How Rakuten Trade trades Hong Kong stocks?

Rakuten Trade officially opens up to trade Hong Kong stocks with commissions as low as RM7! This article takes you through the advantages and disadvantages of trading the Hong Kong market with Rakuten Trade, commission structure, platform security, etc.。

Want to trade in Malaysia, the United States and Hong Kong at the same time.?Rakuten Trade provides you with a convenient way to achieve this goal. Through its unique service, you can easily invest in these three markets in one account。

As a well-known online securities dealer in China, Rakuten Trade launched its Foreign Trading Service in January 2022 and pioneered the opening of the US Share Trading Service.。On December 27, the platform officially expanded to the Hong Kong Stock Market (Hong Kong Trading Service), providing users with more diversified securities trading options.。

The following is an in-depth introduction to Rakuten Trade's Hong Kong stock trading services, including an overview of the Hong Kong stock market, trading mechanisms, the advantages and disadvantages of using Rakuten Trade to trade in the Hong Kong market, Hong Kong stock trading fees, the opening of Rakuten Trade Hong Kong stock trading services and application conditions, and the safety of the use process.。

Rakuten Trade's New Hong Kong Stock Trading Service

Founded in 2017, Rakuten Trade is Malaysia's first online securities dealer regulated by the Securities Commission Malaysia.。Over the years, Rakuten Trade has been actively innovating, in addition to building a full-line securities trading service and platform exclusive trading app - iSPEED..My, in January 2022 more officially launched overseas stock trading services, has opened up the U.S. market, Hong Kong market, to bring users diversified local and global securities trading channels.。

The new Hong Kong Trading Service is connected to Interactive Brokers, one of the world's largest securities dealers, which is responsible for clearing and safe custody, and uses IBKR PRO accounts under the IBKR Smart Routing System to provide users with the ability to trade shares listed on the Hong Kong Stock Market (HKEX).。

When placing an order, users are free to trade in ringgit (MYR) or Hong Kong dollar (HKD), with commissions as low as RM1 or HKD35, depending on the amount of the transaction.。

Hong Kong Stock Market Features

1, the world's fifth largest stock exchange.

Hong Kong Stock Exchange (HKEX) is the fifth largest stock exchange in the world, with more than 2,000 companies listed on the Main Board, with a total market capitalization of 35.HK $1 trillion (HKEx data as of 23 Dec 2022)。Many well-known multinational companies such as HSBC Holdings, Alibaba, Tencent Holdings, Xiaomi Group, Meituan, etc. have chosen to list in Hong Kong.。There are also many high-quality blue chips in the Hong Kong stock market, which is one of the options for the dividend family to increase portfolio diversity and diversify risk.。

2, active trading, high volume

The Hong Kong stock market is one of the most active financial markets in the world, with active trading volume and high liquidity, which is more conducive to short-term operations to buy and sell.。In addition, the trading mechanism of Hong Kong stocks is T + 0 trading, and the shares bought on the same day can be sold on the same day, thus creating an investment environment suitable for short-term speculation and making profits through short-term spreads.。

However, it is worth noting that the settlement mechanism in the Hong Kong stock market is T + 2, and the day's trading will have to wait until the next second trading day to complete the settlement of stocks and funds.。Suppose you trade stocks on Tuesday and you can't finish settlement until Thursday; if you trade stocks on Thursday, you can't finish settlement until next Monday, and so on.。If you meet a holiday, the delivery time will be extended。

3, the lowest trading unit of Hong Kong stocks.

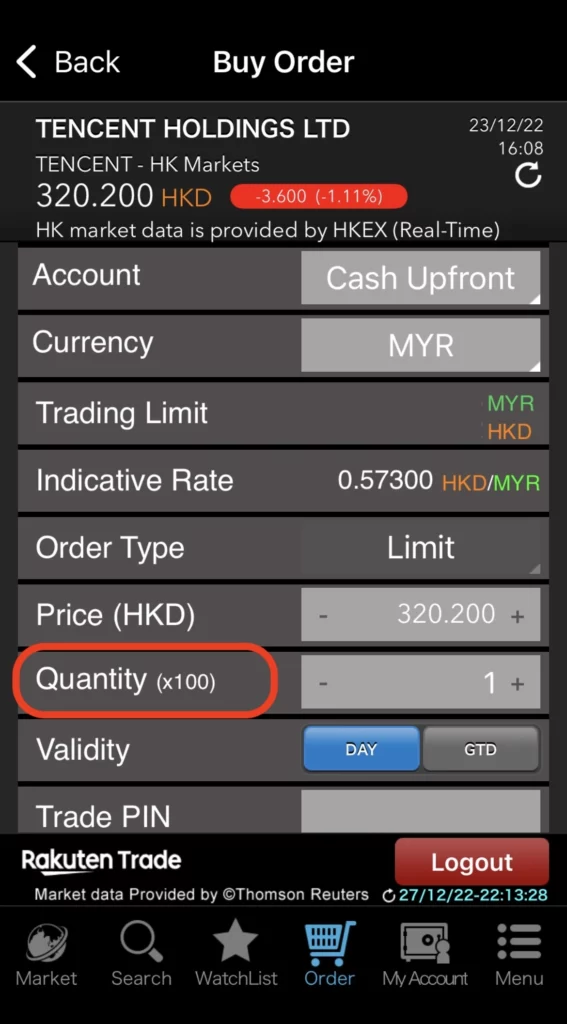

The minimum trading unit for Hong Kong stocks is one lot (lot), not one share (the minimum buying unit for U.S. stocks is one share), with a higher entry threshold.。Different companies have different criteria for the number of shares per lot, with a lot ranging from 100 to 2,000 shares。For example, Tencent (00700) has 100 shares in one hand, Xiaomi Group (01810) has 200 shares in one hand, Haidilao (06862) has 1,000 shares in one hand, and China Resources Land (01109) has 2,000 shares in one hand.。When placing a trade at Rakuten Trade, the interface will display the number of shares per lot for that business。

Less than one hand is called a broken strand.。Rakuten Trade does not currently offer trading breaks.。

4. Changes in stock prices

The minimum price change for a Hong Kong stock will depend on its share price, meaning that its minimum price change will change when the share price is in a different range.。In addition, stocks and ETFs have different minimum price movements, as follows.

| Share Price (HKD / share) | Minimum Change Price of Stock | ETF minimum price change |

| 0.01 to 0.25 | 0.001 | 0.001 |

| 0.25 to 0.50 | 0.005 | 0.001 |

| 0.50 to 1.00 | 0.01 | 0.001 |

| 1.00 to 5.00 | 0.01 | 0.002 |

| 5.00 to 10.00 | 0.01 | 0.005 |

| 10.00 to 20.00 | 0.02 | 0.01 |

| 20.00 to 100.00 | 0.05 | 0.02 |

| 100.00 to 200.00 | 0.1 | 0.05 |

| 200.00 to 500.00 | 0.2 | 0.1 |

| 500.00 to 1,000.00 | 0.5 | 0.2 |

| 1,000.00 to 2,000.00 | 1 | 0.5 |

| 2,000.00 to 5,000.00 | 2 | 1 |

| 5,000.00 to 9,995.00 | 5 | 1 |

| 9,995.00 to 9,999.00 | – | 1 |

Hong Kong Stock Trading Hours

Hong Kong stocks open from Monday to Friday, except on public holidays and closed due to bad weather。The trading sessions are as follows:

| Hong Kong Stock Trading Hours | All Day City | Half-Day City |

Pre-opening bidding period Pre-Opening Session |

9:00 – 9:30 | 9:00 – 9:30 |

Morning Market Morning Session |

9:30 – 12:00 | 9:30 – 12:00 |

Continue morning market Extended Morning Session |

12:00 – 13:00 | Not applicable |

noon market Afternoon Session |

13:00 – 16:00 | Not applicable |

Closing Auction Trading Session Closing Auction Session |

The market opens at 16: 00 and will close randomly between 16: 08 and 16: 10. | The market opens at 12: 00 and will close randomly between 12: 08 and 12: 10. |

* There will be no continuation of morning and afternoon trading on Christmas Eve, New Year's Eve or Lunar New Year's Eve。

* Rakuten Trade cannot trade pre-opening and closing auction sessions。

5. Trading arrangements in bad weather (during typhoons, extreme conditions and black rainstorms)

Extreme weather will affect trading in the Hong Kong stock market. If the Hong Kong Observatory issues a typhoon signal No. 8 (or above) or a black rainstorm warning, please pay attention to the news issued by the HKEx market system to see if the typhoon signal / rainstorm warning affects trading.。

What investment products can Rakuten Trade trade in Hong Kong stock market?

Currently, users can trade stocks listed on the Hong Kong Stock Exchange (HKEX) through Rakuten Trade, such as Tencent Holdings, Baidu, AIA, HSBC Holdings, Li Ning, etc.。Referring to the list issued by Rakuten Trade, the number of tradable Hong Kong shares is 349.。(As of July 24, 2023)

Rakuten Trade Hong Kong Stock Trading Commission Structure

Users can choose to trade Hong Kong stocks in the ringgit (MYR) or Hong Kong dollar (HKD).。For transactions in ringgit, the commission will be calculated in ringgit; for transactions in Hong Kong dollars, the commission will be calculated in Hong Kong dollars.。

The following is a compilation of Rakuten Trade's Hong Kong stock trading commission structure for your reference.。

● Trading Hong Kong stocks in ringgit (MYR)

Rakuten Trade's Hong Kong stock trading commissions range from RM1 to RM100。At the time of the transaction, the system converts the Hong Kong dollar transaction value of each transaction to the transaction value of the ringgit at a better exchange rate (indicative rate) than the bank, and calculates the commission based on the final ringgit transaction value.。The commission structure is as follows:

| Single transaction value (RM) | Commission (RM) |

| < 699.99 | RM1 (1% of transaction value) |

| 700 – 9,999.99 | RM9 |

| 10,000 – 99,999.99 | 0.10% |

| >99,999.99 | RM100 |

* If the user requests Rakuten Trade to assist in placing the order, an additional RM30 service fee will be levied.。

Examples of actual transactions:

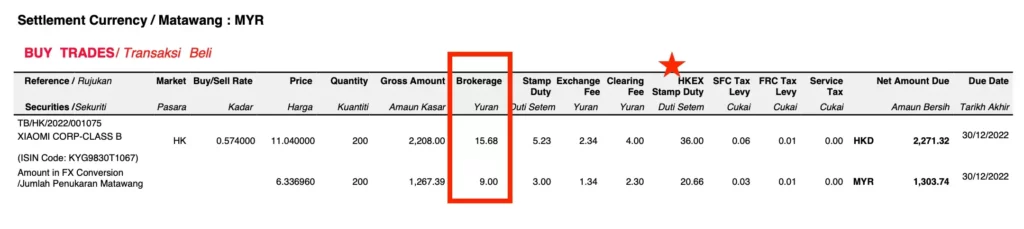

Trading a lot of Xiaomi Group (1810), or 200 shares, at 11.HK $04, HK $2,208 required for 200 shares, which translates to RM1,267.39。The value of this transaction is between RM700 and RM 9,999, and the commission is RM9.。

Note: Stamp duty on Hong Kong shares (at Red Star) in this model transaction was charged at HK $36, but should have been charged at HK $3 only.。The Rakuten Trade team verified that the fee was wrong, so Rakuten Trade will issue a refund。

Remind everyone that you still need to check the trading statement after the transaction to ensure that all fees are correct。

● Hong Kong stocks traded in Hong Kong dollars (HKD)

Trading Hong Kong stocks in Hong Kong dollars, the trading commission is 0..10% * transaction value, minimum HK $35 per transaction。No trading commission cap。

| Single transaction value (RM) | Commission (HKD) |

| Arbitrary transaction value | 0.10% * minimum trading value HK $35 without commission cap |

Examples of actual transactions:

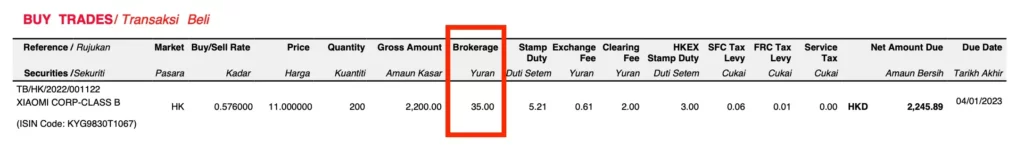

Trading a lot of Xiaomi Group (1810), i.e. 200 shares, with a share price of HK $11, 200 shares requires HK $2,200 and a commission of 0.10% * 2,200 = 2.HK $20。As the minimum commission threshold is not met, a minimum commission of HK $35 (approximately RM20) will be levied on this transaction.。

● Which commission is more cost-effective to trade in ringgit (MYR) or Hong Kong dollar (HKD)??

The following is a list of trial balances for different transaction amounts so that you can see directly which currency to trade in and which commissions are cheaper.

| Single transaction value | Commission (MYR) | Commission (HKD) |

| RM800 (≈ HKD1,432) | RM9 ★ | HKD35 (≈ RM20) |

| RM8,000 (≈ HKD14,317) | RM9★ | HKD35 (≈ RM20) |

| RM20,000 (≈ HKD35,738) | RM20 | HKD35.74 (≈ RM20.12) |

| RM 80,000 (≈ HKD143,177) | RM80 | HKD143.18 (≈ RM80.60) |

| RM 120,000 (≈ HKD214,800) | RM100 ★ | HKD214.80 (≈ RM121) |

Whether it's an actual trading example or a trial example, we can see that trading Hong Kong stocks with Malaysian ringgit (MYR) has lower commissions.。

● Other fees to be paid for trading in the Hong Kong stock market

When trading Hong Kong stocks, in addition to paying trading commissions to Rakuten Trade, you will also find that other fees are levied in the trading statement (Trading Statement).。These fees are not levied by Rakuten Trade, but by other third-party agencies。The types of fees levied, the amount of fees charged and the collection agencies are listed below.

| Expense type | Amount of charge | Collector |

| Clearing Fee | 0 of turnover.002%, minimum HKD2 per trade, maximum HKD100 | HKEX HKEX |

| Stamp Duty | For every RM1,000 transactions, RM1 is levied.00, with a maximum levy of RM1,000 | Government of Malaysia |

| Transaction fees Exchange Fee | 0 of the value of each transaction levied.00565% | HKEX HKEX |

| SFC Transaction Levy | 0 of turnover.0027%, minimum HKD0 per trade.01 | Securities and Futures Commission SFC |

| FRC Transaction Levy | 0 of turnover.00015%, minimum HKD0 per transaction.01 | Financial Reporting Board FRC |

| Stock Stamp Duty HKEX Stamp Duty | 0 of turnover.13%, carry to nearest integer | Hong Kong Government |

* Information taken from the official Rakuten Trade website

Who can apply for Rakuten Trade Hong Kong stock trading?What conditions need to be met?

New users need to open a Rakuten Trade Cash Upfront cash account and apply for the opening of overseas stock trading service (Foreign Trading Service), you can execute transactions in the same account, to achieve global trading of horse stocks, U.S. stocks, Hong Kong stocks zero time difference.。

Existing users have opened the U.S. stock trading service and can use the Hong Kong stock trading service immediately by agreeing to the new version of the terms and conditions of the overseas stock trading service (agree to the updated Foreign Trading T & Cs).。

Before opening a Rakuten Trade account, ensure that the following conditions are met:

18 years of age or older (non-bankrupt)

Have any bank account in Malaysia.

Have a credit / debit card from any bank in Malaysia.

Advantages of Trading Hong Kong Stocks with Rakuten Trade

● Opening an account is quick and easy

Rakuten Trade online account opening the fastest only 1 hour, the application process is simple and easy to understand, open overseas stock trading services need 3 working days to review。

● One account manages trading of Hong Kong, US and horse stocks

Horse stocks, U.S. stocks and Hong Kong stocks are all connected to the same Cash Upfront account, from account opening, deposit and withdrawal, trading, portfolio management can be completed online, making securities trading more convenient and fast!

● Competitive Hong Kong stock trading commissions

Rakuten Trade gives the lowest Hong Kong stock trading commission in China, with a minimum of RM1 or HKD35 and lower cost investment.。

● Accumulate Rakuten Trade (RT) Points per transaction

Rakuten Trade (RT) Points can be accumulated each time through the Rakuten Trade (RT) points, rebates commission, 1RT Point = RM0.01 Commission。

Rakuten Trade Hong Kong Stock Trading Disadvantages

● Fewer investment product choices

At present, Rakuten Trade Hong Kong stock trading only provides investment in Hong Kong stocks, product selection is relatively small, for investors who want to invest in Hong Kong exchange-traded funds (ETFs), real estate trusts (REITs), financial derivatives such as bull and bear securities, options, futures and so on.。

● Do not support financing and margin trading

Only cash transactions are supported, and the trading methods of financing and financing are not open for the time being.。As the minimum trading requirement for Hong Kong stock trading is one lot, rather than one share, the entry threshold is high, which is relatively difficult for small capital investors.。

● Do not support stock transfers in and out

Stock transfers between different Hong Kong stock brokers are not supported for the time being, and all Hong Kong stock trading and deposits can only be executed in the Rakuten Trade system.。

Is it safe to trade Hong Kong stock market with Rakuten Trade?

Rakuten Trade is regulated by the Securities Commission Malaysia, holds a capital market services licence issued by SC, legally engages in securities trading activities and provides investment advice to investors, so it is safe to use Rakuten Trade to trade the Hong Kong stock market.。

SUMMARY

Overall, through Rakuten Trade's Hong Kong stock trading services, investors can easily achieve their global investment objectives in the three financial markets of Malaysia, the United States and Hong Kong.。As a highly regulated online securities dealer, Rakuten Trade provides an easy and efficient trading platform that enables users to manage and execute cross-border investments within the same account。By connecting to the world's largest securities dealer, the platform not only expands the scope of trading, but also provides a competitive commission structure.。

As the world's fifth largest stock exchange, Hong Kong's active market, high liquidity and the listing of many well-known companies provide investors with a wealth of investment opportunities.。However, investors also need to be aware of some shortcomings when choosing to use Rakuten Trade's Hong Kong stock trading services, such as the relatively small selection of investment products, the lack of support for financing, margin trading and the lack of support for restrictions such as the transfer of shares in and out.。

Nevertheless, Rakuten Trade, with its advantages of easy account opening, competitive trading commissions, and point rebates, is still ideal for many investors to trade cross-border.。Most importantly, as a regulated securities trading platform, using Rakuten Trade to trade the Hong Kong stock market is safe and reliable, and users can invest with confidence and find more investment opportunities in the global market。In the future, with the continuous innovation of fintech and the development of the securities market, Rakuten Trade is expected to continue to provide investors with more convenient and diversified services.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.