Loss)。Therefore, Contra Account is suitable for investors who enter the market in the short term, prefer short-term investment trading, and have some investment knowledge.。

Note that you must sell your shares within 2 days of trading。Otherwise, the broker is entitled to a mandatory sale of your shares on the third day after the transaction。Of course, you can also choose to continue to hold the stock, but you'll need to use your own funds to buy the stock。

What is Rakuten Trade Contra Account??

Rakuten Trade has launched the convenient Contra Account, which not only simplifies the process of opening an account, but also provides investors with up to 5x leverage.。

Rakuten Trade Contra Account allows investors to trade shares in cash or stock based on the Collateral Value and the individual's Trading Limit。

Investors who open a Rakuten Trade Contra Account can also enjoy very low brokerage fees。Investors only pay the same brokerage fees as Cash Upfront Account。

In addition, investors in Rakuten Trade Contra Account receive an intraday trading rebate (Day Trade Rebate) if they buy and sell the same stock on the same business day, which means that investors do not have to pay the commission fees incurred in selling the stock on the same day.。It is important to note that this rebate is based on the transaction amount of the shares sold and the off-price。

Investors can also choose to own both Cash Upfront Account and Contra Account, trading on an 8-to-2 or 7-to-3 capital ratio.。This combination allows Cash Upfront Account to act as a buffer for Contra Account, reducing risk。

In this case, the investor puts most of the money into the Cash Upfront Account and invests the rest through the Contra Account。Even if the investment is unfavorable, the investor still has a cash provision to cover possible losses and balance the risk。

▍ Rakuten Trade Contra Account trading mechanism

○ Trading limits

Trading limits, also known as stock purchasing power, indicate the number of shares you can buy。Rakuten Trade will allocate a multiple of each stock and increase the trading limit based on the value of your collateral, which can be 1, 3, or 5 times.。

By looking at the trading limits, you can see how much money you have available to buy shares。This gives you more flexibility to use your own collateral for investment transactions。

Note that the following shares are for demonstration purposes only and are not investment advice。All investments are risky and it is recommended that you do your homework and risk planning before entering the market.。

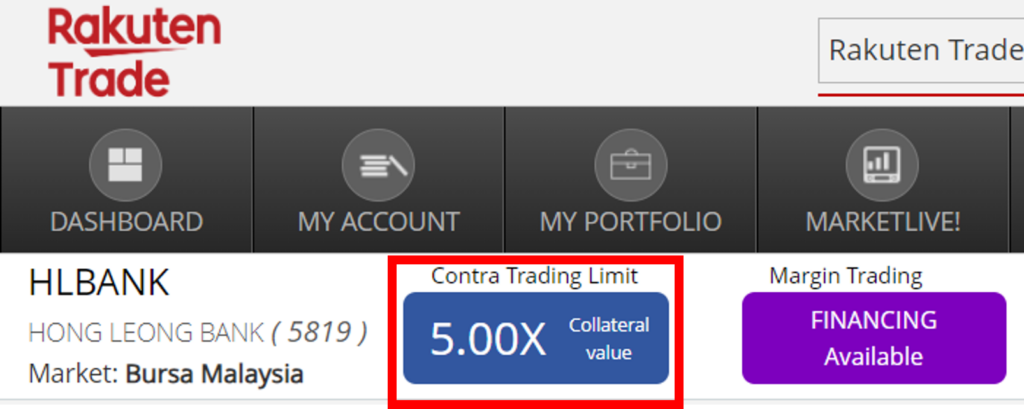

Suppose your collateral value is RM 1,000 and you want to buy shares of Hong Leong Bank, which is allocated a trading multiple of 5x.。Only RM 1,000 is actually available in your Rakuten Trade Contra Account。But since Fenglong Bank stock is allocated a trading multiple of 5x, you get an additional RM 4,000, and you can use RM 5,000 (5x) to buy Fenglong Bank stock。

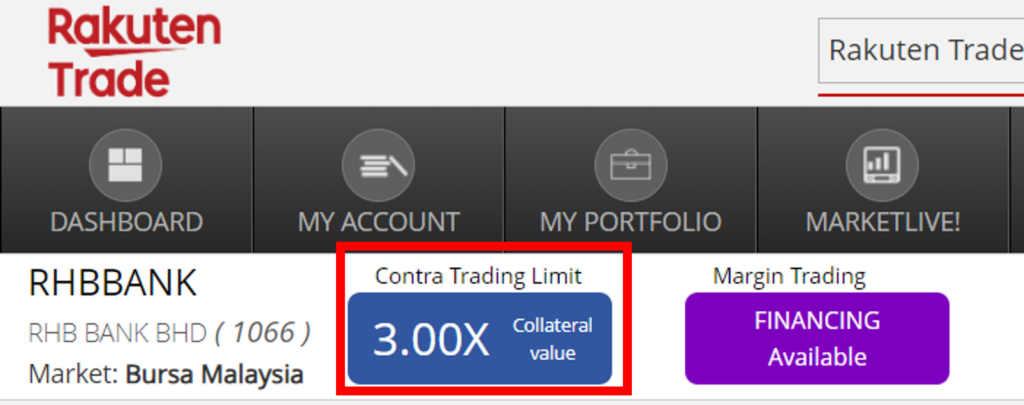

Similarly, suppose your collateral value is also RM 1,000 and you want to buy RHB Bank stock, which is allocated a trading multiple of 3x。Therefore, you can purchase Societe Generale shares through RM 1,000 in the Rakuten Trade Contra Account, plus an additional RM 2,000, for a total of RM 3,000.。

○ Collateral

To get a higher trading limit, you can provide collateral as security。With Rakuten Trade Contra Account, you can offer paid shares or cash or both as collateral for more trading limits。

Cash is the funds available to you for your deposit at Rakuten Trade and is calculated in ringgit。If you choose to use cash as collateral, you will receive a collateral value equal to 100% of the cash amount。For example, if you provide RM 5,000 in cash as collateral, you will receive RM 5,000 in collateral value。

The collateral value of a stock depends on the type of market to which the stock belongs.。If you mortgage Main Market Shares, you will receive 80% of the value of the shares as collateral value.。If you mortgage a GEM stock (Ace Market), you will receive 50% of the value of the stock as collateral value。

It is important to note that all collateral must be held in a trading account at Rakuten Trade and not in another broker or investment trading platform.。

○ Trading multiples (Multiplier)

You can know your trading limit by trading multiples and then based on the value of your collateral。At Rakuten Trade, each stock has a different trading multiple。Only selected shares in the FTSE Malaysia Kuala Lumpur Composite Index 100 (Bursa Malaysia FTSE 100) are eligible for 5x trading multiples。

You can check the trading multiples of Main Board and GEM stocks through Rakuten Trade's official website.。

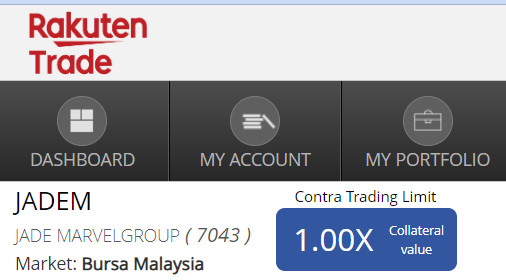

In June 2023, Jima Group (JADEM, 7043, Main Board Industrials), which raised RM80 million by issuing preferred shares, was allocated to 1x trading multiples.。When you mortgage a collateral of RM1,000, you will receive a trading limit of the same amount of RM1,000。

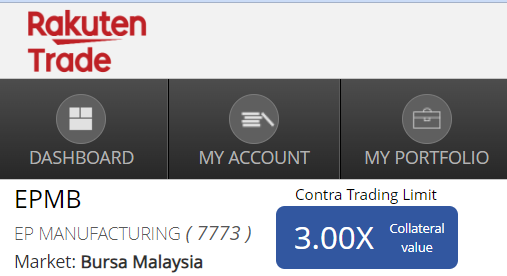

EP Manufacturing (EPMB, 7773, Main Board Industrials), a local auto parts manufacturer that received conditional approval from the Ministry of Investment, Trade and Industry to produce and assemble electric vehicles in July 2022, was allocated a trading multiple of 3 times。When you mortgage 1 unit of collateral, you can get 2 additional trading limits。

In other words, when you mortgage RM1,000 of collateral, you get an additional trading limit of RM2,000, with a total of up to RM3,000 available to trade shares.。

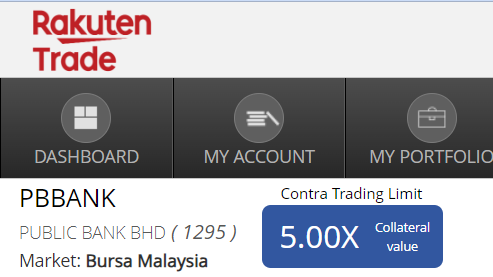

Net profit in the first quarter of 2023 was 1.713.96 billion, up 22% year-on-year..55% of Volkswagen Bank (PBBANK, 1295, Main Board Financials) were allocated 5x trading multiples。When you mortgage 1 unit of collateral, you can get an additional 4 transaction limits。

In other words, when you mortgage RM1,000 of collateral, you get an additional RM4,000 trading limit, with a total of up to RM5,000 available to trade shares.。

It is important to note that trading multiples for stocks may be adjusted in response to changes in the market。Therefore, before trading, please check the latest information on the Rakuten Trade investment trading platform to obtain accurate trading multipliers and trading limits.。

▍ Transaction costs of Rakuten Trade Contra Account

○ Rakuten Trade Horse Stock Trading Commission

You can use Rakuten, through the Contra Account, to trade horse shares in Rakuten Trade commission fees are as follows:

| Trading volume of horse stocks, Hong Kong stocks or US stocks in Malaysian currency | Brokerage Fee (RMK) |

| Less than RM 699.99 | 1% of the transaction amount (minimum is RM 1.00) |

| Less than RM 700.00 and RM 9,999.Between 99 | RM 9.00 |

| Less than RM 10,000.00 and RM 99,999.Between 99 | 0 of the transaction amount.1% |

| RM 100,000.00 or above | RM 100.00 |

It should be noted that you can only withdraw ringgit from Rakuten Trade Contra Account。Therefore, you need to convert Hong Kong dollars or US dollars into Malaysian ringgit before withdrawing cash, the currency exchange rate will be updated at 6 pm Malaysian time.。

○ Other transaction costs

In addition to brokerage fees, you will also have to pay additional fees, such as liquidation fees, stamp duty, regulatory fees, etc.。

| Expense type | Cost (RM) |

| Clearing Fee | 0.03%, with a maximum charge of RM1,000 per order |

| Regulatory Fees on Sell Transactions | Zero |

| Stamp Duty on Transactions (Stamp Duty) | Fees depend on stock type |

| SST | Zero |

| Corporate Action | without any handling fee |

| Account Opening Fee | Free |

▍ Rakuten Trade Contra Account process

If you are a new user of Rakuten Trade and have not yet opened any accounts, you can first open a Cash Upfront Account and then follow the steps below to open a Contra Account.。

If you have already opened a Cash Upfront Account at Rakuten Trade, then you can follow the instructions below to open a Contra Account。As long as you can submit information and related documents as soon as possible, in an ideal situation, you can successfully open an account and conduct investment transactions within 72 hours。

Opening a Rakuten Trade Contra Account requires only 7 simple steps:

1.Click to open Contra Account

2.Fill in investment information

3.Fill in identification

4.Fill in tax information

5.Statement of Acceptance and Consent

6.Fill in the employment status

7.Complete account opening

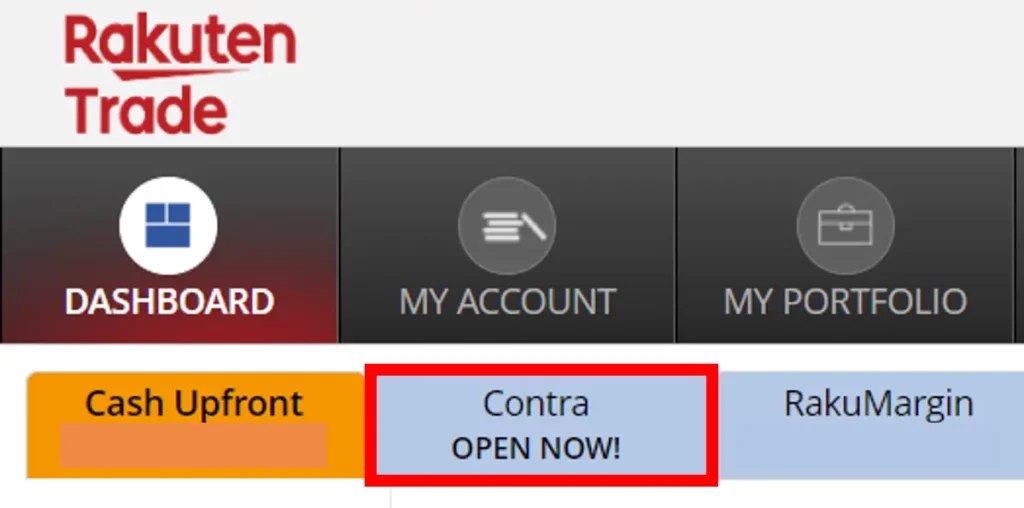

Step 1: Click to open Contra Account

Click "Contra Open Now" on the Rakuten Trade homepage。

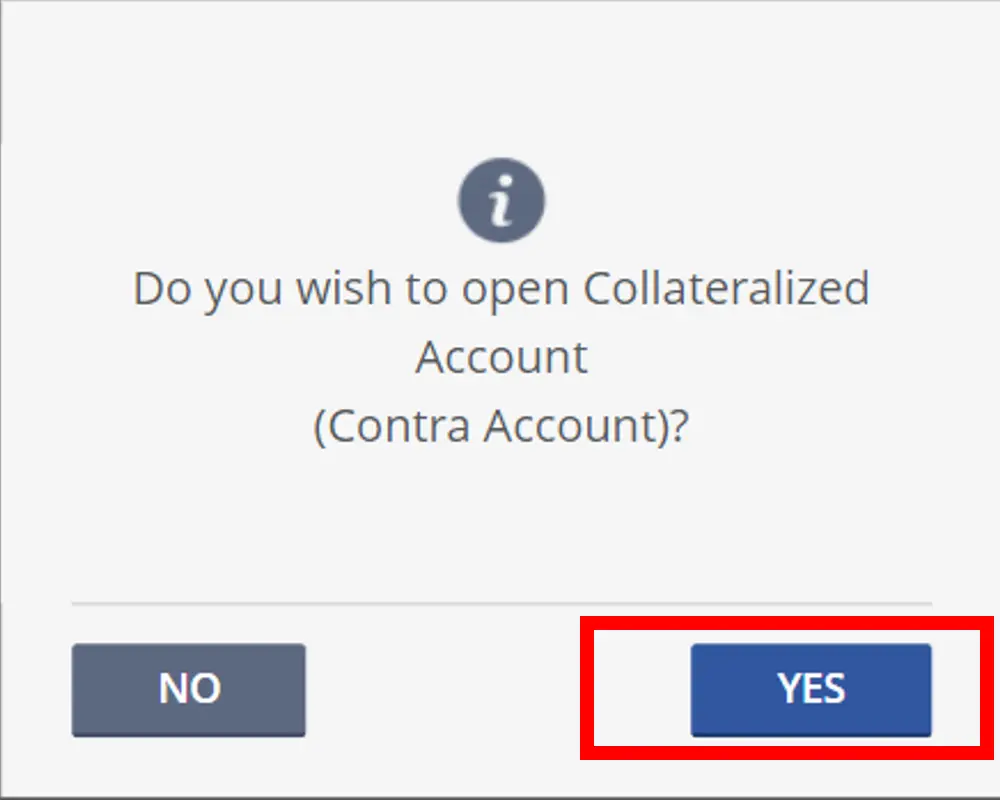

When the system pops up asking if you want to open Contra Account, click "Yes"。

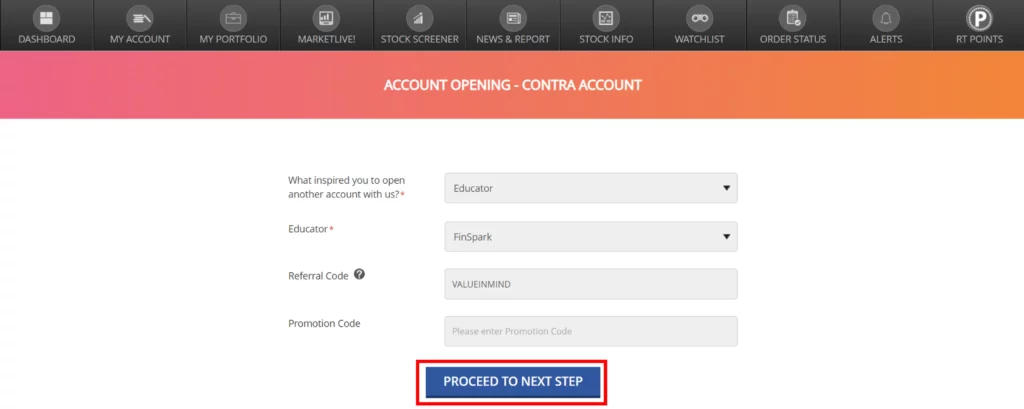

Confirm the referral information (as shown in the figure below), and click "Proceed to Next Step" to continue the account opening process of Contra Account。

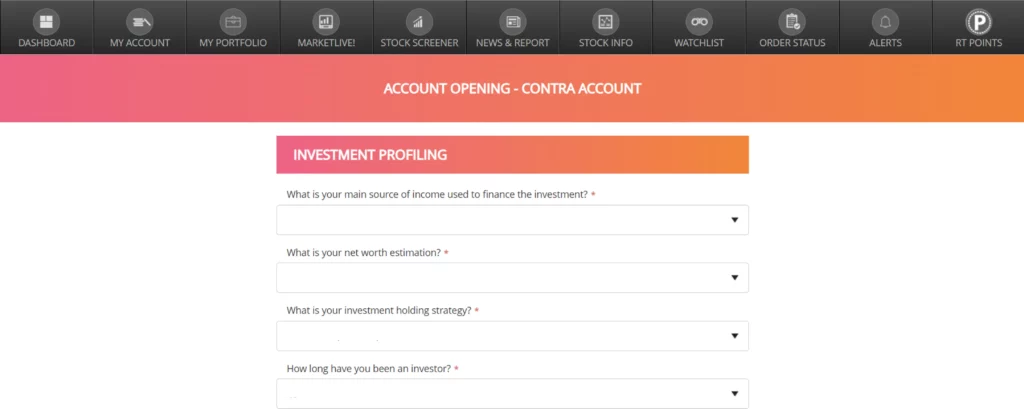

Step 2: Fill in the investment information

Based on your current situation, fill in the main source of income used to invest, what is the estimated net worth, investment strategy and how long it has been for investors。

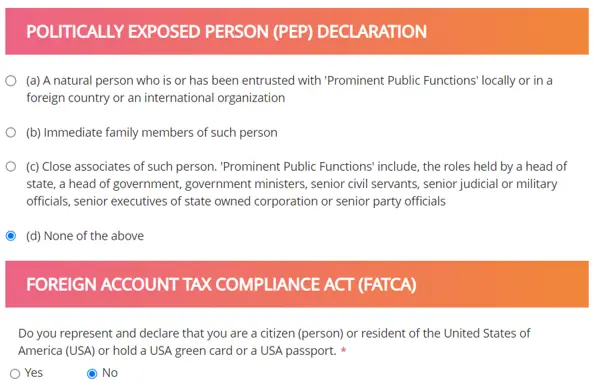

Step 3: Fill in the identification

You need to fill out a political public figure statement, choose whether you are a U.S. citizen or hold a U.S. green card or a U.S. passport.。

If you are not a person who holds important public positions at home and abroad, nor are you a direct family member or partner of the person holding the position, then you only need to choose "None of the above" at Politically Exposed Person Declaration.。

If you are not a U.S. citizen, or do not hold a U.S. green card or passport, select "No" in the Foreign Account Tax Compliance Act section.。

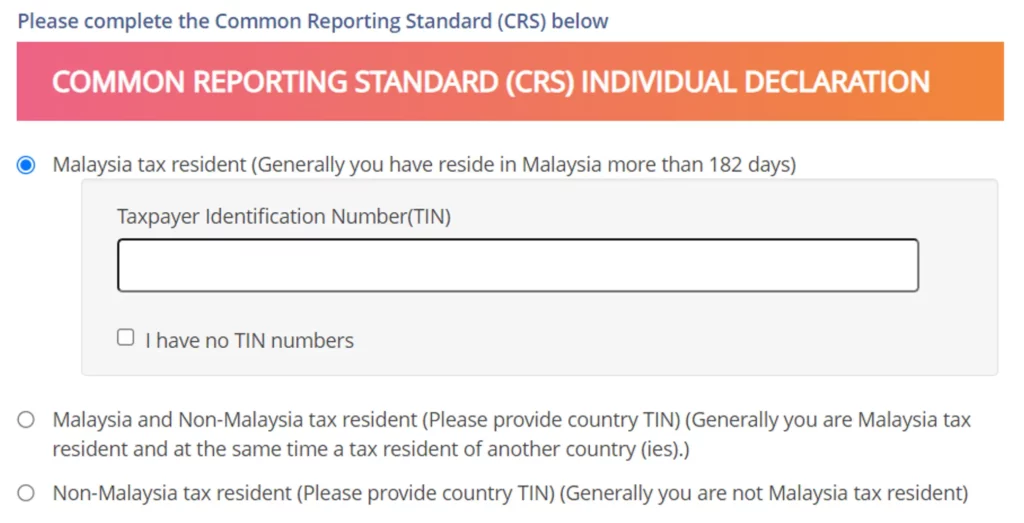

Step 4: Fill in the tax information

Fill in your Malaysian taxpayer number。You can go to your MyTax account or get your taxpayer number from your Payslip。

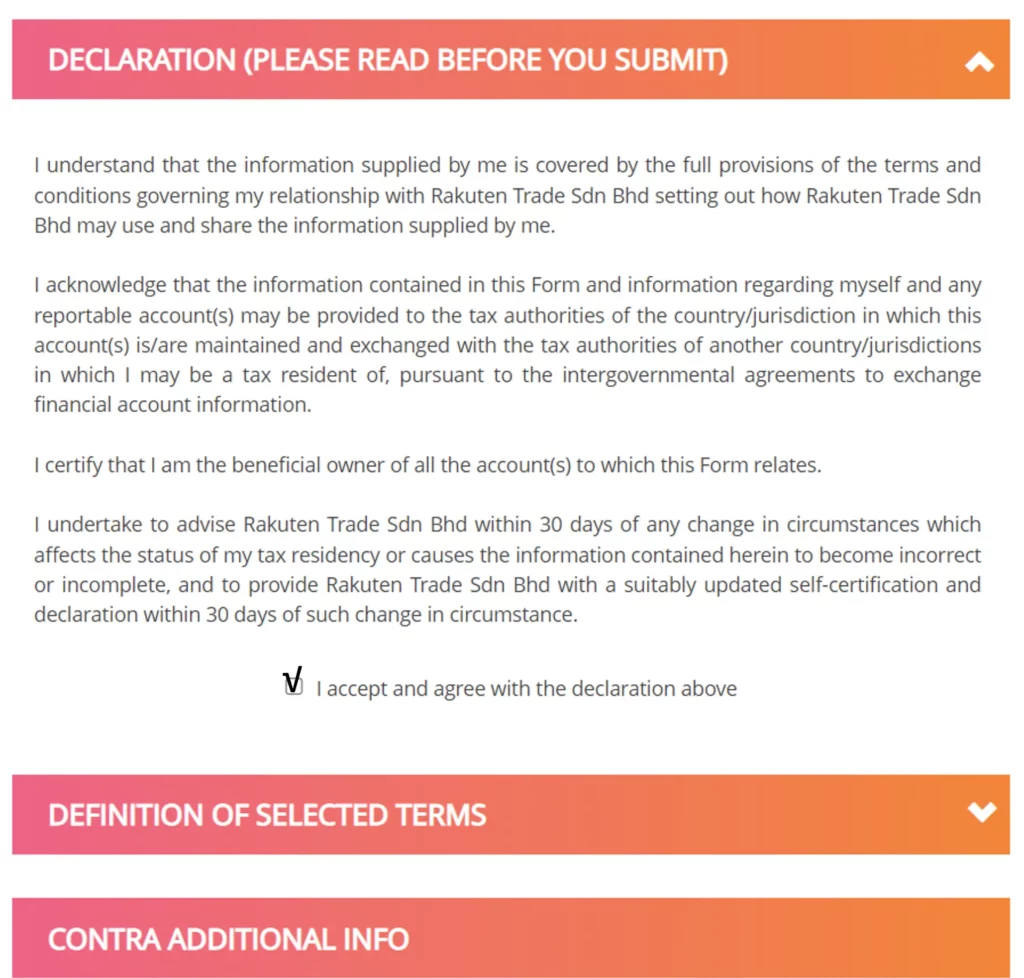

Step 5: Statement of Acceptance and Consent

By ticking "I accept and agree with the declaration above," you accept and agree with the statement。

Please read the statement carefully before ticking。Once you check the box, you agree with this statement, which includes: you agree that the information provided and the account information may be provided to the tax authorities, agree that you are the holder of the investment account, agree that you will inform Rakuten Trade of the change in your tax status and nationality within 30 days, and provide up-to-date proof, or add incorrect or incomplete information within 30 days。

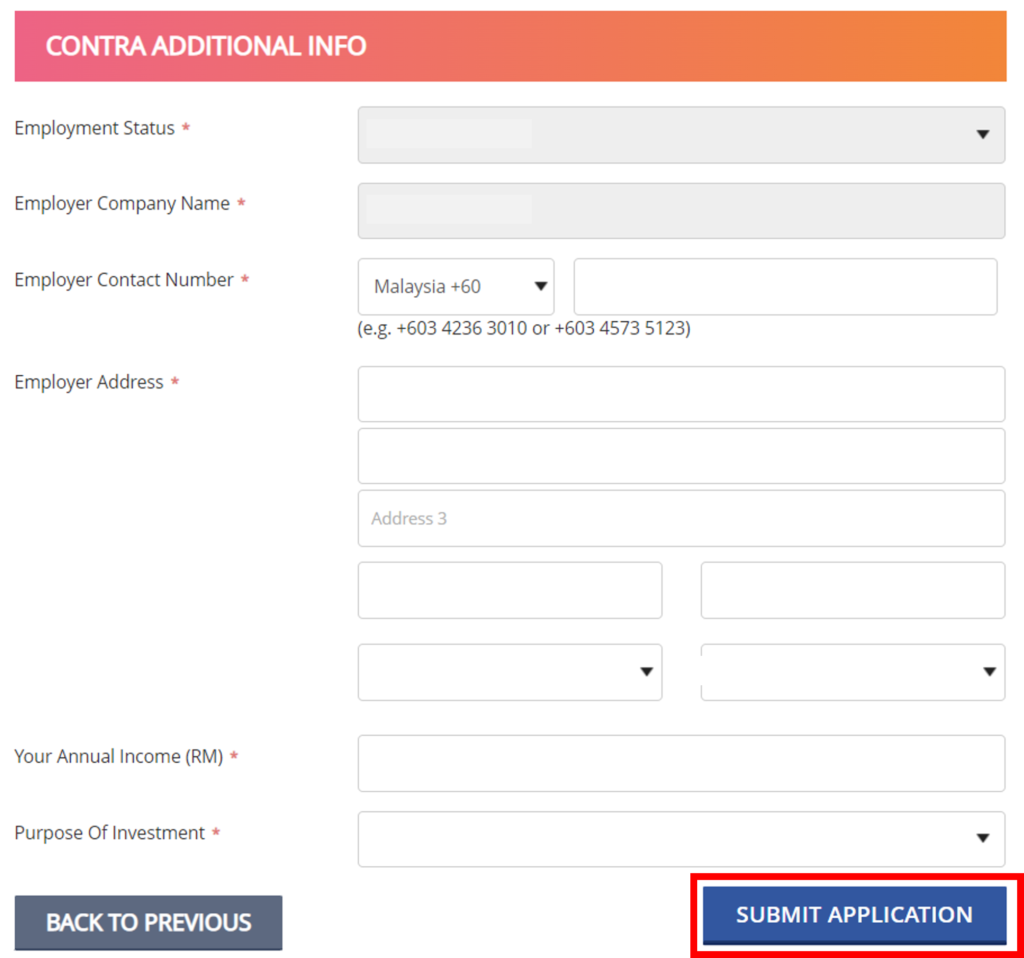

Step 6: Fill in the employment status

Fill in the employer company name, employer contact number, employer address, annual income and investment purpose, click "Submit Application"。

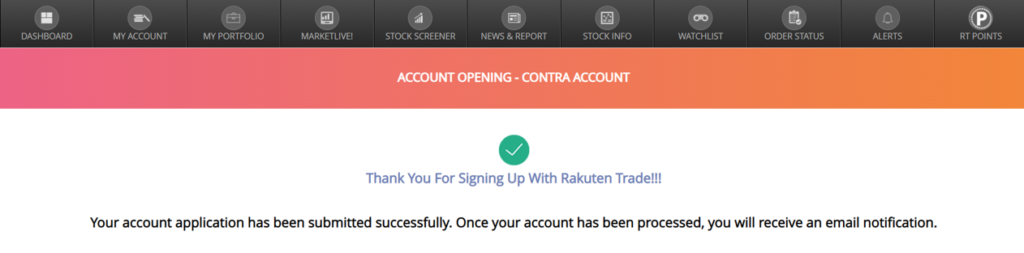

Step 7: Complete the account opening

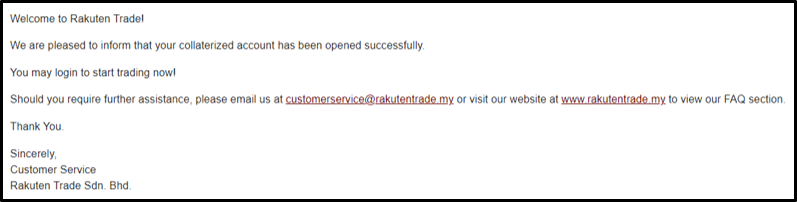

You will receive an email notification after your account application has been processed。

The SSF team measured the submission of the Rakuten Trade Contra Account account application at 10 a.m. and received an email notification of the successful account opening of the Contra Account at 11: 08 a.m. on the same day。

▍ How to use Rakuten Trade Contra account for investment transactions?

Before trading stocks, you need to deposit money to Rakuten Trade。You can transfer money online through major banks.。

Next, SSF will demonstrate how to trade stocks using Rakuten Trade Contra Account。

Note that the following shares are for demonstration purposes only and are not investment advice。All investments are risky and it is recommended that you do your homework and risk planning before entering the market.。

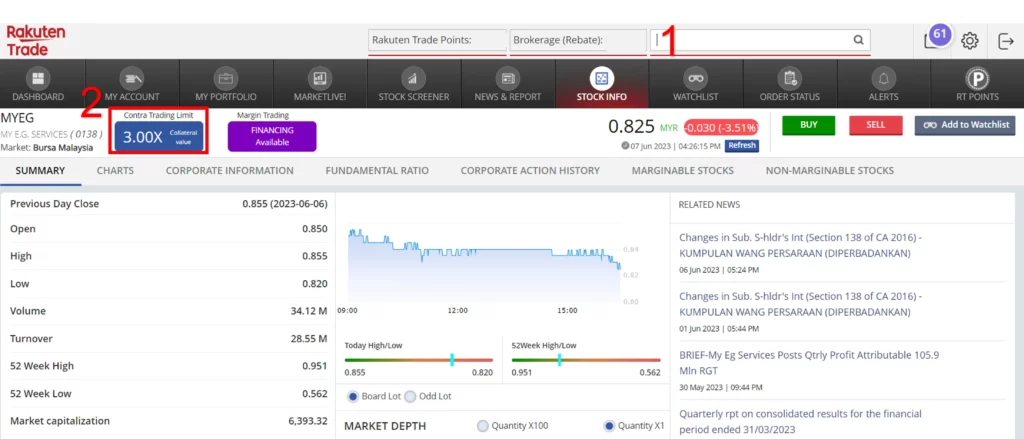

Step 1: Enter the stock you want to buy in the Search column

In MYEG, for example, you only need to enter MYEG or stock number 0138 in the Search section, and the stock will appear on the page, and you can click MYEG.。

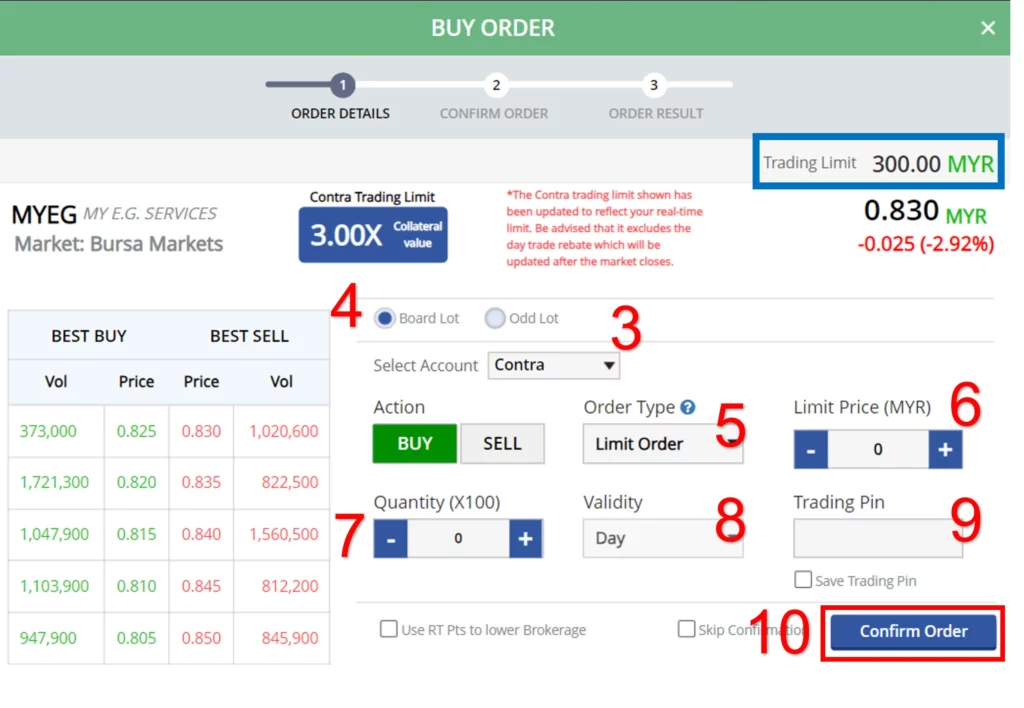

Step 2: After entering the MYEG stock page, click the blue "3".00X Collateral Value "

Step 3: Check whether the trading account is Contra Account

When you choose 3..After 00X Collateral Value, the system usually displays Contra directly in the Select Account column.。If Cash Upfront appears, you can still click on this column and select "Contra."。

In this step, you can view the current Trading Limit。Taking the above image as an example (blue grid), Trading Limit is RM 300。

Step 4: Select Lot Type

As with Cash Upfront, 1 Lot = 100 shares

When you choose Board Lot, this means that the number of shares you buy must be at least 1 Lot, which is 100 shares.。

For example, when you buy MYEG, you choose Board Lot, buy 4 Lot that is 400 MYEG stock, buy 8 Lot that is 800 MYEG stock, buy 12 Lot that is 1200 MYEG stock, and so on.。

Second, when you choose Odd Lot, it means that you are buying fewer than 100 shares, or that you do not want to buy shares as an integer Lot。For example, when you only want to buy 20 shares of MYEG, you can choose Odd Lot and subscribe to 0.2 Lot.。

Before you choose Odd Lot, it's important to note that you're likely to face difficulties selling Odd Lot, as most investors will prefer to buy Board Lot and subscribe to the stock in whole numbers。

Step 5: Select Order Type

Limit Type: When you choose Limit Type, the stock you want to buy won't be traded right away, but will wait until the stock price drops to your desired price before you can subscribe successfully。

MYEG above is an example, the picture shows that MYEG's share price is RM0.830。However, you want to use RM0.825 subscription, you can choose Limit Order and wait until the stock price drops to RM0.At 825, buy the stock again.。

Market Order: When you choose Market Order, you can buy horse stocks directly at the current market price.。

Take the MYEG stock price in the above picture as an example, the stock price is RM0.830 / 0.660。When you choose Market Order, you are directly using RM0.830 Buy MYEG。

Step 6: Enter Limit Price

If you select Limit Type in the Order Type section, then you must enter Limit Price, which is how much you want to buy the horse stock you want。

Conversely, if you are choosing Market Order, then you don't have to fill in this column because the system will buy stocks directly based on the current stock price。

Step 7: Choose the quantity you want to buy

Generally, investors will choose Board Lot。When you want to buy 100 shares, you just need to fill in the "1" in the Quantity column instead of 100。You notice that the Quantity column has a note (x100), which means 1 x 100, and filling in 1 means buying 100 shares.。

Step 8: Select the Validity of the purchase

When you choose DAY, this means that your transaction will be completed on that day。Your purchase request will be automatically cancelled in the event that no transaction matching your requirements occurs on that day。

If you choose GTD, this means that your transaction will be completed within the date you set.。For example, you set a time limit of 5 days, then within 5 days, if a transaction meets your requirements, then your purchase request will take effect。Conversely, if the requirements of your transaction are still not met within 5 days, your purchase request will be automatically cancelled。

Step 9: Enter the Trading Pin

After selecting all purchases, you must fill in the six-digit password you entered when creating your Rakuten Trade account。

If you forget the transaction password, you can reset a new password。

Step 10: Click "Confirm Order" to confirm the order

After confirming your order, you can check your order status at Order Status。

If your order is closed, you can view your portfolio at My Portfolio。

▍ Contra Account profit (Contra Gain) and loss (Contra Loss)

Contra Account's transactions are based on a T + 2 settlement cycle, which is two business days after the transaction is completed.。Investors make a profit from the bid-ask spread by selling the rising price of the stock after buying it and before settlement, which is known as Contra Gain.。

However, if the stock price falls and the price at the time of sale is lower than the price at the time of purchase, the investor will lose money, which is called Contra Loss。If the amount of the loss is insufficient, the investor needs to make up the difference。

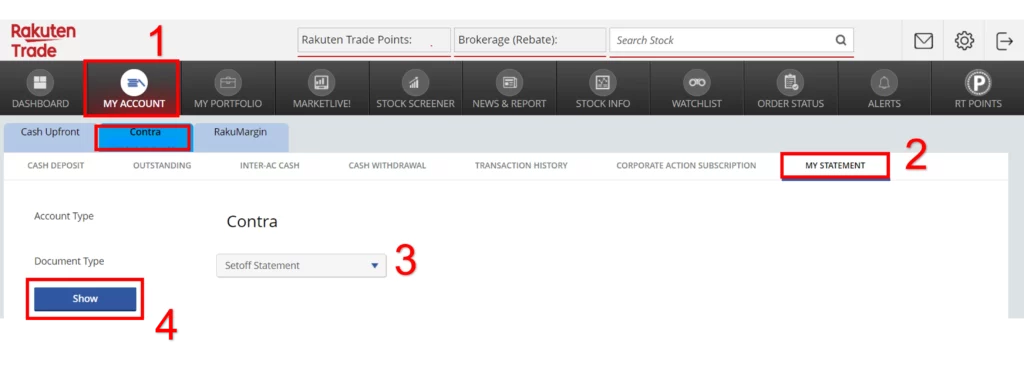

You can log in to Rakuten Trade, click "My Account," click "My Statement," select "Setoff Statement" and click "Show," so you can check the gains and losses of Contra Account.。

Contra Gain will be deposited into your account two trading days (T + 2) after the sale of the outstanding stock order (outstanding purchase).。When there is a loss after you sell an unpaid stock order, the system will automatically deduct it from your available cash balance。

If the system finds that your account does not have enough cash after deducting losses, you will receive an email notification on the third business day (T + 3) after the trading day, asking you to send an email to the customer service department before 8am to get instructions for manual withdrawals.。

▍ How to submit settlement?

Regardless of whether your investment is profitable or losing money, all Contra trading account investors are required to settle the stock transaction before 11pm on the second business day (T + 2) after the transaction is made, otherwise the system will force the sale of the shares you bought through Contra Account on the morning of the third business day (T + 3) after the transaction.。

The following is the settlement process of Contra Account:

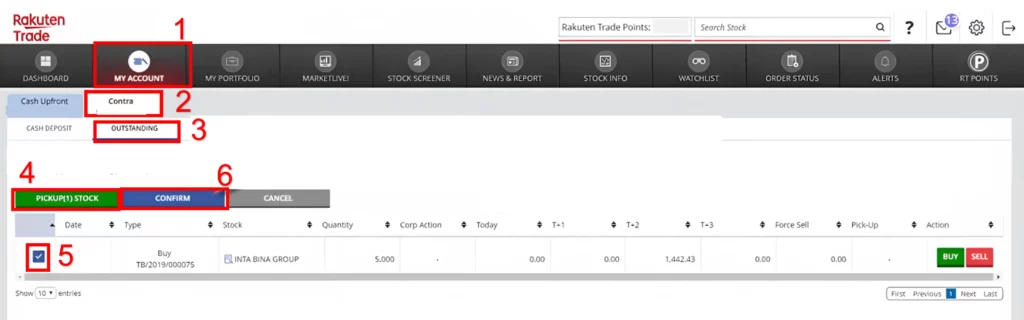

Step 1: Click "My Account"

Step 2: Click "Contra"

Step 3: Click "Outstanding"

Step 4: Click on "Pickup Stock"

Step 5: Select the stocks you want to settle by ticking

Step 6: Click "Confirm"。The system will pop up a message to confirm the settlement, you just need to click "Ok"。

What is the difference between Rakuten Trade's Cash Upfront Account, Margin Account, and Contra Account??

| Cash Upfront Account | Margin Account | Contra Account | |

| Funding requirements | Use cash for transactions | Margin required | Trading with Collateral |

| interest expense | No interest expense | Interest charges are required: the interest rate on the margin balance is 7 per annum..3% | No interest expense |

| Transaction Limits | Subject to the amount of cash available | Subject to margin provided | Subject to the value of collateral provided |

| Risk Management | Low risk | Higher risk | Higher risk |

| leverage effect | no leverage effect | Leveraged transactions can be used, determined on the basis of collateralized cash and collateralized stock, and proof of income can be submitted to apply for a higher amount of financing. | Leveraged trading can be used, allowing up to 5x leverage |

▍ Rakuten Trade Contra Account FAQs

What happens if a stock in a Contra trading account stops trading?

When the trading of shares in the Contra trading account is suspended, the trading limit of the shares will be adjusted to 0, and Rakuten Trade will send you an email and notify you through the platform。

Can I sell my shares on the day of the forced sale??

When the system performs a forced sell, you cannot sell the stock on your own on the day of the sell。

How can I increase my trading limit?

You can increase your trading limit by depositing additional cash or stock and transferring to a Contra trading account。

When do I need to liquidate my outstanding stock transactions (outstanding purchase)?

You need to settle your stock trades by 11pm on the second business day (T + 2) after trading.。

Suppose you buy a stock on Monday, then T + 2 is Wednesday, and you must liquidate your stock trading on Wednesday at the latest.。

If you buy a stock on a Thursday, T + 2 is the Monday of the following week。

What would have happened if I hadn't settled the stock exchange by 1 pm on T + 2?

The system will execute a forced sale on the morning of T + 3, which means your stock will be automatically sold。

Do I have to pay an additional fee for the forced sale of unsettled shares??

The Rakuten Trade platform is not subject to a mandatory fee for selling shares, so you don't have to pay any fees。

What should I do when the system has no buyers when forcing a sale?

The system will manually retrieve your unsettled shares。

Conclusion

The Rakuten Trade Contra trading account is suitable for investors who are interested in real-time stock markets, the latest stock movements and investment risks, and are engaged in short-term investments.。However, before deciding whether to open this account, be sure to assess the investment risk you can afford and determine whether you have enough time to follow the latest developments in the stock market and enough money for short-term investments。

Hope this article has helped you understand Rakuten Trade Contra Account related matters and help you easily and easily handle Rakuten Trade Contra Account operations。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.