How Rakuten Trade conducts US stock trading services

Rakuten Trade opens up U.S. stock trading services, SSF comprehensive analysis of the advantages and disadvantages, account opening conditions, commissions and other brokerage comparison, security, as well as the complete opening of the U.S. stock trading process teaching.。

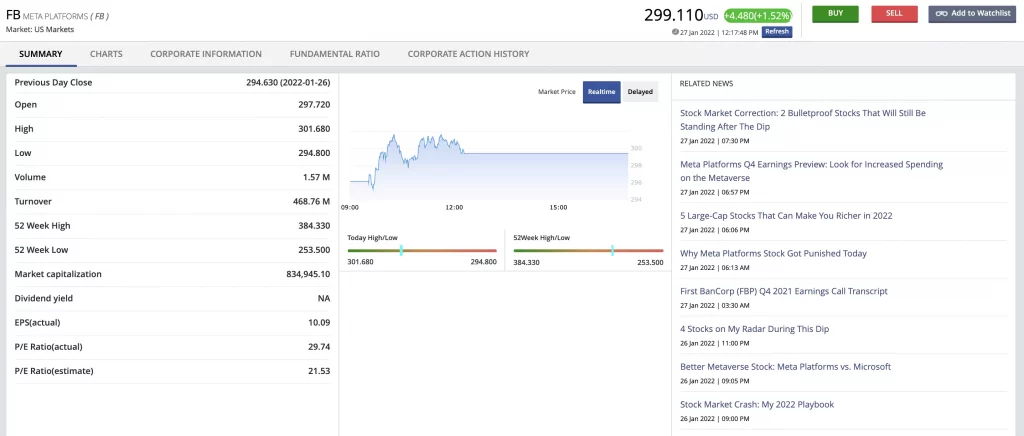

Another option to buy U.S. stocks! Rakuten Trade, a well-known domestic online securities firm, officially opened its overseas stock trading service on January 27, 2022, first opening up the U.S. Share Trading Service (US Share Trading Service), which can trade stocks, ETFs, ADRs, and offer the lowest commission fees for U.S. stocks in Malaysia, with a single transaction not exceeding RM700 (converted to ringgit in U.S. dollars) and commissions only requiring the lowest R。

Exactly what are the advantages and disadvantages of trading the US market through Rakuten Trade?How to open Rakuten Trade US stock trading service?What are the conditions?Today's financial review series is an open-box Rakuten Trade U.S. stock trading service, including.

◇ Rakuten Trade U.S. stock trading advantages ◇ Rakuten Trade U.S. stock trading disadvantages ◇ Rakuten Trade U.S. stock trading commissions and fees, compared with other brokerage fees ◇ Rakuten Trade U.S. stock trading security ◇ Open Rakuten Trade U.S. stock trading process teaching.

Rakuten Trade US Stock Trading Service Background

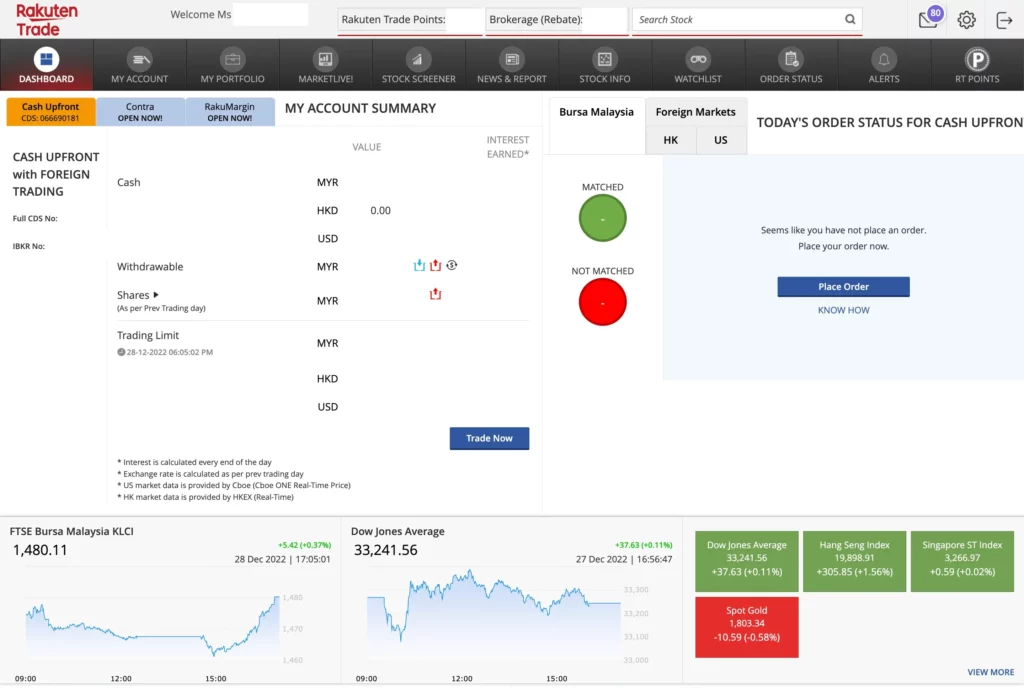

Rakuten Trade is Malaysia's first online securities dealer, founded in 2017, the main line of securities trading services, from account opening, deposit and withdrawal, trading trading, portfolio management can be in Rakuten Trade web version and mobile phone APP - iSPEED..My easy to complete, and the interface is simple and easy to use, novice can quickly get started。

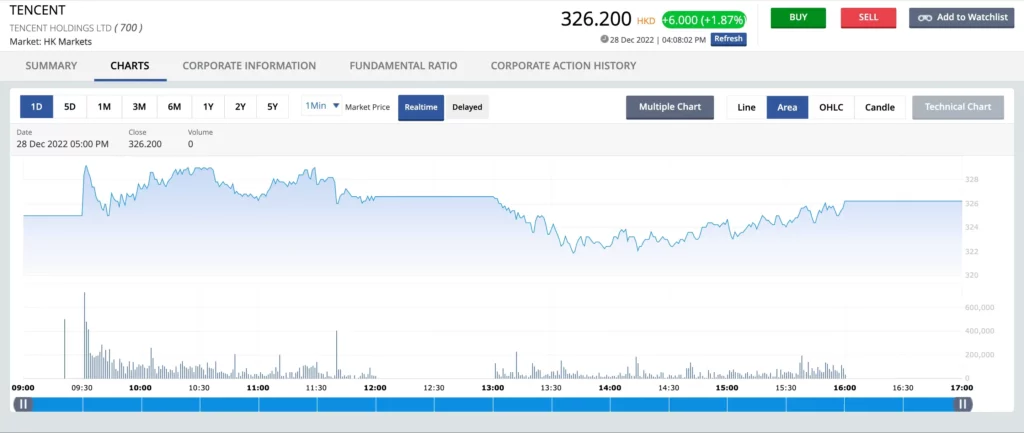

In order to provide more diversified securities trading, Rakuten Trade officially launched its overseas stock trading service in January 2022, first opening up the US Share Trading Service.。The Hong Kong market trading service is expected to open in the fourth quarter of 2022, according to officials.。

As long as you hold a Rakuten Trade Cash Upfront cash account, you can apply for the U.S. stock trading function.。Rakuten Trade's U.S. stock trading is currently connected to the world's largest U.S. stock securities dealer, Interactive Brokers (Interactive Brokers), which is responsible for clearing and safe custody, and uses IBKR Lite accounts.。

Simply put, trading U.S. stocks through Rakuten Trade is in the form of a trustee account (Custodian Account)。

What investment products can Rakuten Trade trade in the U.S. stock market?

(Check the full list)

Users can trade stocks, equity index funds (ETFs) and American depositary receipts (ADRs) listed on the New York Stock Exchange (NYSE) and Nasdaq Stock Exchange (NASDAQ) through Rakuten Trade, such as Apple, Tesla, AMD, Meta and other stocks, SPY, IVV, VOO, QQQ and other ETFs, Alibaba, Nio, Sea Limited and other ADRs。

It is worth noting that only most U.S. stocks and ETFs, as well as a small portion of ADRs, are currently traded through Rakuten Trade, and not all of the underlying can be invested.。Referring to the list released by Rakuten Trade, tradable U.S. stocks are 926, ETFs are 249, and ADRs are 25.。(As of July 24, 2023)

Who can apply for Rakuten Trade US stock trading?What conditions must be met?

Users are required to open a Rakuten Trade Cash Upfront cash account and apply for the U.S. stock trading service after successfully opening the account.。

Opening an account is usually approved within 1 working day, while opening a U.S. stock trading service requires 3 working days。

Before opening a Rakuten Trade account, please ensure that the following conditions are met:

18 years of age or older (non-bankrupt)

Have any bank account in Malaysia.

Have a credit / debit card from any bank in Malaysia.

Rakuten Trade U.S. Stock Trading Advantages

The following analysis of the advantages and disadvantages of using Rakuten Trade to trade the US stock market。

One account manages trading in horse stocks, U.S. stocks and Hong Kong stocks.

As long as you open a Cash Upfront account, you can seamlessly manage the portfolio of horse stocks, U.S. stocks and Hong Kong stocks, and operate horse stocks, U.S. stocks and Hong Kong stocks trading on the same interface, which is very convenient.。

Lowest U.S. Stock Trading Commission in China

In the past, to trade the U.S. stock market, local brokerages often charged higher commissions than overseas brokerages, such as moomoo Futu Securities, Longbridge Securities, Tiger Securities, etc., which would drive up investment costs for investors and would not be cost-effective.。And often face the problem of depositing money and withdrawing it back to Malaysian banks.。

Currently, users can choose to trade U.S. stocks using either the ringgit or the U.S. dollar at Rakuten Trade。

If the user chooses to trade U.S. stocks using ringgit, the commission is 1% of the trading value and the minimum commission for a single transaction is RM1 as long as the single transaction does not exceed RM700 (converted to ringgit in U.S. dollars); if the user chooses to trade U.S. stocks using U.S. dollars, the commission is 0% of the transaction..1%, while the single minimum commission is USD1.88 (approximately RM8)。

Rakuten Trade's low U.S. stock trading commissions allow Malaysian investors to diversify their asset allocation by trading more quality listed companies in the U.S. market at more affordable investment costs.。Access to gold directly through domestic banks, without worrying about the high cost of wire transfers, making it easier to invest in U.S. stocks.。

As with horse stocks, Rakuten Trade (RT) Points can be accumulated for each trade in U.S. stocks, and these RT Points can be refunded commissions, 1RT Point = RM0.01 Commission。Not applicable to Stamp Duty, Clearing Fee。

Free real-time quotes

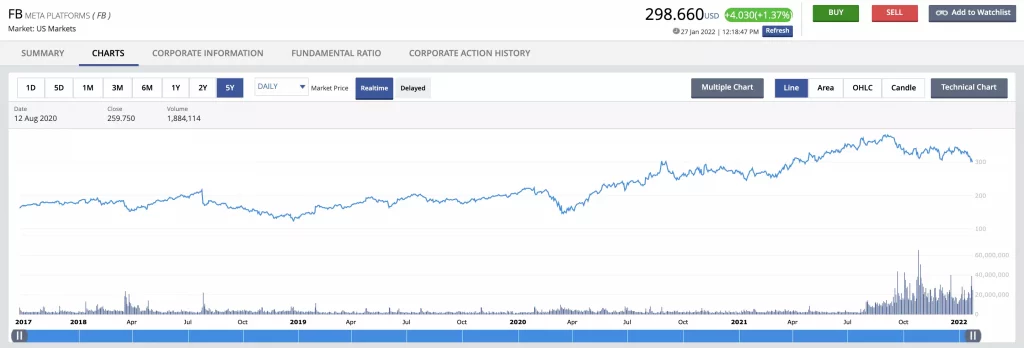

Rakuten Trade's U.S. stock market quotes are real-time quotes, free of charge, but do not support Market Depth for the time being.。

Quotations reflect the actual trading results of the stock exchange, while stocks with more active trading volumes fluctuate wildly every minute, or even every second.。Real-time market quotes allow investors to effectively grasp the current price of the investment target and decide whether to enter or exit the market.。

Rakuten Trade provides free real-time quotes on U.S. stocks to help users start their investment journey in U.S. stocks.。Quote information provided by Luft REFINITIV。

No platform fees, custody fees, dividend collection fees, corporate activity service fees

Another advantage of Rakuten Trade U.S. stock trading is that there are no platform fees and other non-transaction fees, such as custody fees, dividend collection fees and corporate activity service fees, and only commissions and taxes are paid, greatly reducing the investment cost of trading U.S. stocks and allowing users to take advantage of more investment opportunities in a more economical way.。

Competitive exchange rates

If a user trades U.S. stocks in Rakuten Trade in ringgit (MYR), the system will automatically convert the ringgit cash from the Cash Upfront account to U.S. dollars when placing an order to execute the transaction, and use the ringgit to exchange U.S. dollars, which is better than most banks.。

US dollar foreign currency accounts are provided for users to deposit US dollars

Rakuten Trade officially launched its US dollar foreign currency account on August 26, 2022.。

When a user wants to trade U.S. stocks in Rakuten Trade in U.S. dollars (USD), the user must convert the currency to U.S. dollars before trading.。Users can trade directly in U.S. dollars, and the dollar profits from the exchange can also be deposited in a U.S. dollar account for the next trade.。In this way, users do not need to exchange "USD - ringgit" frequently, and can save the exchange rate difference generated during the exchange process.。

Rakuten Trade's currency exchange function does not charge any fees.。

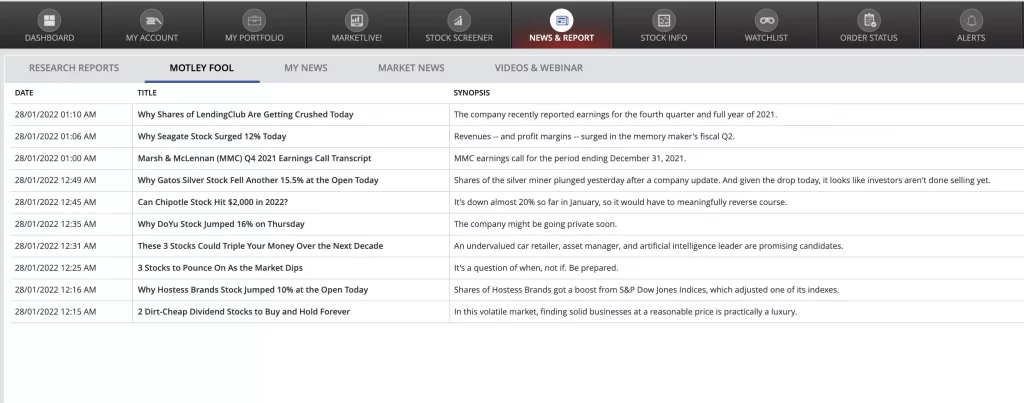

Provide in-depth US stock analysis reports (e.g. Motley Fools)

Rakuten Trade provides in-depth U.S. stock analysis reports, which can be read by Rakuten Trade's in-house research team, Rakuten Securities, Inc..) And Motley Fools research and analysis content, increase investment inspiration, adjust investment strategies to maximize investment returns。

Rakuten Trade U.S. Stock Trading Cons

Fewer investment product choices

Rakuten Trade only supports trading U.S. market stocks, ETFs and ADRs, and not all stocks, ETFs and ADRs are tradable, with fewer options than other overseas U.S. stock brokerage firms。And currently only a small number of American depositary receipts (ADRs) are supported, the over-the-counter market (OTC) is not supported, and there is no dividend reinvestment plan (DRIP), which investors should be aware of.。

No support for stock transfer in and out

Rakuten Trade does not support stock transfers between different U.S. stock brokerages for the time being, meaning that users cannot transfer U.S. stock assets from other brokerages or transfer U.S. stocks in Rakuten Trade to another broker.。

Fractional Share not supported

The minimum trading unit for U.S. stocks is 1 share, while fractional shares (Fractional Share) are stocks that are less than 1 share, also known as broken shares。Rakuten Trade is currently unable to trade zero shares。For small capital investors, it will be more difficult to trade blue chips with higher share prices.。

Of course, not all investors have the need to trade zero shares, so this shortcoming varies from person to person。If you want to trade zero U.S. stocks, consider Interactive Brokers.。

Pre-post trading not supported

U.S. stocks have a pre-market after-hours trading system that allows investors to buy and sell during irregular trading hours, that is, between 09: 30 a.m. and 16: 00 p.m. (Eastern Time).。

Rakuten Trade users can place orders in advance in pre-market and after-market hours, and trades will be matched during normal trading hours (match)。In other words, users cannot participate in pre-market and post-market trading.。

Financing and margin trading are not supported

At present, Rakuten Trade U.S. stock trading only supports cash trading, temporarily not open financing, margin trading methods.。

Rakuten Trade US Stock Trading Commissions and Other Fees

Rakuten Trade's U.S. stock trading fees are divided into commissions (Commission) and other trading fees (Other Trading Fees)。One of its advantages is that it does not charge platform fees (Platform Fee) or other non-transaction fees, such as custody fees, dividend collection fees, and corporate activity service fees.。

The following collates Rakuten Trade's U.S. stock trading commission structure and other trading fees, and compares them to other domestic brokerages that also offer U.S. stock trading.。

Commission

Users can choose to trade US stocks in either the ringgit (MYR) or the US dollar (USD)。If the user chooses to trade in RMJ, the commission is calculated in RMJ; if the user chooses to trade in USD, the commission is calculated in USD。

US stocks traded in ringgit (MYR)

If the user chooses to trade U.S. stocks in ringgit, the U.S. stock trading commission is between RM1 and RM100.。The calculation is that, at the time of the transaction, the system converts the dollar transaction amount to the ringgit transaction amount at a better exchange rate than the bank, and calculates the commission based on the final ringgit transaction amount.。

A single transaction does not exceed RM700, the commission is 1% of the transaction value, and the minimum commission for a single transaction is RM1;.99, with a commission of RM9; between RM10,000 and RM99,999 for a single transaction.99, the commission is 0 of the transaction amount.10%; more than RM100,000 for a single transaction with a commission of RM100。

For example, buy 1 share of Apple stock (NASDAQ: AAPL) at 170.33 USD, total transaction converted to RM713。This transaction volume is higher than RM700, and the commission is RM9;

If you buy 10 shares of Apple stock, the stock price is 170.33 USD, total turnover converted to RM7,136。The turnover is between RM700 and RM9,999.99, the commission is RM9。and so on。

Note that the actual transaction volume (ringgit) is based on the Rakuten Trade system display, the above is a trial example。

| Single transaction volume (RM) | Commission (Cash Upfront account) |

| < 699.99 | Minimum RM1 (1% of trading volume) |

| 700 – 9,999.99 | RM9 |

| 10,000 – 99,999.99 | 0.10% |

* Additional RM30 service fee will be levied if the user requests Rakuten Trade to assist in placing the order。

U.S. stocks traded in U.S. dollars (USD)

The commission for trading U.S. stocks in U.S. dollars is calculated differently from the ringgit because the commission for trading U.S. stocks in U.S. dollars is calculated directly at 0% of the transaction volume..1% to calculate, the minimum commission per transaction is USD1.88, the highest commission is USD25。

For example, buy 1 share of Apple stock (NASDAQ: AAPL) at 170.$33; 170.$33 of 0.1% is about USD0.17033, which is lower than the minimum commission for a single transaction, so the user is required to pay the minimum commission, which is USD1.88 (approximately RM8)。

If you buy 20 shares of Apple stock, the stock price is 170.33 USD, total turnover converted to Ringgit is approximately USD3,406.60。3,406.$60 of 0.1% is about USD3.40, which is higher than the minimum commission for a single transaction, so the commission that users need to pay is USD3.40 (approximately RM15.20) Commission。

Note that the actual transaction volume (ringgit) is based on the Rakuten Trade system display, the above is a trial example。

| Trading volume | Commission (USD) |

| Arbitrary amount | 0 of turnover.1% * Minimum commission per transaction USD 1.88; up to USD 25 |

Comparison with other brokerage commission charges

Malaysian investors who want to trade U.S. stocks, with security concerns, typically re-commission through local investment banks, such as CIMB, MAYBANK, MIDF Invest, or through investment platforms such as FSMONE.。The advantage is that local investment banks and trading platforms are regulated by the Malaysian Securities Regulatory Commission and are safe, except that the fees for trading U.S. stocks are relatively high.。

Below let's compare Rakuten Trade, FSMONE and MIDF Invest US stock trading commission rates。

| Single transaction volume (RM) | Rakuten Trade (in ringgit deal) | Rakuten Trade (Traded in US Dollars) | FSMOne | MIDF Invest (Investor) |

| <RM699.99 | RM1 – RM6.99 | USD 1.88 ( ≈ RM8.14) | 0.08% * lowest turnover USD 8.80 | USD 0.015 / share minimum USD 8 |

| RM700 – 9,999.99 | RM9 | USD 1.88 – USD 2.30( ≈ RM8.14 – RM 9.99) | 0.08% * lowest turnover USD 8.80 | < USD 1,000USD 0.015 / share minimum USD 8 > USD 1,000 USD 0.015 / share minimum USD 10 |

| RM10,000 – 99,999.99 | 0.10% | 0.10% | 0.08% * lowest turnover USD 8.80 | USD 0.015 / share minimum USD 10 |

| >RM99,999.99 | RM100 | USD 25 ( ≈ RM108.26) | 0.08% * lowest turnover USD 8.80 | USD 0.015 / share minimum USD 10 |

Let's look at which trading platform is the best way to trade U.S. stocks based on the actual trading volume.。The following to buy Apple stock (share price is USD 170.33) As an example of calculation:

| Number of shares bought (single) | Single transaction amount (USD) | Rakuten Trade (Traded in US Dollars) | FSMOne | MIDF Invest (Investor) |

| 1 | USD 170.33 | USD 1.88 ★★★ | USD 8.80 | USD 8 |

| 10 | USD 1,703.30 | USD 1.88 ★★★ | USD 8.80 | USD 10 |

| 20 | USD 3,406.60 | USD 3.4066 ★★★ | USD 8.80 | USD 10 |

| 100 | USD 17,033.00 | USD 17.033 | USD 13.6264 | USD 10 ★★★ |

| 500 | USD 85,165.00 | USD 25 | USD 68.132 | USD 10 ★★★ |

In comparison, it will be found that Rakuten Trade's U.S. stock trading commissions are generally lower, especially when the amount of a single transaction is lower, reducing the cost of investing in U.S. stocks and making it particularly suitable for small capital investors, or investors whose transaction amount does not exceed RM100,000 per transaction.。

Other transaction charges

In addition to commissions, investors pay tax-related fees such as stamp duty, SEC compliance fees (SEC Fee) and trading activity fees (Trading Activity Fee).。Of these, SFC fees and transaction activity fees are charged only at the time of sale.。

The following is a compilation of other transaction fee structures for your reference.。

| Category | 费用 | Toll Collection Agency |

| SFC fees (only charged on sale) | 0.0008% * Minimum transaction amount USD0.01 | SEC |

| Transaction activity fee (only charged at the time of sale) | 0.0145% / share minimum USD0.01, the highest USD7.27 | FINRA |

| Stamp duty (US stocks) | RM1 received per RM1,000 transaction amount.00 Maximum RM1,000 | Revenue Authority of Malaysia LHDN |

| Stamp Duty (ETF) | RM1 received per RM1,000 transaction amount.00 Maximum RM200 | Revenue Authority of Malaysia LHDN |

Is it safe to trade U.S. stocks with Rakuten Trade?

The answer is safety, Rakuten Trade is regulated by the Securities Commission Malaysia, holds a capital market services licence issued by SC, legally engages in securities trading activities, and provides investment advice to investors.。

Who is suitable for using Rakuten Trade US stock trading services?

Rakuten Trade Launches US Stock Trading Service with Commissions as Low as RM 1 or USD 1.88, is undoubtedly changed the market generally believe that through the Malaysian brokerage investment in U.S. stocks "high commission" "high cost" impression。

If you wish to use a brokerage firm regulated by the Malaysian Securities Regulatory Commission, Rakuten Trade is one of the highly recommended options, with deposits and withdrawals made through domestic banks in ringgit.

If you're a long-term investor, Rakuten Trade's U.S. stock trading services allow you to invest more cheaply in the U.S. stock market and economy, maximizing your return on investment.。

Opening Rakuten Trade US Stock Trading Process Teaching

* This operation process is applicable to users who have opened horse stock trading accounts before October 30, 2023.

The following is the complete process for opening the Rakuten Trade Cash Upfront Account (Foreign Market).。

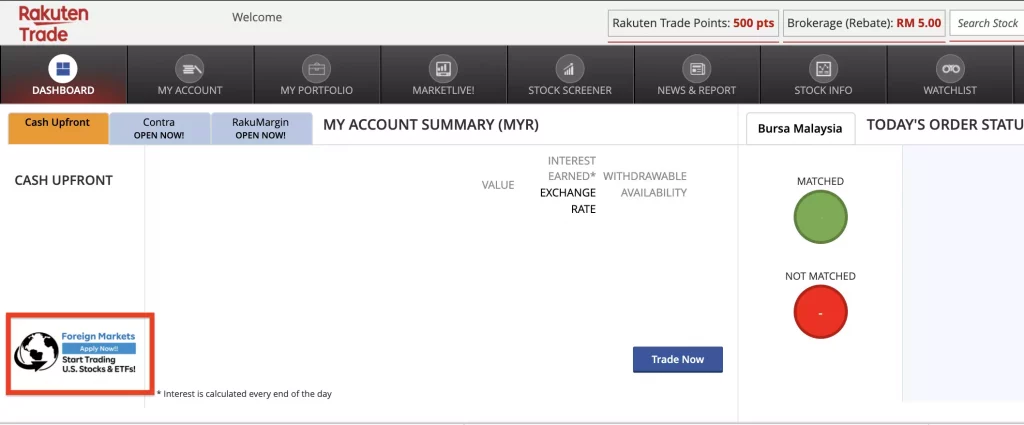

Step 1: Log in to your Rakuten Trade account and start applying for the U.S. stock trading function

Log in to your Rakuten Trade account and see the chart for applying for the US stock trading function on the home page (Dashboard)。Click to enter the application page。

Step 2: Declare under Malaysia's Exchange Control Regulations (FEA)

The National Bank (BNM) manages all foreign exchange transactions in the country in accordance with the Foreign Exchange Administration (FEA) to support and protect the stability of the financial system and currency.。Under FEA control, all foreign exchange transactions must be conducted with a domestically registered or foreign bank.。

What is Domestic Ringgit Borrowing??

Domestic Ringgit Borrowing refers to domestic ringgit borrowing, which refers to borrowing from another Malaysian resident (Malaysia Resident), corporation (Corporation) or financial institution (Financial Institution)。

In this case, the individual must declare whether any domestic Ringgit Borrowing (DRB) is involved.。If there is a DRB involved, check it. If there is no DRB involved, do not check it.。

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *。

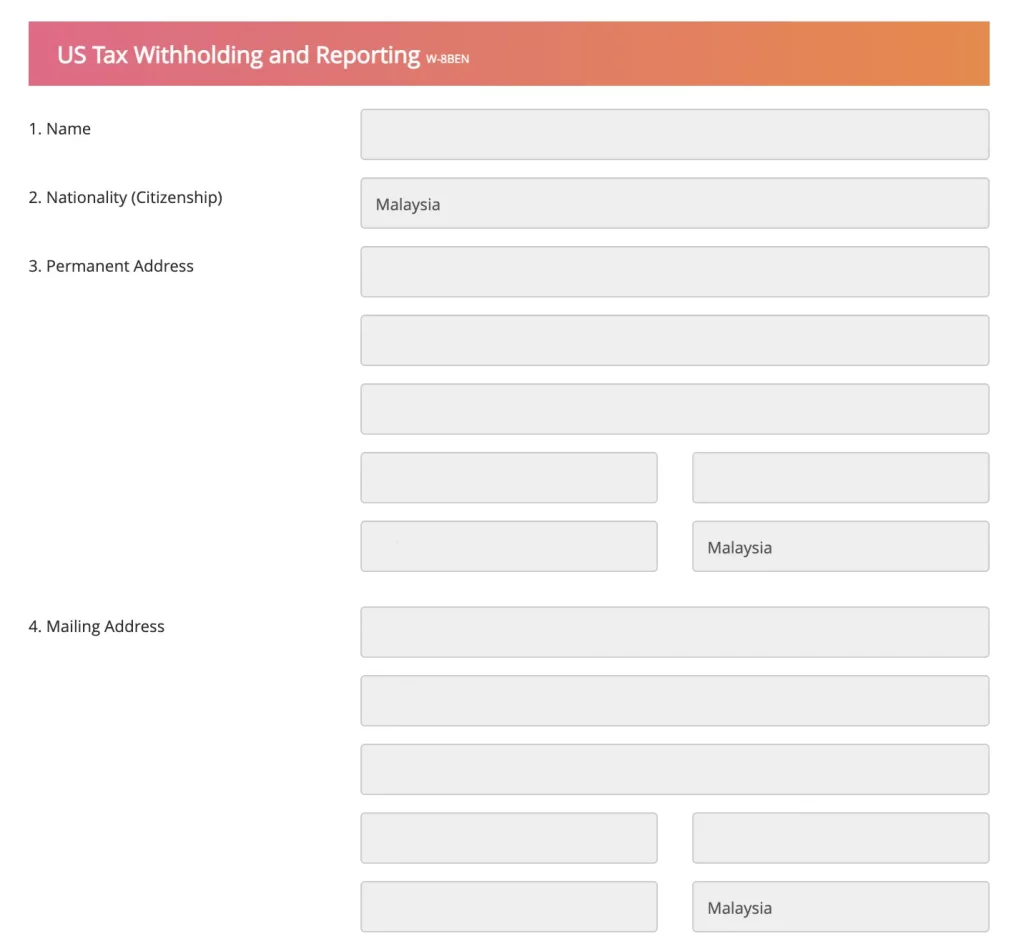

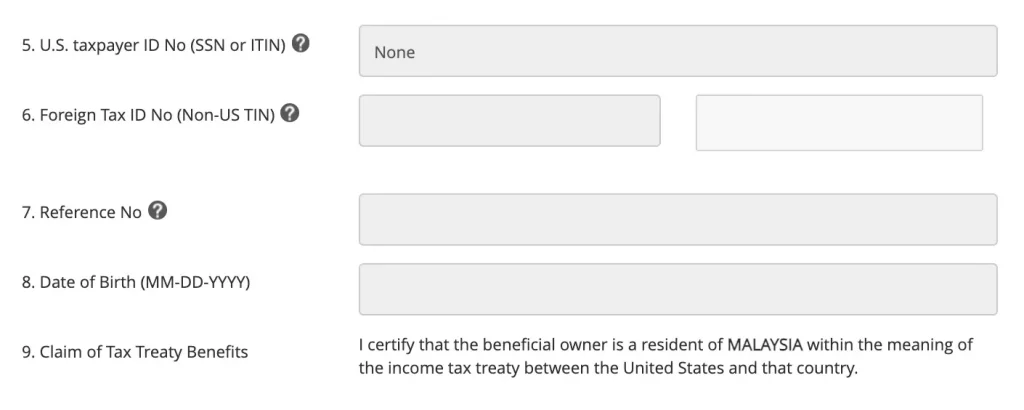

Step 3: Check whether the US W-8BEN tax form information is correct

The Rakuten Trade system automatically generates the W-8BEN tax form (tax exemption form from the U.S. Inland Revenue Department) based on the information filled in when opening an account.。

W-8BEN is a required form for investing in U.S. stocks, the U.S. will tax capital gains, and signing W-8BEN means that you are a foreigner and can enjoy the U.S. tax rate benefits without paying capital gains tax.。However, dividend withholding tax (Withholding Tax) must still be paid, depending on the country of the listed company that pays the dividend, the average U.S. listed company's dividend withholding tax is 30%。

You can check whether the personal information in the W-8BEN form is correct, and if you find any errors, you must notify Rakuten Trade to help modify it.。

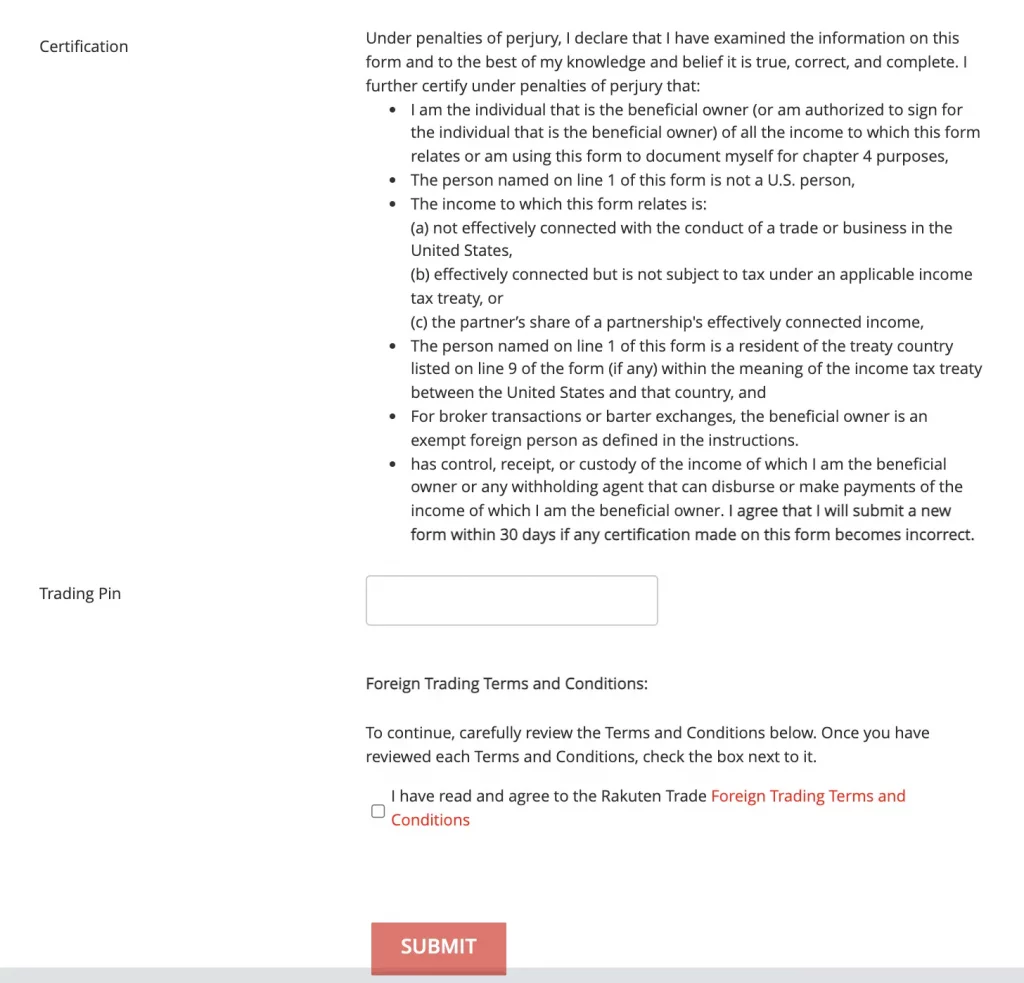

Step 4: Read the compliance information and create a transaction password

Read the compliance information and confirm that I am the ultimate owner of the account, not a U.S. citizen, etc.。

Next, create a trading pin (Trading Pin), which is the verification pin that will be used when trading U.S. stocks later, and finally, indicate that you have read and agreed to the terms and conditions of Foreign Trading.。

Step 5: Submit an application

Finally, click "Submit" to submit the US stock trading function application.。Rakuten Trade will complete the audit within 3 working days。Rakuten Trade will send an email notification after the U.S. stock trading function opens。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.