RakuMargin Trading Account Opening Teaching

Open a RakuMargin account, you can enjoy high leverage, the lowest fees in Malaysia, online application to increase financing limits, all-weather online investment and other services.。RakuMargin Trading also provides instant margin ratios for investors holding RakuMargin accounts, making it easy for investors to check anytime, anywhere.。

A margin trading account is a financial instrument that allows investors to improve their ability to invest and trade by borrowing funds.。The instrument allows investors to buy more shares with less capital, thereby achieving greater returns when the share price rises。

When trading on margin, the investor is required to pay a certain percentage of the margin as security for the transaction。Brokers will provide financing support based on the investor's capital position and risk assessment.。The RakuMargin trading account under Rakuten Trade is a typical example of providing margin trading services.。

The following is a detailed description of the RakuMargin trading account, including information on the account opening process, trading methods, interest and fee calculations。

RakuMargin Margin Trading Account

The RakuMargin Trading Account is a financing measure developed by Kenanga Investment Bank Berhad and designed specifically for Rakuten Trade investors.。The RakuMargin trading account is like a credit card, and investors can trade shares on the Malaysian Stock Exchange using existing funds and / or pre-approved financing limits by Kennag Investment Bank Limited.。

Rakuten Trade is a Malaysian investment platform that provides digital trading, providing margin trading for account opening, deposit, trading, settlement, etc.。Investors can also apply for financing limits through Rakuten Trade's website。Rakuten Trade also offers instant margin ratios that investors can check anytime, anywhere。

Key Features of RakuMargin Trading Account:

○ Free online registration, only need to provide online supporting documents

○ 100% of online transactions

○ Automatic financing limit of RM 100,000

○ Financing services provided by Kenag Investment Bank Limited

○ RakuMargin trading account will be approved within 72 hours

○ Ultra-low commission from RM 1 to RM 100

○ The annual interest rate on the outstanding balance is 7.3%。

○ 0.5% Transfer Fee (Rollover Fee)

It is important to remember that when you trade stocks through a RakuMargin trading account, the default financing limit for the RakuMargin trading account is RM 100,000。You can also apply for a higher financing limit through the platform homepage (Dashboard).。

Second, the annual interest rate on the outstanding balance is 7.3%, and these arrears refer to the items you owe, including: stock financed, losses, interest on borrowings, etc.。In order to avoid the need to repay a higher amount, remember to pay off the arrears on time。

In addition, rollover (rollover) means that in the absence of settlement, the position is extended until after the end of the trading day。At the end of each rollover period, the flat rate for the outstanding amount of the principal purchase becomes zero.5%。

Transaction fees for RakuMargin Account

| 费用 | Number | Calculation method |

| Commission | 0 of turnover.1% single minimum RM 1, maximum RM 100 | - Missing transactions of RM 699, trading commission of 1% of trading volume, minimum RM 1 per transaction。- Replace RM 700 to RM 9,999.99 of transactions with a commission of RM 9 - then RM 10,000 to RM 99,999.99 of the transaction commission, 0 of the transaction amount.1% - Transactions greater than RM 100,000 with a commission of RM 100 |

| Interest on margin balance(Interest on Margin Outstanding Balance) | Annual interest rate 7.3% | Calculated at the end of each day after T + 2 (trading day + 2 business days)。Interest on unpaid balances will be shown at the end of the month。 |

| Transfer Fee (Rollover Fee) | 0.5% | At each rollover, based on the amount of outstanding purchases per principal, at 0 per installment.5% flat fee, 3 months for rollover points。Take RM 10,000 as an example of an outstanding purchase amount, RM 10,000 x 0.5% = RM50 Therefore, the transfer cost is RM50。 |

The process of opening a RakuMargin Account

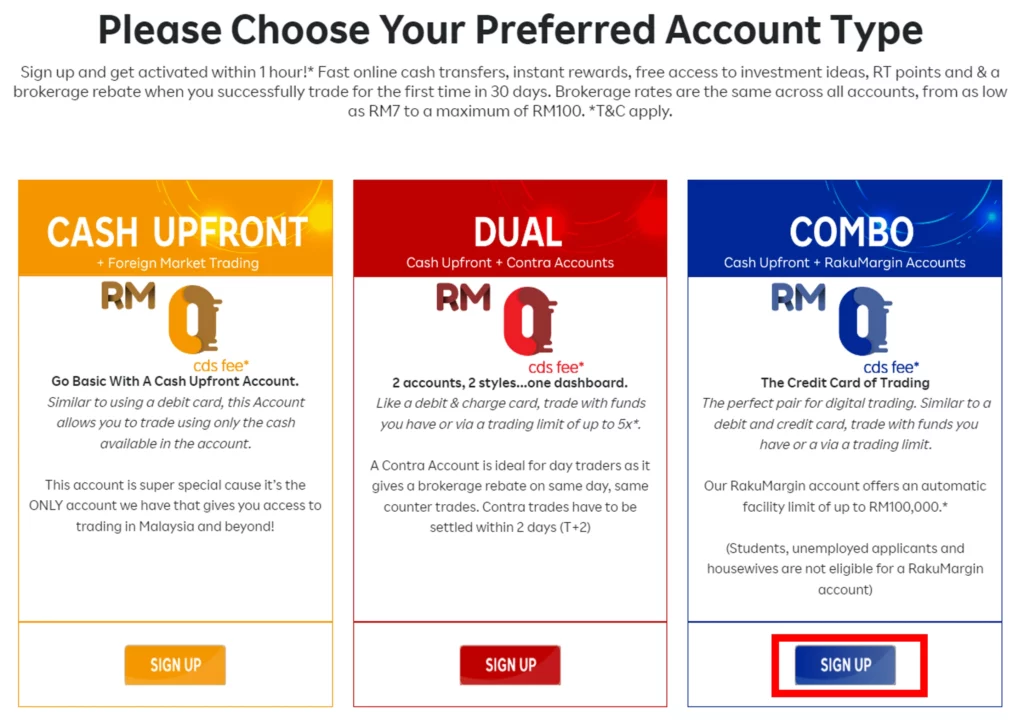

When opening an account, click "Sign Up" in blue and choose to open Cash Upfront and RakuMargin Account at one time。

If you have opened Cash Upfront on the Rakuten Trade investment platform, you can open a RakuMargin account by following these steps。As long as you can submit information and related documents as soon as possible, in an ideal situation, you can successfully open an account and conduct investment transactions within 72 hours。

A RakuMargin account requires only 11 simple steps, and the files you can prepare in advance are:

Malaysian Tax Number (TIN)

○ Identity card number of immediate family member or spouse

○ Electricity bill, water bill, bank bill or Internet bill for the last 3 months under your own name (PDF version)

Step 1: Select your RakuMargin account

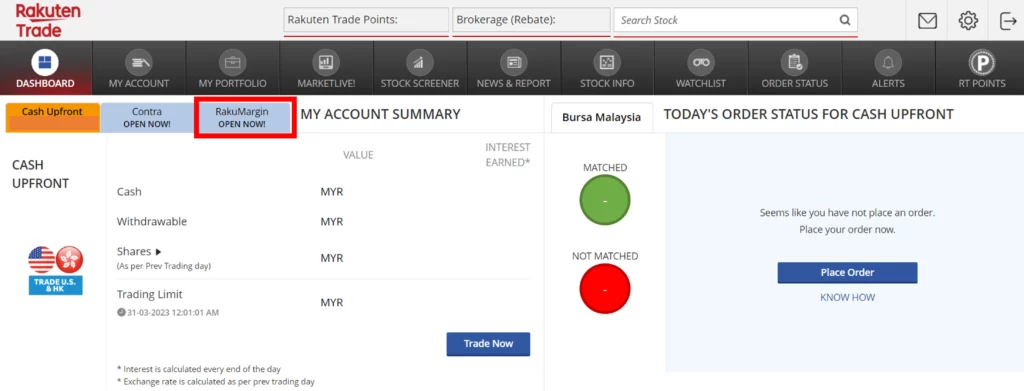

Click "RakuMargin Open Now" on the Rakuten Trade homepage (Dashboard)。

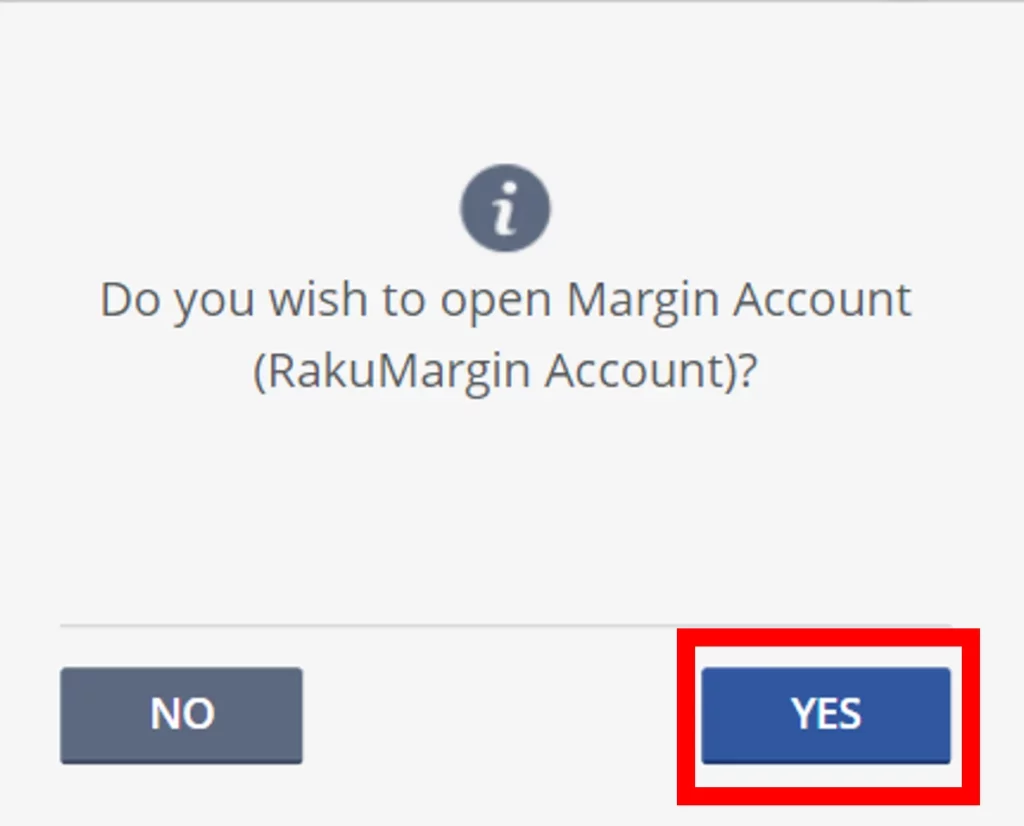

When the system pops up asking if you want to open a RakuMargin account, click "Yes"。

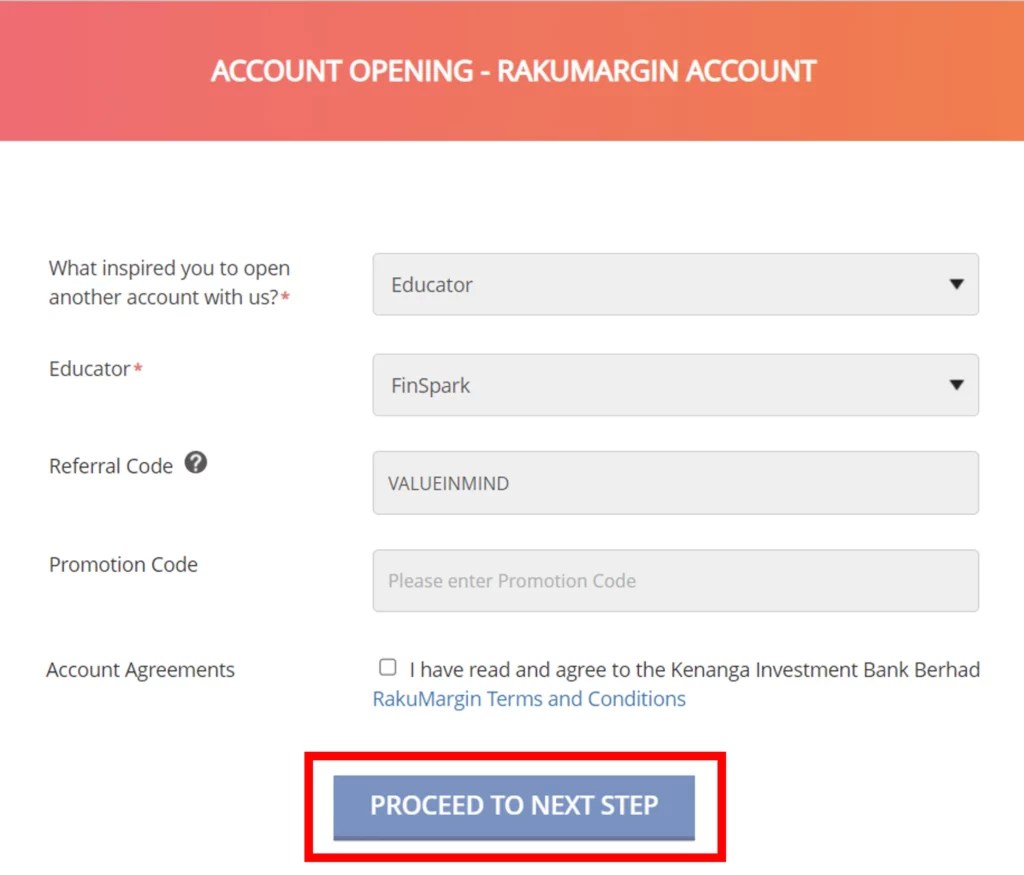

The system will automatically fill in the referral information for the correct account, you only need to agree to RakuMargin's conditions and terms, and click "Proceed to Next Step"can be。

Step 2: Fill in the investment status information

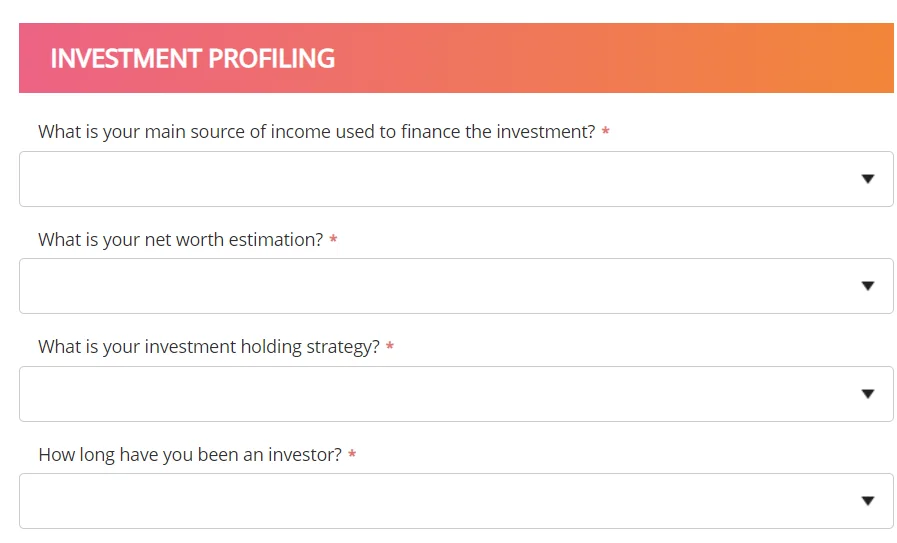

Choose the main source of income you use for investment, what is the estimated net worth, investment strategy and investment time.。

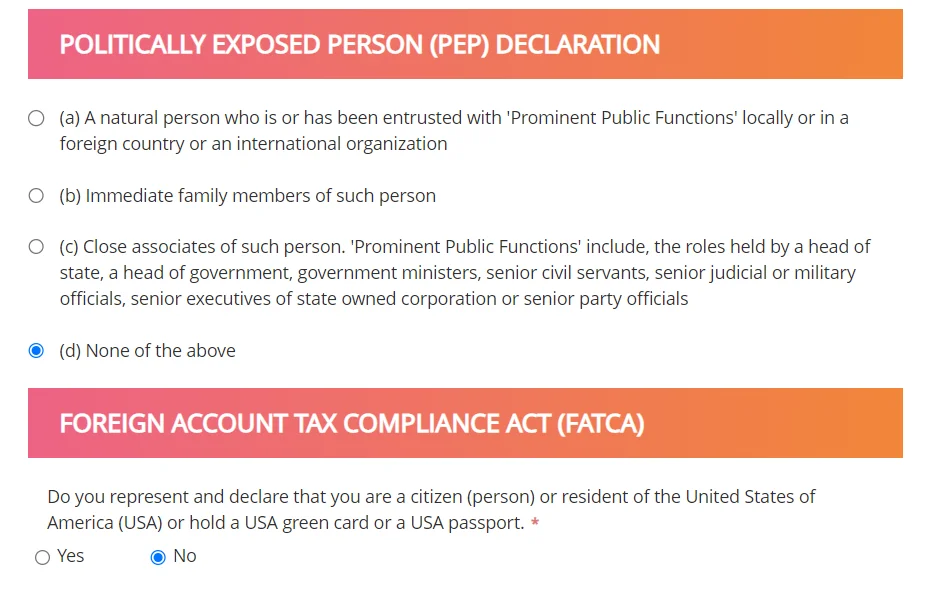

Next, you need to fill out your own political public figure statement and choose whether you are a U.S. citizen or hold a U.S. green card or hold a U.S. passport。

If you are not a person holding an important position at home and abroad, nor are you an immediate family member or member of the person holding the position, then you only need to select "None of the above" in the politically sensitive person statement.。

If you are not a U.S. citizen, or do not hold a U.S. green card or passport, select "No" in the Foreign Account Tax Compliance Act section.。

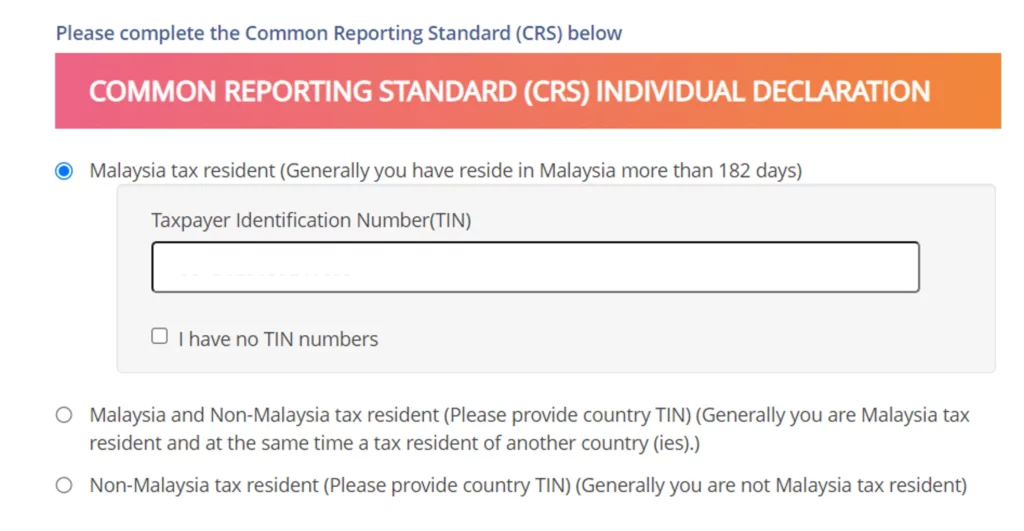

Next, fill in your Malaysian taxpayer ID number

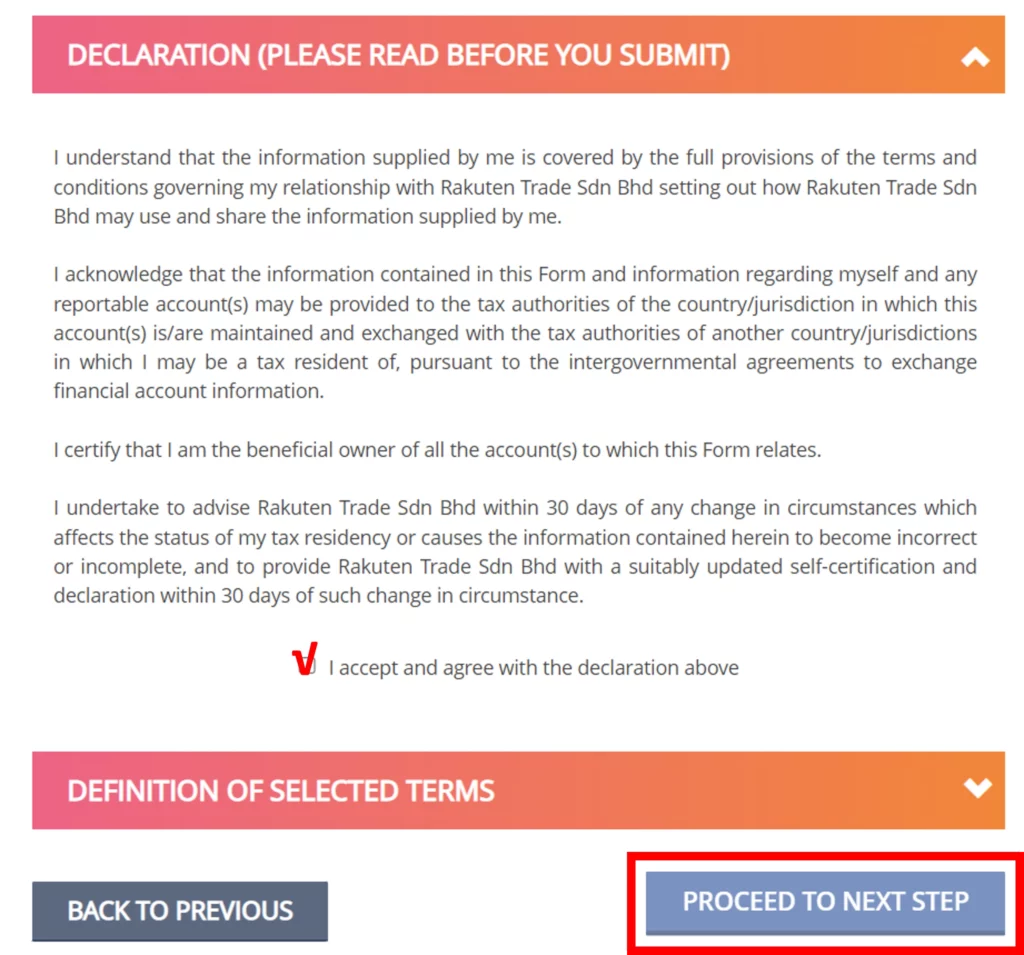

Step 3: Statement of Acceptance and Consent

By ticking "Accept and agree with the declaration above" and clicking "Proceed to Next Step," you accept and agree to the declaration.。

Please read the statement carefully before ticking。Once you check the box, you agree with this statement, which includes: you agree that the information provided and account information may be provided to the tax authorities, agree that you are the holder of a RakuMargin investment account, agree that you will inform Rakuten Trade of the change in your tax status and nationality within 30 days, and provide up-to-date proof, or add incorrect or incomplete information within 30 days。

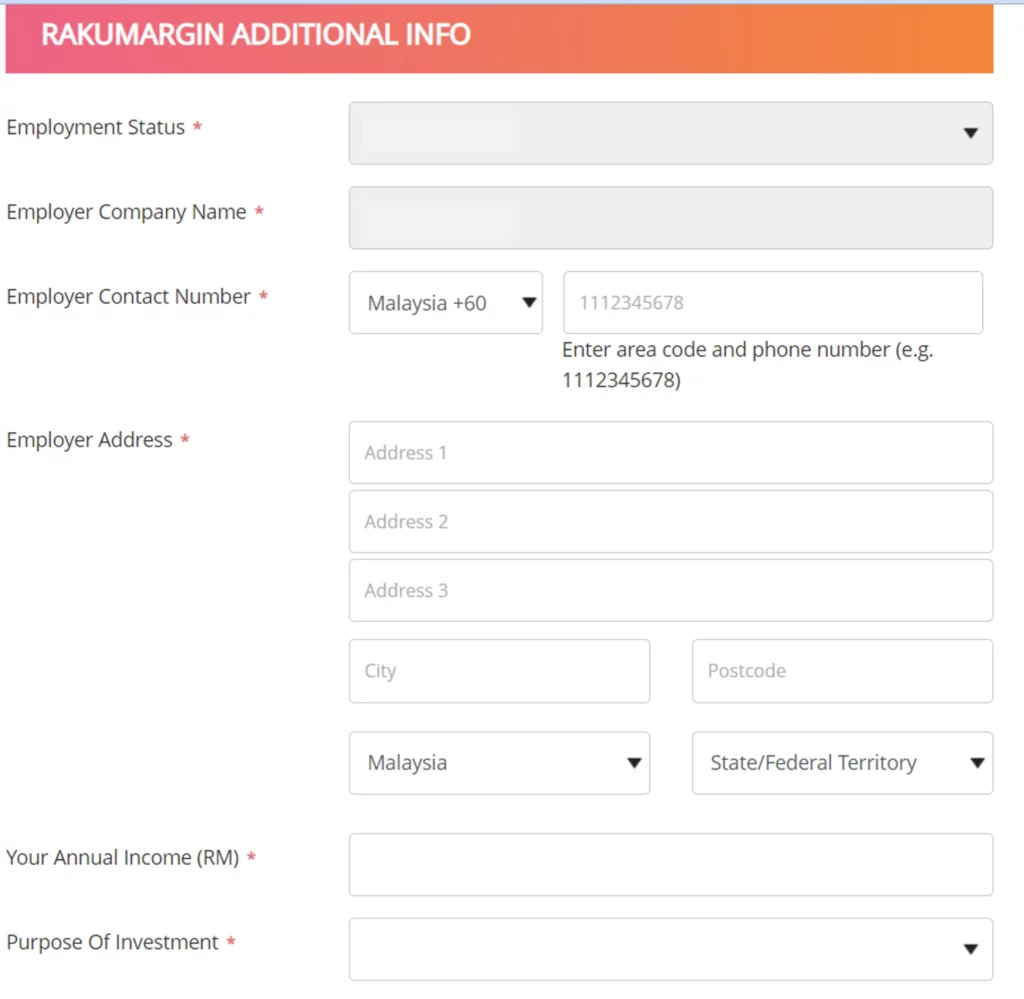

Step 4: Fill in the employment status

Fill in your employer's company name, employer contact number, employer address, annual income and investment purpose。

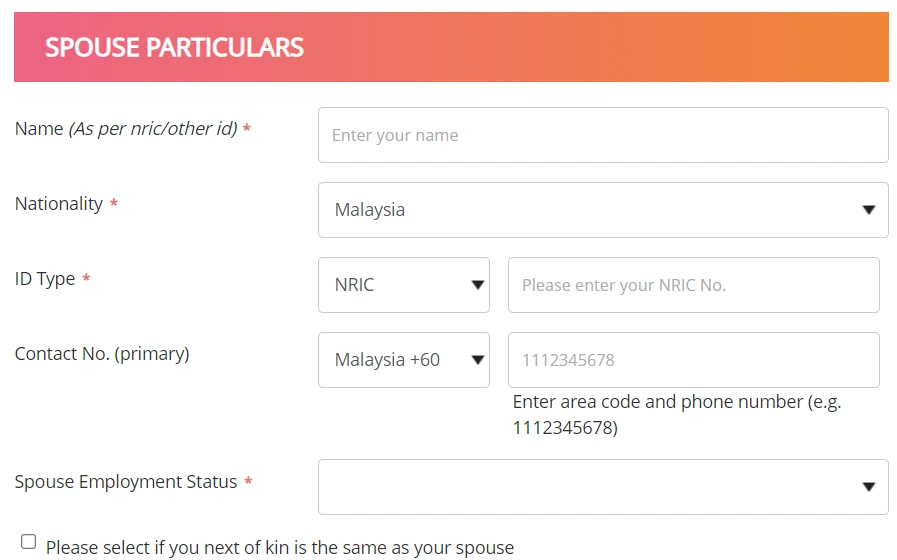

Step 5: Fill in the partner's information (if any)

These include: name (based on the name on the identity card), nationality, identity card number, contact number and employment status。Please select if your next of kin is the same as your spouse。

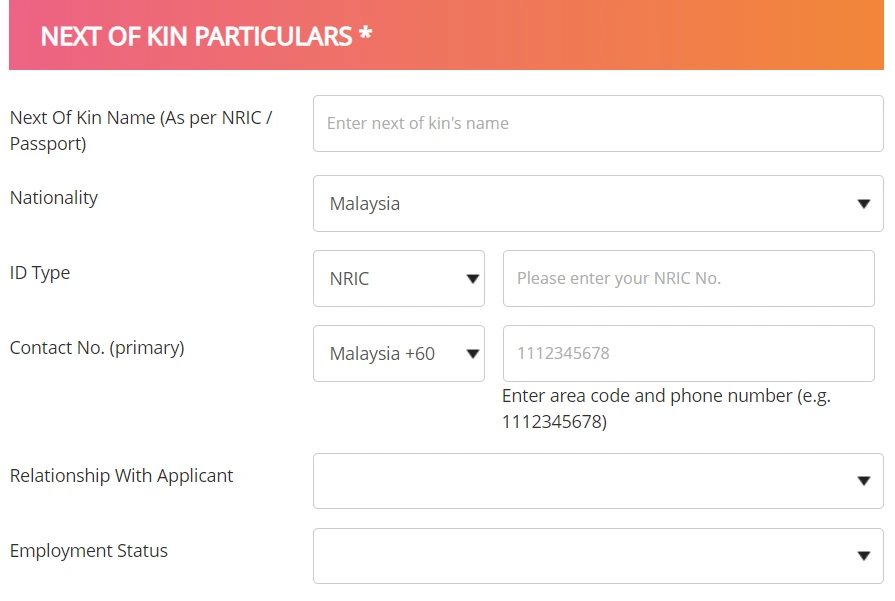

Step 6: Fill in the information of the immediate family member

You will need to fill in the name of your immediate family member (which must be the same as the name registered on your ID card), nationality, ID number, contact number, relationship and employment status.。If you have ticked the box in Step 9 to indicate that the immediate family member and partner are the same person, then you do not need to fill out this section。

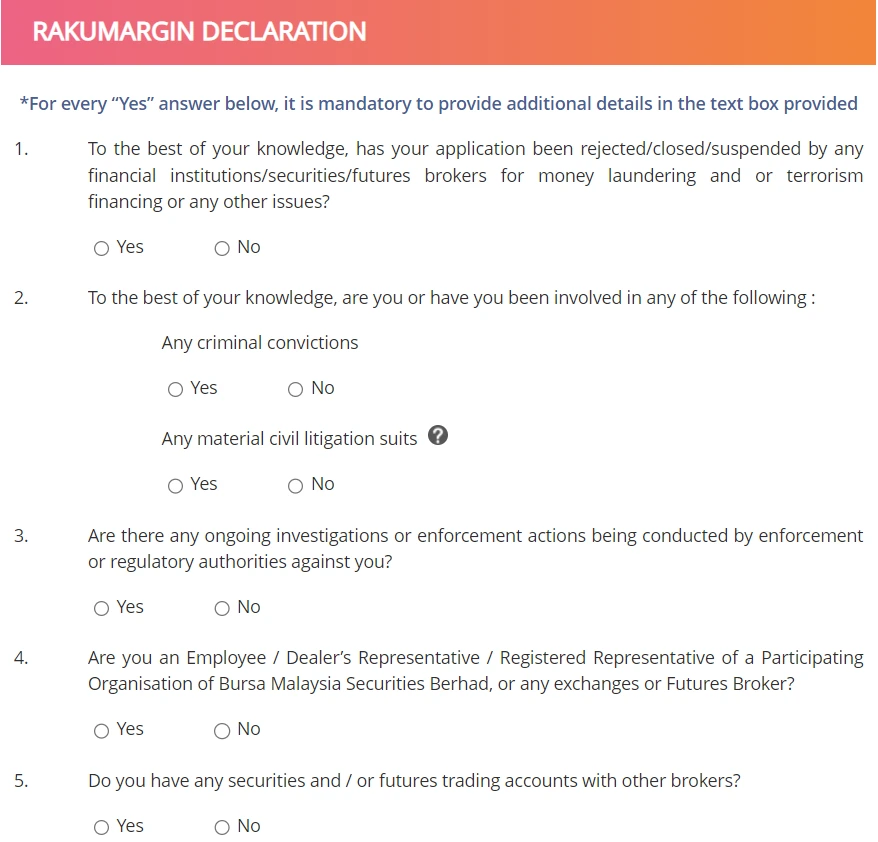

Step 7: Background checks

This section is mainly to choose whether it involves a criminal conviction, whether it involves a civil lawsuit, whether law enforcement or regulatory agencies are investigating you, whether you are involved in the Malaysian Stock Exchange, whether you have any securities or futures trading accounts with other brokerage companies, whether you are a related person of the Kenanga Group, etc.。

If your choice in one of the questions is (Yes), then you need to provide additional details。

After answering all questions, you can click "Submit Application" to submit your application.。

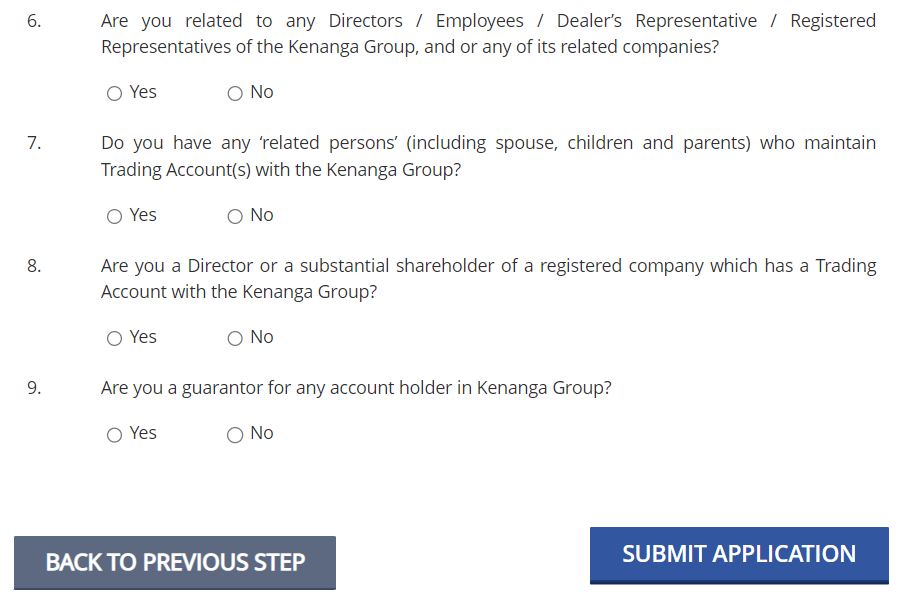

Step 8: Submit the required documents

After your account is processed, you will receive an email notification。

Rakuten Trade will email you for proof of residential address certification and you can attach an electricity bill, water bill, bank statement or internet bill。

Note that you must submit proof of your address in English within the last 3 months, and this address must be registered in your name。

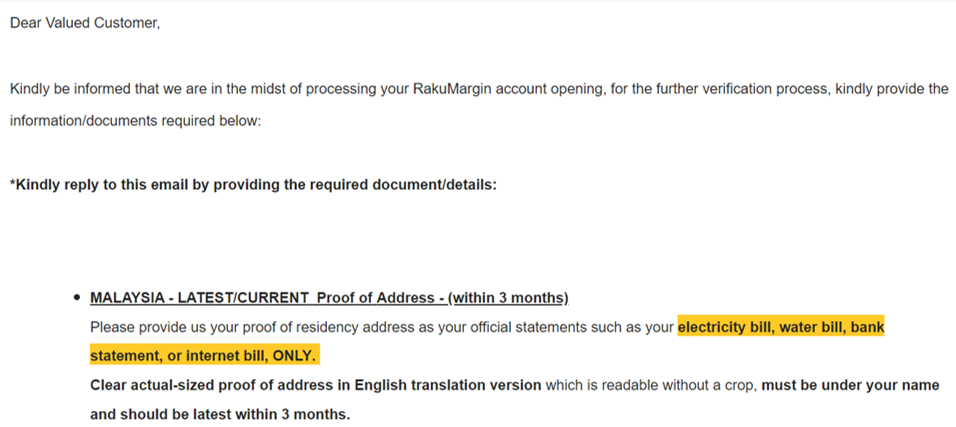

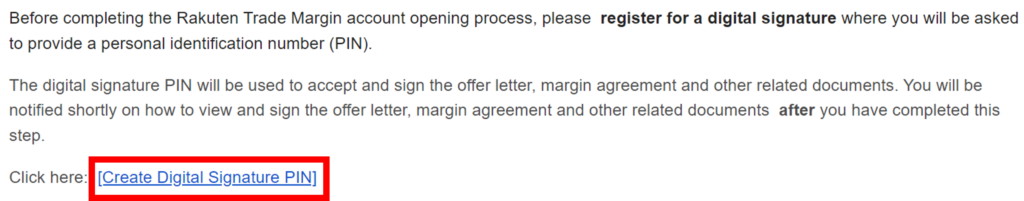

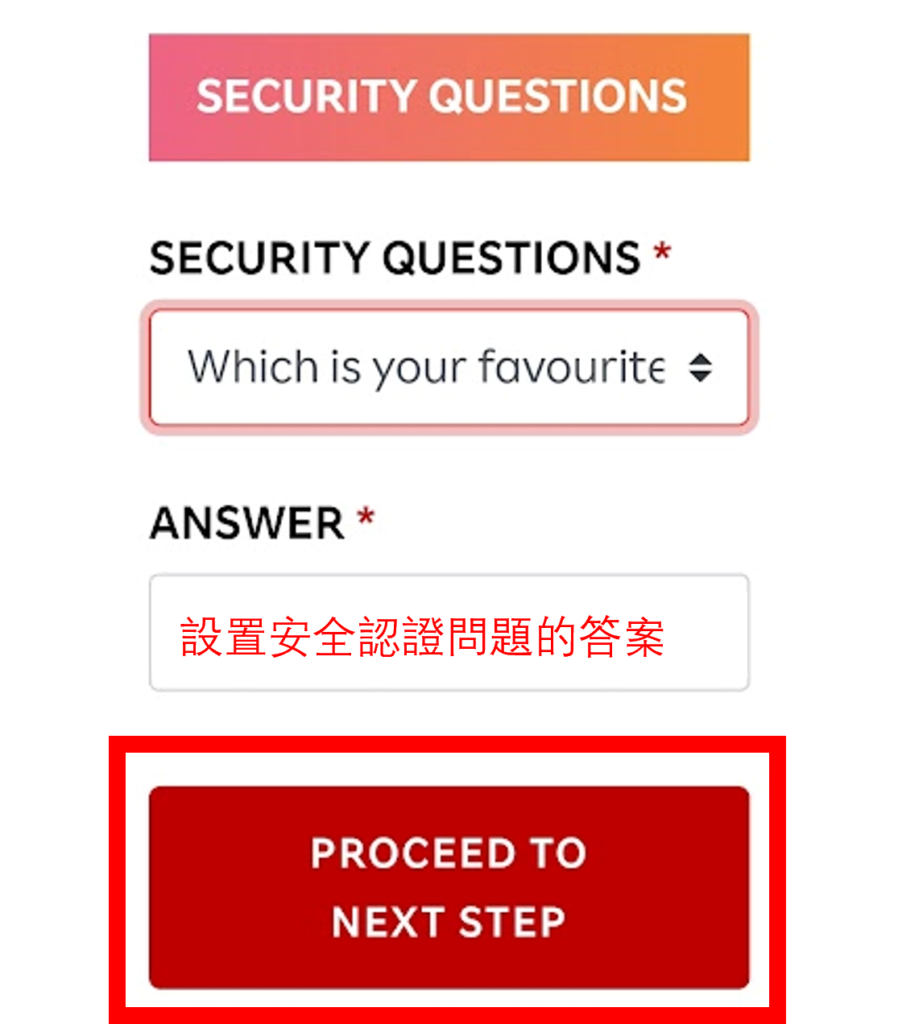

Step 9: Register Electronic Personal Identification Password

After reviewing the data, Rakuten Trade requires you to register an electronic personal identification password (Digital Signature PIN) before officially opening your RakuMargin account.。This electronic PIN will be used to sign a consent form, agreement or other related document。All you need to do is click on the blue "Create Digital Signature PIN" in your email.。

After selecting the security authentication question and setting the answer, click the red "Proceed to Next Step"。

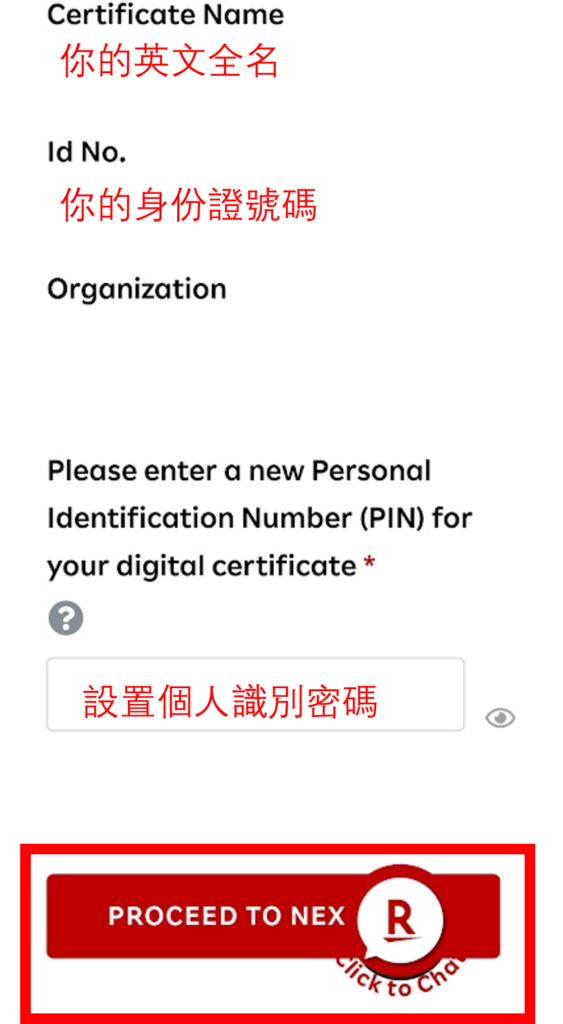

After checking whether the name and ID number are correct, set the personal identification password, and then click the red "Proceed to Next Step"。

If you find an error in the name or ID number displayed on the website, you can click on the red "Click to Chat" at the bottom right to contact Rakuten Trade's customer service team to correct the information.。

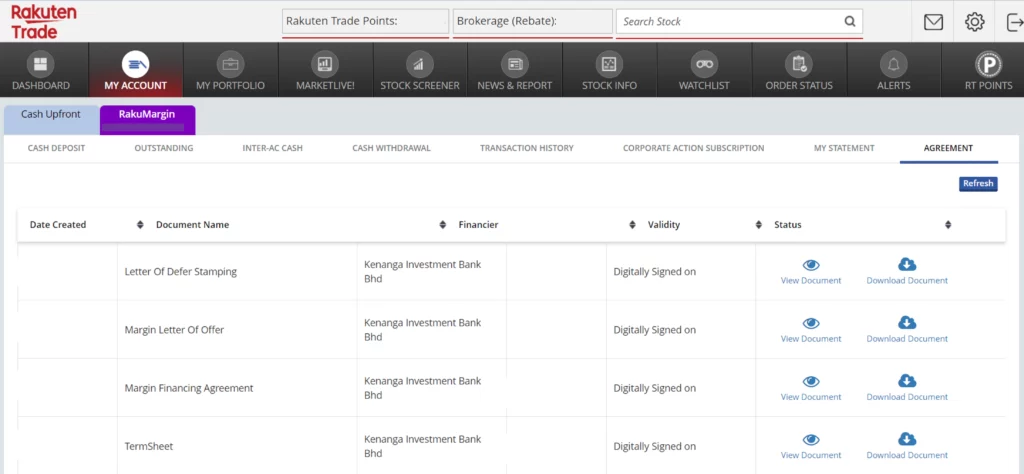

Step 10: Download, read and sign the Agreement

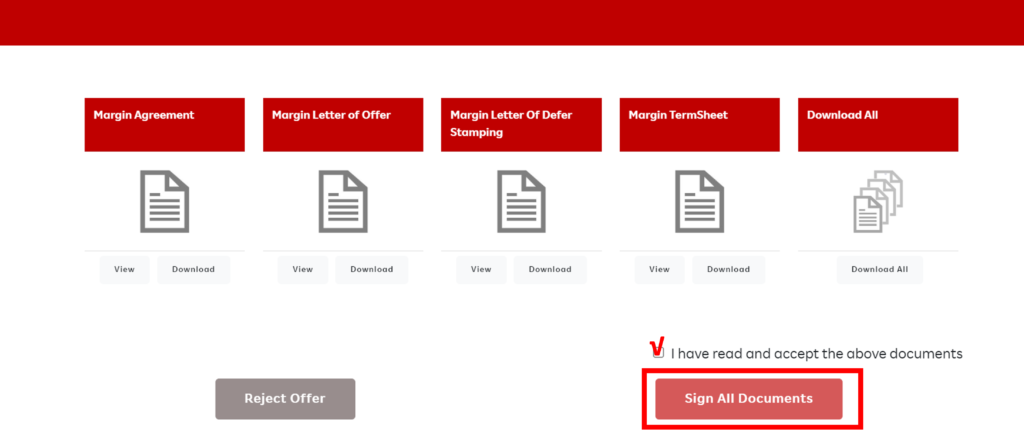

You will receive an email from Rakuten Trade asking you to download and agree to the agreement for your RakuMargin account.。All you need to do is click on the blue "View and Accept / Reject Margin Offer" in your email.。After clicking, you need to enter the answer to the security authentication question set in the previous step and the personal identification password (Digital Signature PIN) to read and sign the agreement。

Note that you need to sign the agreement before the specified date.。

In case you forget the personal identification password you have set, you can click "Reset Pin" to reset the password。

Next, you simply tick I have read and accept the above documents and click on "Sign All Documents" in red.。

Step 11: Successfully open a RakuMargin account

After signing the agreement, Rakuten Trade will notify you by email if you have successfully opened your RakuMargin account。

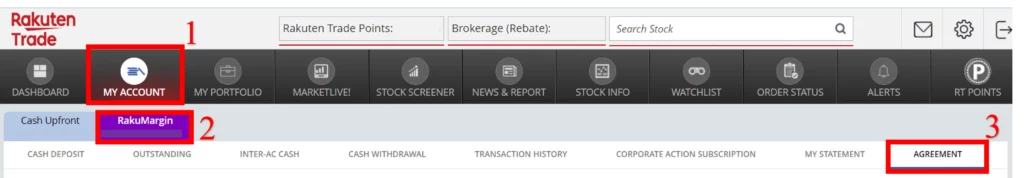

After success, you can log on to the Rakuten Trade website, click on "My Account," click on "RakuMargin," and then select "Agreement" to view 4 RakuMargin agreements。

How to use RakuMargin Account for financing transactions?

Similar to Cash Upfront Account, you need to deposit money into your RakuMargin Trading account before trading shares.。RakuMargin Trading accounts are deposited in the same way as Cash Upfront, and online transfers can be made through major banks。

This section mainly shares how to trade stocks with RakuMargin Trading account。

Step 1: Enter the stock you want to buy in the Search column

Note that the following shares are for demonstration purposes only and are not investment advice。All investments are risky and it is recommended that you do your homework and risk planning before entering the market.。

In Maybank, for example, you only need to enter Maybank or stock number 1155 in the "Search" section, the stock will appear on the page, and you can click Maybank.。

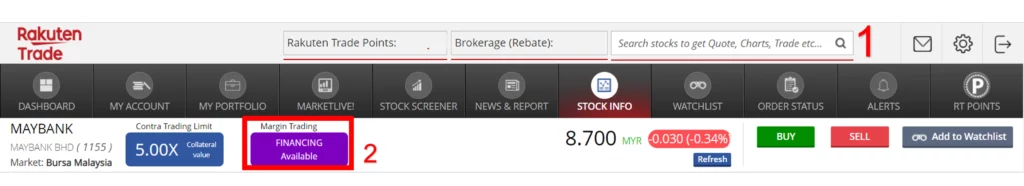

Step 2: Use Margin Trading to Trade Stocks

After going to the Maybank stock page, click on the purple "Financing"。

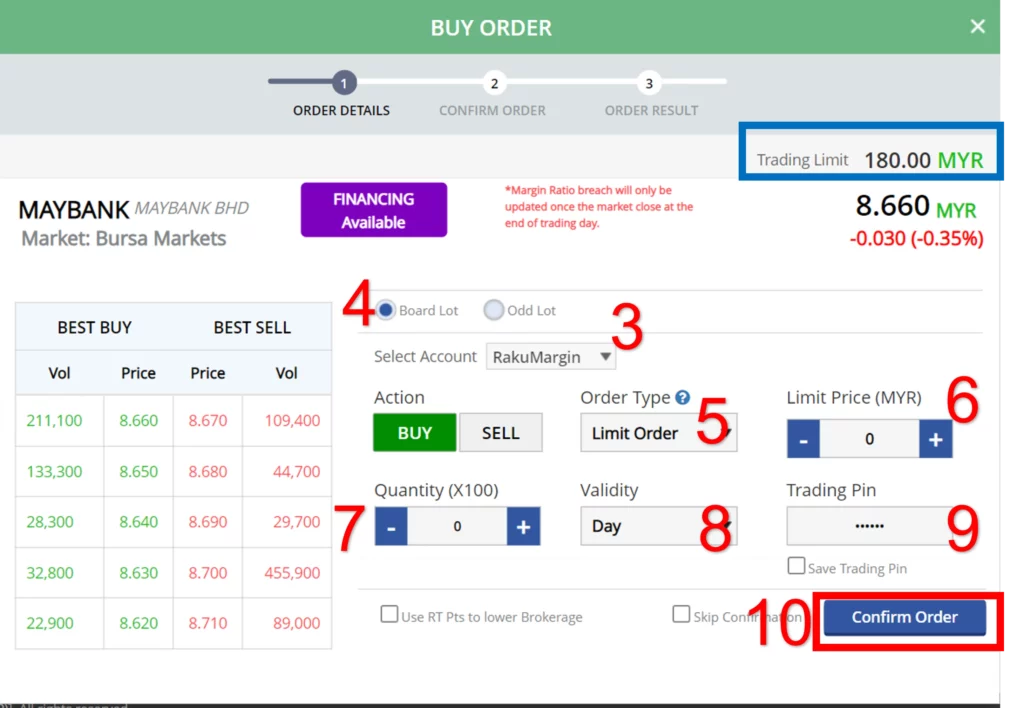

Step 3: Check if the trading account is RakuMargin

When you select "Financing" in step 2, the system will generally display RakuMargin directly in the Select Account column。If Cash Upfront appears, you can still click on this column and select "RakuMargin."。

In this step, you can view the current Trading Limit。Taking the above picture as an example (blue grid), Trading Limit is RM 180。

Step 4: Select Lot Type

As with Cash Upfront, 1 Lot = 100 shares

When you choose Board Lot, this means that the number of shares you buy must be at least 1 Lot, which is 100 shares.。

Note that the following shares are for demonstration purposes only and are not investment advice。All investments are risky and it is recommended that you do your homework and risk planning before entering the market.。

For example, when you buy Maybank, you choose Board Lot, buy 3 Lot, which is 300 Maybank, buy 6 Lot, which is 600 Maybank, buy 12 Lot, which is 1200 Maybank, and so on.。

Second, when you choose Odd Lot, it means that you are buying fewer than 100 shares, or that you do not want to buy shares as an integer Lot。For example, when you only want to buy 10 shares of Maybank, you can choose Odd Lot and subscribe to 0.1 Lot.。

Before you choose Odd Lot, it's important to note that you're likely to face difficulties selling Odd Lot, as most investors will prefer to buy Board Lot and subscribe to the stock in whole numbers。

Step 5: Select Order Type

Limit Type: When you choose Limit Type, the stock you want to buy won't be traded right away, but will wait until the stock price drops to your desired price before you can subscribe successfully。

Note that the following shares are for demonstration purposes only and are not investment advice。All investments are risky and it is recommended that you do your homework and risk planning before entering the market.。

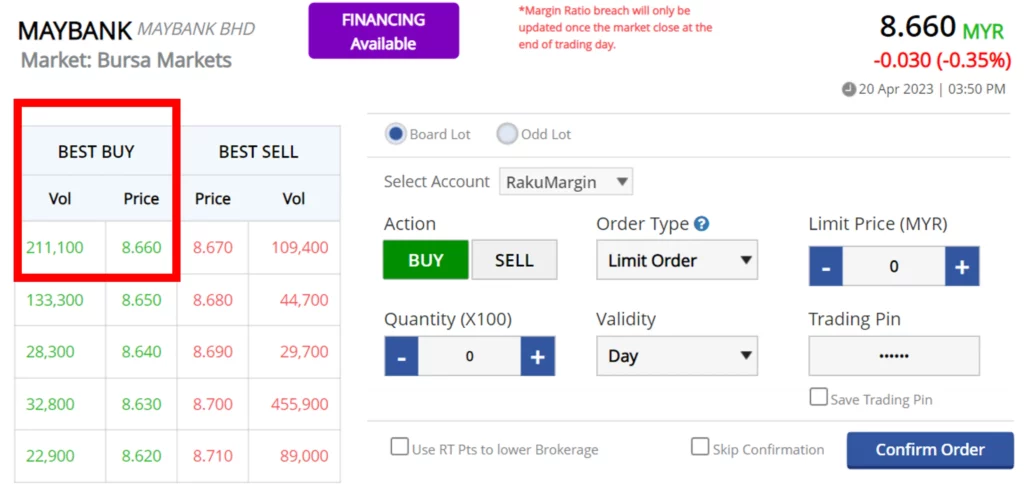

In the case of Maybank, for example, at 3: 50 p.m. on April 20, 2023, the share price was RM8.660。However, you want to take RM 8.500 subscription, you can choose Limit Order and wait until the stock price drops to RM 8..At 500, buy the stock again.。

Market Order: When you choose Market Order, you can buy horse stocks directly at the current market price.。

Take the Maybank price of the picture, the share price is RM 8.660。When you choose the market price list, you are directly in RM 8..660 Buy Maybank。

Step 6: Enter Limit Price

If you select Limit Price in the Order Type section, then you have to enter Limit Price, then how much do you want to buy the horse shares you want。

Conversely, if you are choosing Market Order, then you do not need to fill in this column because the system will buy stocks directly based on the current stock price。

Step 7: Select the quantity you want to buy

Generally, investors will choose Board Lot。When you want to buy 100 shares, you only need to fill in the "1" in the quantity column instead of 100。You note that the number of columns has a note (x100), which means 1 x 100, and filling in 1 means buying 100 shares.。

Step 8: Purchase the selected quantity (Validity)

When you select DAY, this means that your transaction will be completed on the same day。Your purchase request will be automatically cancelled in case no transaction matching your requirements appears on the same day。

If you choose GTD, this means that your transaction will be completed within the date you set。For example, you set a time limit of 5 days, then within 5 days, if a transaction meets your requirements, then your purchase request will take effect。Conversely, if the requirements of your transaction are still not met within 5 days, your purchase request will be automatically cancelled。

Step 9: Enter the transaction password (Trading Pin)

After selecting all purchases, you must fill in the six additional passwords that you entered when creating your Rakuten Trade account。

If you forget your trading password, you can reset a new one。

Step 10: Click "Confirm Order" to confirm the order

RakuMargin margin trading account mechanism

1.How to calculate transaction limits (Trading Limit)?

In a RakuMargin trading account, trading limits are based on collateralized cash (pledged cash) and collateralizable shares (marginable shares).。

Pledged cash (pledged cash) means that you use cash as collateral in order to obtain a financing loan.。If you need to make payments or market adjustments result in a decrease in cash, the total amount of collateralized cash will decrease accordingly。

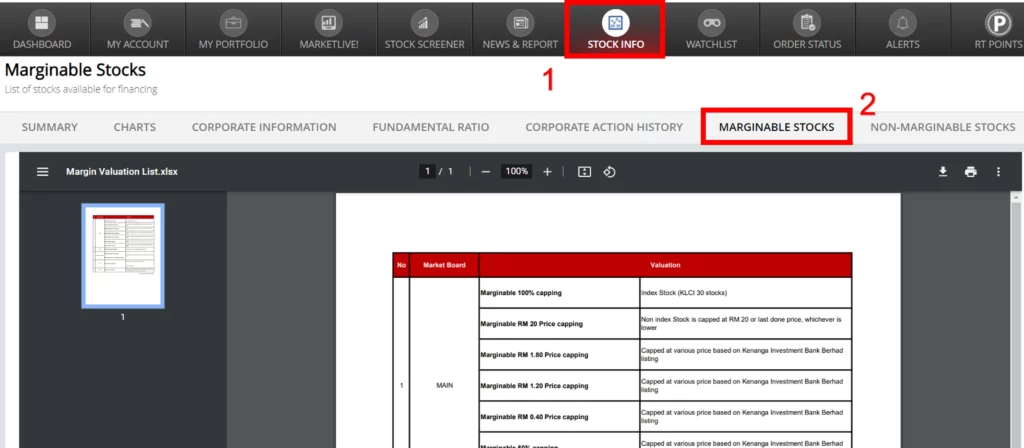

Mortgagable shares (marginable shares) are some of the stocks, bonds, or stocks that you hold that are approved by your RakuMargin account for financing, and these stocks can be used as collateral for you to get a financing loan.。These stocks are highly liquid, you can click "Stock info" and click "Marginable Stock" for a list of mortgageable stocks.。

Example 1: No outstanding balance

| Collateral | Amount (Amount) |

Trading limits |

| Total Mortgage Cash | RM 40,000 | RM 50,000 |

As explained on Rakuten Trade's website for trading limits, investors will have an estimated trading limit of RM 50,000 as long as they have placed RM 40,000 worth of collateralizable shares.。

When the trading limit is RM 50,000, investors can only buy up to RM 50,000 shares.。Take Maybank as an example of a margin-able stock, if an investor takes RM8.Purchase of 6,000 units of Maybank stock at a price of 25, including RakuMargin account transaction costs, at a total cost of RM 49,617.32。

In this case, the outstanding contract is RM 49,617.32。After T + 2 (trading day + 2 business days), Rakuten Trade will charge 6.8% APR, calculated daily and shown at month end。

If the investor decides to hold the stock for a long period of time (more than 3 months), after 3 months, the investor is required to pay 0.5% Rollover Fee, which is RM 49,617.32 x 0.5% = RM 248.09。

Example 2: There is an outstanding balance

Option 1: [(Stock Collateral Value + Cash) - Total Outstanding Balance] x Financing Collateral / (Financing Collateral - 100%)

Financing collateral (MOF) Percentage of collateral value used to secure margin。In the case of RakuMargin, for example, RakuMargin's MOF requirement is 180%, which means that the investor needs to secure RM 10,000 outstanding loans with a total of RM18,000 financing collateral.。

Option 2: Margin Facility Limit - Gross Outstanding Balance

According to the calculation, Trading Limit will be subject to the lower amount。

2.How to Apply for a Higher Facility Limit?

The financing facility refers to a loan made by Rakuten Trade to an investor under the terms of a RakuMargin Trading account, allowing the investor to trade with more money.。

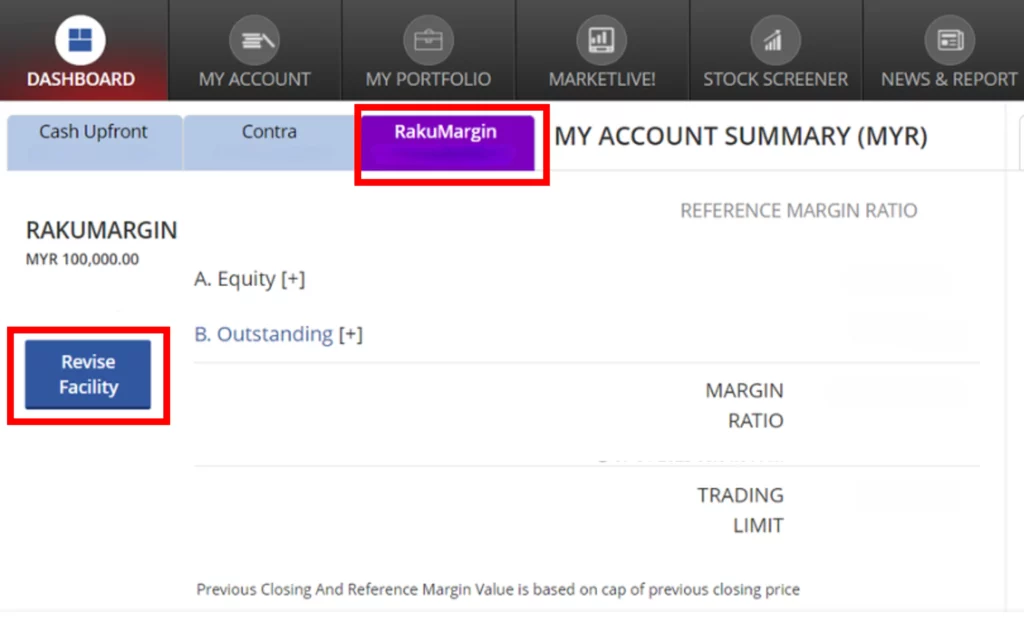

Step 1: Log in to the Rakuten Trade Dashboard, click "RakuMargin," and then click the blue "Revise Facility"。

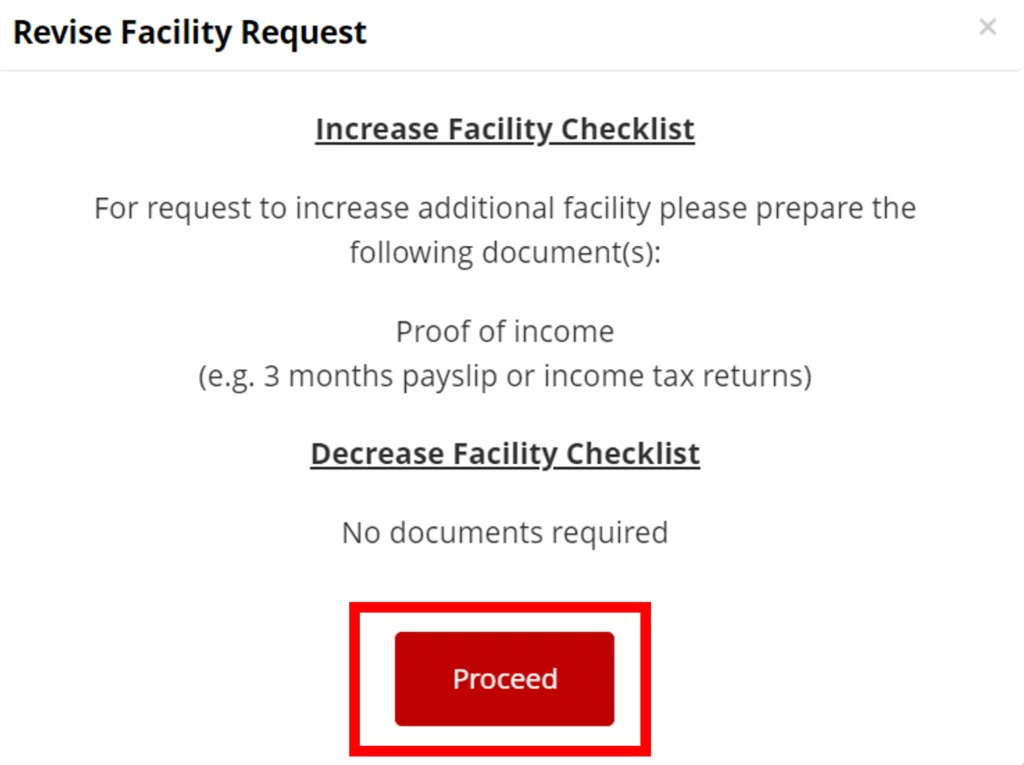

Step 2: The system will automatically pop up a notice stating that you need to have proof of income ready to apply for a higher amount of financing, such as a 3-month salary slip or income tax return。After reading, click on the red "Proceed"。

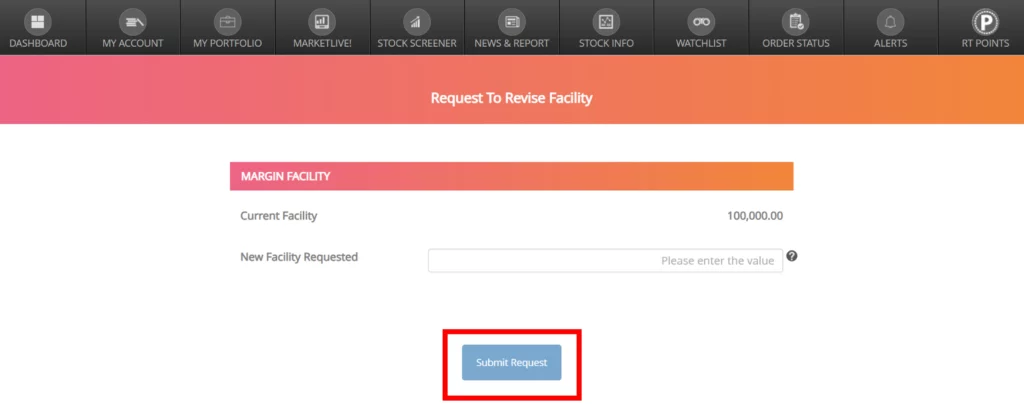

Step 3: Enter the amount of financing you want to apply for in the New Facility Requested column, and then click "Submit Request"。

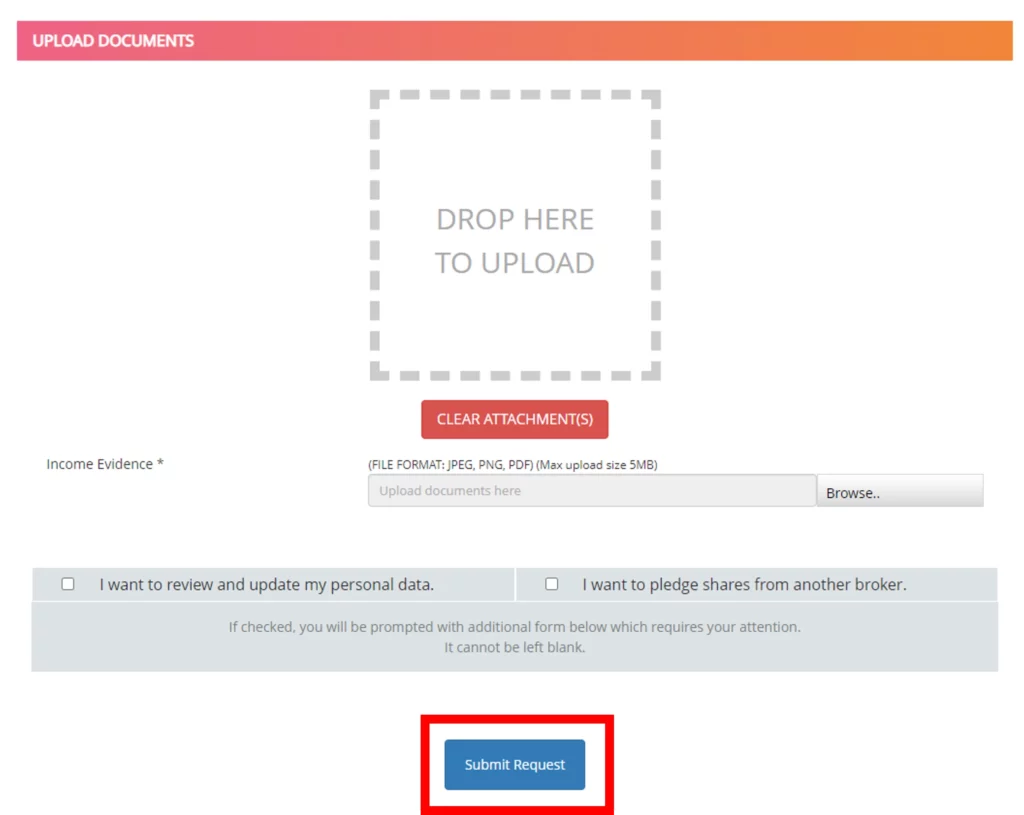

Step 4: Upload your proof of income。It should be noted that the Rakuten Trade system only accepts 3 file formats, including: image format (JPEG and PNG) and document format (PDF)。

If you would like to review and update your profile, please tick "I want to review and update my personal data"。

Once you want to mortgage shares from another broker, you can tick "I want to pledge shares from another broker."。

If you have a tick in one or both of these columns, you will be asked to fill out an additional form to provide relevant information。

Step 5: After receiving the email from Rakuten Trade, sign the Supplementary Letter of Offer with a digital signature.。After signing, you click "My Account" on the Rakuten Trade page, then click "RakuMargin," and then click "Agreement" to find the agreement.。

How to submit a settlement application?

After investing in RakuMargin, you can check the amount outstanding directly on Rakuten Trade's website, which includes: shares financed, losses, interest, etc.。

The investor is required to settle and repay all outstanding losses, interest and other incidental expenses before the financing period (also known as rollover).。Investors also need to ensure that unpaid balances do not exceed the amount of financing at any time.。

If the financing is not renewed, the investor is required to pay all outstanding amounts immediately.。

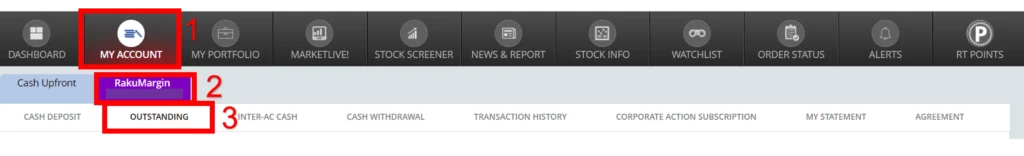

Step 1: Click "My Account"

Step 2: Click "RakuMargin"

Step 3: Click "Outstanding"

Step 4: Enter the amount you want to settle in the Amount for settlement field

It is important to note that after entering the amount, you will need to wait for the review and approval of Kenanga Investment Bank Berhad and Rakuten Trade to ensure that the margin ratio (margin ratio) is not less than 180% before the settlement application is successful.。

How to check if you want a margin call (Margin Call)?

When you receive a Margin Call (margin call) system prompt, it indicates a death warning for the investor's current position, and the investor will either renew his life through a margin call or wait for the broker to force the position to be closed.。

King of Speculation Jesse Livermore (Jesse L.Livermore) once said, "If you get a Margin Call, you're on the wrong foot.。Why put money in after a mistake??You should save your money and wait for the next chance。"

Margin Call (Margin Call) is a financial term that means that when the equity (Equity) in an investor's account falls below the maintenance margin level, the broker will issue a notice requiring the investor to deposit additional margin to maintain the normal operation of the account.。

Generally, the receipt of a margin call indicates that the margin is insufficient, the investor overuses the RakuMargin Trading account when there is a shortage of funds, and the investor fails to stop the loss in time when the trade is at a loss, swallowing the margin.。

RakuMargin's highly leveraged investments also mean high losses if the market develops against your stock position。Even if it is impossible to predict market fluctuations, investors should take control of their positions and close them in a timely manner when the situation is unfavorable, and it is best never to receive a margin call.。

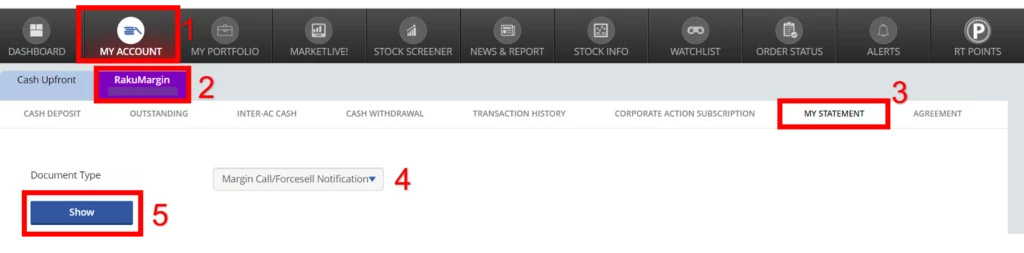

Step 1: Click "My Account"

Step 2: Click "RakuMargin"

Step 3: Click "My Statement"

Step 4: Select "Margin Call / Forcesell Notification" in the Document Type column

Step 5: Click "Show"。If you are required to make a margin call, you will be notified of the margin call in this section。

RakuMargin Trading Account FAQs

Will my RakuMargin account information be shared with other parties??

Your account information is limited to Rakuten Trade and Kenanga Investment Bank Berhad。

Who is eligible to register for a RakuMargin Trading account?

You can register as long as you are a Malaysian and non-US citizen aged 18 or above and meet the terms and conditions of your RakuMargin Trading account。

Can I get a RakuMargin account without a Cash Upfront account?

No, you need to have at least one Cash Upfront trading account。

Can I open a COMBO account, but then close my Cash Upfront account??

Investors holding a RakuMargin account must hold at least either a Cash Upfront account or a Contra account or both。

Can I place GTD orders during non-trading hours??

Yes, but be aware that your margin ratio is not less than 180%。If the margin ratio is less than 180%, the stock trading order will be rejected。Rakuten Trade will notify you via email about the cancelled order。

Conclusion

The RakuMargin Trading account is more suitable for mature investors who have a good understanding of investment risk and margin trading.。Before considering whether to open an account, make sure to fully assess your tolerance for investment risk and determine whether you have mature investor literacy。This decision is about personal finances and the future of investment, so various factors need to be carefully weighed。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.