How Rakuten Trade Horse / US / Hong Kong Stocks Are Traded?

Invest in horse stocks, U.S. stocks, Hong Kong stocks, Rakuten Trade one account easy to manage。This article explains the Rakuten Trade platform features, regulatory strength, commission charges, use advantages and disadvantages.。

When Rakuten Trade is mentioned, it is natural for many to associate it with the Malaysian stock market.。However, do you know?Rakuten Trade is not just a platform for trading horse stocks。In 2022, they partnered with a well-known international brokerage firm, Infar Securities, to enable users to trade multiple markets, including U.S. and Hong Kong stocks, in one account at the same time, providing investors with a wider range of investment opportunities in international securities markets.。

This article will introduce you to the characteristics and competitiveness of Rakuten Trade as a full-service trading service center, the strength of supervision, and the advantages and disadvantages of its use.。If you are interested in Rakuten Trade but have limited knowledge of it, or are looking for a broker that can meet the needs of stock markets trading in multiple countries, then this article may provide you with some suggestions。

Meet Rakuten Trade

Rakuten Trade (Chinese: Rakuten Trading) is a joint venture between investment bank Kenanga Investment Bank Berhad (Kenanga Investment Bank Berhad) and Rakuten Securities (Rakuten Group), a Japanese network service giant, and is regulated by the Securities Commission Malaysia (Securities Commission Malaysia).。

Rakuten Trade is positioned as an all-round trading service center, with trading markets covering horse stocks (KLSE), U.S. stocks (NASDAQ, NYSE), Hong Kong stocks (HKEX), etc., and trading projects covering stocks, ETFs, etc., providing diversified choices for investors with different profit objectives and risk tolerance.。

Its strongest competitiveness is the full line of securities trading services, from the opening of investment accounts, remittance of funds to buy and sell transactions, on the Internet can be successfully completed.。

Rakuten Trade Features

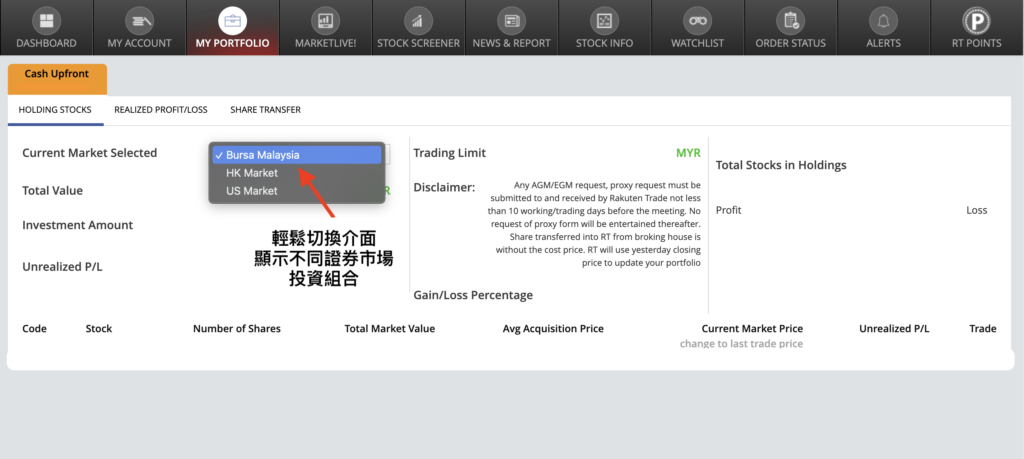

One account trades horse stocks, U.S. stocks, Hong Kong stocks.

At Rakuten Trade, you can freely manage your foreign portfolio online with just one trading account, eliminating the hassle of managing multiple investment accounts at the same time and making efficient use of your funds.。

When initially established, Rakuten Trade's services focused on trading the Malaysian stock market (Bursa Malaysia)。Until January 27, 2022, Rakuten Trade officially launched its overseas stock trading service, which first supports trading in the U.S. Market (US Share Trading Service) and can trade stocks, ETFs, ADRs.。

On December 27 of the same year, Rakuten Trade expanded its overseas investment services to the Hong Kong Stock Market (Hong Kong Trading Service).。

For those who want to invest in U.S. and Hong Kong stocks, but are not familiar with the use of TD Ameritrade and Interactive Broker overseas brokerage firms, or have doubts about the use of overseas brokerage firms, Rakuten Trade is undoubtedly the most suitable brokerage platform.。And the platform does not levy account management fees, investors can save a lot of costs per month.。

Funds are managed in the same account

Rakuten Trade account built-in foreign currency service (Foreign Currency Facility) to store ringgit, U.S. dollar and Hong Kong dollar funds, easy for users to choose to trade in any currency。For example, when trading the U.S. stock market in U.S. dollars, the U.S. dollar profits from the exchange can be deposited directly in the account for the next transaction, without the need to exchange money to the ringgit, which is more convenient to trade and saves a lot of foreign exchange costs.。

The ringgit, US dollar and Hong Kong dollar funds are displayed independently, making it easy for users to grasp the status of funds.。

Regulated by the Malaysian Securities Regulatory Commission

As Malaysia's first online securities dealer, Rakuten Trade is regulated by the Securities Commission Malaysia, so investors can use it safely and with peace of mind to trade securities.。

iSPEED.My trading APP, seamless trading anytime, anywhere

In terms of trading use, in addition to the Rakuten Trade web version, investors can also use the platform's exclusive trading app - "iSPEED.".my "to complete the securities trading, exchange and other operations, to achieve investment without restrictions, anytime and anywhere to grasp investment opportunities.。

What are the advantages of trading horse stocks, U.S. stocks and Hong Kong stocks at the same time??

The United States and Hong Kong are the world's most important economies, a large number of blue-chip companies listed here, investment opportunities, very suitable for the pursuit of long-term profits and short-term speculation investors.。This also helps investors build portfolios that meet their individual needs, diversify their investments, and spread risk across different securities markets and investment products to create higher returns.。

In terms of time zone, the Malaysian stock market is in the same Asian time zone as the Hong Kong stock market, while the U.S. stock market is in a different time zone, trading at night, the opposite of the Asian time zone.。When brokerage firms provide the convenience of trading multinational stock markets, it means that investors have the advantage of investing in horse stocks and Hong Kong stocks during the day and investing in U.S. stocks at night, with trading opportunities from morning to night.。

With the easing of the neo-crown epidemic, the gradual recovery of the global economy, China's significant easing of epidemic prevention policies, coupled with the Fed's hawkish interest rate hike policy has a turning signal, the global economy is expected to be better than expected.。The potential growth momentum of the US and Hong Kong stock markets, which are important economies in the world, in the new year is undoubtedly quite attractive to investors.

On the Malaysian stock market, analysts see the Malaysian economy as relatively strong and foreign investment promising to return to the stock market。And the Bank of China unexpectedly did not raise interest rates in January this year (interest rates remained at 2.75%), giving the stock market a shot in the arm that can support economic and stock market growth。

Rakuten Trade Horse Stock Trading Services

tradable financial products

Equity and Real Estate Trusts (REITs) listed on the Malaysia Stock Exchange (KLSE)。

Commission Structure

Commission is the main investment cost of securities trading, theoretically the lower the commission, the lower the investment cost, the actual profit is naturally higher.。One of the strongest competencies of Rakuten Trade is that commissions are as low as RM1 as long as they are traded in ringgit, regardless of whether they are traded in equine, US or Hong Kong stocks.。

The following is the Rakuten Trade Ringi trading commission structure:

| Single transaction value (RM) | Commission (RM) |

| <RM699.99 | Minimum RM1 (1% of trading volume) |

| RM700 – RM9,999.99 | RM9 |

| RM10,000 – RM99,999.99 | 0.10% |

| >RM99,999.99 | RM100 |

Comparison with other brokerage commission charges

Next, we will compare Rakuten Trade's horse trading commission rates with those of other brokerages, using CGS-CIMB and FSMONE as a comparison.。

| Single transaction value (RM) | Rakuten Trade | CGS-CIMB | FSMOne |

| <RM699.99 | 1% * lowest transaction value RM1 | 0.1% * lowest transaction value RM8 | 0.05% * lowest trading value RM8.80 |

| RM700 – RM9,999.99 | RM9 | 0.1% * lowest transaction value RM8 | 0.05% * lowest trading value RM8.80 |

| RM10,000 – RM99,999.99 | 0.10% | 0.1% * lowest transaction value RM8 | 0.05% * lowest trading value RM8.80 |

| >RM99,999.99 | RM100 | 0.1% * lowest transaction value RM8 | 0.05% * lowest trading value RM8.80 |

Let's look at which trading platform is the best way to trade horse stocks based on the actual trading value.。

| Single transaction value | Rakuten Trade | CGS-CIMB | FSMOne |

| <RM699.99 | RM1 – RM6.99 | RM8 | RM8.80 |

| RM1,000 | RM9 | RM8 | RM8.80 |

| RM5,000 | RM9 | RM8 | RM8.80 |

| RM10,000 | RM10 | RM10 | RM8.80 |

| RM50,000 | RM50 | RM50 | RM25 |

| RM100,000 | RM100 | RM100 | RM50 |

By comparison, it will be found that Rakuten Trade has the lowest commission at trading values below RM700。With a trading value of RM10,000, Rakuten Trade's commissions are similar to those of CGS-CIMB and FSMONE; with a trading value of more than RM10,000, the commission charges of the other two brokerages are relatively cost-effective。

Charges for Other Trading Fees

In addition to commissions, tax-related fees are payable at the time of trading, i.e. Stamp Duty and Clearing Fee.。The following is a list of tax fee structures for your reference。

| Category | 费用 | Toll Collection Agency |

| Stamp duty | Per transaction RM1,000, payment of 0.1% up to RM1,000 | Revenue Authority of Malaysia LHDN |

| Liquidation fee | 0.03% * transaction value is capped at RM1,000 | Malaysia Exchange |

Advantages and Disadvantages of Trading Horse Stocks with Rakuten Trade

Advantages

1, online can open an account, no need to go out to handle

2, trading commissions are competitive, especially suitable for small capital investors.

3, investment account types, including cash account (Cash Upfront Account), allowance account (Contra Account) and margin account (RakuMargin Account)

4, can use leveraged trading.

5, access to gold can use local banks, Rakuten Trade does not levy access fees.

6, the order method includes Stop Market Order (Stop Market Order) and Stop Limit Order (Stop Limit Order), allowing users to trade in a more flexible form.

7. Provide professional local market analysis and individual stock research reports, and obtain relevant information through Rakuten Trade's official website, trading platform or exclusive Telegram group.

Disadvantages

1, horse stock account belongs to the agent account (Nominee CDS) form, can not participate in the IPO new share purchase.。Dividends are collected by Rakuten Trade and a proxy from the broker is required to attend the shareholders' meeting.

2, can not apply for initial public offering (IPO)

3, do not provide virtual account (paper account)

Rakuten Trade US Stock Trading Service

tradable financial products

Stocks and ETFs listed on the New York Stock Exchange (NYSE) and Nasdaq Stock Exchange (NASDAQ)。Note that not all of the underlying can be invested.。Currently tradable U.S. stocks are 916, ETFs are 249, and ADRs are 22.。(As of July 24, 2023)

Commission Structure

At the time of the transaction, the user may choose to complete the transaction using either the ringgit or the US dollar。

Trading US stocks in ringgit

Trading in U.S. stocks in ringgit, the commission is calculated based on the total value of the ringgit traded in exchange.。For example, buy 1 share of Apple stock (NASDAQ: AAPL) at USD 144.29, the total transaction value converted to ringgit is approximately RM615.51。The system will follow the trading value of RM615..51 Calculation of commission, i.e. RM7。

The following is the commission structure for Lingi's trading of U.S. stocks.

| Single transaction value (RM) | Commission (RM) |

| <RM699.99 | Minimum RM1 (1% of transaction value) |

| RM700 – RM9,999.99 | RM9 |

| RM10,000 – RM99,999.99 | 0.10% |

| >RM99,999.99 | RM100 |

US Stocks Traded in Dollars

Trading U.S. stocks in U.S. dollars, trading commissions are 0.10% * transaction value, minimum USD 1 per transaction.88, maximum USD 25。

The following is the commission structure for U.S. dollar-traded U.S. stocks.

| Single transaction value (RM) | Commission (USD) |

| Arbitrary transaction value | 0.10% * transaction value, minimum USD 1.88, maximum USD 25 |

Comparison with other brokerage commission charges

In China, in addition to Rakuten Trade, well-known local investment banks and investment platforms such as CIMB, MAYBANK, FSMONE, etc. also provide investment services in overseas markets.。

Let's compare Rakuten Trade, CGS-CIMB and FSMONE US stock trading commission rates below。

| Single transaction value (RM) | Rakuten Trade | CGS-CIMB | FSMOne |

| <RM699.99 | RM1 – RM6.99 | 0.25% * minimum transaction value USD 18 | 0.08% * lowest transaction value USD 8.80 |

| RM1,000 | RM9 | 0.25% * minimum transaction value USD 18 | 0.08% * lowest transaction value USD 8.80 |

| RM5,000 | RM9 | 0.25% * minimum transaction value USD 18 | 0.08% * lowest transaction value USD 8.80 |

| RM10,000 | 0.10% | 0.25% * minimum transaction value USD 18 | 0.08% * lowest transaction value USD 8.80 |

| RM50,000 | RM100 | 0.25% * minimum transaction value USD 18 | 0.08% * lowest transaction value USD 8.80 |

Let's look at which trading platform is the best way to trade U.S. stocks based on the actual trading value.。

| Single transaction value (RM) | Rakuten Trade | CGS-CIMB | FSMOne |

| <RM699.99 | RM1 – RM6.99 | USD 18 * approx. RM76.78 | USD 8.80 * approx. RM36 |

| RM1,000 | RM9 | USD 18 * approx. RM76.78 | USD 8.80 * approx. RM36 |

| RM5,000 | RM9 | USD 18 * approx. RM76.78 | USD 8.80 * approx. RM36 |

| RM10,000 | RM10 | USD 18 * approx. RM76.78 | USD 8.80 * approx. RM36 |

| RM50,000 | RM50 | USD 29 * approx. RM125 | USD 9.55 * approx. RM40 |

| RM100,000 | RM100 | USD 59 * approx. RM251 | USD 19.09 * Approximately RM80 |

* Using February 1, 2023 exchange rate data USD 1 = RM4.27 Calculation

In comparison, it will be found that Rakuten Trade's U.S. stock trading commissions are generally lower when the value of a single trade does not exceed RM50,000, thus effectively reducing the cost of investing in U.S. stocks.。

Charges for Other Trading Fees

Investors are also required to pay tax-related fees such as stamp duty, SEC compliance fees (SEC Fee) and trading activity fees (Trading Activity Fee) for each U.S. stock transaction.。Of these, SFC fees and transaction activity fees are charged only at the time of sale.。

The following is a list of other securities trading fee structures for U.S. stocks for your reference.。

| Category | 费用 | Toll Collection Agency |

| SFC fees (only charged on sale) | 0.0008% * lowest transaction value USD 0.01 | SEC |

| Transaction activity fee (only charged at the time of sale) | 0.013% / share minimum USD 0.01, maximum USD 5.95 | FINRA |

| Stamp duty (US stocks) | RM1 received per RM1,000 transaction value.00 Maximum RM1,000 | Revenue Authority of Malaysia LHDN |

| Stamp Duty (ETF) | RM1 received per RM1,000 transaction value.00 Maximum RM200 | Revenue Authority of Malaysia LHDN |

Advantages and Disadvantages of Trading U.S. Stocks with Rakuten Trade

Advantages

1 、 As long as you open a Cash Upfront account, you can operate horse stocks, U.S. stocks, Hong Kong stocks trading in the same account, saving the time cost of managing multiple accounts.

2, the lowest domestic U.S. stock trading commission, each transaction as low as RM1.

3. No platform fees and other non-transaction fees, such as custody fees, dividend collection fees and corporate activity service fees.

4, to provide U.S. dollar foreign currency accounts, can deposit U.S. dollar funds or profits, without the need for "U.S. dollar - ringgit" exchange.

Rakuten Trade is regulated by the Securities Commission Malaysia and can be used safely.

6, access to gold directly through domestic banks, compared to the use of overseas brokerages such as moomoo Futu Securities, Long Bridge Securities must wire transfer access to gold, Rakuten Trade allows investors to save wire transfer fees.

Disadvantages

1, only support the trading of U.S. market stocks, ETFs and ADRs, and not all stocks, ETFs and ADRs can be traded, limited options.

2. The U.S. stock account is in the form of a custodian account (Custodian Account), with dividends collected by Rakuten Trade and corporate activities handled by Rakuten Trade.

3, does not support the transfer of stocks between different U.S. stock brokerages.

4, do not support zero share trading (Fractional Share)

5, do not support pre-market after-market transactions.

6, do not support financing, margin trading.

7, the trading interface is relatively simple, only trading, stock price trend table and other basic functions, compared to overseas brokerages such as moomoo Futu Securities, Changqiao Securities will provide a wealth of financial information, user discussion area, the law will be live broadcast function.

Rakuten Trade Hong Kong Stock Trading Services

tradable financial products

Shares listed on the Hong Kong Stock Exchange (HKEX)。Note that not all of the underlying can be invested.。The number of Hong Kong shares currently tradable is 349.。

Commission Structure

At the time of the transaction, the user may choose to complete the transaction using either the ringgit or the Hong Kong dollar.。

Hong Kong stocks traded in ringgit

As with the U.S. stock commission fee, at the time of trading, the system calculates the commission based on the Hong Kong dollar trading value of each transaction, converted to the trading value of the ringgit.。The commission structure is as follows:

The following is the commission structure for trading Hong Kong stocks in Ringgit.

| Single transaction value (RM) | Commission (RM) |

| < 699.99 | RM1 (1% of transaction value) |

| 700 – 9,999.99 | RM9 |

| 10,000 – 99,999.99 | 0.10% |

| >99,999.99 | RM100 |

Hong Kong stocks traded in Hong Kong dollars

Trading Hong Kong stocks in Hong Kong dollars, the trading commission is 0..10% * transaction value, minimum HK $35 per transaction。No trading commission cap。

The following is the commission structure for Hong Kong stocks traded in Hong Kong dollars.

| Single transaction value (RM) | Commission (HKD) |

| Arbitrary transaction value | 0.10% * trading value, minimum HK $35, no commission cap |

Comparison with other brokerage commission charges

Let's compare Rakuten Trade, CGS-CIMB and FSMONE Hong Kong stock trading commission rates below。

| Single transaction value (RM) | Rakuten Trade | CGS-CIMB | FSMOne |

| <RM699.99 | RM1 – RM6.99 | 0.2% * lowest transaction value HKD 80 | 0.08% * lowest transaction value HKD 50 |

| RM1,000 | RM9 | 0.2% * lowest transaction value HKD 80 | 0.08% * lowest transaction value HKD 50 |

| RM5,000 | RM9 | 0.2% * lowest transaction value HKD 80 | 0.08% * lowest transaction value HKD 50 |

| RM10,000 | 0.10% | 0.2% * lowest transaction value HKD 80 | 0.08% * lowest transaction value HKD 50 |

| RM50,000 | RM100 | 0.2% * lowest transaction value HKD 80 | 0.08% * lowest transaction value HKD 50 |

Let's look at which trading platform is the best way to trade Hong Kong stocks based on the actual trading value.。

| Single transaction value (RM) | Rakuten Trade | CGS-CIMB | FSMOne |

| <RM699.99 | RM1 – RM6.99 | HKD 80 * approx. RM43.52 | HKD 50 * approx. RM27.20 |

| RM1,000 | RM9 | HKD 80 * approx. RM43.52 | HKD 50 * approx. RM27.20 |

| RM5,000 | RM9 | HKD 80 * approx. RM43.52 | HKD 50 * approx. RM27.20 |

| RM10,000 | RM10 | HKD 80 * approx. RM43.52 | HKD 50 * approx. RM27.20 |

| RM50,000 | RM50 | HKD 183.83 * about RM100 | HKD 73.53 * approx. RM40 |

| RM100,000 | RM100 | HKD 367.66 * approx. RM200 | HKD 147.06 * Approximately RM80 |

* Using February 1, 2023 exchange rate data HKD 1 = RM0.54 Calculation

In comparison, it will be found that Rakuten Trade commissions are cheaper at transaction values below RM50,000;。

Charges for Other Trading Fees

In addition to commissions, investors are required to pay tax and other securities trading fees, such as stamp duty, SFC transaction fees, FRC transaction fees, etc.。

The following is a list of other securities trading fee structures for Hong Kong stocks for your reference.。

| Category | 费用 | Toll Collection Agency |

| Stamp duty on shares | 0.13% * lowest transaction value HKD 1 | Hong Kong Government |

| Liquidation fee | 0.02% * lowest transaction value HKD 2 highest HKD 100 | HKEX HKEX |

| SFC transaction levy | 0.0027% * lowest transaction value HKD 0.01 | SFC Hong Kong SFC |

| Financial Reporting Council transaction levy | 0.00015% * lowest transaction value HKD 0.01 | Financial Reporting Board FRC |

| Transaction Fee | 0.00565% * Transaction Value | HKEX HKEX |

| Malaysia Stamp Duty | Per transaction RM1,000, payment of 0.1% up to RM1,000 | Revenue Authority of Malaysia LHDN |

Advantages and Disadvantages of Using Rakuten Trade to Trade Hong Kong Stocks

Advantages

1 、 As long as you open a Cash Upfront account, you can operate horse stocks, U.S. stocks, Hong Kong stocks trading in the same account, saving the time cost of managing multiple accounts.

2. Trading Hong Kong stocks in ringgit with the lowest commission in Malaysia

3. No platform fees and other non-transaction fees, such as custody fees, dividend collection fees and corporate activity service fees.

4, to provide Hong Kong dollar foreign currency account, can deposit Hong Kong dollar funds or profits, without the need for "Hong Kong dollar - ringgit" exchange.

5, access to gold directly through domestic banks, saving wire transfer fees.

Disadvantages

1. Currently, only trading stocks are available, with fewer items to choose from.

2, like U.S. stocks, Hong Kong stock accounts are in the form of escrow accounts (Custodian Account), dividends are collected by Rakuten Trade, and corporate activities are handled by Rakuten Trade.

3, do not support financing, margin trading.

4, do not support the transfer of shares into and out.

SUMMARY

If you are looking for a multinational securities investment account, but are hesitant to use an overseas brokerage platform that is not regulated by the Malaysian Securities Regulatory Commission, such as TD Ameritrade, Interactive Broker, moomoo Fortis Securities, Tiger Securities, etc., then Rakuten Trade, which is regulated by Malaysian securities, may be an ideal choice.。The platform has many competitive advantages, including trading commissions as low as RM7, an easy-to-understand interface, a convenient, fast and fee-free access process, no platform fees and custody fees and other non-transaction fees, as well as foreign currency accounts that can be used to deposit foreign currency funds such as US dollars and Hong Kong dollars.。

However, Rakuten Trade also has some limitations, including higher commission fees for large trading values (e.g., over RM50,000) than other local brokerages and relatively few tradable targets for U.S. and Hong Kong stocks.。In addition, Rakuten Trade accepts only cash transactions in overseas securities markets, which is indeed less attractive to investors who prefer leveraged financing.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.