Phillip Securities POEMS Launches "US Stock Asian Session"!

Huili Securities launched in the Asian market opening time can trade U.S. stocks, so that investors can participate in U.S. stock investment earlier, to seize more investment opportunities.。This article details the service features and advantages and disadvantages of the "U.S. Stock Asia Session."。

Phillip Securities officially launched the "US Asian Hours" service on July 19, 2022, offering investors a trading session from 09: 00 a.m. to 17: 00 p.m. (Singapore time), allowing them to participate in the trading of US stocks and ETFs as soon as the Asian market opens.。Huili Securities became the first broker to offer this service in the Asian market, providing investors with the opportunity to participate in the U.S. stock market earlier, allowing them to get ahead of their investment activities and capture more investment opportunities.。

What are the unique features and advantages of the "US Stock Asia Points" service??Relatively speaking, are there some shortcomings?What are the similarities and differences between them compared to pre-market trading stocks?Which way should investors choose to gain a greater advantage??In the following content, we will unravel the mystery of the "U.S. Stock Asia Points" service of Huili Securities, discuss its characteristics and advantages and disadvantages, and compare the advantages and disadvantages of trading the stock market before the market, so that investors can have a more comprehensive understanding of various investment options.。

◇ "U.S. Stock Asia Points" 4 Major Features

◇ Advantages of Using "US Stock Asia" Trading

◇ Take advantage of "Risky U.S. Stocks Asia" trading shortcomings /

◇ "U.S. stocks Asian gains" choose vs pre-market trading, which?

First, what is the "Asian session of U.S. stocks"?

The "US Asian Hours" service is a trading service first launched by one of Singapore's largest brokerage firms, Phillip Securities, to provide trading in specific US stocks at the opening hours of the Asian market.。Investors can use the online trading platform POEMS 2 from 09: 00 a.m. to 17: 00 p.m. Singapore time..0 or mobile app POEMS Mobile 3 to buy and sell US stocks。

Users can trade popular US-listed stocks and equity index funds (ETFs) in US stocks Asia, referring to the list released by POEMS, with 38 popular US stocks and funds available for trading (the list will increase as of July 5, 2022)。

Who can use the "US Stock Asia Time" service??What conditions must be met?

Any POEMS customer who desires to use the "US Stock Asia Points" service, applicable to all POEMS account types。

Three, "U.S. stocks Asia points" 4 features.

(i) Additional 7 hours of U.S. stock trading time

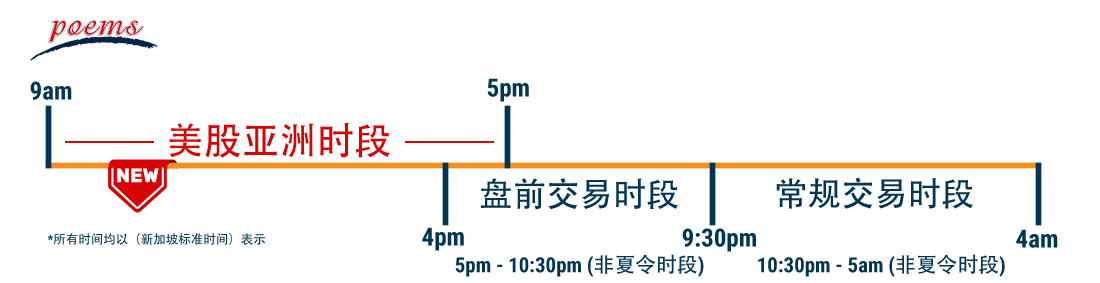

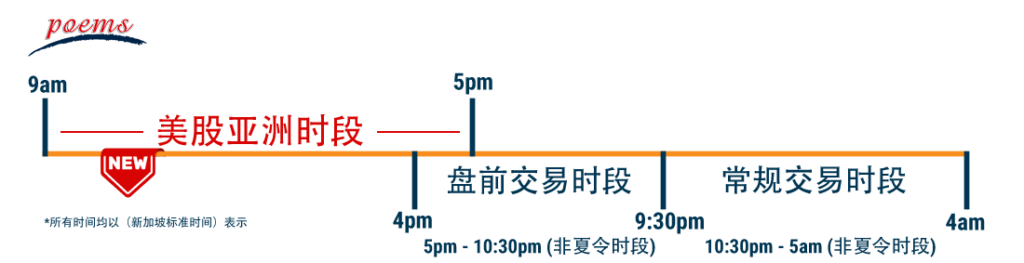

In the past, participation in the U.S. stock market was generally only possible during fixed trading hours and pre-market trading (pre-market trading).。Fixed trade gains from 21: 30 p.m. Singapore time to 04: 00 a.m. the next day; non-summer gains from 22: 30 p.m. Singapore time to 05: 00 a.m. the next day。

Pre-market trading hours correspond to 16: 00 p.m. to 21: 30 p.m. Singapore time。

With the launch of "U.S. Stock Asia," investors can advance from 09: 00 a.m. to 17: 00 p.m., through the special intensification of trading U.S. stocks on the POEMS platform, which is a full 7 hours higher than the current frequent trading in the United States.。It undoubtedly provides more flexibility and convenience, giving investors the opportunity to adjust their entry and exit strategies and make more advantageous investment decisions in response to market volatility events that occur outside of any trading trigger.。

Huili Securities is the first domestic brokerage to provide Asian time trading services for U.S. stocks.。

Commissions as low as 0.08% (no minimum commission)

At present, Huili Securities launched in the "U.S. stock Asian session" to trade U.S. stocks, commissions as low as 0.08% benefit, while not setting a minimum commission to minimize investment costs。

(iii) Minimum order size of $5,000

Users can use the US Stock Asia Time service through the following two channels:

◇ Web version POEMS 2.0

◇ POEMS Mobile 3 mobile app

The order type is "Market Order," the minimum trading unit is 1 share, and the minimum order value is 5,000 US dollars, orders less than 1 share or 5,000 US dollars will be rejected。

Order size = quantity x bid or ask price

(iv) All participating traders are clients of Huili Securities

Intraday participation in the "U.S. Stock Asian Session" is limited to customers from all over the world at Huili Securities, who are quoted through the POEMS trading platform.。

Fourth, the advantages of "U.S. stock Asia"

◇ Solve the jet lag problem and trade U.S. stocks without having to stay up late.

◇ Can participate in investing in the U.S. stock market for a longer period of time and take action on any market volatility events other than delayed trading hours

◇ The buying and selling of U.S. stocks between the Asian session and the regular trading session and the pre-market trading session are seamlessly connected.

◇ Low commission rate during preferential period

Supporting financing transactions

V. "U.S. Stock Asia Score" Disadvantages

◇ Fewer tradable investment targets (currently 38)

◇ The minimum trading center is $5,000, which will be more difficult for small capital investors.

◇ Trading is limited to Huili Securities customer base, low liquidity

◇ In the Asian session of U.S. stocks, due to low liquidity, individual stock prices may rise or fall more than in regular trading sessions, and personal risk tolerance must be assessed before trading.

Six, "U.S. stocks Asian gains" choose vs pre-market trading, which.?

Trading in U.S. stocks during the Asian session, investors can release any unexpected news that may trigger market volatility in Asian time (such as bank interest rate adjustments, earnings announcements, international political and economic changes), have a first-mover advantage, adjust investment layout and entry and exit strategies, have the opportunity to buy U.S. stocks at low prices (sell at high prices), continue to rise in pre-market trading sessions or sell at high prices (buy at low prices) during regular trading sessions, and。

The downside is that fewer U.S. stocks are currently available for trading during the Asian session, while pre-market trading is open to exchanges with stocks and equity index funds (ETFs) listed on the New York Stock Exchange (NYSE) and Nasdaq Stock Exchange (NASDAQ), with more investment options.。

Investors can decide whether to trade in U.S. stocks during or before the Asian session based on their individual investment strategy, noting that the minimum trading threshold for U.S. stocks during the Asian session is $5,000.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.