What are market orders and limit orders??What is the connection between ROD, IOC and FOK??

Market Order (Market Order) is the most common order in securities trading, which requires the trade to be traded immediately at the current market price, regardless of the current price, in order to trade quickly.。

What is the market price list??

Market Order (Market Order) is the most common order in securities trading, which requires the trade to be traded immediately at the current market price, regardless of the current price, in order to trade quickly.。

Generally, if the investor has no other special needs at the time of the transaction, it will be executed in the form of a market order, so it is also the most basic way of trading, as long as the broker receives the securities trading order, it will process the transaction for the investor at the current price.。

We all know that securities trading is liquid, the current share price and the next second share price will be different, and in the case of limited liquidity, securities trading will not be executed at the same time in the present moment, may be processed after a few more seconds to complete, which will cause the market price order sometimes produce spreads, commonly known as "slippage."。

This spread volatility usually occurs when trading volume is particularly high, or liquidity is particularly low, or stock price movements are particularly large, or both, and market orders must take a long time to process and complete.。In addition, if the market order is executed during the closing hours, the trade will not be executed until the next round of market opening, not now.

What is a limit order??

Limit Order (Limit Order) is another mainstream trading method, second only to the market price order, allowing investors to set the price they are willing to buy and sell, and wait for the price of the security to reach the set price before executing the trade, unlike the market price order, the limit order focuses on the trading price, rather than the trading time.。

One of the benefits of limit orders is that they give investors a better grasp of the bid and ask price of the transaction, in other words, the method can be to give investors a better grasp of how their funds are used.。

Limit orders are usually suitable for securities with low liquidity, high volatility and large bid-ask spreads, because the prices of these securities may continue to fluctuate and it is more difficult to grasp the stock price trend, so trading with limit orders is more able to control stock price risk.。

However, although the investor specifies a price, if the price of the security has not reached the price of the index, the limit order will not be executed until the price of the security reaches the price of the index, so the use of the limit order without a specified deadline, it is possible to see that the order can not be executed, or even never executed.。

However, some investors in the operation of the limit order will specify the day to close (Day) or specify a date (Good til date, GTD), meaning that the limit order is valid on the day, if the day did not reach the specified price, the order will be cancelled;。

If a limit order is opened at closing time, the order will not be included in the execution until the next round of opening and will not be processed immediately.。

What happens when limit orders are illiquid??

There are two more obvious risks associated with trading with limit orders, one of which is that a trade will not be triggered if the price of the security never reaches the specified price range.

Another risk is illiquidity, which can result in limit orders not being fully executed because of illiquidity, even if the share price has reached the conditions.。

Market Order vs Limit Order

Both of these trading methods can be traded to stocks, with the difference being that the difference in approach may lead to a fall in the final bid / ask price.。

In most cases, market orders are easier to execute because the investor does not need to specify a price (and does not need to care), but rather allows the trade to be executed as quickly as possible。

The limit order is more standardized, in addition to the need to set the bid and ask price, but also may have to set when the order expires (when the limit order exceeds the expiration date but is not executed, the order will be cancelled)。

About Extended Order Types for Market and Limit Orders

What is a stop-loss limit order??

- Limit Order: Trading to a security at a specified price

- Stop loss order: also specify a price, when the stock price touches the finger pricing, it triggers the market order mode.

- Stop loss limit order: combines the characteristics of both limit order and stop loss order, when used to specify two prices, namely stop loss price and limit price.。Stop loss price is the first trigger point for the start of the trade, and then to set a limit price, when the stop loss price is triggered, the order will be converted to a limit order to trade, when the stock price touches the specified limit price will trigger the trade, this is the second trigger point。

The main benefit of buying stop-loss limit orders is that they allow investors to better grasp the bid and ask prices in an environment of rapid stock price volatility。A stop-loss limit order does not guarantee that a trade will be closed, only when the trade price arrives.。

- Stop-loss market order: a combination of stop-loss and market order characteristics, investors as long as set a stop-loss price, when the trade is triggered to the stop-loss price will be executed at the market price, this order guarantees the transaction, but does not guarantee the price。

The relationship between ROD and limit orders?

ROD (Rest of Day) is a valid order of the day, as long as the limit order, until the close of the day, this ROD is valid, which is also the default limit order type of some brokerage APP.。

Relationship between IOC and market order?

IOC (Immediate or Cancel) is an immediate transaction or cancellation, after sending out the order, the system will immediately execute for you, theoretically all transactions are the best, but if you encounter a lack of liquidity, the system will only deal for you part, the remaining part of the transaction will be cancelled directly.。

Generally, as long as you trade with a market order, it will be executed in an IOC manner。

Relationship between FOK and market order?

FOK (Fill or Kill) is immediately all the transaction or cancel, it is similar to IOC, will immediately execute the transaction for the investor, the difference is that FOK receives the order is all executed together, so the transaction can only be fully executed, if only part of the transaction, FOK would rather cancel the transaction than execute.

SUMMARY

To summarize briefly, a market order will purchase securities at the current market price, which will guarantee a deal but not a price; a limit order will purchase securities at a preset price, which may be cancelled because the price may be delayed in reaching the index price, which is characterized by a guaranteed price but not a guarantee of a deal。

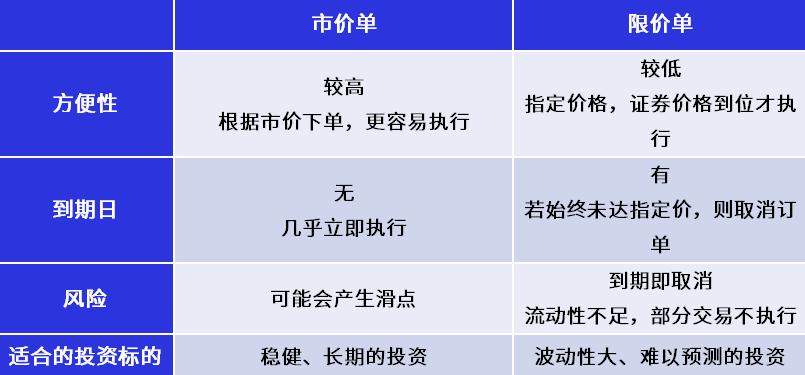

These two methods are the most mainstream trading methods on the market, although both can be traded to securities, but still different, respectively, the following 4 points:

- Convenience: the market order is slightly better, because the market order will only be based on the market price to immediately execute the transaction;

- Expiry date setting: only limit orders are available because the price needs to be set and the order will be cancelled if the share price is not priced until the expiration date.

- Risk: Market orders may cause slippage; limit orders may not be transacted, or orders may not be fully transacted due to lack of liquidity.

- Suitable investment targets: market orders are more suitable for trading in stable targets; limit orders are more suitable for trading in volatile targets.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.