Turkey's economic and financial risks eased by recent shift toward policy normalization

The Central Bank of the Republic of Turkey (CBRT) has turned to a consistently loose monetary policy to bring down double-digit inflation, boosting its credibility and repairing years of damage to the country's reputation for sound economic management.。

Scope Ratings revised its rating outlook for Türkiye (foreign currency rating B-) from negative to stable on January 12, based on a recent record of more conventional policies following the May 2023 election.。The Central Bank of the Republic of Turkey (CBRT) has turned to a consistently loose monetary policy to bring down double-digit inflation, boosting its credibility and repairing years of damage to the country's reputation for sound economic management.。

Several interest rate hikes and a selective credit crunch have begun to slow credit growth and private consumption, reducing the current account deficit and aggregate external financing needs.。Scope estimates that figure at $250 billion (about 19% of GDP) in 2024。It will also be easier to cover financing needs due to improved foreign investor sentiment。Ministry of Finance and Finance plans to raise $10 billion in external funding in 2024。

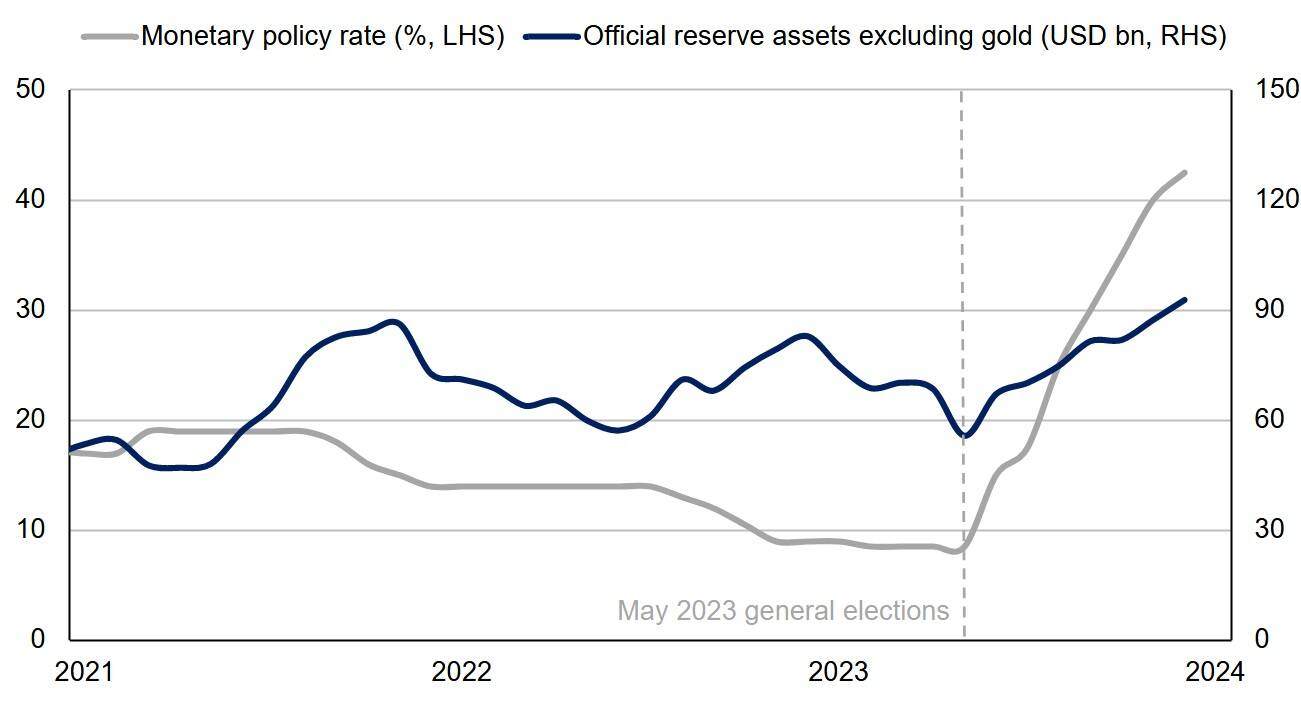

Another benefit of the tighter monetary policy is the recovery of Turkey's total international reserves excluding gold, which rose from $55.7 billion in May 2023 to $92.8 billion in December last year (Figure 1).。Nevertheless, international reserves are still insufficient to cover overall external financing needs。

Source: CBRT, Scope Ratings More conventional macroeconomic policy mix offsets record of policy reversals

If CBRT can maintain its recent orthodox policy approach, we expect the Turkish economy to gradually rebalance and become more resilient to external shocks.。

However, until further progress is made in reducing inflation, external and financial risks remain prominent.。This is also because the CBRT has relinquished control of the lira and has no commitment to maintain the exchange rate。

The real policy rate remained deeply negative in December 2023, rising to -22% from -31% in May 2023.。Curbing soaring consumer prices will take time。As a result, we expect inflation to average 60% in 2024, up from 53% last year, due to the depreciation of the lira and the lag in the transmission of monetary policy tightening.。

Economic growth is strong but will slow this year

GDP growth expected to moderate as funding crunch offset by reconstruction efforts。We forecast real GDP growth of 3.3%, down from 4 in 2023.1%。

President Recep Tayyip Erdogan has publicly backed the central bank's policies, having previously said low interest rates would curb inflation.。However, the potential for a significant decline in economic growth due to external shocks and / or geopolitical tensions may still test the sustainability of the recent policy normalization.。

One of the tests will be the government's commitment to orthodox economic policy ahead of local elections in March, as economic growth slows amid tighter monetary policy over the past few months.。

In a tense scenario, political interference in monetary decisions may re-emerge。This could raise the risk of policy reversals and reduce the likelihood of lower inflation and further economic rebalancing.。Decision-making remains highly centralized and independent institutions are often influenced by politicization。Government is reportedly cracking down on internet access ahead of local elections。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.